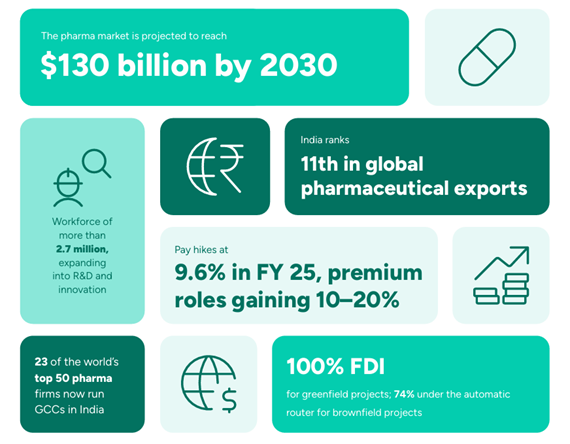

India’s pharmaceutical sector is entering a high-growth hiring phase, backed by strong market expansion, regulatory support, and innovation-led transformation. With the industry projected to reach $130 billion by 2030, India Decoding Jobs 2026 Report highlights that India is rapidly strengthening its footprint as a global pharma powerhouse- currently 11th among the world’s largest exporters and home to 23 of the top 50 pharma companies operating GCCs.

With a workforce of over 27 lakh professionals and hiring intent rising toward 10% in FY26–27, the sector is now moving beyond manufacturing dominance into high-value R&D, biotech, personalised medicine, and digital healthcare ecosystems. Pay increments are trending at 9.6%, with niche scientific and regulatory roles commanding 10–20% higher premiums, signalling the growing importance of specialised skillsets.

As we step into the next phase of growth, pharma hiring is expected to deepen across innovation, compliance, AI in drug discovery, large-scale clinical research, and global market expansion, setting the tone for workforce transformation and future-ready capability building.

Pharma Hiring Momentum & Workforce Evolution

The Indian pharmaceutical industry is entering one of its most dynamic workforce transformation cycles yet. Compensation trends clearly mirror the fierce competition for niche talent- salary hikes averaged 9.6% in FY25, outpacing India Inc’s 8.8%.

This upward curve is expected to hold through FY26–27, with emerging roles like digital health specialists, AI analysts, pharmacovigilance experts, and real-world evidence scientists commanding 10–20% premiums above market average.

Regional hiring is accelerating as well. Hyderabad has cemented itself as India’s pharma nerve centre, with Eli Lilly setting up an innovation hub expected to generate 1,500 jobs, and Bristol Myers Squibb & Amgen scaling rapidly. According to India Decoding Jobs 2026, Tier-II clusters are now catching up, led by Sun Pharma’s ₹3,800-crore expansion in Madhya Pradesh, projected to create 2,000 roles. Meanwhile, Telangana’s ₹36,000-crore pipeline could unlock over 50,000 direct jobs, powered by a new life sciences policy launch in FY26.

Global Capability Centres (GCCs) are reshaping talent needs. 23 of the world’s top 50 pharma companies now run GCCs in India, expanding from shared services to high-value functions like drug discovery, AI diagnostics, real-world evidence analytics, and regulatory affairs. Penetration across advanced domains is deepening:

- 45% in drug discovery functions

- 60% in regulatory affairs

- 54% in medical affairs

- 50% in commercial operations

This shift is fuelling demand for top-end specialists- from regenerative medicine researchers to AI-driven R&D analysts– firmly positioning India as the engine of global pharmaceutical innovation.

Regional Pharma Workforce Clusters

India’s pharmaceutical workforce is becoming increasingly hub-driven, anchored by powerful regional clusters that are shaping hiring demand across research, biotech, regulatory affairs, manufacturing, and digital health.

Cities like Hyderabad, Ahmedabad, Mumbai, Pune, and Chandigarh are emerging as high-value talent zones- backed by industry investments, academic R&D partnerships, and government-led innovation policies. These hubs are expected to fuel the bulk of growth through FY26–27, strengthening India’s position as a global pharmaceutical powerhouse.

