The rules of talent acquisition have fundamentally changed. India enters 2026 with an 11% overall hiring intent, which is up from 9.75% last year. CHROs face a paradox: more hiring, but exponentially harder decisions.

The hiring trends shaping this year aren’t just about volume; they’re about strategic recalibration in an era where every hire carries amplified risk and opportunity cost.

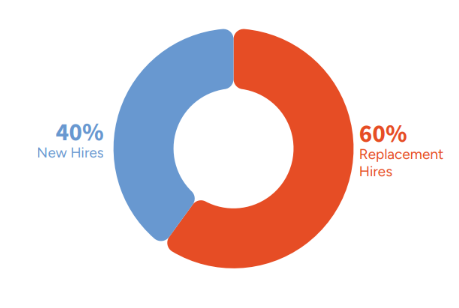

The India Decoding Jobs Report 2026 reveals a market in transition- where 60% of roles are replacements rather than net-new positions, where AI adoption has reached 44% implementation, and where the gap between what organizations need and what the market supplies has never been wider.

For Chief Human Resources Officers navigating budget pressures, digital transformation mandates, and board-level scrutiny on talent ROI, understanding these recruitment trends isn’t optional- it’s existential.

Why Traditional Talent Acquisition Models Are Breaking in India?

Traditional hiring models are no longer effective because they rely on rigid job roles, long hiring cycles, and outdated evaluation methods. These ways can’t keep pace with rapid digital transformation, AI adoption, skill shortages, and changing candidate expectations.

Modern organisations need faster, skills-based, and data-driven hiring strategies to attract and retain in-demand talent.

The Speed vs Quality Hiring Trap is a Growing Talent Acquisition Risk

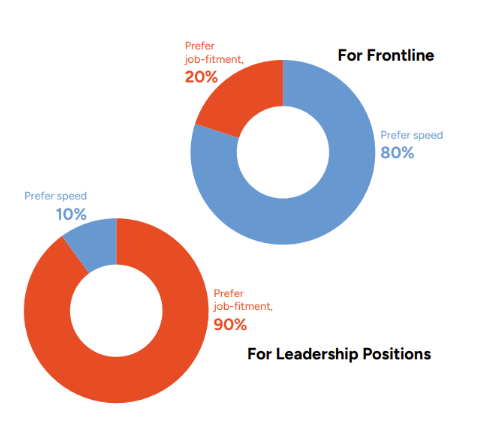

Here’s the uncomfortable truth from our research: 80% of hiring leaders prioritize speed over job-fitment for frontline roles, while 90% reverse this priority for senior positions. This bifurcated approach creates a dangerous illusion of efficiency that’s costing organizations far more than they realize.

The hidden costs accumulating in your organization:

Rising derailment behaviors across the workforce- resistance to feedback, self-centered work styles undermining team collaboration, low accountability under stress, ambition without adaptability leading to premature burnout, and overcommitment followed by disengagement. These patterns don’t emerge overnight. They’re the downstream consequence of hiring for speed at the frontline, where cultural and behavioral alignment gets deprioritized.

Consider the compounding effect: by the time these professionals reach middle management (the 62% of 2026 hires with 1-10 years’ experience who form your promotion pipeline), the damage multiplies. A mis-hire at the frontline becomes a problematic team leader in 4-6 years, creating dysfunction that spreads across teams and drives away your best performers.

What CHROs must rethink: The false economy of fast frontline hiring. With average cost-per-hire rising to INR 2-12 lakh for senior roles and turnaround times extending to 60+ days for leadership positions, the real expense isn’t the hire- it’s the mis-hire discovered three years later. One study found that bottom-quartile hires consume 3-4x the management time of top-quartile hires, effectively reducing management capacity by 25-30%.

How Taggd solves the speed-vs-fit dilemma: Traditional recruitment forces a binary choice, but Taggd’s approach delivers both through pre-qualified talent pools of 50+ million professionals, AI-powered behavioral assessments.

The Replacement-Heavy Market Signals Deeper Structural Problems

That 60-40 split between replacement and new positions isn’t a sign of market maturity- it’s a red flag about retention architecture. When BFSI, FMCG, and Healthcare sectors lead replacement hiring to “manage attrition and business continuity,” it indicates organizations are running faster just to stay in place.

