India’s BFSI industry stands on the brink of its most transformative decade yet. The sector has expanded 50x since 2005 and continues to maintain strong momentum, growing at 11.5% CAGR through 2030. Today, BFSI employs nearly 30 lakh professionals, and hiring is rapidly deepening across Tier-2/3 cities- a sign that financial services are no longer metro-centric but nationally distributed.

The next few years will be defined by scale. India is expected to add 2.5 lakh new BFSI jobs by 2030, with recruitment intensity projected to rise from 8.7% in FY26 to 10% by FY30, powered by digitisation, risk-tech, AI-led banking models, cyber resilience, and product-first financial innovation.

At the heart of this growth is the fintech engine. The Indian fintech market is set to hit $550.9B by 2033, growing at 30.26% CAGR, supported by 2,100+ fintech players spanning digital lending, regtech, insurtech, wealth-tech and payment tech ecosystems. As capital flows deepen and adoption accelerates, BFSI is becoming not just a financial sector- but a technology-driven growth economy of its own.

Key Trends in BFSI Hiring

As per Taggd’s India Decoding Jobs Report 2026, the BFSI sector is entering a high-intensity hiring phase in 2026, driven by AI adoption, cybersecurity expansion, digital payments growth, rising fintech demand, flexible gig-work models, and large-scale reskilling.

These trends are reshaping workforce needs and redefining how banks build future-ready talent.

1. Digital Transformation & AI Talent Surge

Banks and NBFCs are rapidly modernising core banking systems with AI, automation, and advanced analytics.

Hiring is forecast to rise 8.7% in FY 2025–26, with the highest demand for:

- AI/ML engineers for credit risk & decision models

- Digital product managers

- Automation engineers & model validation analysts

AI-powered banking adoption is expected to scale sharply through 2030, creating sustained, multi-year hiring demand.

2. Cybersecurity Workforce Expansion

With rising digital transactions and fraud threats, BFSI institutions are building dedicated cyber-risk teams.

High-demand roles include:

- Cybersecurity Architect

- SOC Analyst

- Threat Modelling Specialist

- Zero-Trust Security Lead

Salary benchmarks range ₹18–50 lakhs, reflecting criticality and niche skill scarcity.

3. FinTech Growth & Digital Payments Boom

India’s fintech ecosystem is scaling globally, with the market expected to reach $550B by 2033 (30.2% CAGR). Digital payments alone could hit $10T by 2026, driving demand for:

- Payments Product Managers

- Fraud/Risk Analysts

- API Banking & UPI Engineers

- Compliance & Regulatory Tech Talent

Fintech is emerging as a primary hiring engine for BFSI.

4. Gig-Work Integration in BFSI Workforce

By 2026, 20% of BFSI talent will operate through gig or hybrid models, enabling cost optimisation and agility. Institutions are increasingly blending:

- Contract professionals

- Flexible gig talent pools

- Permanent workforce for core functions

This shift is reducing fixed cost load and accelerating digital transformation capability.

5. Upskilling > Hiring: Cost Efficiency Mindset

Reskilling talent is now cheaper and more sustainable than replacing them.

A financial institution spends:

- $31,800 to reskill

- $80,900 to release + rehire

A BFSI firm with 30,000 employees could save $75–115M in 4 years through structured upskilling- a massive competitive advantage.

