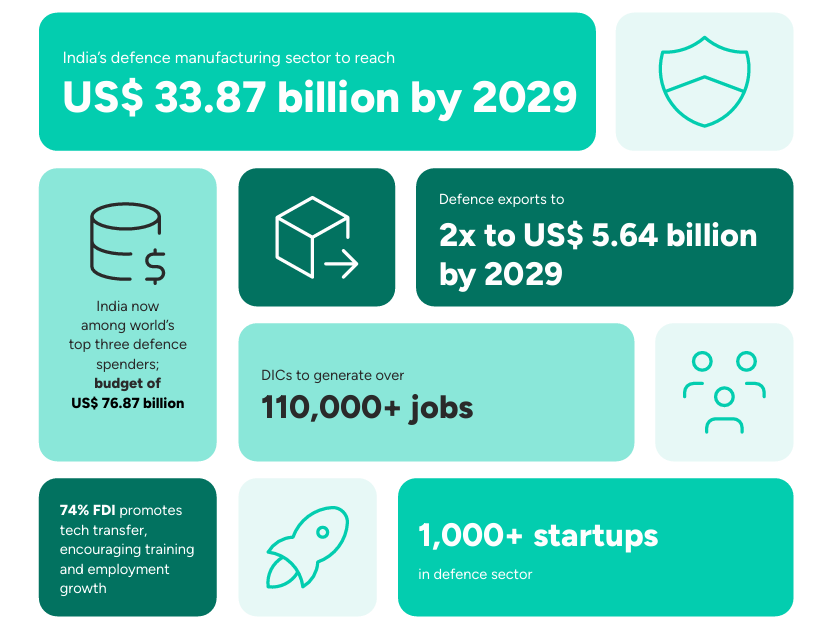

India’s defense manufacturing industry is entering a scale-up phase unlike any seen before. With the sector projected to touch ₹3 lakh crore in output by 2029, defence exports expected to double to ₹50,000 crore, and over 65% of equipment now produced domestically, the talent demand curve is rising faster than the supply pipeline.

Backed by ₹6.81 lakh crore in national defence spending, a growing private manufacturing base, and 74% FDI that encourages technology transfer and skill formation, India is laying the foundation for one of the world’s most powerful indigenous defence ecosystems.

According to projections featured in Taggd’s India Decoding Jobs 2026 Report, this growth is translating directly into workforce creation. The Defence Industrial Corridors (DICs) in Uttar Pradesh and Tamil Nadu alone are projected to generate 1,10,000+ new jobs by 2027, while flagship projects like the Tata–Airbus C295 assembly line in Vadodara are opening thousands of high-skill opportunities across fabrication, avionics, materials, and systems integration.

Alongside this, an exploding innovation network- 1,000+ defence-tech startups, 6,000+ students entering innovation pipelines every year, and over 600 iDEX-supported entities is accelerating demand for engineers, designers, R&D specialists, and digital-first defence talent.

With campus hiring surging across IITs, NITs and specialised aerospace universities, and private sector contribution crossing ₹32,000 crore, the industry is fast evolving into India’s next major high-skill employment engine.

As we move into 2026, the core question becomes: Where is talent demand rising the fastest? And more importantly- how can manufacturers attract, train, and retain the defence workforce of the future?

Get the full projections in Taggd’s India Decoding Jobs 2026 — Download the report for CHRO-grade insights.