The strategic questions every CHRO should be asking:

Are you replacing roles because of natural attrition, or because your employee value proposition hasn’t evolved for hybrid-native, purpose-driven talent? With only 10-25% of positions filled through internal mobility, most organizations essentially admit they’d rather buy talent than build it. This is sustainable- until it isn’t.

As the future of hiring in India tilts toward specialized skills (AI/ML engineering, cloud architecture, cybersecurity), external-only strategies will price organizations out of critical capabilities. The math is brutal: external senior hires cost INR 2-12 lakh in recruitment fees plus 60-90 day time-to-hire plus 6-12 month ramp-to-productivity. Internal promotions cost INR 0 in recruitment fees, 0 days time-to-hire, and 3-6 months ramp-to-productivity- delivering 40-60% faster ROI at 30-50% lower total cost.

How Taggd transforms internal mobility: We don’t treat it as an HR program but as a talent marketplace requiring platform, product, and incentive design. Our methodology includes implementing talent marketplace platforms with real-time job visibility and skills-based matching.

The Derailment Crisis: The Silent ROI Killer No One’s Measuring

The India Decoding Jobs Report 2026 report highlights an alarming trend: derailment behaviors are increasing across the workforce. For a mid-level manager earning INR 25 lakh annually, total derailment costs range from INR 37.5 lakh (direct separation and replacement costs) to INR 1.5-2 crore (including opportunity costs from failed projects and cultural costs from voluntary departures of team members).

When derailment rates increase from 5% to 10% in a 1,000-person organization, the annual cost increase ranges from INR 18.75 crore to INR 75 crore depending on role mix and whether cultural costs are included.

Sector-Wise Hiring Trends: Where Companies Should Hire More or Hold Back

As India enters FY26–27, hiring decisions are no longer about expansion alone- they’re about precision. With uneven growth across sectors, CHROs and business leaders must know where to invest in talent and where to slow down. This section breaks down sector-wise hiring trends to guide smarter workforce planning.

Automobile: Navigating the ICE-to-EV Talent Chasm

India enters FY26–27 with strong momentum, led by an 8% hiring intent and a 10.1% average salary increase, marking the fifth consecutive year of double-digit wage growth. This sustained rise in compensation highlights continued demand for skilled talent, inflation-adjusted pay corrections, and competitive hiring across high-growth sectors such as automotive, BFSI, manufacturing, and technology, reinforcing India’s leadership in talent-led economic growth.

The crisis beneath: An 80% skills gap for high-skill roles in battery engineering, software, and automation. Only 55% of graduates are employable, there’s a 4.3 vacancy rate per 100 employees, and 43% overlap between ICE and EV competencies means 27% of your current talent needs complete reskilling, not just upskilling.

The automotive software market is projected to reach $43 billion by 2027. India’s autonomous vehicle market will hit $23.3 billion by 2033 (24.3% CAGR). The global automotive cybersecurity market is expanding at 18.93% CAGR to $31.34 billion by 2031. These aren’t incremental changes- they’re existential transformations.

Critical recruitment challenges in automobile:

The “hire and train” model breaks completely when battery engineering requires electrochemistry knowledge that mechanical engineers don’t possess, software-defined vehicles demand embedded systems expertise traditional automotive engineers lack, and autonomous systems need computer vision and machine learning skills that require years to develop.

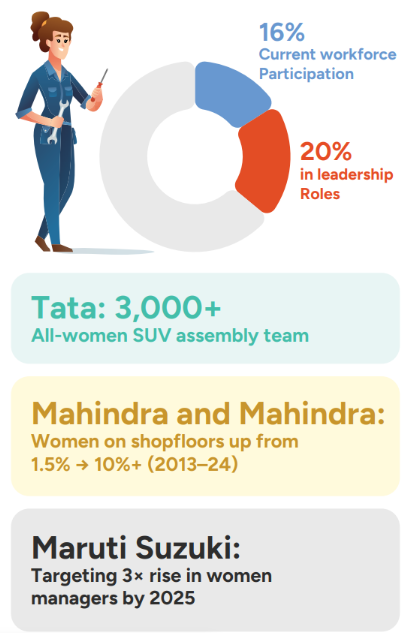

At 15% female representation versus 30% targets elsewhere, automotive leaves massive talent pools untapped. Research shows diverse teams deliver 15-20% better revenues, yet only 20% of automotive leadership is female.

