EdTech Hiring Trends: The Indian EdTech sector is entering a decisive new chapter- one defined less by hypergrowth and more by resilience, discipline, and long-term value creation.

After the explosive, pandemic-led expansion and the funding correction that followed, EdTech companies are now recalibrating their strategies to build sustainable, outcome-driven businesses.

Valued at US$7.5 billion in 2024 and projected to cross US$29 billion by 2030, the sector is still growing at a healthy CAGR of over 15%, powered by rising internet and smartphone penetration and the rapid digitisation of education across rural and semi-urban India.

This structural shift is having a direct and profound impact on hiring, as highlighted in Taggd’s India Decoding Jobs Report 2026. As the market matures, EdTech organisations are moving away from aggressive headcount expansion toward more selective, skills-led recruitment.

Demand is rising for professionals who can blend pedagogy with technology, drive learner engagement, scale digital platforms, and deliver measurable learning outcomes.

In this context, EdTech Hiring Trends 2026 explores how talent priorities are evolving, which roles and skills are gaining prominence, and how employers are rethinking workforce strategies to stay competitive in a more disciplined, performance-focused ecosystem.

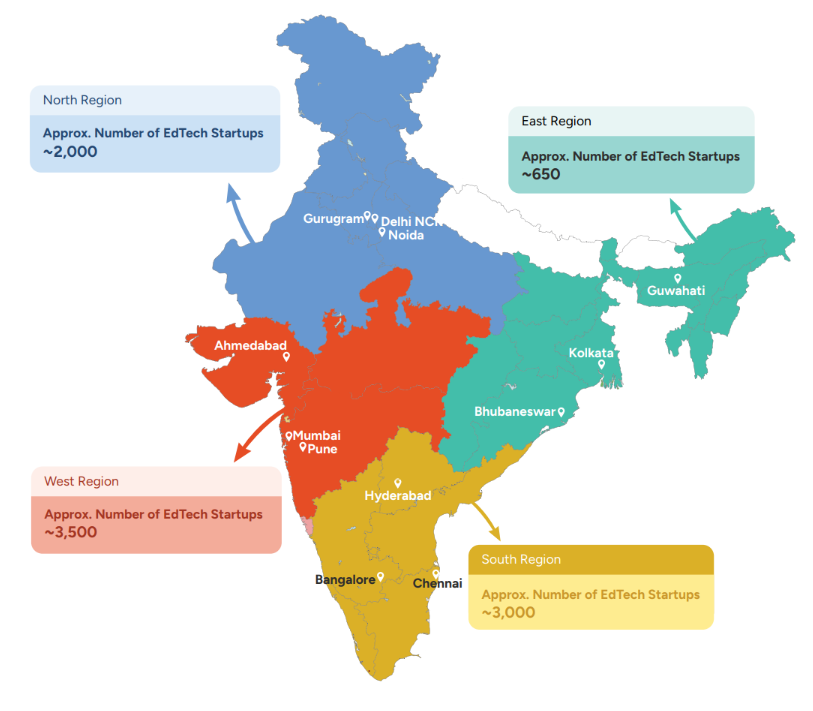

Region-Wise EdTech Hiring Landscape in India

India’s EdTech hiring ecosystem is geographically diverse, with startup density and talent demand varying significantly by region. While metro cities continue to anchor innovation and capital, hiring momentum is increasingly shifting toward Tier 2 and Tier 3 markets- mirroring learner adoption patterns and platform expansion strategies.

North India: Policy, Test Prep & K-12 Stronghold

- Approx. EdTech Startups: ~2,000

- Key Hubs: Delhi NCR, Noida, Gurugram

North India remains a critical hub for K-12 learning platforms, competitive exam preparation, and government-aligned education initiatives. Proximity to policymakers and regulatory bodies has also fueled demand for roles in curriculum compliance, academic operations, and partnerships with public education systems.