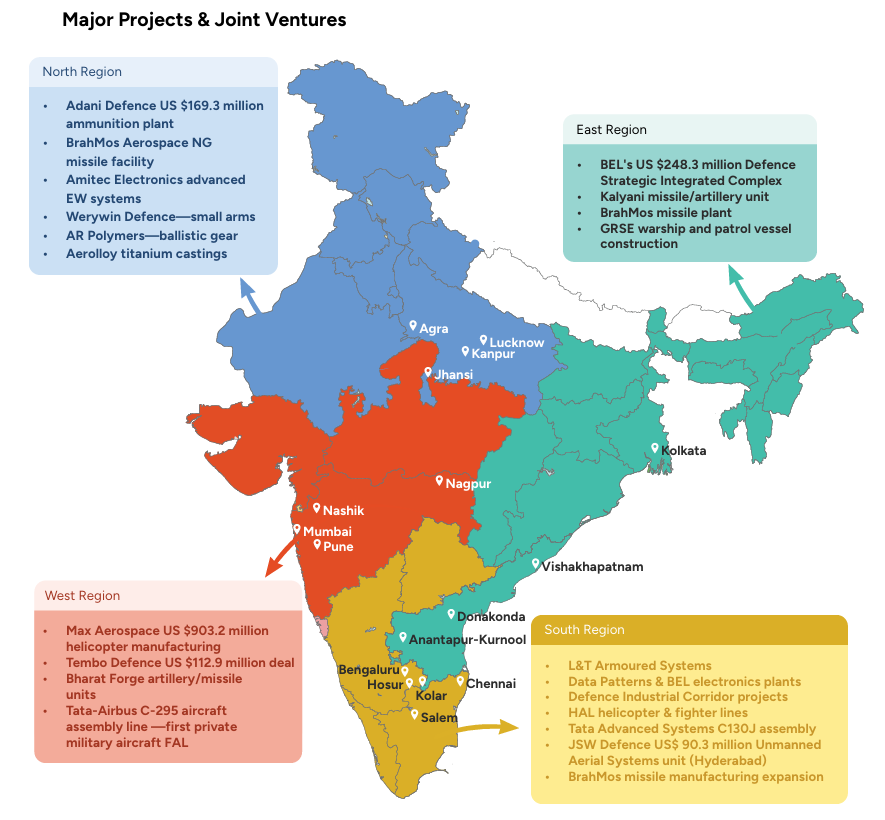

Region-wise Hiring & Industrial Growth in Defense Manufacturing

India’s defence manufacturing hiring landscape is expanding rapidly across all four regions, each emerging as a specialised hub for distinct technologies, production capabilities, and talent pipelines.

From missile integration in the North to naval engineering in the East, regional employment is being reshaped by large-scale plants, joint ventures, and corridor-driven industrial acceleration.

North India: Missile, Ammunition & Advanced Electronics Manufacturing Hub

Northern defence clusters led by Lucknow, Kanpur, Jhansi, Agra, Aligarh, and Chitrakoot are witnessing strong job growth powered by public and private sector investments. Key contributors include Adani Defence, BrahMos Aerospace (DRDO), Amitec Electronics, Werywin Defence, Aerolloy Technologies, AR Polymers, and Adhunik Materials.

Major projects such as Adani Defence’s ₹1,500 crore ammunition plant, BrahMos NG missile facility, and Amitec’s advanced EW system operations are paving the way for high-skilled roles. Alongside this, Werywin Defence and AR Polymers are boosting hiring in small arms and ballistic gear manufacturing. The North corridor is increasingly emerging as an innovation-focused recruitment zone for ammunition, missiles, tactical weapons, and precision electronics talent.

South India: Aerospace, Armoured Systems & Defence Electronics

South India- especially Chennai, Hosur, Bengaluru, Kolar, Tumakuru, Salem remains one of the biggest defence hiring engines in the country. Large-scale employers include L&T Defence, HAL, DRDO, BEML, Data Patterns, TVS, Tata Advanced Systems, and Bharat Electronics.

Hiring acceleration is being driven by flagship initiatives such as the L&T Armoured Systems division, BEL–Data Patterns electronics plants, and HAL helicopter & fighter aircraft lines. Tata Advanced Systems’ C130J assembly and JSW Defence’s ₹800 crore UAS manufacturing unit in Hyderabad further expand aerospace and unmanned systems talent demand.

With BrahMos expansion projects underway, South India is solidifying its status as the primary zone for roles in aerospace engineering, ordnance systems, embedded electronics, AI-enabled weapons platforms, and armoured production lines.

West India: Helicopters, Artillery, Naval & Aircraft Platforms

Defence activity across Pune, Nashik, Nagpur, Mumbai, Amravati is driven by top OEMs like Tata Advanced Systems, Bharat Forge, Max Aerospace, Mazagaon Dock, L&T, and DRDO.

A major hiring catalyst is Max Aerospace’s ₹8,000 crore helicopter program, alongside Tembo Defence’s ₹1,000 crore contract and Bharat Forge’s artillery & missile units. The landmark Tata-Airbus C295 aircraft final assembly line — India’s first private military aircraft FAL — is expected to transform western India into an aerospace jobs hub with thousands of specialised positions in airframe assembly, propulsion, avionics integration, and quality systems engineering.

West India remains the strongest region for rotary-wing manufacturing, artillery platforms, naval shipbuilding, and ammunition-heavy R&D workflows.

