India’s Core and Energy sector is entering a pivotal growth phase: one that blends traditional industrial strength with modern digital transformation. As the backbone of the economy, the eight core industries- coal, crude oil, natural gas, refinery products, fertilisers, steel, cement, and electricity, continue to power everything from infrastructure development to manufacturing output. Together, they account for 40.27% of India’s Index of Industrial Production (IIP), underscoring their critical role in national productivity, as highlighted in Taggd’s India Decoding Jobs Report 2026.

The hiring landscape is evolving rapidly. With 12% hiring intent projected for FY27, core and energy companies are gearing up for expansion driven by three major forces: large-scale government investments in infrastructure, accelerated automation and digital adoption, and a massive retirement wave that is reshaping the workforce pipeline. This is creating fresh demand for skilled talent across engineering, operations, grid modernisation, green energy, safety, and digital roles.

Despite a mixed performance in 2025, where strong double-digit growth in steel (12.8%) and cement (11.7%) was offset by weather-led declines in coal and contractions in crude oil and natural gas- the broader outlook remains positive.

Core industries continue to show steady annual growth of 1.6–2.2%, supported by flagship national programs like Gati Shakti, Make in India, and India’s ongoing urbanisation wave.

In the energy segment, 63% of power companies expect hiring growth in H2 FY25, aligned with large-scale capacity expansion and grid upgrades. Meanwhile, the steel industry is forecasted to nearly double from 148 million tons in 2025 to 300 million tons by 2030, fuelling a surge in talent demand across production, logistics, maintenance, and project engineering.

As India accelerates toward a high-growth industrial era, here’s a detailed look at the Core and Energy Hiring Trends for 2026, the skills shaping the next-generation workforce, and what employers need to prepare for in the coming year.

Key Hiring Trends in Core & Energy Sector in 2026

India’s Core and Energy sector is set for strong hiring momentum in 2026, driven by record infrastructure spending, rapid steel sector expansion, and accelerated digital transformation across power, mining, and refining.

Companies are increasingly investing in automation, AI, and predictive technologies, creating high demand for tech-enabled engineers, data specialists, and digital operations talent.

At the same time, ESG priorities, clean energy investments, and the rise of deep-tech startups are reshaping workforce needs. With PSUs and private players expanding capacity and modernising operations, the sector is experiencing a clear shift toward skilled, tech-savvy, and sustainability-focused talent – marking one of the most transformative hiring phases in recent years.

1. Infrastructure Spending Fuels Hiring Across Core Industries

India’s massive infrastructure build-out is directly accelerating job creation in the core industries. Under the National Electricity Plan, a record ₹33.6 trillion has been allocated to boost power capacity to 609 GW by 2032, signalling sustained demand for engineers, project managers, and energy specialists.

Core-sector output, despite short-term volatility, showed 2% YoY growth in mid-2025, powered by strong performance in:

- Steel (+12.8%)

- Cement (+11.7%)

This growth is tied to big-ticket national programs- roads, railways, metros, housing, industrial corridors that are pushing domestic steel demand up 9–10% in FY25, with cement consumption expected to rise 8%.

High-volume hiring will continue in construction engineering, material science, EPC project roles, safety, logistics, and operations management. Companies will prioritise talent with cross-functional skills to support large, multi-year projects.

2. Steel Sector Expansion: India’s Growth Engine for Industrial Jobs

India, now the world’s second-largest steel producer, is scaling output at record speed. July 2025 saw a 12.8% jump in production, demonstrating the sector’s rapid upward trajectory.

Leading players like Tata Steel and JSW Steel are:

- Modernising plants with AI-driven automation

- Advancing green steel technologies

- Expanding capacity across eastern and western India

This has triggered fresh hiring demand for:

- Metallurgists & materials engineers

- Process & quality engineers

- Plant maintenance & reliability technicians

- Automation and mechatronics specialists

Digital-ready steel plants are redefining skill needs. Candidates with hybrid skills like engineering + technology will be most in demand. Entry-level hiring is expected to rise sharply due to capacity expansion and green steel investments.