Check out India’s key pharma talent hubs, major players, and their workforce specializations:

1. North India: Research-Driven Pharmaceutical Growth Hub

- Key Regions: Chandigarh, Mohali

- Major Companies & Startups: Venus Remedies, Ind-Swift, Panacea Biotec + emerging biotech startups

- Key R&D & Academic Projects: NIPER-Mohali, Cureton Biotech R&D Campus, Panacea Digital Lab

- Primary Hiring Areas: Clinical trials, contract R&D, formulation development, QA/testing

2. South India: The Nerve Centre of Biotech & Vaccine Innovation

- Key Regions: Hyderabad (Genome Valley), Bangalore, Visakhapatnam

- Major Companies: Dr. Reddy’s, Eli Lilly, Aurobindo, Bharat Biotech, Novartis + API-led startups

- Key Projects & Collaborators: Pharma City (Hyderabad), Eli Lilly & Company, Bharat Biotech, CCMB, NIPER-Hyderabad, IICT

- Core Talent Demand: Vaccine R&D, biosimilars, biotech research, API & intermediate manufacturing, regulatory science

3. West India: India’s Largest Manufacturing & Export Powerhouse

- Key Regions: Ahmedabad, Mumbai–Pune Belt, Vadodara, Indore, Dewas

- Major Companies: Zydus Lifesciences, Sun Pharma, Cipla, Lupin, Glenmark, Intas, Cadila, Medley, Neon Labs, Biocon + diagnostics startups like Molbio

- Innovation & Infrastructure: Zydus Innovation Centre, Serum Institute of India, Sun Pharma Advanced Testing Labs, Gujarat Pharma Park

- Hiring Focus Areas: Manufacturing excellence, biotech R&D, digital health, plant operations, clinical trials, regulatory affairs

4. East India: The Rising API & Bulk Drug Production Zone

- Key Regions: Kolkata, Durgapur, Guwahati

- Major Companies: Bengal Chemicals, Albert David, East India Pharma Works, Zenexa Healthcare + emerging biotech players like Sea6 Energy

- R&D & Academic Nodes: IIT Kharagpur Drug Development Lab, IISER Kolkata, East India Pharma Works R&D

- Key Talent Demand: API development, bulk drug synthesis, analytical research, generics formulation, compliance & quality

India’s pharma hubs are no longer just manufacturing bases- they are becoming full-spectrum innovation centres, integrating drug discovery, digital health, AI-led research, clinical trials, and advanced biologics. As we move into FY26–27, these clusters will define hiring strategies, attract global investment, and power India’s journey to $130B in pharma value.

Key Challenges in India’s Pharmaceutical Talent Landscape

The pharma workforce is evolving rapidly, but the pace of scientific innovation, digital expansion, and regulatory advancement has also created significant hiring and capability gaps. Competition for niche talent is intensifying, employee turnover is rising in major hubs, and organisations are under pressure to accelerate cross-functional upskilling to stay globally competitive.

1. Severe talent shortages in advanced science & biotech roles

More than 80% of pharma companies report shortages in specialised domains such as clinical research, AI-powered drug discovery, regulatory sciences, gene-editing, and computational biology. Limited supply is leading to extended project timelines and aggressive cross-industry talent poaching.

2. Increasing compliance complexity adds to hiring strain

Global regulatory standards are evolving continuously, especially for export-driven companies. The result- longer onboarding cycles, constant retraining requirements, and widening gaps in regulatory job functions despite high investment in learning programs.

3. Digital transformation slowed by skill mismatch

Around 43% of organisations continue to struggle with digital maturity due to inadequate tech-integrated talent. Shortages in AI, automation, data modeling, and cloud-based manufacturing are delaying the shift toward next-gen, data-driven pharma operations.

4. High attrition in major pharma hubs

Cities like Hyderabad, Bengaluru, Pune, and Mumbai are facing escalating retention challenges as salaries rise and hiring competition peaks. Employers are responding with retention bonuses of up to 20%, accelerated career growth tracks, and higher salary multiples (1.5–1.8x) to secure scarce innovation and biotech talent.

5. Reskilling pace not matching market demand

Although internal capability-building frameworks, digital academies, and academic tie-ups are growing, they still lag behind the industry’s transformation speed. Many employees remain under-equipped for AI-first research environments, slowing enterprise-wide digital adoption.

Global Pharma Hiring Landscape

The global pharmaceutical workforce reached 12.2 million professionals in FY2025, marking the highest expansion in three years with 625,000 new jobs added. This momentum is set to continue, with 3–6% annual workforce growth expected through FY2027, driven by advancements in biotechnology, vaccines, and precision medicine.

The world is entering a new research era by FY2027, 30% of drug discovery roles may be AI-driven, as leading innovators expand into automation, combinatorial chemistry, and digital biology. Global majors including Novartis, Roche, Johnson & Johnson and Sanofi are restructuring research workflows around AI-enabled discovery, reshaping hiring priorities toward computational biology, digital-first R&D, translational science and automation.

