Compensation benchmarking is the methodical process of stacking your organisation’s pay practices up against the wider market. At its core, it’s about digging into external salary data to make sure your pay scales are competitive, fair, and perfectly aligned with your business strategy. This isn’t just a box-ticking exercise; it’s fundamental to attracting and keeping the best people.

Building Your Strategic Compensation Framework

Truly effective compensation benchmarking goes way beyond a simple salary-matching game. Think of it as a core strategic function that anchors your entire pay philosophy directly to your business goals. For any CHRO, this isn’t just another HR project—it’s a powerful lever for driving organisational performance and carving out a competitive edge.

The journey begins with a clear vision of what success looks like. Your objectives will shape every single decision you make from here on out.

Define Clear and Measurable Objectives

First things first: what critical business problem are you actually trying to solve? Vague goals will only lead you to vague, ineffective outcomes. You need to zero in on specific, actionable targets that reflect your organisation’s unique pressures and priorities.

Let’s look at a few real-world scenarios:

- Plugging Leaks in Key Roles: Are your top software engineers constantly being poached by competitors? Your main objective might be to position your tech salaries at the 75th percentile of the market to stop the exodus.

- Championing Internal Pay Equity: Is there a nagging concern about pay gaps between genders or departments? Your goal could be to systematically identify and close those gaps, creating a compensation structure that is both fair and defensible.

- Winning the War for Talent: Does your growth plan hinge on hiring an army of top-tier sales professionals? An objective here could be to design a more aggressive commission structure that truly leads the market, not just meets it.

A well-defined objective acts as your North Star throughout the compensation benchmarking journey. It transforms the process from a reactive task into a proactive business strategy, ensuring every decision supports a larger organisational goal.

Assemble Your Cross-Functional Team

Compensation benchmarking can’t happen in an HR silo. To get it right, you need collaboration and buy-in from across the entire business. Putting together the right team from day one brings in diverse perspectives and makes the eventual rollout much smoother.

Your core team should absolutely include:

- HR Leadership (CHRO/VP of HR): To provide the strategic oversight and champion the project from the top.

- Finance Partners: They’re crucial for modelling the financial impact of any proposed changes and making sure it all aligns with the budget.

- Line Managers and Department Heads: These are the people on the ground. They offer invaluable insights into job roles, team performance, and the competitive pressures they face daily.

- Legal/Compliance: To ensure the final plan adheres to all relevant pay transparency laws and equity regulations.

Getting executive buy-in is non-negotiable. You have to frame the initiative in business terms. Talk about how competitive pay will slash hiring costs, drive down turnover, and ultimately boost revenue. This shifts the conversation from viewing compensation as a cost centre to seeing it as a strategic investment. For a deeper look into this process, explore our guide on the key factors to consider for crafting customized compensation strategies.

By setting up a clear framework and a dedicated, cross-functional team, you’re paving the way for a compensation benchmarking initiative that delivers real, measurable business results.

With your strategic goals defined, it’s time to get into the nuts and bolts of the project. The success of your entire compensation benchmark hinges on two things: the quality of the data you use and how accurately you map your internal roles to that data. Let’s be clear: a single, static salary survey just won’t cut it in today’s market.

You need to build a blended data strategy. Think of it as layering information from multiple sources to create a complete, defensible picture of the market. Relying on just one provider is like trying to navigate a city with a single landmark—you have a reference point, but you’re missing the full context.

Choosing Your Data Sources

The world of compensation data is crowded, from the old guard of consulting firms to the new wave of real-time data platforms. Each has its pros and cons, and knowing the difference is crucial for making the right call for your business.

Established providers like WTW, for example, often package their solutions with a heavy focus on industry-specific surveys and powerful analytics.

This snapshot shows how they let companies drill down into specific sectors or roles—a vital feature for getting your benchmarking right.

Your ideal mix will probably include a few of these:

- Traditional Salary Surveys: These are the big names like Mercer, Aon, or WTW. They’re often seen as the gold standard because of their strict methodology and huge participation numbers, making them a solid foundation for your pay structures.

- Real-Time Data Platforms: Companies like Ravio or Pave are changing the game with continuously updated data, often pulled directly from company HRIS systems. This is a lifesaver in fast-paced industries like tech, where an annual survey is out of date the moment it’s published.

- Industry-Specific Reports: For niche sectors like life sciences or financial services, these specialised reports give you the granular detail needed for those hard-to-fill, critical roles.