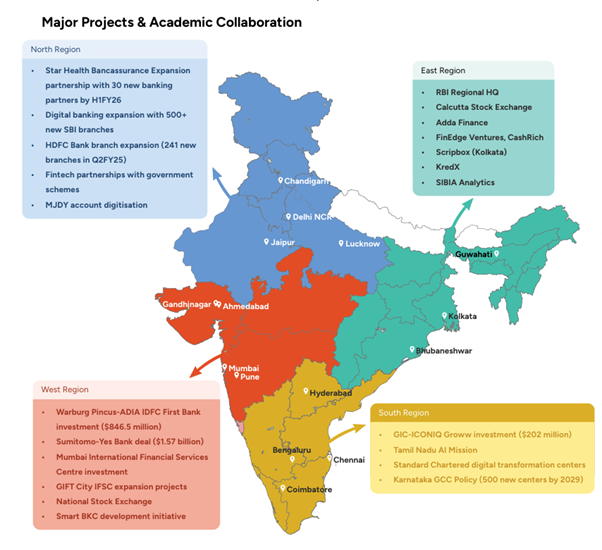

Region-Wise BFSI Hiring Growth in India

The BFSI sector’s regional expansion in FY2026 demonstrates how India is evolving into a multi-cluster financial powerhouse, driven by digital adoption, fintech investments, and inclusive banking penetration.

Each region is developing its own hiring signature- from AI-first FinTech growth in the South to rural-financial expansion in the East.

| Region | Key Cities/Nodes | Key Public & Private Institutions | Major Projects & Collaborations | Focus Areas for Growth & Hiring |

| North India | Delhi NCR (Gurugram, Noida), Chandigarh, Jaipur, Lucknow | SBI, PNB, BOI, UCO Bank, Central Bank of India, HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra, Yes Bank, IndusInd Bank | Star Health’s Bancassurance expansion with 30 new banking partners by H1FY26, SBI to open 500+ digital-first branches, HDFC Bank added 241 new branches (Q2FY25), increasing fintech convergence under govt schemes | Tier-2/3 banking growth, digital transformation, MSME credit acceleration, fintech partnerships, govt scheme digitisation (PMJDY), financial inclusion |

| South India | Bengaluru, Chennai, Hyderabad, Coimbatore, Kochi, Mysuru | Standard Chartered GBS, ICICI Lombard, Ujjivan SFB, CreditAccess Grameen, Fincare SFB, Mr Cooper Group | GIC-ICONIQ–Groww investment $202M, Tamil Nadu AI Mission, Standard Chartered Digital Hub scale-up, Karnataka GCC policy aiming for 500 new GCCs by 2029 | GCC expansion, AI/ML hiring, cybersecurity hubs, digital lending platforms, insurtech, CX transformation, startup-driven BFSI innovation |

| West India | Mumbai, Pune, Ahmedabad, Surat, Gandhinagar (GIFT City), Nashik | SBI, HDFC Bank, Bajaj Finance, Kotak Mahindra, Tata AIG, HDFC ERGO, Goldman Sachs GCC, JPMorgan Chase GCC | Warburg Pincus + ADIA investment in IDFC First Bank (₹7,500 Cr), Sumitomo–Yes Bank deal $1.57B, GIFT City IFSC infrastructure push, Smart BKC fintech district | Global BFSI hub, cross-border banking, wealth-tech growth, blockchain & RegTech adoption, payments scale-up, wealth & private market advisory |

| East India | Kolkata (epicenter), Siliguri, Bhubaneswar emerging | Bandhan Bank HQ, UCO Bank, Allahabad Bank, United Bank, NABARD East, RBI HQ (Regional), Calcutta Stock Exchange | Rise of home-grown fintechs including Adda Finance, FinEdge Ventures, CashRich, Scripbox (Kolkata), KredX, SIBIA Analytics |

Key Challenges in BFSI Hiring

India’s BFSI industry is scaling fast but growth isn’t frictionless. The sector is entering 2026 with strong demand, yet talent shortages, regulatory risk, digital skill gaps, and evolving workforce expectations are slowing execution. These challenges directly impact product rollouts, compliance, fraud control, and fintech competitiveness.

Here’s a deeper look at what’s holding hiring back and how Taggd helps organisations overcome these barriers.

1. Tech-Skill Gap in AI, Data & Cloud

As BFSI moves toward hyper-automated, predictive and cloud-native operations, demand for tech talent is outpacing supply. Studies show a 42% skill gap for AI and data roles in BFSI GCCs — and this deficit is expected to widen in 2026.