With 60% onsite roles and only 35% hybrid, automotive can’t compete with tech companies offering remote flexibility. And internal mobility stuck at 10-25% means companies are laying off ICE engineers while struggling to recruit EV engineers-destroying institutional knowledge while inflating recruitment costs.

The winning automotive strategy for FY26-27:

Shift from “hire and train” to “train and hire”: Build EV academies through partnerships with 5-7 Tier-2/Tier-3 engineering colleges. Co-design curriculum, sponsor research, offer co-op programs, and guarantee interviews for top performers. Investment of INR 2-3 crore annually per partnership generates 50-75 qualified graduates annually, saving INR 6-12 lakh per hire compared to market recruitment.

Build internal transition pathways: Create 6-12 month reskilling programs for mechanical engineers moving to battery engineering, 4-6 month programs for powertrain engineers moving to electric powertrains, and 3-6 month programs for software engineers learning automotive-specific protocols. The math: reskilling costs INR 5-8 lakh vs. INR 8-15 lakh for external recruitment, while preserving institutional knowledge and cultural fit.

Fix gender diversity strategically: Overhaul employer branding to feature female engineers prominently, partner with women engineering associations, mandate diverse interview panels (which improve ALL hires by 25-35%), implement genuinely flexible hybrid models, enforce zero tolerance for exclusionary behavior, and audit promotion rates annually. Target: increase female hiring from 15% to 25% in Year 1.

Regionalize intelligently: With 55% of automotive hiring outside Tier-1 cities (35% Tier-2, 20% Tier-3), anchor in emerging clusters like Sanand, Chakan, and Sri City before compensation inflation erodes the arbitrage. Leverage apprenticeships at 12% of hires—pay competitively (INR 15-25k/month), provide structured learning, and create clear conversion pathways. Maruti Suzuki runs 2,000+ apprentices annually with 70% conversion rates, saving INR 15-20 crore annually.

Our automotive hiring model helps you solve auto industry’s toughest challenges and build teams across every segment.

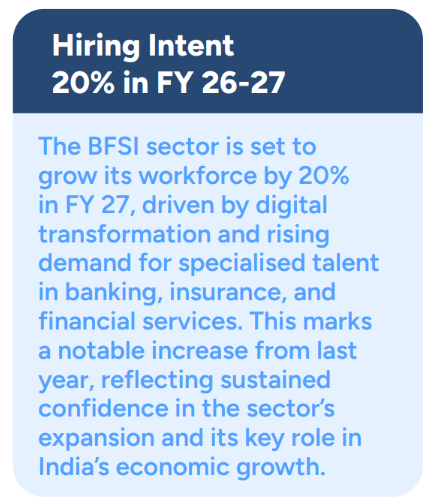

BFSI: Leading Intent, Lagging Digital Transformation

BFSI leads overall hiring intent in 2026 but faces a critical inflection point. As digital transformation demands cybersecurity heads, chief data officers, and AI/ML engineering managers, the sector’s traditional talent pipelines are fundamentally misaligned.

Source: India Decoding Jobs Report 2026, Taggd

The trap: Over-indexing on pedigree and credentials when the actual need is adaptive capacity and digital fluency. With AI adoption at 44% implementation across Indian organizations, BFSI’s conservative culture may create a “skills debt” that compounds quarterly.

What to rethink:

Redefine “banking experience”: Fintech poaching your talent isn’t about compensation alone- it’s about velocity and autonomy. Create internal “fintech pods” with separate operating models: modern tools, agile processes, equity compensation for critical digital roles benchmarked against tech industry rather than banking industry.

Invest aggressively in employer branding: With 60% of organizations actively investing in branding strategies to attract Gen-Z, BFSI’s traditional employer image is a liability. Showcase your AI initiatives, innovation labs, and transformation journey- not just stability and benefits.