East India: Missile Integration, Naval Systems, Drone & Electronics

The East with hubs like Kolkata, Lepakshi, Vishakhapatnam, Anantapur-Kurnool, Donakonda, Jaggaiahpet is growing into a strategic zone for missile, drone, and naval engineering capabilities.

Major players include BEL, Kalyani Strategic Systems, BrahMos Aerospace, Media Matrix, and GRSE in the naval segment.

BEL’s ₹2,200 crore Strategic Integrated Complex, Kalyani’s artillery-missile unit, and BrahMos assembly lines are accelerating hiring for propulsion engineers, control systems integrators, and advanced electronics manufacturing. GRSE’s warship and patrol vessel programs are further boosting demand for naval architects, marine engineers, system designers, and defence-grade fabrication talent.

The East is now positioned as a future-ready cluster for missiles, naval systems, drones, electronics integration, and high-complexity manufacturing.

Key Hiring Challenges in Defense Manufacturing

India’s defence manufacturing sector is scaling rapidly, but several bottlenecks continue to restrict hiring and production agility. A shortage of high-end technical talent remains the biggest barrier, with limited employability and low formal manufacturing training slowing capability-building.

R&D investment is still below global benchmarks, delaying innovation cycles and affecting advanced tech readiness. Slow adoption of digital manufacturing, AI, robotics, and cyber-systems further limits productivity, while regional skill imbalances and supply-chain delays constrain large-scale ramp-up.

Together, the mentioned challenges are the most pressing barriers affecting defence manufacturing hiring today as per the findings from India Decoding Jobs Report 2026.

1. Severe Advanced Skills Shortage

India’s defence manufacturing ecosystem is evolving faster than its talent pipeline. Although engineering output is high, only 42.6% of graduates are employable, and just 4.4% possess formal manufacturing training, leaving industry-ready talent in short supply.

Nearly 65% of OEMs and Tier-1 suppliers now highlight difficulty hiring for mechatronics, avionics, AI-integrated systems, embedded electronics, and propulsion engineering roles. As defence platforms become more digital and automation-led, this talent deficit poses a direct threat to production timelines, R&D cycles, and scale-up capacity.

2. R&D Investment & Innovation Slowdown

India currently invests under 1% of its defence budget in R&D, far below the global average of 2–4%. As a result, institutional research appetite struggles to match ambition. A large share of DRDO programs miss original development timelines, slowing down prototype-to-production transitions.

This delays hiring for simulation engineers, material science researchers, autonomy specialists, and test lab talent, creating a domino effect across the supply chain. Until private–public R&D collaboration deepens, workforce expansion in advanced technologies will continue to lag behind capability goals.

3. Slow Adoption of Frontier Digital Technologies

Although defence tech is modernising, scaling of frontier technologies remains slow and uneven across regions and organisations. Many facilities are still early in adopting digital twins, EW simulation tools, robotics-integrated assembly lines, ML-led quality control, and smart material inspection systems.

This limits the absorption of high-end talent in cyber-defence, robotics control engineering, and automated factory systems- roles that global peers are hiring aggressively. Without faster digitalisation, productivity improvements will stall and hiring pipelines for next-gen warfighting capabilities will remain insufficient.

4. Production Delays & Supply Chain Load

Capacity gaps directly translate into longer production cycles for mission-critical assets. Programmes like the Light Combat Aircraft Mk-IA and AMCA have encountered extended timelines, partly due to skill shortages in machining, avionics integration, propulsion, and systems testing.

These slowdowns restrict workforce ramp-up planning- manufacturers cannot hire at scale until delivery schedules stabilise. As supply chains continue to expand around missiles, aircraft, propulsion systems, and naval vessels, the lack of trained manpower risks becoming a compounding bottleneck.

5. Regional Talent Imbalance

India’s two Defence Industrial Corridors- Uttar Pradesh and Tamil Nadu are now absorbing a major share of investments and advanced hiring demand. While this accelerates growth in these hubs, it has also triggered wage inflation and aggressive talent competition.

Meanwhile, other states struggle to build equivalent skill pools, creating “talent deserts” for radar systems, AI-driven avionics, drone propulsion, and advanced composites. This imbalance limits national deployment capacity and makes scaling multi-location manufacturing more expensive and time-consuming.