Banks and NBFCs specifically struggle with:

- AI/ML engineering

- Cloud security and architecture

- Cybersecurity defence

- Data science, analytics & risk modelling

- DevOps + platform automation

2. Uneven Talent Supply Across Regions

Tier-2 and Tier-3 hiring is accelerating — but talent distribution isn’t uniform. While metro hubs supply data + fintech-ready talent, smaller cities excel in lending ops, collections, and retail banking.

This skill mismatch leads to:

- Delays in scale-ups

- Higher cost of relocation

- Lower productivity in new markets

3. Regulatory & Compliance-Linked Hiring Risks

With identity discrepancy rates at 11.69%, and employment falsification forming nearly 29% of verification issues, BFSI hiring is exposed to fraud risk and audit escalations. Compliance-heavy roles require rigorous background checks, documentation workflows and stringent verification.

4. Seasonal Hiring Spikes & Inefficient Recruitment

BFSI hiring surges in bursts- credit cycles, seasonal loan demand, insurance peak season, collections expansion. But many organisations still run recruitment manually, causing:

- Long time-to-fill cycles

- High hiring cost and drop-off

- Slow mass-intake ramp-ups

5. Generational Shift & Evolving Talent Expectations

Gen Z talent wants purpose, growth, digital work environments, and financial stability — not just jobs. Legacy BFSI structures still struggle with flexibility, modern role design, and career acceleration.

6. Leadership Succession Gaps at Senior Levels

As senior banking leaders move toward retirement, BFSI is facing a deficiency in digital-first successors. The shortage is most visible in roles like CRO, CISO, DPO, digital banking heads and transformation leaders.

How Taggd Solves BFSI Hiring Challenges

Taggd helps BFSI organisations close talent gaps with a single integrated recruitment ecosystem. Through AI-driven sourcing, deep talent intelligence, region-wise skill mapping, and strong compliance-first processes, we make BFSI hiring faster, scalable, and more predictable.

Our specialised talent communities help bridge the shortage in AI, data, cloud, cybersecurity and digital finance roles, while pre-built frontline pools enable seamless mass recruitment during peak demand cycles.

We also bring verification-ready hiring to reduce fraud and identity mismatches, activate Tier-2/3 hiring with local pipeline development, and build youth-focused employer branding to attract and retain Gen-Z talent. At leadership level, Taggd supports succession planning through passive talent tracking and executive search capability.

In short, Taggd enables BFSI companies to hire right talent at scale, faster, and with stronger compliance across tech, digital, operational and leadership roles.

Global BFSI Hiring Landscape and India’s Position

The global BFSI industry is projected to grow at 6% CAGR, reaching $25.7 trillion by 2026, led by rapid digitisation, rising cyber-risk, embedded finance adoption, and fintech ecosystem maturity. The US, China, Japan, UK and India collectively account for over 60% of BFSI value, shaping global talent demand and technological advancement trends.

Major global banks are restructuring talent models- JPMorgan (317,000+ employees), HSBC (211,300), and Goldman Sachs (46,500) are reducing legacy operational roles and expanding hiring in software engineering, payments technology, risk modeling, and cloud.

Many are shifting high-value work to Asia, especially India, to build digital product teams and cybersecurity functions. Result: hiring is becoming more specialised, leaner, and technology-first.

Regulatory reforms across regions are also influencing skill requirements. The UK’s regulatory shift under EU DORA is creating demand in operational resilience and third-party risk management, while the US FedNow and T+1 Settlement ecosystem fuels rapid hiring in payments, AI, and instant transaction processing roles. Remote work, contract-based employment, and Innovation Hubs are quickly becoming top hiring drivers worldwide.

India: Third-Largest BFSI Market & Fastest-Scaling Talent Hub

According to India Decoding Jobs Report 2026, India is now among the top three BFSI markets globally, valued at ₹91 trillion ($1.1T+) and accelerated by fintech adoption, digital public infrastructure, and expanding financial access in Tier-2 and Tier-3 cities.