Biologics and vaccines are set to surpass traditional small molecules in both value and workforce expansion. Global hubs such as Boston, Basel, Shanghai, and Singapore are scaling capacity in cell & gene therapies, antibody design, biosimilars, and regulatory science, with talent demand rising sharply for bioprocess engineers, molecular biologists, and advanced regulatory specialists.

Precision medicine is another breakout cluster, expected to expand 11.4% globally, with projected 12–15% CAGR growth in genomics hiring across the US, UK, Germany, China, and Japan. Simultaneously, digital therapeutics is forecast to reach $32.5B by FY2027, accelerating demand for software engineering, telehealth, clinical informatics, data analysis, and regulatory compliance talent.

The global centres powering this shift include:

- US (Boston, SF, New York, Raleigh)– AI, biologics, digital health

- China (Shanghai)– vaccines & biosimilars scale-up

- Europe (Cambridge, Basel, Munich, Paris)- innovation in rare disease & regulatory talent

- APAC (Singapore, Japan, South Korea)– genomics, bio-manufacturing, deep tech biology

India’s Pharma Hiring Landscape

India is moving from being the world’s pharmacy to a global innovation engine.

- Job openings surged 62% YOY up to March 2025– the fastest in a decade

- R&D hiring rose 15–20% across pharma + health-tech

- Biologics & digital therapeutics emerging as high-opportunity talent streams

Biologics manufacturing is becoming one of the strongest hiring engines as Biocon, Dr. Reddy’s, Zydus, Cipla and CDMOs expand capacity. Vaccine clusters in Hyderabad, Pune and Ahmedabad strengthened further with ₹36,000+ crore in new life sciences investment in FY2025, signalling long-term job creation across quality, compliance, biosimilars and process science.

New growth tracks are emerging fast:

| Next-Wave Hiring Areas | Trend Outlook 2026–27 |

| AI-driven R&D & digital discovery | Demand for health informatics, ML, automation |

| Precision medicine | Genomics, diagnostic analytics, personalised trials |

| Biosimilars & bioprocessing | 5x growth expected by FY2030 |

| Regulatory affairs & pharmacovigilance | +2200 new roles added in FY2025 |

| Clinical research & outsourcing | 2nd largest hub globally after China |

India already supplies 40% of US generics & 25% of UK medicines, but the shift toward innovator pipelines is now accelerating. Digital-health and pharmacovigilance experts earn 15–25% higher pay, and by FY2027 India is expected to compete directly with US, Europe & China for high-value pharma talent.

Why This Matters for HR, Talent Leaders & The Future of Work

India is at the centre of a once-in-a-decade pharma hiring inflection point.

The jobs being created now are not generics-led- they are biotech, digital, AI-first and global-scope R&D roles.

Campus hiring is shifting to IITs, IISc, NIPERs, IISERs, while hybrid R&D models open global work pathways for Indian scientists. Talent strategies must now prioritise:

- Skill-aligned hiring over degree-driven intake

- Certification-first career pipelines

- Global regulatory exposure

- AI + digital proficiency for every science role

This is India’s Decoding Jobs moment in pharma– where the world is hiring advanced science talent, and India is supplying it. Unlock more insights with the India Decoding Jobs 2026 Report.

Wrapping Up

India is entering a defining decade for pharmaceutical innovation and workforce evolution. What was once a manufacturing-led sector is now rapidly transforming into a global hub for advanced R&D, biologics, AI-integrated drug discovery, digital therapeutics, and precision medicine. Hiring momentum, rising salary premiums, GCC expansion, and regional innovation clusters make it clear- India’s pharma talent market is moving toward high-value scientific capabilities and global competitiveness.

For HR leaders, CXOs, and workforce strategists, the road ahead will require smarter hiring models, deeper academic partnerships, digital-first upskilling, and faster capability alignment. The organisations that invest early in niche science talent, AI-enabled R&D, and regulatory excellence will lead this next era of growth.

India’s Pharma Industry is not just growing- it’s evolving. And the workforce powering it must evolve too.

To get deeper insights into Pharma hiring trends, AI-based workforce transformation, and India’s talent demand outlook, download the full India Decoding Jobs 2026 report- complete data, hiring charts, industry forecasts & strategic recommendations.

Download Now- India Decoding Jobs 2026.