Build T-shaped talent: Instead of hiring pure-play digital experts or pure-play banking experts, develop T-shaped professionals with deep expertise in one domain plus broad competency in adjacent areas. Send traditional bankers to coding bootcamps for basic Python and data analytics. Embed tech professionals in banking operations to learn credit risk and regulatory constraints.

How Taggd solves BFSI’s digital talent challenge: We source fintech professionals who have both digital skills and finance context, management consultants who understand banking with external digital exposure, e-commerce talent combining technology fluency with customer-centricity. Our AI-powered BFSI hiring solutions, specialized talent pools and cross-industry sourcing access the 70-80% of candidates traditional BFSI recruiting misses by over-indexing on pedigree.

IT/Tech: From Volume to Value in a Specialized Era

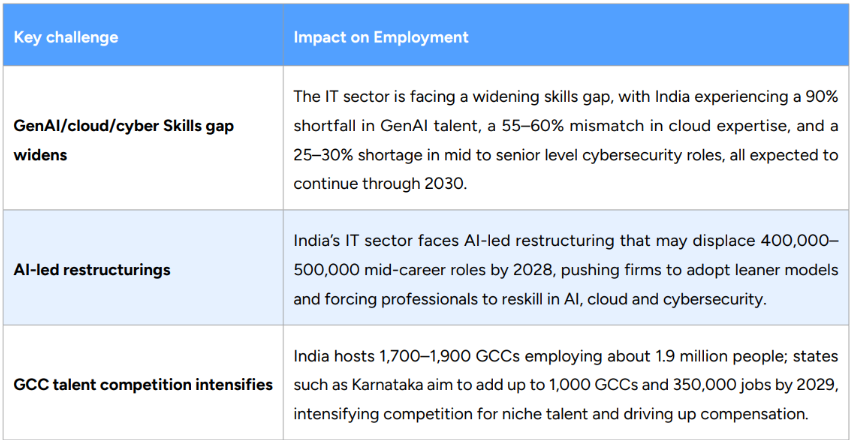

Despite following automotive and manufacturing in hiring intent, IT faces unique pressures. The shift from staff augmentation to specialized delivery creates fundamental talent architecture challenges.

The opportunity: High-demand, low-supply roles in AI/ML engineering, data science, and cloud architecture position tech leaders to shape the entire market’s talent acquisition trends.

The risk: Commoditizing tech hiring when differentiation matters most. With 72% of roles permanent but gig work comprising 16% of opportunities, IT CHROs must architect portfolio careers, not just job descriptions.

What to rethink:

Kill the “bums on seats” mentality: With 40% hybrid work and productivity imperatives, measure outcome contribution, not utilization rates. The billable hours model is dying; value delivery is the future.

Build “boomerang bridges”: Low internal mobility (10-25%) means you’re losing institutional knowledge. Create alumni networks and flexible re-entry pathways. Former employees who return bring external exposure while retaining cultural understanding.

Embrace portfolio careers: The 16% gig workforce isn’t temporary- it’s structural. Design role architectures that blend permanent core teams with flexible specialized talent, creating opportunities for professionals who want variety over linear progression.

To explore more about global hiring trends, Indian outlook, challenges, and other IT industry detailed insights, download the Taggd’s India Decoding Jobs Report.

Manufacturing, Core Industries & Defense: The Decentralization Imperative

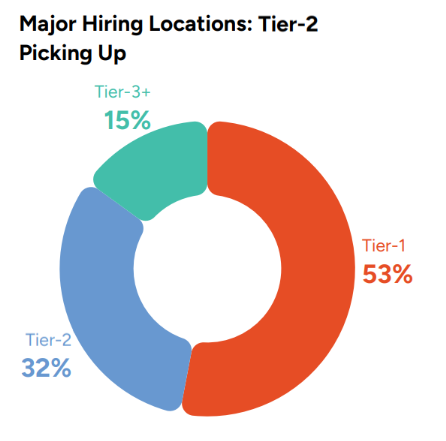

With 55% of automotive hiring now outside Tier-1 cities and Tier-2 locations capturing 32% overall, manufacturing’s geographical strategy is evolving faster than its talent strategy.