3. Automation, AI & Predictive Technologies Reshaping Workforce Composition

Automation is transforming India’s mining, refining, and power industries. Companies are deploying:

- AI-based monitoring systems

- Sensor-led predictive maintenance

- Remote-operated and autonomous machinery

- Cloud-enabled plant performance dashboards

This shift is reducing dependency on manual roles while creating demand for:

- AI/ML engineers

- Industrial IoT specialists

- Control system engineers

- Predictive maintenance experts

- Data analysts with domain knowledge

The future core-sector workforce will be smaller but more skilled. Employers must address widening skill gaps in automation-led job functions. Upskilling and certification-based hiring will become mainstream in 2026.

4. Digital Transformation Becomes a Hiring Priority

A recent survey shows 36% of core sector employers are hiring specifically to accelerate digital transformation. This includes roles in:

- Data analytics

- Cybersecurity

- Digital twin modelling

- Plant automation

- Cloud operations

Digital fluency is no longer optional—it is becoming a baseline requirement across functions.

Demand for digital and tech-forward roles will grow faster than traditional engineering positions. India Decoding Jobs data indicates a 2–3x rise in listings for digital engineering roles across power, steel, and mining units.

5. Coal, Energy, and Large PSUs Continue as Major Job Providers

Coal India, with 220,272 employees (2025), remains one of India’s biggest employers. While traditional roles persist, the organisation is hiring more specialists in:

- Mine safety

- Environmental compliance

- Automation & AI operations

- Sustainability and ESG reporting

Positive trends:

- Women now make up 22% of the energy workforce, especially in technical roles.

- Major private investments- like Adani’s ₹70,000 crore coal gasification project (30,000 jobs) and Vow Iron & Steel’s 1,500-job facility are boosting regional employment.

Hiring remains strong through:

- GATE recruitment

- PSU drives

- Apprenticeship & trainee programs

Energy PSUs remain gateways for engineering talent, but are now increasingly looking for digital, ESG, and clean energy skills. Diversity hiring is also emerging as a core priority.

6. Startups Are Emerging as Job Creators in Core & Energy

The core sector is no longer just about PSUs and large conglomerates.

A new wave of deep-tech, clean energy, EV, and digital infrastructure startups is transforming the landscape.

Examples:

- Indian Oil’s Startup Scheme has supported 42 startups, creating 635 jobs in clean energy, fuel innovations, and digital tech.

- At Startup Mahakumbh 2025, oil and gas PSUs showcased 32 startups working in deep tech, EV infrastructure, AI optimisation, and renewable energy.

This indicates a structural shift: core-sector talent is moving toward agile, innovation-led startups. Hiring is expanding in roles like R&D engineering, product development, automation, and sustainability. Startups will be strong competitors for young technical talent in 2026.

7. ESG, Sustainability & Long-Term Transition Are Redefining Talent Needs

As India pushes for long-term energy transition and environmental compliance, companies are investing heavily in:

- Carbon management

- Energy efficiency audits

- Cleaner fuels

- Green hydrogen

- Waste heat recovery systems

Demand is rising for certified:

- Energy managers

- Energy auditors

- ESG analysts

- Environmental engineers

ESG is now intertwined with hiring strategy. Core industries need talent capable of navigating sustainability mandates, reporting norms, and emission reduction goals.

8. Emerging Skill Gaps Pose a Workforce Challenge

While investment and output are rising, companies face significant talent shortages in:

- Automation & robotics

- Digital operations

- AI-based plant management

- Predictive maintenance

- Green energy technologies

The next phase of India’s industrial growth will depend on bridging these skill gaps through targeted training, certifications, and partnerships with skilling institutions. Explore detailed insights into hiring trends in India Decoding Jobs Report 2026- Fourth and Forward – Fuelled by Talent.