The ecosystem includes banks (57% share), NBFCs, insurance (fastest-growing in G20), AMCs (₹5.7 lakh cr AUM), pensions, and microfinance.

India’s fintech economy is growing explosively- projected to reach $550.9B by 2033 (17.4% CAGR) and Digital Payments may cross $10 trillion by 2026 driven by UPI, Aadhaar, mobile penetration, and policy support.

India’s fintech adoption rate stands at 87%, far above the global average of 67%.

Hiring is scaling accordingly:

- 61 lakh professionals currently employed

- +2.5 lakh new BFSI jobs expected by 2030

- Median fintech engineering salary ~₹10L, rising to ₹35L for senior roles

- Blockchain & AI architects now command ₹50L+ + ESOP packages

Public sector banks are responding by deepening tech hiring. PNB onboarded 350 specialist officers (AI, data, cybersecurity) and Union Bank hired 500+ in IT & risk roles to support digital expansion, fraud mitigation, and advanced risk management.

This surge places India at the core of global BFSI workforce supply, fintech engineering, and digital transformation capability.

BFSI Skill Matrix- Demand vs Hiring Difficulty

| Difficult to Hire + High Demand | Difficult to Hire + Low Demand |

| Risk Manager / Compliance Officer | Corporate Underwriter |

| Actuary & Risk Modelling Talent | Derivatives Trader |

| Quant/Algo Analyst | Portfolio Risk Specialist |

| Investment Banker | Wealth Mgmt Specialist |

| Treasury / Credit Risk Experts | — |

| Easy to Hire + High Demand | Easy to Hire + Low Demand |

| Retail Banking Officer | Teller / Cashier |

| Loan Processing Officer | Back-Office Clerk |

| Relationship Manager | Claims Processor |

| Credit Analyst | Operations Executive |

| Financial Analyst | — |

| Insurance Sales Officer | — |

AI + Risk + Cybersecurity talent will remain the most competitive hiring zones through 2026, while frontline roles scale with mass-recruitment velocity.

Talent Sourcing Strategies- What Works for Each Skill Tier

| Role Category | Best Hiring Approach |

| 1. High-Demand + Difficult | CXO/Exec search, international sourcing, premium compensation, referral drives, top-tier university engagements |

| 2. Niche & Specialist | Talent mapping, passive engagement, flexible contracts, boutique recruitment firms |

| 3. High-Volume + Easy | Mass drives, walk-ins, campus hiring, job boards |

| 4. Low-Demand + Easy | Standard recruitment, local job portals, apprenticeships, seasonal/contract hiring |

Future Hiring Trends in India’s BFSI Sector

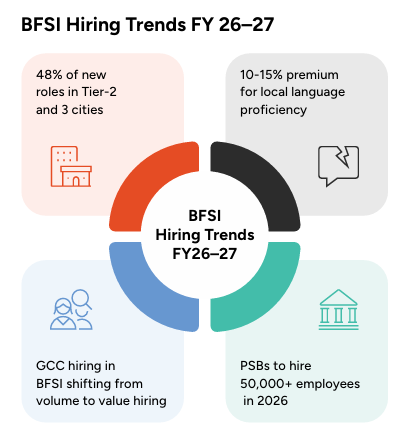

India’s BFSI industry is entering one of its most transformative talent cycles yet. Taggd’s India Decoding Jobs 2026 report highlights that hiring is projected to grow at 11.5% CAGR until 2030, driven by digitisation, financial inclusion, widened credit reach, fintech adoption, and rapid capability-building across risk, AI, and digital products. The next two years (FY26–27) will reshape where talent is hired, what skills are valued, and how organisations build workforce capacity.

1. Tier-2 & Tier-3 Cities Will Drive 48% of New BFSI Hiring

The hiring map is shifting away from metros towards growth corridors like Indore, Coimbatore, Nagpur, Guwahati, Surat, Jaipur, Lucknow, and Bhubaneswar, where BFSI talent demand is rising by 11–18%.