South India: Product, Technology & Deep-Tech Innovation

- Approx. EdTech Startups: ~3,000

- Key Hubs: Bengaluru, Chennai, Hyderabad

The southern region leads EdTech hiring in technology-first roles, particularly AI/ML engineers, data scientists, cloud architects, and learning platform developers. Bengaluru continues to be the epicentre for immersive learning, adaptive assessment engines, and enterprise learning solutions.

West India: Scale, Monetisation & EdTech Enterprise Models

- Approx. EdTech Startups: ~3,500

- Key Hubs: Mumbai, Pune, Ahmedabad

West India hosts the largest concentration of EdTech startups, driven by investor access, consumer-tech DNA, and strong enterprise learning demand. Hiring here is skewed toward growth roles, including product managers, revenue strategists, UX designers, and B2B learning consultants.

East & Northeast India: Regional Content & Market Expansion

- Approx. EdTech Startups: ~650

- Key Hubs: Kolkata, Bhubaneswar, Guwahati

Though smaller in scale, Eastern India is emerging as a high-potential talent base for regional-language content creation, educator onboarding, and learner support operations. Companies are increasingly hiring locally to improve content relevance and cost efficiency.

How EdTech Hiring Has Evolved Post-COVID

Unlike the pandemic boom years- where hiring was volume-driven- EdTech recruitment in 2026 is decisively skills-led and outcome-focused.

In-Demand Skill Clusters

- Technology & Product: AI/ML engineers, data scientists, UX/UI designers

- Learning Innovation: AR/VR specialists, gamification experts, instructional designers

- Content & Localisation: Regional-language educators, curriculum designers

- Governance & Compliance: Regulatory specialists, academic auditors

- Hybrid Roles: Professionals blending pedagogy, technology, and industry alignment

As highlighted in Taggd’s India Decoding Jobs Report 2026, EdTech is among the fastest-evolving sectors when it comes to hybrid job roles, where domain depth alone is no longer sufficient without digital fluency.

Distributed Workforce: The Rise of Tier 2 & Tier 3 Hiring

EdTech companies are actively decentralising talent acquisition to Tier 2 and Tier 3 cities to:

- Access qualified educators and content creators at scale

- Reduce cost pressures amid funding rationalisation

- Support hyperlocal learner engagement

This trend aligns with government-led digitisation through NEP 2020, DIKSHA, and continued investments in digital classrooms- creating long-term structural demand for education professionals across India.

Key Challenges Shaping EdTech Hiring in 2026

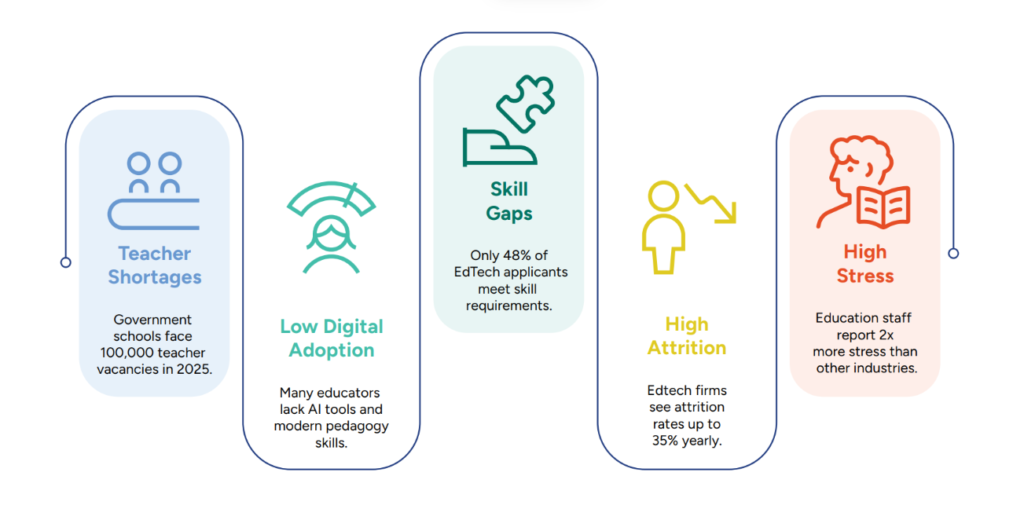

Despite sustained demand for digital learning, upskilling, and online education, EdTech companies in India are navigating a complex recruitment landscape in 2026. The industry’s shift from rapid expansion to sustainable growth has exposed deep-rooted talent challenges that directly influence hiring quality, speed, and retention.