Key Industry Players in India’s Core & Energy Ecosystem in 2026

India’s Core and Energy ecosystem is powered by a strong network of public-sector giants, private conglomerates, and fast-growing regional hubs across the North, South, West, and East.

These regions are home to the country’s most critical power plants, steel mills, refineries, ports, and industrial corridors, making them the largest generators of jobs, investments, and infrastructure activity.

Below is a region-wise breakdown of the top clusters, companies, and projects shaping India’s core sector workforce in 2026.

North India: Power & Steel Dominate Hiring Demand

Key Regions: Kanpur, Mirzapur, Etah, Prayagraj, Ludhiana, Bihar, Haryana, Uttarakhand

Major Players: NTPC, BHEL, SAIL, Hindustan Petroleum, Shree Cement

Flagship Projects:

- Bhilai Steel Expansion

- Chambal Fertilisers

- Char Dham Highway

- NCR Power Grid

- National Capital Region Railway Corridor

Sector Focus: Electricity, steel, coal, renewable energy

Hiring Insight: Northern India remains a powerhouse for large-scale power generation, heavy engineering, and public-sector hiring. With ongoing grid upgrades, railway corridors, and mega infrastructure projects, demand is rising for electrical engineers, civil engineers, plant operators, project managers, and renewable energy technicians.

South India: Refining, Coal & Metro Projects Fuel Growth

Key Regions: Chennai, Nagapattinam, Ennore, Udangudi, Visakhapatnam, Amaravati, Hyderabad, Vijayanagar

Major Players: JSW Steel, Bharat Heavy Electricals Ltd., ACC Cement, Neyveli Lignite Corporation, Vizag Steel

Flagship Projects:

- Chennai Metro Rail

- Vizag Steel Plant Expansion

- Krishnapatnam Port

- Bangalore Suburban Rail

- Hyderabad Metro

Sector Focus: Electricity, coal, refinery products, crude oil, natural gas, cement

Hiring Insight: South India’s modernisation wave across metro networks, ports, steel plants, and energy corridors is generating high demand for automation engineers, refinery specialists, EPC experts, mining professionals, and digital operations roles within power and steel facilities.

West India: Refineries, Ports & Industrial Hubs Lead Job Creation

Key Regions: Mumbai, Surat, Dahej, Ahmedabad, Pune, Nashik, Jalna

Major Players: Reliance Industries (Jamnagar Refinery), Tata Steel, UltraTech Cement, Adani Power (Mundra), Indian Oil Corporation (Gujarat)

Flagship Projects:

- Jamnagar Refinery Complex

- IFFCO Kandla & Kalol

- Mumbai Coastal Road

- Mundra Port & Power SEZ

- Western Dedicated Freight Corridor

Sector Focus: Fertiliser, electricity, steel

Hiring Insight: West India hosts some of India’s largest refineries, ports, and manufacturing zones. The expansion of the Jamnagar Refinery and Mundra SEZ alone is driving sustained demand for chemical engineers, refinery operations talent, port logistics specialists, sustainability professionals, and plant maintenance experts.

East India: Mineral Belt & Heavy Industries Remain Critical Employers

Key Regions: Odisha, West Bengal, Jharkhand

Major Players: Coal India (Kolkata), NALCO (Odisha), DVC, SAIL (Rourkela), Hindalco

Flagship Projects:

- Eastern Dedicated Freight Corridor

- Paradip Port Expansion

- Kolkata East-West Metro

- Rourkela Steel Modernization

- Jharsuguda Aluminium SEZ

Sector Focus: Steel, electricity, coal

Hiring Insight: The East is India’s mineral heartland- fueling mining, metal manufacturing, and large-scale energy production. Hiring remains strong for mining engineers, metallurgists, process engineers, safety professionals, and equipment technicians, especially as modernisation programs scale up.