Automotive and manufacturing companies are aggressively expanding into Tier-2 and Tier-3 regions to reduce costs, access land, and be closer to supply chains. New EV plants, component clusters, and logistics hubs are reshaping India’s industrial map. However, while factories and investments are moving quickly, workforce planning has not kept pace with the realities of attracting, relocating, and retaining skilled talent in these emerging locations.

The challenge: Skilled engineers, supervisors, and technical specialists increasingly weigh lifestyle factors alongside compensation. Limited access to quality schools, healthcare facilities, housing, spousal employment opportunities, and social infrastructure makes relocation difficult.

This leads to higher attrition, long commute arrangements, rotational staffing models, or reluctance among experienced professionals to move- ultimately slowing plant stabilisation and productivity.

What to rethink:

Co-create infrastructure: Partner with state governments to build “talent townships” around new clusters- housing, schools, healthcare, recreation. The cost of employee dissatisfaction exceeds the investment in community building.

Leverage apprenticeship models: At 12% of automotive hires, apprenticeships offer sustainable pipelines- but only if designed for real skill-building, not cheap labor. Pay competitively, provide structured learning with mentorship, and create transparent conversion pathways.

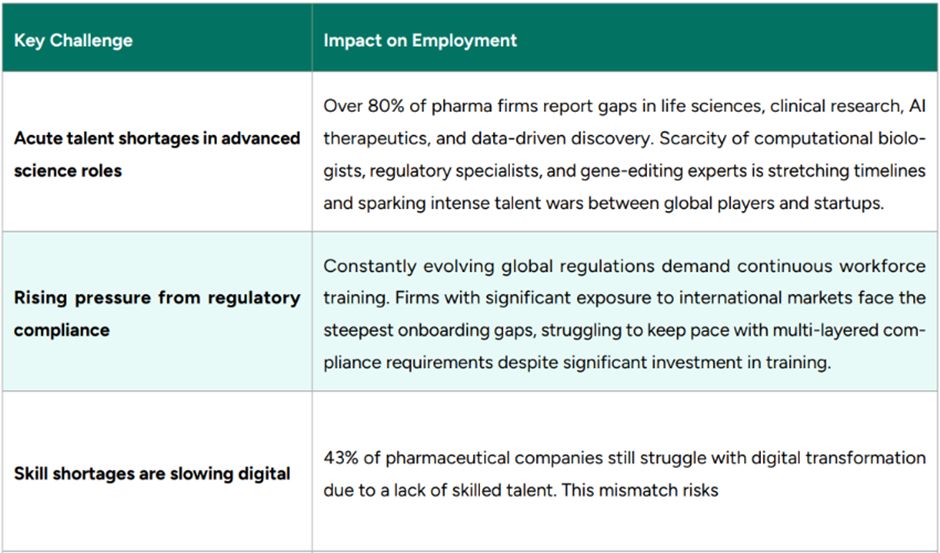

Pharmaceuticals, Biotechnology & Medical Devices: The Quiet Talent Crisis

The pharma, biotech, and medical devices sectors face compound challenges.

These industries operate at the intersection of science, regulation, and global competition.

Roles demand deep domain expertise, long training cycles, and hands-on exposure to highly specialized research, clinical, and compliance environments. At the same time, Indian companies compete with global pharma giants, CROs, and academic institutions for a very limited pool of PhDs, clinical researchers, regulatory specialists, and MedTech experts- intensifying hiring timelines, costs, and attrition risks.

The trap: Scientific careers do not follow corporate timelines. PhD and postdoctoral journeys span years, not quarters, and scientists are driven by intellectual freedom, research impact, and peer recognition- not just compensation.

Applying 15–45 day hiring cycles, generic interviews, and short-term KPIs often leads to misalignment, poor engagement, and early exits, especially when roles feel execution-heavy rather than discovery-led.

What to rethink:

Create research sabbatical programs: Allowing periodic academic re-engagement builds loyalty and keeps skills current. Scientists value intellectual stimulation- provide it or lose them to academia.

Partner with academic institutions early: Sponsor research, don’t just recruit graduates. Fund doctoral programs, co-publish papers, host symposiums. Own the pipeline, don’t rent it.

FMCG, Retail & Logistics: The Gig Economy’s Testing Ground

With gig roles accounting for 16% of overall hiring and steadily rising, several sectors are pioneering flexible workforce models- but often without strategic intent.

