Hiring a great financial analyst doesn’t start with a job description. It starts with a conversation. A real, strategic talk about the specific business problem this person is coming in to solve. Are you trying to sharpen your forecast accuracy? Do you need support for an upcoming M&A deal? Is the goal to find new operational efficiencies? Pinpointing this from the get-go is the only way to attract candidates who are more than just skilled—they’re the right strategic piece for your puzzle.

Defining the Analyst You Actually Need

Before you can even think about attracting a top-tier financial analyst, you have to build a crystal-clear profile of the role. A generic job description is a magnet for generic applicants, and that’s a surefire way to waste everyone’s time. The best hiring processes are built on a foundation of clarity, starting with a frank discussion among your finance leadership.

The question you need to ask isn’t, “What will they do every day?” Instead, ask, “What business challenge will they solve?” This simple shift moves the focus from a list of tasks to genuine business impact.

Distinguishing Between Needs and Wants

Sit down with the hiring manager and define the role’s number one objective. Is the finance team bogged down by manual forecasting that’s slow and riddled with errors? Then you need an analyst who’s a wizard with automation and BI tools. Or maybe the company is gearing up for a major growth spurt with acquisitions on the horizon. In that case, you need someone who lives and breathes valuation modelling and due diligence.

When you articulate the problem clearly, the necessary skills just fall into place. For example:

- Problem: We have zero visibility into departmental spending.

- Solution: Hire an analyst to build and maintain detailed cost models and dashboards.

- Problem: We can’t accurately predict our cash flow for the next quarter.

- Solution: Find an analyst skilled in predictive modelling and scenario analysis.

This approach stops you from creating a laundry list of every financial skill under the sun. Instead, you can zero in on the critical few that will make an immediate difference.

A classic mistake is getting hung up on technical skills while forgetting about the behavioural side. An analyst might build a perfect discounted cash flow (DCF) model, but if they can’t explain what it means to the sales team, they’re only doing half the job. Real business impact happens when technical mastery meets brilliant communication.

Mapping Skills to Business Impact

Once you’ve locked down the main objective, you can start mapping out the required competencies. It’s useful to split these into two buckets: technical and behavioural. Both are vital, but understanding how they work together is the key to a successful hire.

Technical Competencies might include:

- Advanced financial modelling in Excel (e.g., three-statement models, LBOs)

- Proficiency with data visualisation tools like Tableau or Power BI

- Experience querying databases using SQL

- Knowledge of specific ERP systems like SAP or Oracle

Behavioural Competencies are often what separates the good from the great:

- Relentless Curiosity: The drive to dig deeper than the surface-level numbers and constantly ask “why.”

- Clear Communication: The ability to translate complex financial data into a simple, compelling story for non-finance folks.

- Problem-Solving Mindset: A proactive habit of spotting issues and proposing data-backed solutions.

- Adaptability: The ability to thrive in a fast-paced environment where priorities can change at a moment’s notice.

In India’s fast-moving job market, this combination of skills is absolutely essential. The BFSI sector is bracing for major hiring growth, fuelled by new technologies like AI-driven analytics where sharp analysts are needed. You can read more about the projected growth of India’s job market on The Economic Times. This context makes it crucial to define the right mix of modern and traditional skills to attract the very best talent out there.