- Recruitment Data: Don’t forget the intelligence from your own talent acquisition team. They’re on the front lines and can give you a real-world pulse on what it actually takes to get a candidate to sign on the dotted line right now.

The goal here is triangulation. If a traditional survey, a real-time platform, and your recruiters all point to a similar pay range for a key role, you can move forward with confidence.

To help you decide, here’s a quick breakdown of the different data sources you’ll encounter.

Comparison of Compensation Data Sources

| Data Source Type | Key Advantages | Potential Drawbacks | Best Used For |

|---|---|---|---|

| Traditional Surveys | Rigorous methodology, broad market participation, high credibility. | Data can be 6-12 months old, less granular for niche roles. | Establishing foundational pay structures and validating broad market trends. |

| Real-Time Platforms | Continuously updated data, excellent for fast-moving industries. | Data quality depends on participant pool, may lack historical depth. | Benchmarking high-demand tech and startup roles, checking market volatility. |

| Industry-Specific Reports | Highly detailed and relevant for specialised roles and sectors. | Can be expensive, limited scope outside of its specific niche. | Niche industries like biotech, finance, or energy where skills are unique. |

| Recruitment Data | Real-world, up-to-the-minute insights on candidate expectations. | Anecdotal, can be influenced by specific hiring circumstances. | Calibrating offers for competitive roles and understanding immediate market pressures. |

Ultimately, the best approach is to mix and match. Use traditional surveys for your stable, core roles and layer in real-time or recruitment data for those high-velocity positions that are constantly in flux.

The Critical Art of Job Mapping

This is, without a doubt, the hardest—and most important—part of the process. Get job mapping wrong, and even the world’s best data is useless. The most common mistake? Matching roles based on job titles alone. It’s a recipe for disaster.

A “Project Manager” at a 50-person startup is a world away from a “Project Manager” at a multinational conglomerate. The former might be juggling everything from budgeting to client relations, while the latter could have a very narrow, specialised scope.

True job mapping is a forensic exercise. It means dissecting job descriptions to compare actual duties, responsibilities, required skills, and the role’s overall impact on the business.

Job mapping is about matching the work, not the title. It’s an apples-to-apples comparison of a role’s scope, complexity, and level of responsibility against the market, ensuring your pay structures are built on a foundation of reality.

To nail this, you first need to get your own house in order with a clean, consistent internal job catalogue. This is a foundational element of building a solid job architecture that supports your organisation’s structure. Once you have clear internal definitions, you can accurately match each role to its closest equivalent in your survey data. This means looking beyond the title to things like reporting lines, team size, and required experience.

For instance, if you’re benchmarking tech roles in India, you have to consider regional pay differences. Average salaries in tech hubs like Bengaluru and Mumbai can be worlds apart from other cities, especially for software engineers. This reflects the intense local competition. Recent data shows India has a powerful 43% Net Employment Outlook, which is a full 18 points above the global average. This highlights just how competitive the landscape is for CHROs. Getting this regional context right is vital for effective job mapping and making sure your offers are competitive where it counts.

Translating Market Data Into Actionable Pay Structures

So you’ve meticulously gathered all that market data and mapped your internal roles. Now you’re staring at a mountain of numbers. The real challenge begins here: finding the signal in the noise and turning those raw data points into a compensation framework that’s coherent, strategic, and defensible. This is where sharp analysis meets decisive action.

First things first, let’s make sense of market percentiles. These aren’t just abstract figures; they represent very real pay philosophies out in the market.

- 25th Percentile: This tells you that 25% of organisations pay less for a similar role, while 75% pay more. Companies positioning here are often following a lag-the-market strategy. They might be competing on non-monetary perks like a fantastic culture or incredible work-life balance.

- 50th Percentile (Median): This is the dead centre of the market, where half of companies pay less and half pay more. Adopting a match-the-market strategy by targeting the 50th percentile is a common and stable approach. It keeps you competitive without breaking the bank.

- 75th Percentile: Pay at this level, and you’re paying more than 75% of your competitors. This is a classic lead-the-market strategy, perfect for attracting and holding onto top-tier talent in hyper-competitive fields.

Your choice of percentile should be a direct reflection of your business strategy. A high-growth tech firm might target the 75th percentile for its data scientists but stick to the 50th for its administrative staff. It’s a calculated, nuanced decision, not a one-size-fits-all solution.