Global Defense Hiring Trends

The defence manufacturing sector is witnessing the fastest global hiring surge in decades. Direct employment worldwide has crossed 11.6 million, and over 666,000 new defence jobs were added in the last year alone. With the global market projected to grow at 7.1–8.5% CAGR through 2026, defence is set to become a $1+ trillion industry, sustaining high recruitment even in volatile economic cycles.

However, talent shortages are escalating, particularly in AI, cybersecurity, avionics, digital manufacturing, and systems engineering. Across top global defence employers, two software engineers are hired for every hardware engineer, indicating a dramatic shift towards digital-first warfare and autonomous security systems. The cyber talent gap, estimated at 3.4–4 million unfilled roles, highlights the scale of demand, while AI security engineering roles now command $150K–$160K+ salaries and are growing faster than any other domain.

Western markets are leading high-volume defence hiring. Europe continues to post 41% more defence job openings than in 2021, with France, Germany and the UK building talent pipelines for nuclear systems, missile defence, advanced electronics, and aerospace manufacturing. Companies like Leonardo and Thales are adding thousands of engineers annually, while the UK nuclear program alone is expected to generate 30,000+ new jobs by 2030.

Compensation benchmarks reflect the talent premium- average defence salaries in Europe stand 43% above standard industry wages, while U.S. and Australian defence employers offer 30–50% higher pay for specialists in AI, systems integration, autonomous technology and cyber defence.

2026 is projected to be a record-breaking year for global defence hiring, powered by digital transformation, R&D expansion, and large public-private programs reshaping workforce demand at scale.

India’s Defense Hiring Outlook 2026

India has emerged as a top global defence spend leader, with the FY25-26 defence budget reaching ₹6.81 lakh crore, now accounting for 13% of total government expenditure. With self-reliance (Aatmanirbhar Bharat) and export ambition defining strategy, hiring in defence manufacturing has shifted from volume-based recruitment to deep technical, high-skill hiring across aerospace, naval systems, propulsion, missile technology, and digital warfare.

The shift is visible on the ground- the Tata-Airbus C295 aircraft program in Vadodara, upcoming missile assembly units, and Defence Industrial Corridors in UP and Tamil Nadu are expected to create 110,000+ jobs by 2027, with thousands more in Tier-2 & Tier-3 supplier ecosystems.

Yet, India faces a capability challenge similar to the global cycle. Despite large engineering output, only 43% graduates are job-ready for defence technology, and just 4.4% are trained in manufacturing, creating hiring friction at scale. PSUs are experiencing workforce ageing, while private defence OEMs and iDEX-startups are aggressively hiring for avionics, propulsion, naval systems, digital defence, microelectronics, AI & autonomous systems.

India’s rising global partnerships — including the U.S., France, Israel and Japan — are accelerating technology transfer, co-development, and joint training programs. These collaborations are strengthening employment, upskilling pathways, and opening lateral talent opportunities across aerospace, cyber warfare, electronic systems and advanced tactical manufacturing.

India is now firmly positioned as a global defence manufacturing hub, but the next growth phase will depend on skill development as much as capital investment.