Sourcing and Attracting Top Finance Talent

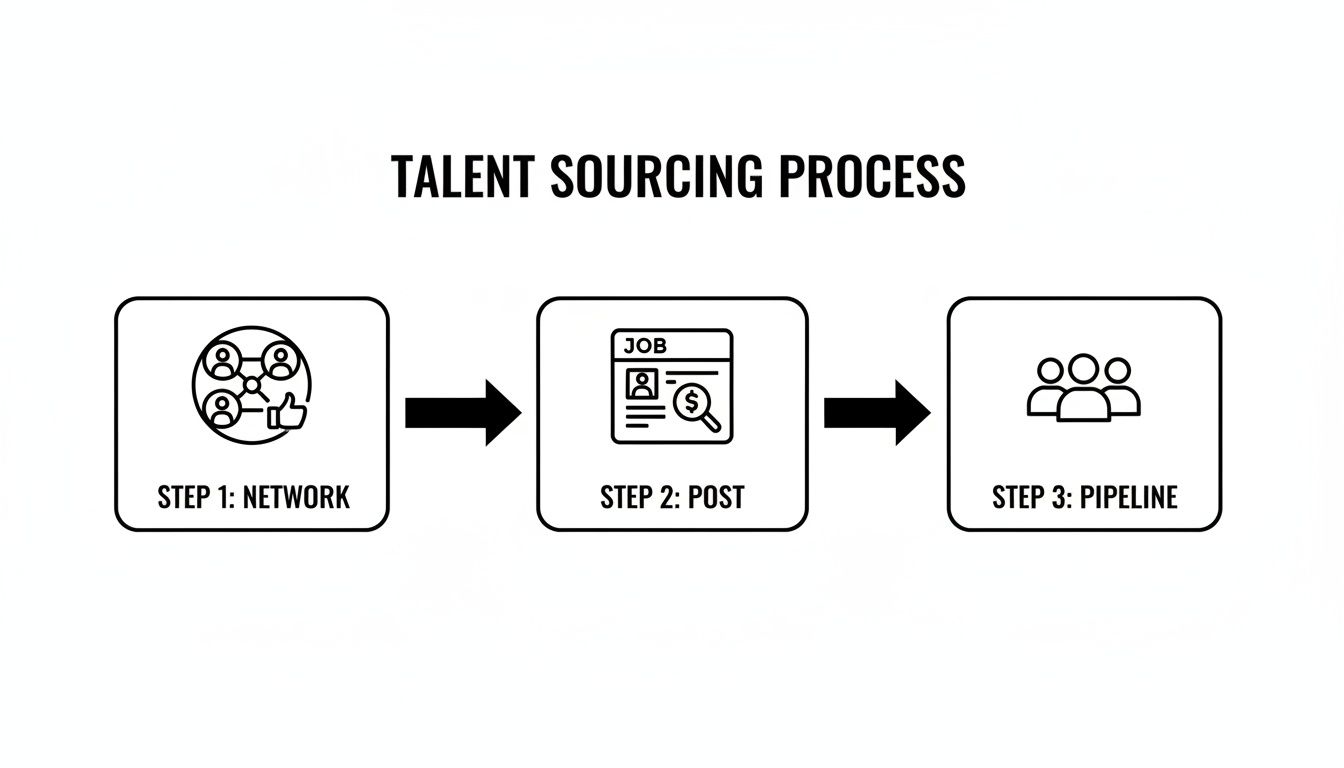

With a clear role profile in hand, the real hunt begins. Just posting a job on a few major boards and waiting for applications to roll in is a recipe for mediocrity. To land the best financial analysts, especially in India’s competitive market, you need a multi-channel sourcing strategy that actively seeks out talent where they are, not just where you are.

This means moving beyond the obvious. Think of it less as casting a wide net and more as precision fishing in well-stocked ponds. Your goal is to find not just the active job seekers, but also the high-performing passive candidates who aren’t even looking—because they’re often the best.

Building a Proactive Sourcing Engine

An effective sourcing strategy for a financial analyst role is never a one-trick pony. Relying on a single channel is risky; a diversified plan is the only way to ensure a steady flow of qualified candidates.

- Professional Networks: LinkedIn is the undisputed king here, but success demands more than just blasting out InMails. Use its advanced search filters to pinpoint analysts with specific skills (think “financial modelling,” “Tableau,” or “M&A”) at your target companies. Before you even mention a job, engage with their content, join relevant finance groups, and start building a genuine connection.

- Niche Finance Communities: Look for specialised online forums and communities where finance professionals in India gather. Platforms where people are discussing CFA exam prep or sharing complex Excel models are absolute goldmines for finding passionate, highly skilled talent.

- University Partnerships: Forge strong relationships with the business and finance departments of top-tier universities. Don’t just show up for the annual career fair. Offer to host workshops on financial modelling or give a guest lecture on industry trends. This builds your employer brand early and creates a direct pipeline of ambitious graduates.

Engaging candidates who aren’t actively job hunting requires a more nuanced approach. For a deeper dive, exploring strategies for passive candidate sourcing can give you a significant edge in uncovering this hidden talent pool.