Crafting Your Salary Grades and Ranges

Once you’ve pinned down your market position, the next logical step is to build formal pay structures. This is how you introduce consistency and fairness, moving away from reactive, ad-hoc salary decisions. The foundation for this is creating salary grades.

Simply put, salary grades group jobs of similar internal value or market worth. For instance, all your senior individual contributors, whether they’re in marketing or finance, might fall into the same grade. This simplifies pay administration and is a huge step toward ensuring internal equity.

With grades established, you can define pay ranges for each one. Every pay range has three core components:

- Minimum: The starting salary for a role in that grade, usually for new hires or those still learning the ropes.

- Midpoint: The competitive market rate you’re targeting for a fully proficient employee, which should align with your chosen market percentile (e.g., the 50th).

- Maximum: The highest possible salary for that grade, reserved for your absolute top performers with deep experience.

Pay ranges are the guardrails of your compensation strategy. They give managers the flexibility to reward performance and experience while ensuring consistency and controlling costs across the organisation.

Building these ranges demands careful analysis. You’ll need to smooth out any data outliers—one survey showing an unusually high salary shouldn’t be allowed to skew your entire structure. This ensures your final framework is both aligned with the market and internally sound. For a deeper dive, you can explore the fundamentals of building a robust salary structure in our detailed guide.

Integrating Total Rewards Into the Framework

Base salary is just one piece of the puzzle. A truly effective compensation framework looks at the whole picture, integrating all elements of total rewards, including annual bonuses and long-term incentives (LTIs). Your salary grades should serve as the foundation upon which these variable components are built.

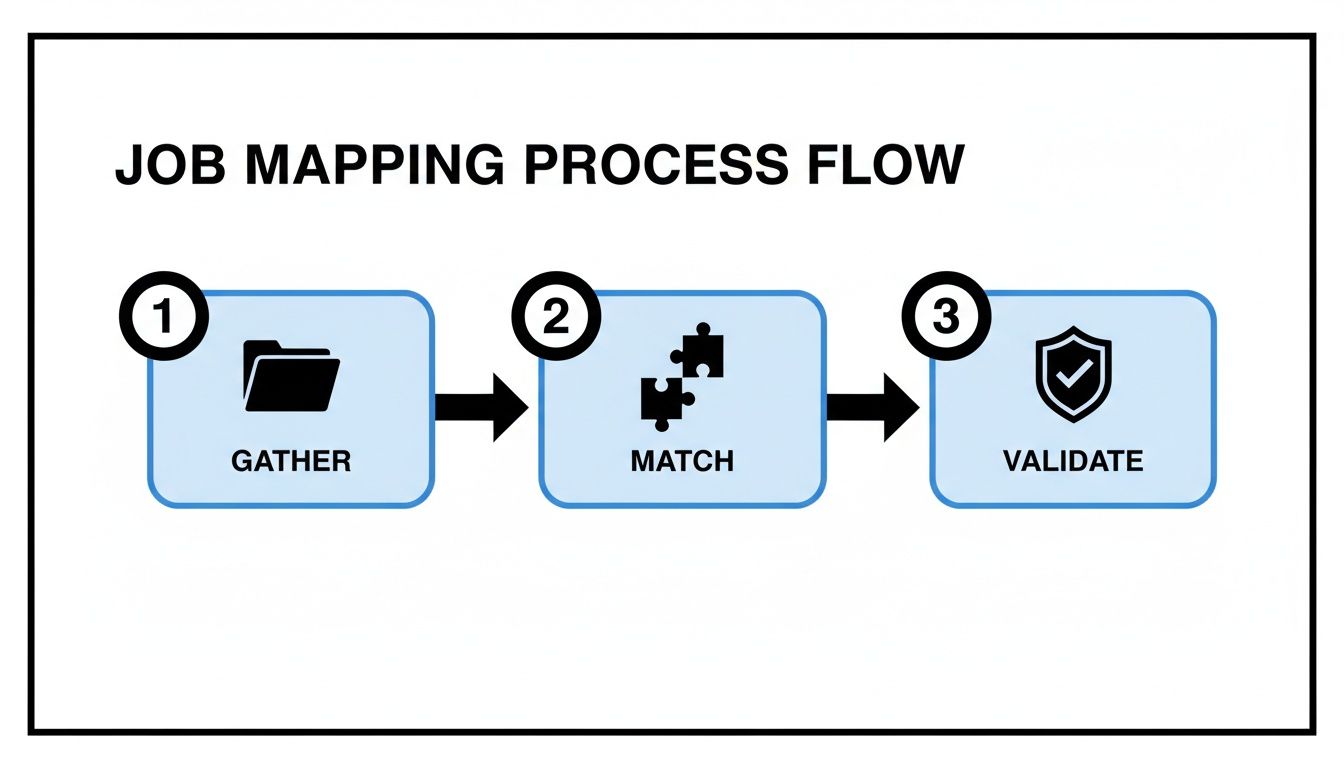

This is especially critical in a dynamic market like India. The workflow diagram below illustrates the job mapping process—a crucial step to ensure your data is clean before you even start building these structures.