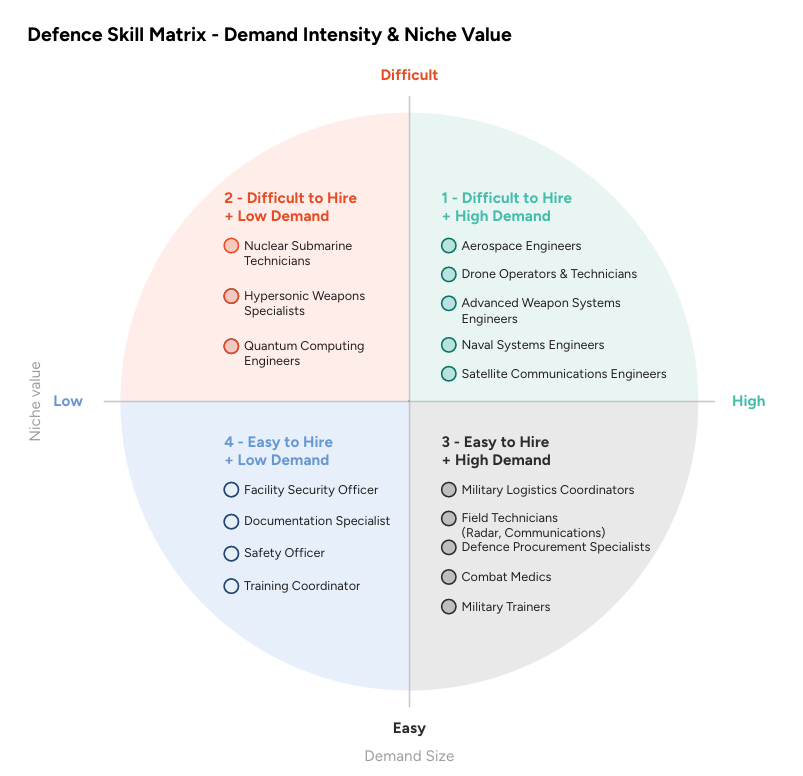

The Defence Skill Matrix – Demand Intensity vs Niche Value reveals how India’s defence talent landscape is evolving, highlighting four distinct skill zones that will shape hiring priorities in 2026.

The most critical quadrant features roles that are high in demand but difficult to hire– including aerospace engineers, drone operators, advanced weapons engineers, naval systems specialists and satellite communication experts- signalling an urgent need for capability development and rapid talent acceleration.

On the opposite end lie skills that are difficult to hire but currently low in demand, such as nuclear submarine technicians, hypersonic weapons specialists, and quantum computing engineers- rare and niche capabilities that may become strategic differentiators as defence modernisation deepens.

Meanwhile, roles like logistics coordinators, field technicians, combat medics and military trainers fall into the high demand but easier to hire bracket, essential for scaling operations quickly.

Finally, support functions such as facility security officers and documentation specialists remain low demand and easier to hire, forming the operational backbone but not driving capability scarcity. Together, this matrix maps where India must invest in training, R&D partnerships, and long-term workforce planning to stay ahead in next-gen defence innovation.

Wrapping Up

India’s defence manufacturing sector is entering a defining decade- driven by Make in India, private sector participation, export expansion, and rapid technological modernisation.

The hiring trends of 2026 indicate a shift from traditional manpower-driven roles to highly specialised, technology-intensive skills in aerospace, unmanned systems, advanced weapon engineering, electronics, AI-enabled warfare systems and naval platforms.

While talent scarcity remains a challenge across deep-tech skill clusters, the opportunity for India is clear: invest in R&D capability building, encourage academia-industry collaboration, modernise training ecosystems and build a future-ready defence workforce.

With the right talent strategies, India is well-positioned to not only achieve self-reliance, but also emerge as a global defence manufacturing hub powering innovation, exports, and strategic dominance.

FAQs

Which defence job roles will be in highest demand by 2026?

High-demand roles will include aerospace engineers, drone operators, naval systems engineers, advanced weapon systems engineers, radar & communication technicians, and defense procurement specialists—driven by modernisation and production scaling.

Why is there a talent shortage in next-gen defence roles?

Emerging technologies like hypersonics, quantum computing, AI-driven targeting systems and satellite warfare require deep-tech expertise, while the talent pipeline in India is still developing. Supply is growing slower than demand, creating capability gaps.

What skills will future defence professionals need?

Advanced engineering skills, robotics, AI/ML, avionics, cyber security, materials science, propulsion technology, systems integration, and real-time combat tech knowledge will be critical. Cross-domain proficiency will also gain importance.

Is India investing enough in defence talent development?

Government and industry initiatives are increasing—through DRDO partnerships, Skill India programs, private-sector R&D labs, and defence corridors in UP & Tamil Nadu. However, deeper industry-academia collaboration is needed to accelerate talent readiness.

Will automation reduce jobs in defence manufacturing?

Automation will replace low-skill repetitive work but create far more opportunities in high-skill domains like autonomous systems, digital engineering, predictive maintenance, and smart manufacturing operations.

How can companies attract scarce defence tech talent?

Competitive compensation, accelerated career growth, exposure to R&D, global program collaboration, and purpose-driven employer branding are key strategies. Upskilling and internal mobility pipelines will also be critical.

What does this mean for job seekers entering the defence sector?

Aspiring professionals should build strong technical fundamentals, pursue certifications, work on simulation tools, participate in hackathons/defence tech challenges, and stay aligned with emerging technologies shaping modern warfare.

To get deeper insights into Defense manufacturing hiring trends, AI-based workforce transformation, and India’s talent demand outlook, download the full India Decoding Jobs 2026 report- complete data, hiring charts, industry forecasts & strategic recommendations.

Download Now- India Decoding Jobs 2026. Explore Taggd for RPO solutions.