India’s Core Sector: Massive Job Potential, But Skill Gaps Persist

The Core sector is positioned to create up to one million new jobs over the next decade, led by high-growth segments like building materials, metals, project engineering, and power infrastructure. However, industry competitiveness is challenged by:

- Only 55% of the available workforce being job-ready for advanced engineering roles

- Employee engagement levels at a historic low of 19%

- Growing skill gaps in digital operations, automation, ESG, and predictive technologies

This combination underscores the urgent need for targeted skilling, apprenticeship programs, and workplace improvements to sustain long-term growth.

Key Hiring Challenges in India’s Core & Energy Sector

The India Decoding Jobs 2026 Report highlights several critical hiring challenges that could impact the long-term growth, productivity, and competitiveness of India’s Core and Energy sectors.

Although these eight industries contribute 40.27% to the Index of Industrial Production (IIP) and remain central to national infrastructure and manufacturing, organisations are struggling to find, attract, and retain the right talent.

Below are the most pressing workforce challenges shaping the sector in 2026 and what employers must prepare for.

1. Industry 4.0 & Digital Transformation Expose Huge Skill Gaps

As AI, automation, Robotics, IoT, and predictive analytics become standard across mining, steel, power, and refining operations, the talent gap is widening at an unprecedented pace.

- 80%+ of core-sector employers cannot find skilled digital-ready talent

- Acute shortages in plant operations, maintenance, instrumentation, and automation

- High demand but low availability of AI engineers, data analysts, PLC/SCADA experts, and advanced manufacturing professionals

Why this matters for employers: Digital transformation is no longer optional. Companies that fail to build a tech-enabled workforce risk unsafe operations, higher downtime, costly inefficiencies, and slower capacity expansion.

Taggd’s Core and Energy hiring solutions assist employers by delivering digitally skilled engineering talent, domain-ready workforce pipelines, and targeted hiring solutions for Industry 4.0 roles.

2. Difficulty Attracting Gen Z & Millennials into Core Industries

Gen Z and millennials make up the majority of India’s emerging workforce, yet they show low interest in traditional Core sector jobs.

Key barriers include:

- Perception of the sector as physically intensive, outdated, and rigid

- Desire for flexibility, purpose-driven work, and tech-enabled roles

- Preference for jobs in IT, startups, finance, and new-age tech

This perception gap is hurting employer attraction, especially when competing with tech companies offering modern work cultures.

Why this matters: Core-sector employers risk shortages in entry-level engineering talent, management trainees, and digital operations roles if they do not modernize their value proposition.

3. Persistent Skill Shortage & Employability Gap

The India Skills Report 2025 shows that only 55% of graduates are employable—a statistic that is even more concerning for specialised engineering and operations roles.

Critical gaps exist in:

- Advanced manufacturing skills

- Electrical and instrumentation

- Process engineering

- ESG & sustainability roles

- Digital plant operations and control systems

Why this matters: Projects get delayed, operational efficiency drops, and companies spend more on training and upskilling because fresh talent is not job-ready.

4. Mass Retirement Wave: The “Great Crew Change” is Here

India’s Core industries are experiencing a dramatic demographic shift:

- 27% of the oil, gas & mining workforce is aged 55+

- Nearly 50% of skilled engineers will retire within the next decade

- Massive experience drain in refineries, power plants, and mining units

This generational transition could lead to:

- Loss of institutional knowledge

- Operational disruptions

- Increased safety risks

- Higher hiring pressure on mid-career and specialist roles

Why this matters: Without succession planning, knowledge transfer, and proactive hiring, companies risk operational instability and long-term productivity loss.