This process of gathering internal job data, matching it to market benchmarks, and validating the results is fundamental. It’s what ensures you can build a pay structure that stands up to scrutiny from employees and the board alike.

For example, recent data shows salary increases in India are projected to hold steady at a robust 9.5% for 2025, mirroring the actual increase from 2024. This stability places India as a leader in salary growth across the Asia Pacific region. For CHROs, this trend underscores the intense competition for talent, making precise compensation benchmarking absolutely essential for retention.

Furthermore, with variable payouts expected to be around 12.5%, the push to differentiate rewards based on performance has never been stronger. This means your pay structures must clearly define not just base pay ranges but also target bonus percentages for each grade. A Director-level role will naturally have a much higher variable pay component than an entry-level position, reflecting their greater impact on business outcomes. By translating market data into a cohesive structure, you create a system that is transparent, defensible, and directly tied to your company’s goals.

Communicating and Implementing Your New Compensation Plan

You’ve put in the hours. The analysis is done, the data has been crunched, and you’ve built a defensible, market-aligned compensation plan. But let’s be honest—the most brilliantly designed structure can still fall flat if the rollout is clumsy. This is where the human element takes centre stage; the success of your entire project hinges on how well you manage this change.

Effective communication isn’t just about sending out a single, company-wide memo. It’s a carefully planned campaign, designed to address the specific concerns of different groups across your organisation. Your mission is to steer this ship with transparency, build trust, and make sure everyone understands the ‘why’ behind their pay.

Tailoring Your Communication Strategy

Every audience sees this change through a different lens and comes with their own set of questions. A one-size-fits-all approach is doomed to fail. You need to craft targeted messaging that speaks directly to each group’s priorities, turning potential sceptics into advocates for the new system.

A solid communication plan needs distinct tracks for key groups:

- Executive Leadership: For this audience, it’s all about the strategic business impact. Arm them with data showing how the new plan bolsters talent retention, helps control costs, and gives you a competitive edge. Their job is to champion the project from the very top.

- People Managers: This group is your most critical asset in the rollout. Managers are on the front lines, having the actual pay conversations. They need to be equipped with the right tools and training to handle these discussions confidently and consistently.

- All Employees: For your broader workforce, the message needs to be simple, clear, and focused on fairness and opportunity. Emphasise the company’s commitment to competitive pay and explain the philosophy behind the new structure in straightforward terms.

By tailoring the message, you prevent misinformation from filling the void and build confidence at every level of the organisation.

Preparing Managers for Difficult Conversations

Your managers are the linchpins of a smooth implementation. If they can’t explain the changes clearly and with empathy, employee trust will vanish in an instant. This is why investing in proper training isn’t just a good idea—it’s non-negotiable.

This training has to be more than a simple PowerPoint presentation. You need to get them ready for the tough, inevitable questions.

The success of your compensation plan hinges on your managers’ ability to turn a potentially difficult conversation into a constructive one. Equip them not just with data, but with the confidence to explain the ‘why’ behind every number.

Give them specific scripts and talking points for navigating tricky scenarios, like explaining why someone’s pay isn’t changing or clarifying a new salary range. This prep work empowers them to be credible, consistent messengers for your new compensation philosophy.

Managing Pay Adjustments and Outliers

No compensation project is truly finished until you’ve addressed the employees who fall outside the new pay bands. This requires a thoughtful and fair approach to managing both “green-circled” (underpaid) and “red-circled” (overpaid) employees.

Handling Green-Circled Employees (Underpaid)

Bringing underpaid employees up to the new range minimum should be a top priority.

- Prioritise Adjustments: Start with your most critical roles or those with the largest pay gaps.

- Phase the Increases: If budget is tight, consider implementing the adjustments in phases over two or three pay cycles.

- Communicate Clearly: Let the employee know their pay is being adjusted to align with the new, competitive market rate for their role. This is great news, so deliver it that way!

