At the heart of the talent shortage problem, the fundamental difference between Auto OEMs and Tier 1 suppliers is all about brand power and market position. OEMs, with their big consumer-facing names, are in a direct tug-of-war with tech giants for top-tier software talent. Meanwhile, Tier 1 suppliers are fighting a battle on two fronts: they’re up against the OEMs for core engineering roles and simultaneously battling a general lack of brand visibility to attract the specialised tech experts they desperately need. This creates vastly different hiring headaches and demands completely separate strategies.

The Widening Talent Divide in India’s Automotive Sector

India’s automotive industry is caught in the middle of a serious talent crisis. This has only been accelerated by the relentless industry-wide shift towards electric vehicles (EVs), automation, and connected car technology. Both Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers are finding it incredibly difficult to fill critical positions, but the nature of these shortages—and the damage they cause—looks very different for each. This growing skills mismatch is a major roadblock to innovation and growth for everyone involved.

The root of the issue is a deep chasm between the skills people have and the competencies the industry actually needs. There’s a staggering 80% skills gap in future-critical areas like battery engineering, automation, data analytics, and EV software development. Even though India produces engineers in high numbers, only around 55% are considered truly employable for these advanced automotive roles. It’s a clear sign of the disconnect between what’s taught in universities and what’s needed on the factory floor and in R&D labs.

Comparing Key Battlegrounds for Talent

For any CHRO trying to build a resilient workforce, understanding the subtle yet crucial differences between OEMs and suppliers is the first step. This guide breaks down the comparison across several key areas:

- Brand Magnetism: How an OEM’s household name gives it a clear advantage over lesser-known Tier 1 suppliers when it comes to attracting elite software and AI talent.

- Compensation Power: The financial muscle of OEMs allows them to offer more competitive salaries and benefits, often creating a bidding war that suppliers simply can’t win.

- Hiring Agility: How the sheer scale and internal red tape of each type of organisation impact how quickly and effectively they can secure in-demand professionals.

This comparison isn’t just an academic exercise; it’s a strategic playbook. The talent solutions that work for a massive OEM will almost certainly fall flat for a specialised Tier 1 supplier. A tailored approach isn’t just a good idea—it’s essential for survival.

This analysis is a crucial resource for automotive leaders, packed with actionable insights and RPO strategies to navigate this tough landscape. By digging into the current workforce and production trends in the Indian automotive sector, we can better frame the challenges that lie ahead and spot the real opportunities for growth.

Analysing the Root Causes of the Talent Gap

The talent shortages hitting Auto OEMs and Tier 1 suppliers aren’t happening by chance; they’re a direct result of the ground shifting beneath the entire industry. The massive pivot to the ACES model—Autonomous, Connected, Electric, and Shared mobility—has completely redrawn the talent map. This has created very different recruiting battlegrounds for each type of company. For any CHRO looking to build a resilient workforce, digging into these root causes is the critical first step.

For OEMs, the heart of the problem is a new and powerful rival: big tech. As cars evolve into complex software platforms on wheels, OEMs suddenly need elite developers, AI specialists, and data scientists. This throws them into direct competition with tech giants, who often dangle more attractive salaries, flexible work cultures, and brands that scream “tech-first.”

Tier 1 suppliers, on the other hand, are fighting a tougher, two-front war. First, they have to compete with their own OEM customers for the same pool of traditional automotive and manufacturing engineers. At the same time, they struggle to attract top-tier software talent because they just don’t have the powerful consumer brand recognition that OEMs enjoy.

Brand Perception and R&D Investment

An OEM’s brand is a powerful magnet. Names like Tata Motors, Mahindra, or Maruti Suzuki are instantly recognisable, giving them a huge leg up in attracting talent that wants to work on a final, tangible product. This brand gravity is especially strong when they’re trying to recruit from outside the traditional auto sector.

Tier 1 suppliers, even global powerhouses, often operate in the background. A software engineer is naturally more drawn to the idea of developing the infotainment system for a flagship SUV than creating the underlying control module, even if the module is a more complex piece of tech. This perception gap is a major hurdle they need to overcome.

The sheer scale of R&D investment also creates a clear divide. OEMs can pour billions into high-profile “moonshot” projects like fully autonomous driving platforms. These flagship initiatives are powerful recruitment tools, pulling in top minds who want to work on the most visible and ambitious challenges. Suppliers, working with tighter margins, tend to focus their R&D on specific components, which can feel less glamorous to potential hires.

The talent war in India’s automotive sector has reached fever pitch. According to Sitaram Kandi, VP of HR at Tata Motors, “The talent shortage in software, AI, and other EV-specific areas is significant. There’s essentially a talent war in these domains.” This pressure has driven substantial salary hikes, with specialists in EV technology potentially seeing pay increases of up to 50% when changing jobs. You can discover more insights about India’s EV talent drive and its impact on the industry.