Crafting a Magnetic Job Description

Your job description is a marketing document, not an internal HR memo. It’s often the first real touchpoint a candidate has with your company, and it needs to sell the opportunity, not just list requirements. A-players are motivated by impact and growth, so your description has to speak directly to those ambitions.

Instead of leading with a laundry list of “must-haves,” start with the “why.” What’s the mission of the finance team? What major projects will this analyst get to own? Frame the role around the problems they will solve and the influence they will have.

A job description that says, “Prepare monthly variance analysis reports” is just a task. One that says, “Deliver critical insights that guide our marketing spend and drive revenue growth” is a mission. Top talent is always drawn to the mission.

When you get into the details, focus on outcomes over activities. Use action-oriented language that paints a clear picture of what success looks like.

From This (Task-Focused):

- Responsible for budgeting and forecasting.

- Must have 3-5 years of experience.

- Proficient in Microsoft Excel.

To This (Impact-Focused):

- You will own the annual budgeting process and develop predictive forecasts that directly influence our strategic investments.

- We’re looking for an analyst with a proven track record of identifying cost-saving opportunities in a high-growth environment.

- Your expertise in advanced financial modelling will be crucial as you build the tools that shape our executive decisions.

This simple shift in language makes the role feel far more significant and appealing to candidates who want to make a tangible difference.

The Power of a Talent Pipeline

Finally, remember that the most effective hiring strategies are continuous. Don’t wait until a position opens up to start sourcing. Building a talent pipeline means you are always networking, identifying promising individuals, and nurturing those relationships over time.

This is where a Recruitment Process Outsourcing (RPO) partner can be a true game-changer. An RPO provider can tap into India’s diverse talent hubs, connecting you with a pre-vetted pool of both active and passive candidates. This doesn’t just cut down your search time; it ensures you have a ready list of qualified analysts the moment a need arises, turning a reactive hiring process into a strategic, proactive one.

Designing a Realistic Assessment Process

With a promising pipeline of candidates, it’s time to separate the great from the good. A well-designed assessment process does more than just tick boxes on a CV; it throws real-world business challenges at candidates to see how they truly perform under pressure. This is where you move from paper credentials to proven capability.

The idea is to build a multi-stage evaluation that tests technical chops, problem-solving instincts, and behavioural competencies. You want a process that feels rigorous and relevant. After all, a clunky, generic assessment can put off top talent, while a thoughtful one shows you’re a serious, data-driven organisation.

Creating a Relevant Case Study

Don’t just download a generic financial modelling test. The most insightful technical assessments are custom-built to mirror the actual work your new financial analyst will be doing. This makes the test a genuine predictor of their on-the-job performance, not just an academic exercise.

For example, if the role is focused on improving profitability for a specific product line, give them a case study with messy, real-world sales and cost data. Ask them to build a model that spots key profit drivers, explains variances, and wraps it all up in a clear, concise summary with actionable recommendations.

To build a case study that really works:

- Use a real business problem: Take a sanitised version of a challenge your team recently tackled. This makes the test instantly feel authentic.

- Provide imperfect data: Real-world data is never clean. Including inconsistencies or missing information is a great way to test a candidate’s attention to detail and ability to make sound assumptions.

- Set a clear goal, not a rigid path: You’re not testing their ability to follow instructions. You’re testing how they think. Give them the destination and let them map the route.

This kind of practical evaluation is a cornerstone of modern hiring. To get a wider view on different evaluation methods, you can explore more about pre-employment testing and how it fits into a holistic talent strategy.

Probing Deeper in Technical Interviews

The technical interview shouldn’t just rehash the case study; it should build on it. This is your chance to discuss their submission and really dig into their understanding of the financial concepts behind their model. Forget asking, “How do you build a DCF model?” and pivot to scenario-based questions that test their critical thinking.

Try questions like these:

- “Walk me through the key assumptions you made in the case study. Why did you land on that specific growth rate?”

- “Imagine our CEO challenges your valuation. What are the three most critical variables in your model, and how would you defend them?”

- “If you had access to any other data, what would you ask for to make your analysis even more robust?”