Industries such as BFSI, logistics, e-commerce, manufacturing support, and customer operations are increasingly relying on gig and contractual talent to manage demand volatility, seasonal spikes, and project-based work. However, in many organisations, gig hiring remains reactive rather than embedded within long-term workforce strategy.

The risk: Treating gig hiring as “hiring lite” instead of a distinct workforce capability.

When gig roles are managed like temporary fixes, organisations face inconsistent performance, compliance risks, low engagement, and weak accountability.

Gig talent requires different management frameworks, technology enablement, and cultural integration. Without this, productivity drops and dependence on third-party aggregators increases.

What to rethink:

Build gig into workforce planning: Don’t use contingent workers to paper over poor demand forecasting. Integrate them into core operations with clear pathways to permanence.

Invest in gig infrastructure: Platforms, benefits, training- or watch aggregators commoditize your workforce access. Own the relationship with your flexible workforce or lose control entirely.

Get detailed insights into these industries in India Decoding Jobs 2026 Report.

Semiconductors, Telecom & Aviation: The Scale-Up Pressure

Semiconductors, telecom, and aviation are among India’s fastest-scaling sectors, driven by PLI schemes, supply-chain diversification, 5G rollout, and aerospace manufacturing localisation.

The core challenge is expanding talent capacity rapidly while preserving deep technical quality, especially as India integrates into global value chains with zero tolerance for skill gaps.

The opportunity: Organisations that invest early in in-house academies for chip design, RF engineering, avionics, and systems integration can shape job-ready talent rather than compete endlessly for scarce experts.

Structured academies aligned to global standards reduce ramp-up time, improve quality, and create long-term talent moats.

The challenge: Indian firms compete directly with global employers offering international exposure, cutting-edge projects, and premium compensation. Without equivalent learning depth, mobility, and career progression, retaining specialised engineers becomes increasingly difficult.

What to rethink:

Lobby for visa reciprocity: If you’re building in India for the world, ensure your talent can move globally for experience, then return. Brain circulation beats brain drain.

Create technical ladders rivalling management tracks: Lose the “up or out” mentality that pushes engineers into management. Many want to remain technical while advancing- create Fellow, Principal Engineer, Distinguished Engineer tracks.

Education & Oil/Gas: The Disruption Outliers

Education and Oil & Gas sit at opposite ends of the disruption spectrum yet face a common challenge- reinventing their workforces while sustaining core operations. Education institutions must digitally upskill educators, administrators, and support staff even as they deliver tech-enabled learning.

Oil & Gas organisations must manage the energy transition while ensuring safety, reliability, and regulatory compliance in legacy operations.

What both need: Incremental training is no longer enough. Both sectors require clearly articulated reskilling roadmaps that openly acknowledge role evolution and obsolescence, while outlining credible pathways to future relevance. Trust erodes when transformation is implied but not explained.

What to rethink:

• Name the roles at risk- early and clearly: Avoid euphemisms. Employees respond better to clarity than uncertainty.

• Invest in transition, not just training: Pair learning programs with job pathways, certifications, internal redeployment, and financial safety nets.

• Link reskilling to future demand: Align programs with digital education delivery, data-led learning models, renewables, hydrogen, safety tech, and energy analytics.

5 Strategic Bets Defining the India Hiring Outlook 2026

As India’s hiring outlook for 2026 turns cautiously optimistic, one truth is unmistakable: incremental tweaks to yesterday’s hiring playbook will not deliver tomorrow’s workforce advantage.

The hiring trends in India now reflect a market where risk, speed, and strategic precision intersect. CHROs who win will do so not by hiring more- but by hiring differently.

Based on the India Decoding Jobs Report 2026, these five strategic bets will distinguish talent leaders shaping the future of hiring in India from those struggling to keep up.

1. Treat AI as Talent Infrastructure, Not a Recruitment Experiment

With 44% of Indian organisations already implementing AI and another 37% planning adoption, AI-led hiring has decisively crossed the experimentation threshold. Yet most recruitment trends in India reveal a narrow use case- AI is heavily deployed for résumé screening (60%) and interviews (45%), while decision intelligence and predictive recommendations remain underutilised.