Below are the most critical recruitment challenges in the EdTech industry that employers must address to stay competitive.

1. Acute Shortage of Qualified Educators with Digital Skills

One of the biggest EdTech hiring challenges is the lack of educators who combine subject expertise with digital delivery capabilities. While demand for online instructors continues to rise, a limited talent pool meets expectations around virtual classroom management, learner engagement tools, and adaptive teaching methods. This gap leads to longer hiring cycles, higher onboarding costs, and inconsistent learning outcomes.

2. Talent Mismatch for Advanced EdTech Roles

Modern EdTech platforms increasingly rely on AI, machine learning, data analytics, AR/VR, and gamification. However, recruiting professionals who understand both education ecosystems and advanced technology remains difficult. Many candidates are technically skilled but lack exposure to learning science, while education professionals often require extensive upskilling to adapt to tech-driven environments.

3. High Attrition and Educator Burnout

Attrition remains a persistent challenge in EdTech recruitment, with annual rates significantly higher than traditional education and many tech sectors. Factors such as intense performance metrics, extended screen time, limited career progression, and post-pandemic fatigue contribute to educator burnout. High turnover disrupts continuity in learning delivery and increases rehiring and training costs.

4. Funding Volatility Impacting Hiring Stability

Fluctuating investment cycles have made workforce planning unpredictable for many EdTech organisations. Hiring freezes, delayed offers, and short-term contracts affect employer branding and candidate trust. As a result, top talent often prefers more stable sectors, further intensifying recruitment competition.

5. Scaling Regional and Vernacular Talent

With EdTech platforms expanding rapidly into Tier 2 and Tier 3 markets, there is growing demand for regional-language educators, content creators, and academic counsellors. However, sourcing, assessing, and onboarding vernacular talent at scale, while maintaining content quality remains a major operational and hiring challenge.

6. Regulatory Compliance and Academic Governance Roles

As EdTech integrates more closely with formal education systems, employers face rising demand for professionals skilled in regulatory compliance, curriculum alignment, and accreditation standards. These niche roles are difficult to hire for due to limited supply and evolving regulatory frameworks.

7. Employer Branding in a Post-Boom Era

Following layoffs and funding corrections in recent years, rebuilding trust among candidates has become critical. EdTech companies must now differentiate themselves through transparent career paths, educator wellbeing initiatives, and long-term skill development opportunities to attract and retain high-quality talent.

To overcome these recruitment challenges, EdTech companies in 2026 are increasingly adopting skills-based hiring, hybrid workforce models, stronger training pipelines, and strategic talent partnerships.

According to insights from Taggd’s India Decoding Jobs Report 2026, organisations that align hiring with learning outcomes, regional expansion, and workforce wellbeing will be best positioned to build resilient, future-ready EdTech teams.

Global EdTech Hiring Trends 2026

Globally, the EdTech industry is experiencing sustained workforce growth, with over 2 million professionals employed worldwide. This expansion is being fuelled by the rapid adoption of personalised learning, AI-enabled content delivery, AR/VR-based immersive education, and gamified learning platforms. The global EdTech market is projected to double from US$214 billion in 2025 to US$446 billion by 2029, growing at a robust 20% CAGR.

Leading markets such as the United States, India, the United Kingdom, Canada, and Australia continue to dominate EdTech employment. However, the adoption of hybrid education models and microlearning has become universal, creating global demand for specialised digital education talent.