These kinds of questions reveal not just what a candidate knows, but how they apply that knowledge under pressure and communicate complex ideas simply.

A candidate who can only recite textbook definitions is a liability. The analyst you want is the one who can confidently debate the nuances of their own analysis and connect it directly to business strategy. That’s the person who will drive real value.

Assessing Behavioural Fit with Precision

Technical skills might get a candidate through the door, but it’s the behavioural competencies that will determine their long-term success and cultural fit. Assessing soft skills like communication, curiosity, and collaboration needs a structured approach to keep unconscious bias out of the decision.

To do this effectively, you need to map out the key competencies for the role’s seniority level. Here’s a breakdown of what to look for and how to assess it.

Essential Competencies for Financial Analysts

This table breaks down the core technical and behavioural skills you should be prioritising for junior and senior financial analyst roles.

| Competency Area | Junior Analyst (0-2 Yrs) | Senior Analyst (3-5+ Yrs) | How to Assess |

|---|---|---|---|

| Technical Skills | Proficient in Excel, basic financial modelling, understanding of accounting principles. | Advanced modelling (DCF, LBO), data visualisation (Tableau, Power BI), strong grasp of corporate finance. | Case Study, Technical Interview |

| Analytical Thinking | Can identify trends in data and perform variance analysis. | Can synthesise complex data, identify underlying drivers, and forecast future performance. | Case Study, Scenario Questions |

| Communication | Clearly explains findings and can build basic reports. | Presents complex analysis to non-finance stakeholders, crafts compelling narratives from data. | Case Presentation, Behavioural Interview |

| Business Acumen | Understands the company’s business model and key revenue streams. | Connects financial analysis to broader market trends and strategic business objectives. | Behavioural Interview, Scenario Questions |

| Collaboration | Works effectively with immediate team members to gather information. | Proactively partners with cross-functional teams (Sales, Ops) to drive business outcomes. | Behavioural Interview (STAR Method) |

By defining these upfront, you give your interviewers a clear framework for evaluation, ensuring a more consistent and fair process for everyone.

This structured journey, from initial sourcing to final assessment, is designed to systematically identify candidates who are not just skilled, but are the right strategic fit for your team.

The STAR method (Situation, Task, Action, Result) is a fantastic tool for this part of the process. It pushes candidates beyond generic statements like “I’m a team player” and forces them to provide concrete evidence from their past experiences.

Example STAR Questions for a Financial Analyst:

- Situation: Tell me about a time you found a significant error in a financial report.

- Task: What was your specific responsibility in that situation?

- Action: What steps did you take to investigate and fix the error?

- Result: What was the final outcome, and what did you learn from it?

Finally, using an interview scorecard is non-negotiable. It ensures every interviewer is judging candidates against the same predefined competencies—both technical and behavioural. By scoring each competency on a simple scale (say, 1-5), you create a data-driven basis for your hiring decision, dramatically reducing the influence of “gut feel.”

From Finalist to New Hire: Mastering the Offer Stage

You’ve found them. The perfect candidate. They’ve sailed through the interviews, impressed the whole panel, and now you’re on the home stretch. But don’t celebrate just yet. This final phase—turning a promising finalist into your next great hire—is a delicate dance of speed, transparency, and strategy. Get it wrong, and all your hard work could unravel.

Let’s be clear: top financial talent in India doesn’t wait around. The market is hot, and the best candidates often have multiple offers on the table. If you delay, even by a day or two, you risk losing your top choice to a competitor who was just a little quicker, a little more organised. The moment you decide they’re the one, the clock starts ticking.

Getting the Final Handshake from Leadership

Before you even think about drafting an offer, there’s one last crucial meeting: the final chat with a senior leader, usually the CFO or Head of Finance. This isn’t just another interview. Think of it as the final alignment check and a crucial opportunity to sell the role from the top. It’s the last chance to ensure the candidate’s strategic mindset and communication style truly click with the executive team.

For the candidate, it’s a peek behind the curtain at the company’s high-level vision. For you, it locks in that all-important executive buy-in, which makes everything from offer approval to onboarding a whole lot smoother. A leader who is personally invested in a candidate is far more likely to champion their success down the line.

