GCC Report 2025: India’s Global Capability Centres (GCCs) are experiencing an unprecedented growth surge, and we are in the middle of a historic boom.

With over 50% of global GCC activity in India now concentrated in India and 28 million sq. ft. of office space leased in 2024 alone, the country isn’t just supporting global operations, it’s becoming their strategic command centre.

But here’s the twist. the GCCs scaling fastest aren’t following playbooks, they’re rewriting them.

Based on Taggd’s GCC report 2025, in collaboration with JLL and CII, discover some of the top strategies that are helping today’s top-performing GCCs hire smarter, scale faster, and stay ahead.

If you’re planning to build or scale your India GCC team, these are the takeaways that can make or break your journey.

GCC Growth Code #1: Build Where Talent Grows

India’s Tier-1 cities dominate the GCC landscape in 2025, with 92% of all activity concentrated in the top six hubs:

- Bengaluru (39%) – Deep tech & R&D capital

- Hyderabad (17%) – Rising innovation hub

- Chennai (15%) – Engineering + industrial services

- Pune (11.5%) – BFSI + product engineering

- Delhi NCR (13.4%) – Multi-sector (tech, pharma, telecom, consulting)

- Mumbai – BFSI and global finance leadership

These cities have evolved into specialized talent ecosystems, and top-performing GCCs are aligning functions accordingly, not just based on cost, but on strategic capability.

However, as per Taggd’s GCC Report 2025, leading GCCs are moving beyond Tier-1 cities, expanding into Tier-2 and Tier-3 hubs to tap into new talent pools and build scalable, future-ready teams.

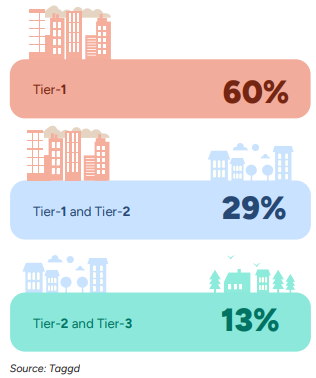

While 60% of GCCs still hire in Tier-1, a growing 40% are now expanding into Tier-2 and Tier-3 locations.

This reflects a new wave of distributed, resilient talent strategies designed for scale, sustainability, and access to untapped potential. Check out the Hiring Intent for FY26:

Cities like Coimbatore, Jaipur, Indore, Kochi, and Bhubaneswar are emerging as next-gen GCC feeder locations. These cities are now becoming the talent pool, backed by:

- Better infrastructure investments

- Growing campus hiring pipelines

- Improved work-from-anywhere readiness

- Lower attrition and higher tenure rates

GCC Report 2025 highlights that as we look toward 2026 and beyond, location will no longer be a constraint, it will be a capability.

The most resilient and scalable GCCs in India will adopt a hybrid geographic strategy, combining Tier-1 innovation hubs with Tier-2 execution and retention engines.

GCC Growth Code #2: Choose Office Space That Reflects Your Strategy

Code #1 was about where to build your team. Code #2 is about how your physical space communicates intent, readiness, and brand value.

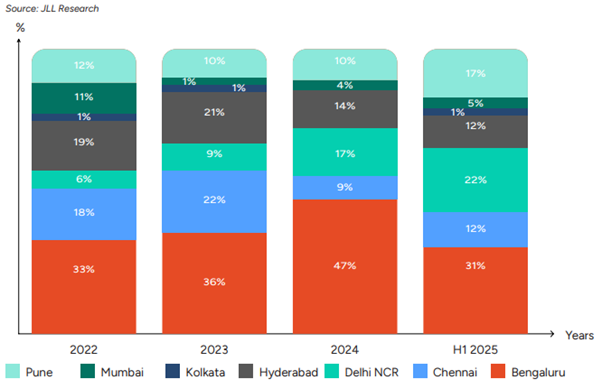

Today, GCCs in India now occupy more than one-third of all Grade A office space in India, making them the largest commercial real estate occupier segment in the country.

That’s not just a real estate stat; it’s a signal for expansion. Despite global macroeconomic headwinds, GCCs are doubling down on India, a clear signal of confidence in India’s talent, infrastructure, and innovation readiness.

As per the GCC Report, here’s where the most action is happening:

- Bengaluru (39%) – The tech and R&D capital of the world

- Hyderabad (17%) – A rising innovation hub backed by strong policy and infrastructure

- Chennai (15%) & Pune (11.5%) – Engineering and BFSI clusters

- Delhi NCR (13.4%) – A multi-sector hub (tech, pharma, telecom, consulting)

- Mumbai – Dominant BFSI base with legacy strength and domain depth

While these cities lead the GCC landscape, the fastest-scaling players aren’t just choosing where to set up, they’re rethinking how their physical footprint supports innovation, attracts talent, and signals long-term commitment.

That’s what sets GCC Growth Code #2 in motion in GCC report. As we move closer to 2026, the kind of office space and location you choose in India will say a lot about your company’s future-readiness.

Your real estate strategy is no longer just about cost savings, it’s a direct reflection of how serious you are about innovation, talent, and long-term success.

Here’s what upcoming GCCs should know about India’s real estate boom to scale smarter and faster:

Choosing Locations with Purpose

They don’t default to Tier-1 cities. Instead, they match function to geography:

- Bengaluru for tech and R&D

- Mumbai for BFSI

- Pune & Chennai for engineering/manufacturing

- Tier-2 cities (e.g., Coimbatore, Jaipur) for fresh talent and low attrition

Blending Sector Focus with Regional Strengths

They’re aligning business functions with local talent ecosystems.