Future Hiring Trends in Core and Energy Sector

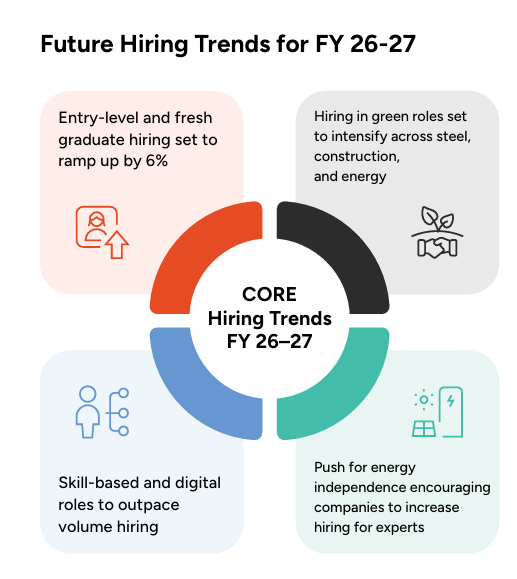

India’s core and energy ecosystem is entering a high-growth hiring cycle. Backed by record infrastructure investments, rapid technology adoption, and evolving energy needs, the next two years will see substantial job creation and a shift toward specialised, future-ready skill sets.

As highlighted in the India Decoding Jobs 2026 Report, the hiring outlook for FY26–27 signals strong opportunities across engineering, digital, sustainability, and green technology roles, positioning the sector as a major contributor to India’s goal of becoming a developed economy by 2047.

Below are the key workforce trends redefining the sector.

1. Surge in Skill Demand Across Coal, Mining & Clean Energy Technologies

The coal sector is undergoing a major transformation with the rise of:

- Mining technology and automation

- Clean coal initiatives

- Coal gasification and coal-to-liquid (CTL) projects

These shifts are creating sustained demand for:

- Mining engineers

- Automation specialists

- Process technicians

- Environmental engineers

- Plant safety professionals

Why this matters: As India diversifies its energy mix, talent with expertise in clean coal and automated mining operations will become essential for large-scale project execution.

2. Formal Flexi Hiring to Hit Record Levels by FY27

Contractual and project-based hiring will expand significantly, with the core sector expected to contribute a major share to India’s 91 lakh contract workforce by FY27.

Rising flexi hiring is driven by:

- Large-scale EPC and construction projects

- Grid modernisation

- Refinery expansions

- Seasonal and project-based staffing needs

Top roles in demand: Site engineers, maintenance technicians, safety officers, logistics supervisors, and plant operations support staff.

3. Big Push in Deep-Sea Oil Exploration Will Boost Specialist Hiring

Government-backed exploration activities—especially deepwater projects—will generate expertise-heavy roles.

Key developments:

- ONGC aims to produce 44.546 million tonnes of oil equivalent by 2026

- Major expansion in the Krishna-Godavari (KG) basin

- Higher investments in offshore rigs and subsea infrastructure

In-demand specialties:

- Seismic and geology interpretation

- Deepwater drilling engineers

- Reservoir management experts

- Subsea engineering and safety specialists

This wave of hiring will drive demand for rare technical competencies.

4. Electronics Sector to Create 12 Million Jobs by 2027

India’s rise as a global electronics manufacturing hub driven by PLI schemes and semiconductor expansion is expected to create 12 million new jobs.

High-growth roles include:

- Electronics engineers

- PCB design experts

- Automation and testing engineers

- Semiconductor fabrication technicians

- Supply chain and quality specialists

5. Entry-Level Hiring to Expand Beyond IT & BFSI

Core sectors are now aggressively attracting fresh graduates, with entry-level hiring expected to grow 6% YoY.

New-generation engineers will find opportunities in:

- Construction

- Renewable energy

- Steel and cement operations

- Power distribution and grid monitoring

- EPC project management

Trend insight: Traditional industries are repositioning themselves to attract Gen Z talent with digital roles, modern workplaces, and advanced technologies.

6. Skill-Based & Digital Roles Will Outpace Volume Hiring

Nearly 36% of organisations in the core sector are prioritising talent skilled in:

- Automation

- AI and machine learning

- Green technologies

- Digital infrastructure

- ESG and sustainability

This marks a clear shift from conventional volume-based hiring to highly specialised, tech-enabled roles.