Why this matters:

- Lower cost of hiring + expanding customer base

- Stronger micro-lending, agri-finance, and SME penetration

- Expanding branch networks + doorstep credit services

- Increasing adoption of remote and distributed teams

Nearly half of all new BFSI roles will come from these emerging regions, marking the largest talent distribution shift the sector has seen in a decade.

2. 10–15% Salary Premium for Local Language & Regional Sales Capability

Candidates with linguistic fluency and grassroots sales exposure now command 10–15% higher pay, especially in retail banking, insurance advisory, microcredit sales, gold loan portfolios, and rural channel management.

Skills gaining salary weightage:

- Native language proficiency

- Field collections & recovery experience

- Understanding of local borrower patterns

- Community trust-building & relationship handling

This reflects a value shift from pure volume hiring to contextual talent hiring.

3. BFSI Hiring Priorities Are Rapidly Changing- New Hot Roles Emerging

Most in-demand profiles going into FY26–27:

| Digital & Tech Roles | Business & Risk Roles |

| AI/ML Engineers | Credit Risk Analysts |

| Data Scientists | Treasury & Risk Modelers |

| Cybersecurity Specialists | Investment & Portfolio Experts |

| ERP/Cloud Specialists | Relationship & Wealth Officers |

| Digital Product Managers | Insurance Claims & Sales Talent |

Sales + relationship talent remains the recruitment backbone, while deep-tech and risk leadership hiring is rising steadily.

4. GCC Hiring- From Volume to High-Value Talent Acquisition

Although BFSI accounts for only 10% of GCCs by volume, it employs 33% of the total GCC workforce in India, signaling a sharp tilt toward capability-led hiring.

Important talent behaviours:

- 11% YoY growth in AI/ML, data, cybersecurity & ERP talent demand

- Hiring moves away from bulk operations → towards niche product & compliance talent

- BFSI GCCs are now talent engines for global risk governance and digital lending products

The GCC hiring model is shifting from scale to sophistication.

5. 50,000+ Public Sector Bank Hires in FY26- A Massive Expansion Cycle Ahead

PSBs are entering one of their largest talent onboarding phases:

- 50,000+ planned hires in FY26

- 20,000 from SBI alone

- Focus areas: Credit processing, IT, cyber-risk, collections, branch ops, underwriting

- Digitisation mandates driving specialist hiring beyond traditional officer roles

This surge aligns with renewed loan growth, NBFC competition, and profitability reforms.

6. Workforce Transformation Is Accelerating, Especially in Insurance

Insurance companies are restructuring talent at scale:

- 78% investing in workforce transformation and upskilling

- Result → 30% faster claims processing + better policy servicing

- Hiring for hybrid financial advisory + digital claims investigation roles

Meanwhile, diversity hiring is rising- 30% of future BFSI hires are expected from underrepresented Tier-2/-3 groups, supported by mobile-based assessments, AI screening, and faster onboarding.

Wrapping Up

India’s BFSI industry is entering its most defining hiring decade yet- led by digital banking, fintech acceleration, cyber resilience, Tier-2/3 expansion, and product-first financial innovation. Demand for AI, data, risk, and cybersecurity talent will continue to surge, while frontline sales and credit roles scale with mass recruitment velocity.

The sector is no longer just growing- it is transforming, and workforce strategies must transform with it. Organisations that invest early in capability-building, regional talent mapping, and agile hiring models will hold a long-term competitive edge. With AI-driven talent intelligence and deep BFSI recruitment expertise, Taggd enables companies to hire faster, smarter, and more reliably across every skill tier. The next wave of BFSI growth is here- India is not just participating in it, but leading it.

To get deeper insights into BFSI hiring trends, AI-based workforce transformation, and India’s talent demand outlook, download the full India Decoding Jobs 2026 report- complete data, hiring charts, industry forecasts & strategic recommendations.

Download Now- India Decoding Jobs 2026.