AI-driven personalisation is no longer a differentiator- it is now a baseline requirement, accelerating hiring for technologists, product managers, learning designers, and digital assessment specialists.

India Decoding Jobs Report 2026 highlights an important global shift is the integration of EdTech with workforce learning and employability ecosystems. Universities and enterprises are increasingly outsourcing learning delivery, credentialing, and assessment to EdTech partners. This has unlocked new job profiles such as instructional designers, learning data analysts, AI curriculum developers, and content localisers, while also driving cross-border hiring and remote-first employment models.

To manage fluctuating enrolments and evolving skills needs, education institutions worldwide are adopting flexible workforce structures. Adjunct instructors, instructional designers, learning technologists, and curriculum consultants are increasingly being hired alongside traditional academic roles.

Demand is also rising in STEM education, special education, school counselling, soft skills training, and experiential learning labs, particularly in regions facing ageing teacher populations.

Global Talent Retention Remains a Major Concern

Despite strong hiring momentum, talent retention is emerging as a critical challenge. A 2025 UNESCO survey revealed that 63% of educational institutions globally struggle to retain qualified staff, especially in STEM, special education, and leadership roles. Burnout, growing administrative burdens, and limited wage growth continue to drive attrition across the sector.

Leading global EdTech companies—including Coursera, Udemy, Duolingo, Instructure, and Pluralsight—are aggressively hiring for AI engineering, product management, UX/UI design, content localisation, and partnership development roles. These organisations have embraced remote-first workforce models, enabling access to global talent pools while increasing competition for scarce digital education skills.

Indian EdTech Landscape

India is at the core of global EdTech growth, contributing significantly to market innovation, workforce expansion, and learner adoption. However, the sector’s focus is shifting from rapid scale to quality, affordability, and outcome-driven education models. Government-led initiatives such as NEP 2020, along with public platforms like DIKSHA and PM e-VIDYA, have significantly expanded demand for both teaching and technology talent.

Post-pandemic funding corrections forced EdTech companies to recalibrate their hiring strategies. Instead of mass recruitment, organisations are prioritising high-impact, specialised roles across AI/ML, software engineering, product management, regional-language content, and career pathway solutions. Hiring is becoming more distributed, with EdTech platforms building regional teams in Tier 2 and Tier 3 cities to improve reach, affordability, and learner engagement.

India’s EdTech workforce needs are expected to rise sharply, particularly in special education, with the country projected to require nearly 20 lakh special education professionals by 2030. The strongest hiring demand continues to be in STEM education, especially for educators specialising in mathematics, coding, artificial intelligence, and robotics.

Online learning adoption is accelerating, especially among early-career professionals. Nearly 81% of Indian professionals upskilled in the past year, reflecting the growing reliance on digital learning to stay employable amid changing job roles. Karnataka, Maharashtra, and Delhi NCR remain the leading hubs for EdTech innovation and company registrations.

Policy support has further boosted hiring momentum. NEP 2020 and faster UGC approvals have driven rapid adoption of online and blended degree programs, with over 65% of Indian higher education institutions offering digital or hybrid learning models by 2025. Leading platforms such as IITs, IIMs, SWAYAM, upGrad, and Coursera are reshaping education delivery while opening new career opportunities in digital marketing, online counselling, instructional design, and learner success roles.

Leading Employers Shaping India’s EdTech Hiring Market

Major Indian EdTech players- upGrad, Unacademy, Vedantu, PhysicsWallah, and Simplilearn– continue to anchor sector hiring, each with distinct talent strategies.

- Unacademy and Vedantu are strengthening their technology teams, particularly in AI/ML and platform engineering, to enable adaptive and interactive learning.

- upGrad and Simplilearn are focused on instructional design, industry-aligned faculty, and B2B partnership roles, catering to professional upskilling and certification markets.

- PhysicsWallah is expanding its teacher and subject-matter expert workforce to support affordable, high-volume exam preparation, complemented by growing tech teams.