Building an Offer They Can’t Refuse

Putting together the offer isn’t guesswork; it needs to be backed by solid data. A compelling package is about the total reward, not just the base salary. It’s about showing you understand the market and the candidate’s value.

This is where your market research really pays off. You need to know the benchmarks, not just nationally, but city by city. An attractive offer in Jaipur looks very different from one in Mumbai or Bengaluru.

Break down the package into its core components:

- Base Salary: Is it competitive for the role’s seniority and your specific city?

- Performance Bonus: Be crystal clear about the structure, target percentage, and the KPIs it’s tied to.

- Joining Bonus: A great strategic tool to help a candidate walk away from an unvested bonus or equity at their current job.

- Benefits: Don’t forget to highlight the extras—things like learning stipends, top-tier health coverage, or genuine work flexibility can be powerful differentiators.

Financial analysts are highly valued in India, and their salaries reflect that. Entry-level roles can start around ₹5 lakhs per year, while seasoned pros can command upwards of ₹18 lakhs. With businesses relying more heavily on sharp financial insights, this is only set to increase. You can dive deeper into the latest financial analyst salary trends on upGrad.com.

The Art of Negotiation and Closing

When you make that first verbal offer, deliver it with genuine enthusiasm. This isn’t just a transaction; it’s the start of a relationship. Walk them through each part of the offer, explaining the value beyond just the numbers.

If they want to negotiate—and many will—listen. Really listen. Is it all about the base salary, or could a higher joining bonus, a slight title change, or an extra week of leave seal the deal? Keeping the conversation open and respectful is the key to finding a win-win.

Remember this: the candidate experience doesn’t stop once they say “yes.” How you handle the negotiation, and just as importantly, how you treat the finalists who didn’t get the job, says everything about your employer brand.

Throughout this final stage, communication is everything. Keep every shortlisted candidate in the loop about where they stand. Ghosting finalists is the fastest way to burn bridges and tarnish your reputation in a tight-knit professional community. Treat every single candidate with respect, and you’ll not only protect your brand but also build a pipeline of talent and goodwill for the future.

Ensuring Success Through Smart Onboarding

Let’s be clear: the work isn’t over when the offer letter is signed. That’s just the starting line. The real challenge is turning that promising new hire into a high-performing, fully integrated member of your finance team.

A strategic onboarding process is the bridge that connects a great hire to tangible business impact. Without it, new analysts can waste weeks just trying to find the right data or figure out team dynamics. That initial momentum dies, and frustration quickly sets in. A well-designed programme gets them contributing meaningfully within their first month, validating your hiring decision and dramatically shortening their time-to-productivity.

Crafting a Purposeful 90-Day Plan

A generic HR orientation simply won’t work for a role as specialised as a financial analyst. Their first three months need to be a carefully orchestrated journey, immersing them in the business, the data, and the culture. Think of it less as a checklist and more as a roadmap to success.

The first 30 days are all about foundational learning. This means getting them immediate access to essential tools, databases, and historical financial models. The goal here is absorption, not groundbreaking analysis. For a structured approach, you can learn more about building a robust framework with this helpful onboarding checklist template.

From days 30 to 60, the focus should shift to guided application. Assign them a smaller, low-risk project, like analysing a specific product line’s performance or helping with a departmental budget review. This builds their confidence and gives you a tangible output for early feedback.

Finally, the 60 to 90-day mark is about demonstrating autonomy. By this point, they should be able to manage a standard reporting cycle or build a new financial model with minimal supervision, slotting right into the team’s regular workflow.

The single most effective element of onboarding is assigning a dedicated mentor—not their direct manager. A peer mentor provides a safe space for the new hire to ask “silly” questions about processes or company culture they might hesitate to ask their boss.

Measuring Success with Relevant KPIs

So, how do you know if your onboarding is actually working? You track specific, role-relevant Key Performance Indicators (KPIs) that go beyond simple task completion. For a financial analyst, these metrics offer objective proof of their growing competence and business impact.

Start tracking their progress against a few key metrics:

- Forecast Accuracy: Once they’re past the initial learning curve, measure the variance between their forecasts and actual results. A steady improvement shows they’re truly getting a feel for the business.