Managing Red-Circled Employees (Overpaid)

This situation is far more delicate and demands a careful, humane strategy.

- Freeze Base Pay: The standard practice is to freeze the employee’s base salary, allowing the market range to catch up over time through annual updates.

- Reward with Variable Pay: You can, and should, continue to reward strong performance. Use lump-sum bonuses or other one-time incentives that don’t add to their base pay.

- Be Transparent: Explain that their current salary is above the market maximum for their role, but be sure to reinforce that their value to the company is recognised. Never, ever reduce an employee’s salary.

Finally, don’t forget the logistics. Work closely with your IT and payroll teams to ensure the new salary grades, ranges, and any pay adjustments are seamlessly integrated into your HRIS. A smooth technical transition avoids administrative headaches and reinforces the professionalism of the entire initiative.

Keeping Your Compensation Program on Track with Ongoing Governance

Let’s be clear: compensation benchmarking isn’t a one-and-done project. After you’ve done the hard work of building and rolling out your new structure, the real work begins—long-term maintenance and governance. A pay structure that was perfectly aligned with the market last year can become outdated surprisingly fast, undoing all the effort you put into gaining that competitive edge.

This ongoing cycle of reviewing and tweaking is what keeps your compensation strategy effective, fair, and perfectly in sync with your business goals for the long run.

Setting a Rhythm for Regular Reviews

The first step is to establish a consistent review cadence. Think of it as a regular health check for your compensation program. Markets shift, new roles pop up, and business priorities change direction. A formal review schedule prevents your pay structures from drifting away from these new realities.

So, what does this look like in practice?

For most companies, a full, deep-dive compensation benchmarking review every 18-24 months is a solid baseline. This gives the market enough time to show meaningful shifts. However, if you’re in a fast-moving sector like technology or life sciences, you can’t wait that long. For high-demand roles in these areas, an annual or even bi-annual “pulse check” is essential to stay competitive. These smaller, more frequent reviews should focus on the specific job families feeling the most heat.

Beyond these major overhauls, your annual budget planning should always loop in a market analysis. This ensures your yearly merit increase budget is backed by solid data, not just a gut feeling. The whole point is to create a predictable rhythm that stops compensation management from turning into a constant fire-fighting exercise.

Monitoring the Metrics That Matter

How do you actually know if your compensation strategy is working? You have to track the right numbers. These key performance indicators (KPIs) give you the hard evidence you need to see how your programme is impacting talent acquisition, retention, and the overall health of the business.

Here are a few essential metrics to keep on your dashboard:

- Compa-Ratio: This is a simple but powerful metric that measures an employee’s salary against the midpoint of their pay range. A ratio of 1.0 means they’re paid exactly at the market midpoint. If you see consistently low compa-ratios, it’s a warning sign you might be underpaying. Consistently high ratios? That could signal budget pressure down the line.

- Attrition Rates: Are you losing people from specific departments or roles? Digging into your turnover data can reveal hotspots where your pay might be falling behind what competitors are offering.

- Offer Acceptance Rates: A drop in your offer acceptance rate is a massive red flag. It’s often the first sign that your compensation packages just aren’t cutting it anymore for the top candidates you want to hire.

- Promotion and Merit Increase Trends: Keep a close eye on how pay increases are distributed. This isn’t just about the budget; it helps you ensure the process is equitable and that you’re truly rewarding your top performers in a meaningful way.

A compensation plan without governance is just a collection of numbers. A formal framework with clear policies and a dedicated committee transforms your data into a sustainable, strategic asset that guides fair and consistent pay decisions.

Building a Formal Governance Framework

To keep things consistent and fair over the long haul, you absolutely need a formal governance structure. This usually means putting together a compensation committee, which should include leaders from HR, finance, and the business. This group becomes the official steward of the entire programme.

The cornerstone for this committee is a compensation committee charter. This document is non-negotiable. It clearly lays out the committee’s responsibilities, its decision-making authority, and the review schedule it will follow. It also locks in clear policies for critical pay decisions—things like guidelines for promotional increases, how merit budgets are allocated, and the process for handling salary adjustments outside of the annual cycle. This structure provides a transparent and defensible foundation for every pay-related decision you make.