The winning CHRO hiring strategy: Use AI to amplify what machines do best- pattern recognition, speed, and bias reduction- while doubling down on human judgment for cultural fluency, adaptability, and leadership potential.

Organisations succeeding with AI are not automating hiring for efficiency alone. They are redesigning hiring for quality, using AI to surface better options while enabling recruiters to make smarter decisions.

What CHROs should do now:

- Audit your recruitment tech stack for AI-readiness and integration gaps

- Train recruiters to collaborate with AI, not compete with it

- Measure AI impact on quality-of-hire and long-term performance, not just time-to-hire

AI will define talent acquisition trends in 2026, but only for organisations that treat it as core infrastructure, not a bolt-on tool.

2. Rebuild Internal Mobility Before the Market Prices You Out

With only 10–25% of roles filled internally, most Indian organisations still operate a “buy-first” talent model. In a market where senior hiring costs range from INR 2–12 lakh and time-to-hire exceeds 60 days, this approach is no longer sustainable.

The workforce trend India can’t ignore: Specialised skills are becoming too scarce and too expensive to rely solely on external hiring.

The winning bet: CHROs who invest in internal talent marketplaces, transparent career pathways, and manager incentives for talent development will reduce external hiring costs by 30–40% while dramatically improving retention and engagement.

What CHROs should do now:

- Launch a visible, skills-based internal talent marketplace

- Reward managers for developing and exporting talent—not hoarding it

- Elevate lateral moves to the same status as promotions

- Track career velocity and employee satisfaction, not just internal fill rates

In the future of hiring in India, internal mobility is no longer an HR program—it is a competitive moat.

3. Design for 30% Female Hiring- Then Redesign the System Around It

India’s hiring targets for FY26–27 aim for 30% female participation across IT, BFSI, and Healthcare- yet sectors like automotive remain stuck at 15%. The real challenge isn’t intent; it’s readiness.

The losing pattern: Hiring more women into unchanged systems and blaming “attrition” when those systems fail them.

The winning CHRO hiring strategy: Reverse-engineer the entire talent ecosystem for inclusion- interviews, performance management, leadership pipelines, and flexibility norms, so diverse talent can actually thrive.

What CHROs should do now:

- Mandate diverse interview panels (proven to improve overall hiring quality by up to 35%)

- Eliminate flexibility stigma in performance and promotion reviews

- Track progression, pay equity, and leadership representation, not just hiring ratios

- Introduce sponsorship programs that actively accelerate high-potential women

In the evolving recruitment trends India is witnessing, inclusion is no longer a DEI initiative, it’s a growth strategy.

4. Treat Employer Branding as a Revenue Lever, Not a Marketing Cost

With 60% of organisations actively investing and another 23% evaluating employer branding, the question is no longer whether to invest, but how.

Gen Z and millennial talent don’t want aspirational messaging. They want evidence.

The winning bet: Authenticity over polish. Employee voices over corporate slogans. Leadership visibility over glossy career pages.

What CHROs should do now:

- Enable employees to share real, unfiltered experiences- including challenges

- Engage transparently on platforms like Glassdoor and LinkedIn

- Position the CEO and CHRO as visible voices on the organisation’s talent journey

- Measure employer brand ROI through offer acceptance rates, referral quality, and time-to-fill

Employer brand is now inseparable from talent acquisition trends in 2026- it directly impacts hiring velocity, cost, and credibility.

5. Regionalise Talent Strategy Before Tier-2 Cities Become Tier-1 Priced

With 32% of hiring now occurring in Tier-2 cities and 20% in Tier-3, India’s talent geography is undergoing a rapid shift. But the arbitrage window is closing fast- cities like Pune, Ahmedabad, and Indore are already experiencing 15–20% annual compensation inflation.

The winning bet: Move early- not just for cost efficiency, but to access overlooked talent pools before competition intensifies.

What CHROs should do now:

- Align three-year hiring plans with city-level talent supply data

- Build hub-and-spoke models with Tier-2 centres of excellence linked to Tier-1 leadership

- Partner with regional colleges and institutions before exclusive pipelines form

In the India hiring outlook 2026, regionalisation isn’t decentralisation—it’s strategic foresight.