Battlegrounds for Specialised Talent

The different business models of OEMs and Tier 1s mean their talent shortages show up in different places. The core challenge is that they are rarely fighting the same opponent for the same talent. This makes a one-size-fits-all recruitment strategy completely ineffective.

Let’s break down the distinct competitive landscapes they face.

OEM vs Tier 1 Supplier Talent Attraction Challenges

| Challenge Factor | Impact on Auto OEMs | Impact on Tier 1 Suppliers |

|---|---|---|

| Software/AI Talent | Go head-to-head with technology giants (Google, Apple) and well-funded tech startups. | Compete with both OEMs and the broader tech industry, but from a weaker brand position. |

| EV Battery Engineers | Compete with other OEMs and specialised battery technology firms. | Face competition from OEMs, dedicated battery manufacturers, and raw material science companies. |

| Mechatronics/Robotics | Primarily compete with other advanced manufacturing sectors like aerospace and industrial automation. | Compete directly with OEMs, who need the same skills for their own advanced assembly lines. |

| Manufacturing Operations | Vie for talent with other high-volume manufacturing industries that offer competitive plant-level pay. | Face stiff competition from OEMs and other Tier 1s, often driving up local wages. |

This comparison really highlights the strategic differences. An OEM’s main concern might be crafting an employer value proposition that can stand up to a tech firm, focusing on innovation and work-life balance.

A Tier 1 supplier needs a different angle. They should highlight opportunities for deep specialisation, greater ownership over a project, and the unique chance to supply critical technology to multiple leading brands—turning their B2B focus into a compelling career advantage.

Comparing Critical Skill Gaps and High-Stakes Roles

While both Auto OEMs and Tier 1 suppliers are feeling the pinch of talent shortages, the specific skills they’re scrambling for are worlds apart. It all comes down to their unique spot in the automotive value chain, which creates entirely different sets of critical roles. Any CHRO who thinks a one-size-fits-all recruitment strategy will work is setting themselves up for failure.

Think about it: the talent an OEM needs to perfect the customer experience is fundamentally different from the talent a supplier needs to innovate at the component level.

An OEM’s priority list is almost always topped by customer-facing technologies and brand perception. They’re in a fierce battle to hire professionals who can create a seamless, engaging experience inside the vehicle. The real pressure is finding talent that lives at the intersection of automotive engineering and consumer tech.

Tier 1 suppliers, on the other hand, are fighting a different war. Their battle is for deep, specialised expertise. Their success hinges on designing, engineering, and manufacturing the cutting-edge components that their OEM clients depend on. This relentless focus on core innovation and manufacturing excellence means their talent acquisition strategy has to be laser-focused.

The OEM’s Focus on Software and User Experience

For OEMs, the most gaping holes are in roles that directly shape how a driver interacts with their vehicle. The car isn’t just a machine anymore; it’s a rolling digital platform.

This massive shift means the most in-demand skills now include:

- Infotainment and UI/UX Design: Creating intuitive, responsive, and slick interfaces for the ever-growing number of screens and digital cockpits.

- Connectivity and App Development: Building the software that connects the car to the cloud, smartphones, and a universe of third-party services.

- AI/ML Engineering: Developing the smart algorithms behind voice assistants, predictive maintenance alerts, and personalised driver settings.

- Cybersecurity Specialists: Protecting the connected vehicle from a growing number of external threats—a role that has become absolutely mission-critical for maintaining brand trust.

The tricky part for OEMs? The talent they need is often working somewhere else entirely. They are now in direct competition with tech giants for software developers and AI experts, forcing them to completely overhaul their employer value proposition to attract people who’ve likely never considered a career in automotive.