Staying on top of market trends is a key part of good governance. For example, sector-specific salary benchmarking reveals huge variations in India’s 2025 landscape, which is critical information for any company trying to attract niche talent. Aon’s research projects a 9% overall salary increase for 2026, but some sectors like real estate, infrastructure, and automotive manufacturing are expected to see increases closer to 10.2%. At the same time, attrition has dropped to 17.1% in 2025, which gives companies a bit more stability to create more targeted pay strategies. You can dive into the details in Aon’s comprehensive salary increase study. By feeding insights like these into your governance process, you ensure your compensation strategy stays agile and competitive.

Answering Your Toughest Compensation Benchmarking Questions

Even after you’ve dotted the i’s and crossed the t’s on a benchmarking project, some questions always seem to pop up. As a CHRO, you need sharp, practical answers to handle the tricky parts of building and managing a competitive pay structure. This section is all about tackling those common queries head-on.

Let’s dive into the concise, real-world insights you need to navigate challenges, communicate clearly, and keep your compensation strategy firing on all cylinders.

How Often Should We Conduct a Full Compensation Benchmarking Review?

A complete, ground-up review of your entire compensation framework is something you should tackle every 18 to 24 months. This cadence is generally the sweet spot—it’s long enough for real market shifts to emerge, keeping your pay structures relevant without throwing the business into constant flux.

But that’s not a hard-and-fast rule. In fast-moving sectors like tech or for roles where the talent war is fierce, you need to be much more agile.

- For Critical Roles: Keep a closer eye on your most competitive job families. Think software engineering or data science—you should be pulse-checking these every 6 to 12 months.

- For Annual Budgeting: A high-level market data refresh should be a non-negotiable part of your annual compensation planning. It’s essential for setting an informed merit increase budget.

This hybrid approach lets you stay nimble where it counts, reacting to market heat for key talent without the headache of overhauling the entire system too often.

What Is the Best Way to Handle Employees Paid Above the New Market Range?

When an employee’s salary is above the maximum of your new pay range, they’re often called “red-circled.” Managing these situations requires a thoughtful, respectful touch. The main goal is to align with the new structure without crushing the morale of a valuable team member.

The standard best practice is to freeze their base salary. Their current pay stays put, giving the market range a chance to catch up over time through annual updates. One thing is crucial: never, ever cut an employee’s existing base pay because of a benchmarking project.

To keep recognising their performance:

- Lean on Lump-Sum Bonuses: Reward great work with one-time bonuses that don’t inflate their base salary further.

- Explore Other Incentives: Consider offering additional stock options or other types of variable pay.

Clear, empathetic communication is everything here. You have to explain the new structure, reassure them of their value, and be crystal clear about how their future contributions will be rewarded.

How Transparent Should We Be About Salary Ranges with Employees?

The push for greater pay transparency is real, but your strategy has to match your company’s culture and maturity. Jumping into full transparency without laying the groundwork can easily create more confusion and anxiety than it solves. I’ve always found a phased approach works best.

Start by being transparent about your compensation philosophy—the ‘why’ behind your pay decisions. This builds a foundation of trust before you even share a single number.

First, make sure everyone understands how pay is decided, where you aim to be in the market (e.g., targeting the 50th percentile), and what drives salary growth. Once that foundation is solid, you can start thinking about sharing the actual salary ranges. This demands a bulletproof, defensible pay structure and, most importantly, managers who are well-trained to handle these conversations.

How Do We Benchmark Niche or Hybrid Roles Without a Clear Market Match?

It’s a classic headache: how do you benchmark those unique, hybrid roles that don’t have a clean, one-to-one match in any survey? The answer is to use a “blended” or composite method. You’re essentially breaking the role down into its core parts and finding the nearest market equivalents.

Take a role like a “Data Privacy Lawyer with Cybersecurity Expertise.” You won’t find that in a standard survey. Here’s how you’d tackle it:

- Identify Core Functions: First, deconstruct the role. Maybe it’s 60% Corporate Counsel (specialising in Data Privacy) and 40% Cybersecurity Analyst.

- Weight the Market Data: Next, you pull the salary data for both of those distinct roles and create a weighted average based on that 60/40 split.

- Add Qualitative Insights: Don’t stop there. Supplement the numbers by talking to specialist recruiters and looking at internal roles with a similar level of complexity and business impact.

The absolute key is to document your methodology. This makes your approach consistent, easy to defend, and repeatable for the next review. It turns a subjective puzzle into a structured, analytical process.

Ready to build a compensation strategy that attracts and retains top talent? Taggd specialises in providing the strategic insights and recruitment process outsourcing you need to stay competitive. Let us help you align your pay practices with your business goals. Discover how we can help at https://taggd.in.