- ER&D and BFSI are thriving in Hyderabad, Pune, Chennai

- Delhi NCR supports diverse sectors like pharma, consulting, and telecom

Viewing Office Space as a Talent Magnet

It’s no longer about the cheapest lease. The smartest GCCs invest in:

- Grade A, innovation-ready workspaces

- Smart infrastructure that fuels collaboration, boosts employer brand, and enhances the employee experience because top talent, especially Gen Z, doesn’t just join a company, they join an environment.

The kind of workspace you offer directly impacts who you attract, how fast you grow, and how long your people stay.

GCC Growth Code #3: Match Hiring to Indian Talent Mindset

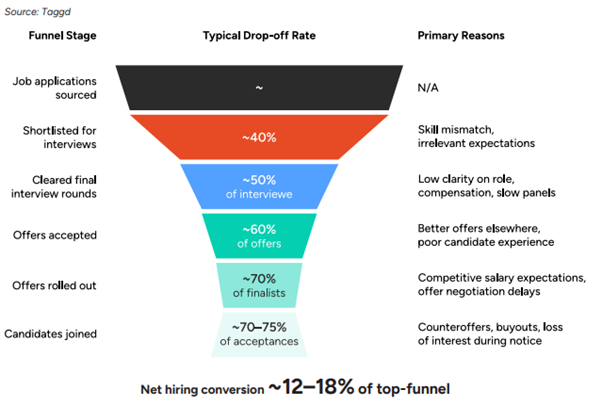

The hiring reality in India resembles a leaky funnel with brutal conversion rates that catch even experienced talent leaders off guard.

India’s talent pool is vast, but turning volume into velocity is where many stumble. According to the GCC Report 2025, the real challenge isn’t talent scarcity, it’s talent efficiency

Even experienced hiring teams are surprised by how leaky the funnel can be in India’s talent market.

Here are the top three pain points you must factor into your hiring strategy:

The Resume-Reality Gap: The first major drop-off occurs during initial screening due to inflated credentials, especially in high-demand tech roles. Limited resume verification creates inefficiencies and extends time-to-hire significantly.

The Notice Period Dilemma: India’s unique professional landscape creates a strategic challenge, 60-90 day notice periods are standard for mid-to-senior professionals. During this extended window, candidates become highly susceptible to counteroffers, retention bonuses, and competing employer outreach.

The Relocation Resistance: Flexibility has evolved from perk to foundational expectation. Professionals increasingly prioritize proximity to family and familiar environments over career advancement, regardless of tier-city location.

The Speed Imperative

Six in ten candidates drop out if the hiring process exceeds three weeks. In India’s competitive talent market, speed isn’t just efficiency, it’s strategy. Long, ambiguous hiring cycles have become primary deterrents to top talent.

Before candidates even apply, they’ve formed impressions through LinkedIn posts, Glassdoor reviews, and peer referrals. Authenticity, speed, and clarity now define employer appeal more than compensation packages.

The New Talent Expectations: Gen Z + Millennials

India’s talent economy driven by Gen Z and younger millennials requires fundamentally new engagement rules:

Gen Z Expectations (18-24 months per role):

- Career acceleration overcompensation

- AI-powered tools and real-time feedback

- Personal alignment: “Does this role reflect who I am?”

- Structured mentorship and clear career paths

Millennial Motivations (Higher stability at 10+ years):

- Professional trajectory amplification

- Bridge between legacy systems and new technologies

- Learning and leadership coexistence

For GCCs, the message is clear: India’s top talent is looking for more than employment

What the Fastest-Scaling GCCs in India are Getting Right?

The most successful GCCs in India share three critical characteristics:

Lifecycle Thinking: They don’t just hire for immediate needs, they embed workforce planning, infrastructure readiness, and ecosystem alignment into every phase of their journey.

Regional Intelligence: They understand that India’s talent landscape isn’t homogeneous. Success requires mapping nuanced skillsets to regional strengths while factoring in cost, infrastructure, and scalability.

Innovation-First Infrastructure: They prioritize premium-grade, innovation-ready spaces over volume-driven expansion, recognizing that the physical environment directly impacts talent quality and retention.

How the Smartest GCCs Are Staying Ahead?

Success in India’s GCC landscape requires understanding that traditional global playbooks don’t translate directly. The fastest-scaling GCCs are those that adapt to India’s unique dynamics while maintaining global standards and strategic vision.

The message is clear: India’s top talent isn’t just looking for employment, they’re looking for momentum. Organizations offering clear growth, meaningful work, and trust-based flexibility won’t just attract the best talent; they’ll retain and elevate them.

As India marches toward hosting 2,800-4,000 GCCs by 2030 with employment reaching 2.8-4 million professionals, the question isn’t whether India should be part of your global strategy, it’s whether you’re prepared to navigate its complexities with the sophistication that today’s landscape demands.

The GCCs that think talent-first won’t just succeed, they’ll define what success looks like for everyone else trying to catch up.

Ready to Build Smarter and Scale Faster?

Download the complete Taggd-JLL-CII GCC Report 2025 to explore all the growth codes that are powering India’s fastest-scaling Global Capability Centres.

Unlock deeper insights on:

- Salary Benchmarking by roles, regions, and experience

- Building Long-Term Talent Pipeline Ecosystems

- Talent Trends Reshaping India’s GCC Landscape

Discover what the most successful GCCs are doing differently and what you need to know before building your India team.