- Project Completion Rate: Keep an eye on their ability to deliver analysis and reports on time. This isn’t just about technical skill; it’s a measure of their time management and ability to navigate internal resources.

- Stakeholder Feedback: Don’t guess. Actively ask the business partners they support for feedback. A simple note about the clarity and usefulness of their analysis is an invaluable qualitative data point.

These KPIs aren’t just for performance reviews; they’re powerful coaching tools. If forecast accuracy is off, it might mean they need more context on market drivers. If deadlines are slipping, it could point to a bottleneck in data access.

Linking Onboarding to Long-Term Retention

At the end of the day, a brilliant onboarding experience is one of your most powerful retention tools. It’s a clear signal that you’re invested in the new hire’s success from day one, fostering a sense of loyalty and engagement that pays off for years.

The process shouldn’t just stop at 90 days; it should flow seamlessly into a continuous development plan. Connect their initial performance to a clear career path within the finance organisation. Show them what “great” looks like and what it takes to get to the next level, whether that’s becoming a Senior Financial Analyst or moving into a specialised role.

By connecting early performance, ongoing learning, and a transparent career trajectory, you do more than just fill a role. You build a finance team that not only performs but is motivated to grow with the company. This strategic approach to financial analyst hiring is what creates a true competitive advantage.

Common Questions on Hiring Financial Analysts

As a CHRO, you’ve probably seen the same questions pop up time and again when hiring for specialised roles like a Financial Analyst. Getting straight answers is the key to building a hiring strategy that doesn’t just fill a seat, but actually adds value. Let’s tackle some of the most common queries we hear from hiring managers.

What Is the Biggest Mistake to Avoid?

Without a doubt, the single biggest mistake is getting star-struck by technical skills and completely overlooking behavioural competencies. It’s easy to be wowed by a candidate who can build a complex LBO model from memory, but that’s only seeing half the picture of what modern finance teams need.

Sure, an analyst needs to be sharp with Excel and understand financial modelling inside out. But their real value is unlocked when they can take that raw data and weave it into a story that resonates. If they can’t clearly explain their findings to the sales team or collaborate with operations to understand ground realities, their brilliant model remains just a spreadsheet.

The real win is finding someone with both technical sharpness and essential soft skills like a relentless sense of curiosity and adaptability. Your interview process has to be built to weigh these two sides equally. That’s how you find an analyst who will truly drive business results, not just crunch numbers.

How Long Should the Hiring Process Take?

In a market this competitive, speed is your secret weapon. From the day you post the job to the day an offer is accepted, you should aim to wrap up the entire financial analyst hiring process in four to six weeks.

Anything longer, and you risk losing your best people. Top-tier analysts, especially in India’s fast-moving job market, are often juggling multiple offers and won’t hang around for a company that can’t make a decision.

This means your internal decision-making process has to be sharp and streamlined. Working with a Recruitment Process Outsourcing (RPO) partner can really give you an edge here. They often come with pre-vetted talent pipelines and handle all the interview logistics, which can shrink your time-to-hire by 25-40%.

Which Certifications Are Most Important?

This is a classic question, and the answer really comes down to the specifics of the role you’re hiring for. While no certification is a silver bullet, some are powerful signals of a candidate’s dedication and deep expertise in certain areas of finance.

A couple you should definitely keep an eye out for:

- Chartered Financial Analyst (CFA): This is the gold standard, particularly for roles in investment management, equity research, and asset management. It’s a rigorous certification that shows a deep, broad understanding of investment topics.

- Financial Modeling & Valuation Analyst (FMVA): For corporate finance roles, this one is incredibly practical. It tells you the candidate has hands-on, applicable skills in building the exact kind of financial models you need for budgeting, forecasting, and valuation.

But here’s the crucial part: treat certifications as strong indicators, not non-negotiable gatekeepers. The real test is how a candidate performs in the case study and technical interviews you’ve designed. Their ability to solve a problem unique to your business is a far better predictor of success than any credential on its own.

At Taggd, we specialise in optimising the entire recruitment lifecycle to connect you with top-tier financial talent faster. Our RPO solutions are designed to build a proactive, strategic hiring function that delivers results. Discover how we can refine your financial analyst hiring process.