Retention is the Defining Challenge Ahead

Talent retention is emerging as a top priority for Indian EdTech CHROs. Teacher burnout, rising urban living costs, and aggressive talent poaching are placing sustained pressure on workforce stability. Going forward, institutions that invest in structured career pathways, retention incentives, and continuous skill development will be best positioned to build resilient teams.

As highlighted in Taggd’s India Decoding Jobs Report 2026, the ability to retain and continuously upskill education talent, rather than simply hire at scale, will define long-term success in India’s evolving EdTech ecosystem.

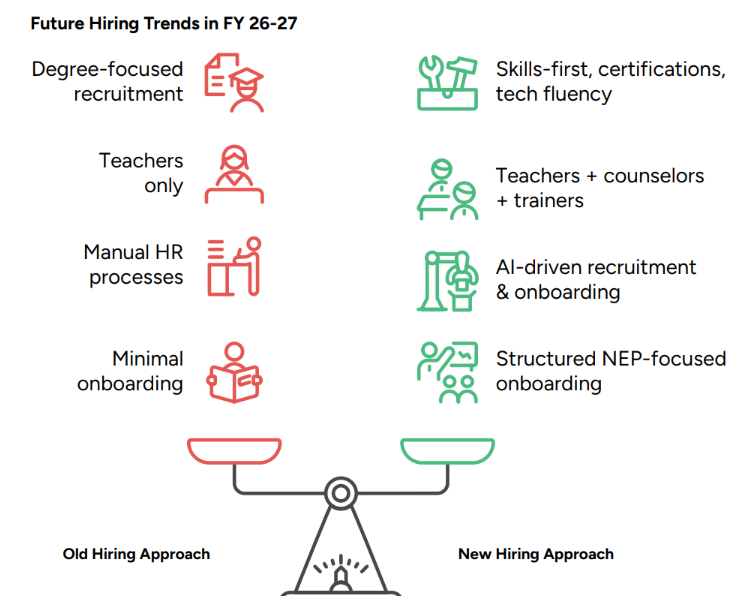

Future EdTech Hiring Trends

As India’s EdTech sector matures, hiring over FY26–27 will be shaped by a clear shift toward intelligent technology, regional relevance, and outcome-based learning models. Moving beyond scale-led recruitment, EdTech companies will focus on building lean, high-impact teams that can deliver personalised learning experiences and measurable career outcomes.

Key hiring trends expected to define the next two years include:

AI-first talent demand will accelerate. EdTech organisations will significantly increase hiring for AI/ML professionals, particularly those skilled in adaptive learning systems, student engagement analytics, and data privacy frameworks. With generative AI becoming central to personalisation, roles that combine learning science with AI-driven product development will be especially critical.

Vernacular and regional expertise will become a hiring priority. Demand for regional-language content specialists and instructional designers will rise as platforms deepen their presence in Tier 2 and Tier 3 markets. Localised pedagogy, culturally relevant content, and language-first learning journeys will be key differentiators in driving adoption and retention.

Partnership, compliance, and education sales roles will gain prominence. Companies will increasingly hire professionals experienced in public–private partnerships, institutional sales, and regulatory navigation, enabling them to capitalise on government-led education initiatives and evolving policy frameworks.

Soft skills will move to the centre of hiring decisions. Beyond technical capability, competencies such as communication, empathy, adaptability, and digital comfort will become non-negotiable in candidate screening, particularly for learner-facing and leadership roles.

Hybrid and remote workforce models will dominate. To optimise costs and tap into wider talent pools, leading EdTech employers will continue to adopt remote-first and hybrid hiring strategies, extending access to specialised tech and content talent beyond metro cities.

Hiring at the intersection of EdTech and employability will expand. Roles focused on career mentoring, placement coordination, and skills certification design will see strong demand as platforms position themselves as end-to-end career partners rather than pure learning providers.

Experiential learning expertise will remain in demand. Continued hiring for gamification specialists, AR/VR developers, and microlearning content creators- some of the top skills in demand – will reflect the market’s appetite for engaging, just-in-time learning solutions, especially for corporate training and skilling contracts.