7. Refinery Capacity Expansion to Drive Hiring Across Construction & O&M

India’s refinery capacity is expected to increase by 22% in the next two to three years.

This expansion creates significant demand for:

- Civil and mechanical engineers

- Shutdown and turnaround specialists

- Instrumentation engineers

- Operations & maintenance crews

- HSE (Health, Safety, Environment) professionals

8. Fertiliser Sector Hiring Concentrated in North & West India

Regions with the highest hiring demand include:

- Gujarat

- Rajasthan

- Uttar Pradesh

With fertiliser production scaling up, jobs will grow in:

- Chemical engineering

- Lab operations

- Supply chain and distribution

- Plant maintenance

- Quality and safety

9. Steel Industry Shifts to Green & Sustainable Technologies

The steel sector is rapidly adopting cleaner and more efficient technologies, leading to new skill requirements.

Growing demand for:

- Green steel engineers

- Electric Arc Furnace (EAF) operators

- Hydrogen-based DRI specialists

- Metallurgists with sustainability expertise

- Automation and robotics technicians

This aligns with India’s push toward low-carbon industrial manufacturing.

From deep-sea exploration and refinery expansions to green steel and electronics manufacturing, the future hiring landscape for FY26–27 is transformative and skill-intensive. Companies that focus on digital capabilities, sustainability skills, and flexible workforce models will be future-ready, while job seekers with specialised technical expertise will find unprecedented growth opportunities.

To know more about global hiring landscape and India’s position in detail, download the India Decoding Jobs Report 2026.

Wrapping Up

India’s Core and Energy sectors are entering a high-growth decade driven by infrastructure expansion, rapid digitalisation, clean-energy transitions, and major public–private investments.

The India Decoding Jobs 2026 report clearly highlights that while job creation will surge across steel, power, oil & gas, metals, mining, and electronics, the industry’s biggest challenge will be talent readiness. Organisations that double down on emerging tech skills, workforce upskilling, and strategic hiring partnerships will outperform peers, both in productivity and project delivery.

For CHROs, this is the moment to rethink workforce planning, adopt skills-first hiring, and build future-ready talent pipelines that will fuel India’s industrial growth story through 2030 and beyond.

FAQs

What are the top hiring trends in India’s Core & Energy sector for FY26–27?

Key trends include rising demand for digital and automation skills, large-scale hiring for clean energy and refinery expansions, growth in contractual workforce, rapid job creation in electronics manufacturing, and increased entry-level hiring across engineering and plant operations.

Which skill areas will be most in demand in Core and Energy Sector in 2026?

Employers will prioritise capabilities in AI automation, robotics, clean coal technologies, green hydrogen, deepwater drilling, digital infrastructure, EAF operations, and Industry 4.0 plant systems. Engineering roles linked to project execution, safety, and maintenance will remain evergreen.

Why is the Core sector struggling to attract young talent?

Gen Z seeks flexibility, rapid growth, and meaningful work- factors traditionally associated with tech and digital-first companies. Core industries must modernise work environments, improve employer branding, and create clearer career pathways to attract younger professionals.

How will contract and flexi hiring evolve by FY27 in core and energy sector?

Contract hiring is expected to expand sharply, with the Core sector contributing significantly to India’s projected 91 lakh contractual workforce by FY27. Roles in construction, fabrication, project engineering, and plant operations will dominate this shift.

What can CHROs do to prepare for the “Great Crew Change”?

CHROs must accelerate succession planning, adopt mentorship-based knowledge transfer, invest in automation to reduce operational dependency, and collaborate with RPO partners for scalable hiring across multiple high-skill roles.

Want deeper insights into Core and Energy hiring trends, AI-based workforce transformation, and India’s talent demand outlook?

Download the full India Decoding Jobs 2026 report- complete data, hiring charts, industry forecasts & strategic recommendations.

Download Now- India Decoding Jobs 2026