Wrapping Up

Here’s what the India Decoding Jobs 2026 report ultimately reveals: hiring is no longer downstream of business strategy- it IS business strategy. When 11% hiring intent meets acute skills shortages in AI/ML, cybersecurity, and digital transformation, when 60% of roles are replacements suggesting retention challenges, and when cost-per-hire is rising while time-to-fill extends for critical roles, talent becomes the constraining function.

The CHROs who will succeed in FY26-27 are those who reframe their mandate from “filling requisitions” to “building competitive advantage through people.” This means:

- Partnering with CFOs on talent investment ROI, showing how internal mobility programs reduce external hiring costs by 30-40%.

- Partnering with CTOs on technology talent architecture, building pathways from traditional IT to AI/ML rather than competing in the external market.

- Partnering with business heads on workforce scenario planning, showing how different hiring strategies impact time-to-market and innovation velocity.

- Partnering with the board on talent risk, making visible the cost of inaction on diversity, skills gaps, and employer brand.

The future trends in recruitment aren’t about predicting what’s next- they’re about building the capabilities to adapt to what’s next, regardless of what it is. The organizations that will win architect for agility, not just optimization. They build talent supply, not just source it. They measure capability acquisition, not just headcount. They treat every hire as a strategic decision with multi-year consequences.

How Taggd Transforms Recruitment from Cost Center to Growth Engine

Everything described in this analysis- from solving the speed-vs-fit dilemma to building internal mobility to preventing derailments to executing sector-specific strategies-requires expertise, relationships, and dedicated focus that internal HR teams struggle to maintain while handling operational demands.

Taggd’s comprehensive approach delivers:

- Strategic capability building beyond requisition filling: College partnership development, apprenticeship program design, internal mobility platform implementation, and reskilling program architecture.

- Specialized talent access: Proprietary database of 50+ million professionals with pre-qualified pools in automotive/EV, BFSI digital transformation, AI/ML engineering, and other high-demand specializations. Cross-industry sourcing bringing adjacent talent pools that traditional recruiting misses.

- Speed without quality compromise: 30-40% faster time-to-hire through persistent pipelining. 40-60% lower derailment rates through structured behavioral assessment. Outcome-based pricing where we take financial accountability for retention and performance.

- Diversity acceleration: Specialized women-in-engineering sourcing delivering 25-30% female hiring rates. Bias-reduced assessment protocols. Employer brand consulting positioning clients as destinations for diverse talent.

- Cost efficiency at scale: 25-35% lower cost-per-hire through process optimization. For large organizations, annual savings of INR 50-80 crore through faster hiring, lower costs, improved retention, and internal mobility enablement.

- Measurable business impact: Our clients don’t just fill positions faster—they build strategic capabilities that drive business outcomes. Reduced time-to-market for new products. Higher innovation rates from diverse teams. Improved customer satisfaction from better-fit employees. Competitive advantage from proprietary talent pipelines.

Your Next Step

The India Decoding Jobs 2026 report provides the evidence layer for these strategic decisions. It offers sector-specific insights across 18 industries, detailed analysis of AI adoption patterns, comprehensive cost and timeline benchmarks, and regional hiring intelligence.

But data alone doesn’t drive change. What separates insight from impact is interpretation, trade-off analysis, and strategic courage.

The question for every CHRO reading this: Are you using talent acquisition trends 2026 to justify the status quo, or to challenge it? Are you presenting hiring plans, or talent strategies? Are you measuring activity, or outcomes?

Because in 2026, the talent war won’t be won by those who hire the most. It will be won by those who hire the smartest- balancing speed and fit, cost and quality, external acquisition and internal development, stability and flexibility.

The playbook has changed. The only question is whether yours has changed with it.

Ready to transform your talent acquisition from reactive hiring to strategic advantage?

Download the full India Decoding Jobs 2026 Report for the complete sector-by-sector breakdown, detailed cost benchmarks, and AI adoption frameworks.

Or contact Taggd to explore how our strategic RPO partnership can deliver 30-40% cost savings, 40-60% faster time-to-productivity, and measurable business impact through superior talent acquisition.

Because in the war for talent, intelligence isn’t just an advantage- it’s the only sustainable weapon.