Lateral and returnee hiring will gain momentum. EdTech companies will increasingly tap into women returning after career breaks, retired government educators, and industry experts transitioning into teaching or training roles, recognising the long-term value of experience over uninterrupted career timelines.

Cross-functional talent will command premium value. Professionals capable of working across product development, content strategy, analytics, and outcome measurement will be highly sought after, reflecting the sector’s growing maturity and intensifying competition.

Together, these trends signal a future where skills depth, adaptability, and learner impact- not just headcount- will define hiring success in India’s EdTech ecosystem through FY26–27.

Wrapping Up

The Indian EdTech sector is clearly marked by measured growth, technology-led innovation, and outcome-driven hiring.

As the market matures through FY26–27, EdTech companies are shifting away from volume-based recruitment toward high-impact, cross-functional talent that can deliver personalised learning, regional relevance, and career-linked outcomes at scale.

AI-driven product development, vernacular content expansion, and the convergence of education with employability are redefining workforce priorities. At the same time, challenges such as educator shortages, attrition, and funding volatility are compelling CHROs and founders to rethink hiring models, retention strategies, and talent pipelines. Hybrid work, distributed teams, and inclusive hiring, particularly of returnees and experienced professionals are becoming strategic advantages rather than operational choices.

As highlighted in Taggd’s India Decoding Jobs Report 2026, the organisations that will lead the EdTech sector forward are those that invest in future-ready skills, regional talent ecosystems, and long-term workforce sustainability.

In a competitive and rapidly evolving education landscape, the ability to attract, develop, and retain the right talent will ultimately determine who scales and who sustains.

FAQs

What are the top EdTech hiring trends in India for FY26–27?

EdTech hiring in FY26–27 will be driven by AI/ML roles, regional-language content creators, instructional designers, and employability-focused positions such as career mentors and placement coordinators. Companies are prioritising skills-based hiring, hybrid work models, and cross-functional talent over large-scale headcount growth.

Which roles are most in demand in the EdTech industry?

The most in-demand EdTech roles include AI engineers, data scientists, product managers, UX/UI designers, instructional designers, STEM educators, and vernacular content specialists. There is also rising demand for professionals skilled in regulatory compliance, partnership management, and learner success.

How is AI impacting hiring in the EdTech sector?

AI is transforming EdTech hiring by increasing demand for talent in adaptive learning systems, student engagement analytics, personalised content delivery, and data privacy. AI literacy is becoming a baseline requirement across both technical and non-technical roles.

Why is EdTech hiring expanding in Tier 2 and Tier 3 cities?

EdTech platforms are expanding hiring in Tier 2 and Tier 3 cities to support regional-language education, improve learner accessibility, and optimise operational costs. Local talent enables better content localisation and stronger learner engagement in emerging markets.

What are the biggest recruitment challenges in the EdTech industry?

Key recruitment challenges include shortages of digitally skilled educators, high attrition rates, talent burnout, funding volatility, and difficulty sourcing niche roles that combine education expertise with advanced technology skills.

How are EdTech companies addressing retention and burnout?

To improve retention, EdTech companies are investing in structured career pathways, continuous upskilling, flexible work models, wellbeing initiatives, and performance-linked incentives. Retention is increasingly viewed as a strategic priority, not just an HR function.

How does EdTech hiring align with employability and skilling trends?

EdTech hiring is closely aligned with employability trends, with growing demand for roles in skills certification, industry-aligned curriculum design, career mentoring, and placement support. This reflects the sector’s shift toward outcome-based education and lifelong learning.

To get deeper insights into EdTech hiring trends, AI-based workforce transformation, and India’s talent demand outlook, download the full India Decoding Jobs 2026 report- complete data, hiring charts, industry forecasts & strategic recommendations.

Download Now- India Decoding Jobs 2026. Explore Taggd for RPO solutions.