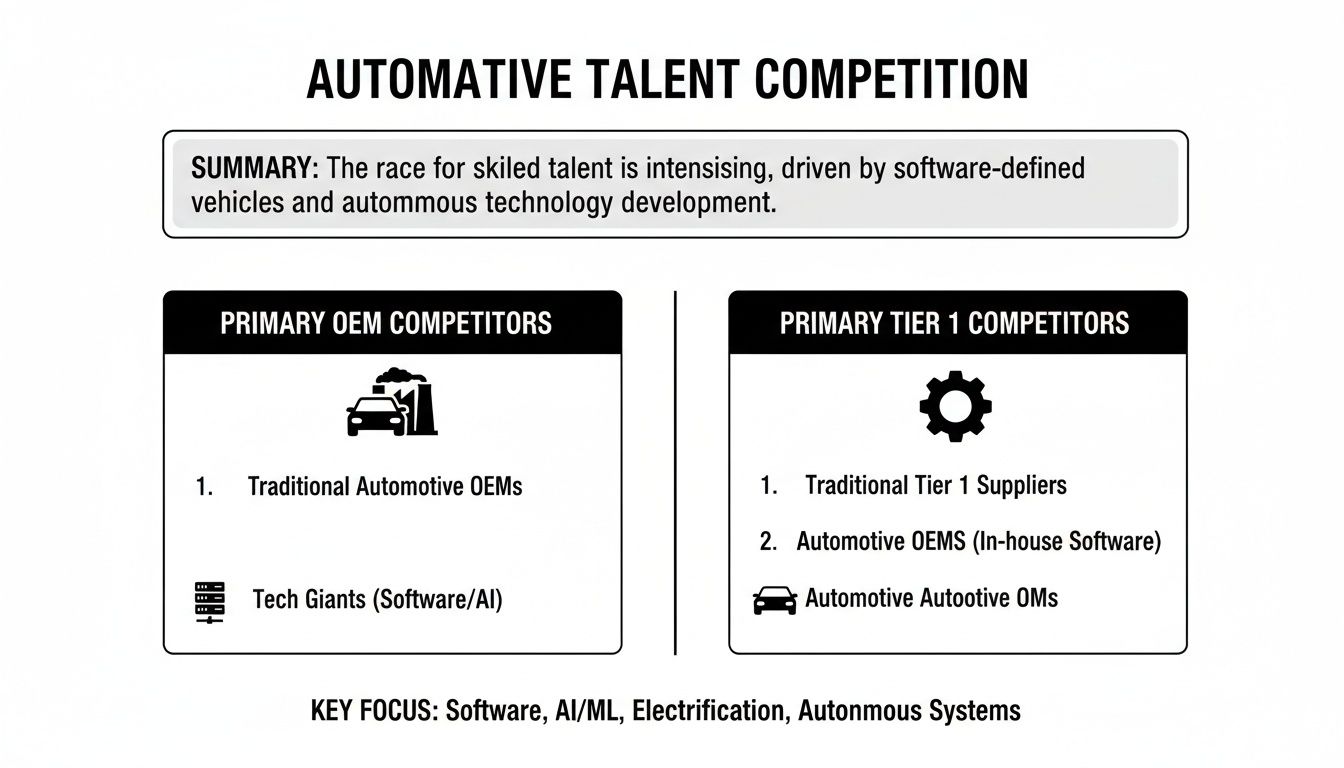

The following infographic really brings the competitive landscape to life for both OEMs and Tier 1 suppliers.

As you can see, OEMs are primarily going head-to-head with big tech for software talent. Meanwhile, Tier 1 suppliers are often competing against their own OEM customers for highly specialised engineering skills.

The Tier 1 Supplier’s Need for Deep Specialisation

Tier 1 suppliers are under a different kind of pressure. They need the true experts, the people who can push the boundaries of what’s possible with component technology. Their talent shortages are concentrated in roles that demand a profound understanding of physics, materials, and complex manufacturing processes.

Key in-demand roles for suppliers include:

- Mechatronics Engineers: Professionals who can masterfully integrate mechanical and electronic systems for components like electric power steering or advanced braking systems.

- Battery Chemistry Experts: The scientists and engineers with deep, hard-won knowledge of cell chemistry, thermal management, and battery pack manufacturing.

- Advanced Materials Scientists: Specialists who develop the lighter, stronger, and more cost-effective materials used in everything from vehicle bodies to interior trims.

- Power Electronics Engineers: The experts who design and build the inverters, converters, and onboard chargers that are the lifeblood of every electric vehicle.

For Tier 1 suppliers, the talent shortage isn’t about the user interface; it’s about the core technology that makes the vehicle actually work. A recruitment approach that values deep technical expertise over broader software skills is essential. For a closer look, you can learn more about how to address these precise skill gaps in the auto industry. The biggest challenge for suppliers is often attracting these niche specialists, who might be tempted by the bigger brand names and R&D budgets of an OEM.

The Real-World Cost of an Empty Desk

Talent shortages aren’t just an HR headache; they’re a direct threat to the bottom line for both Auto OEMs and their Tier 1 suppliers. When a critical role sits empty, the damage isn’t theoretical. It’s a tangible financial hit that stalls projects, suffocates innovation, and chips away at your market position.

For an OEM, this fallout is often public and painful. Think about a delayed vehicle launch because you couldn’t find enough software engineers. That’s not just a missed deadline; it’s surrendering the first-mover advantage to a rival. Or consider buggy infotainment software, pushed out by an overworked, understaffed team. The result? Scathing customer reviews and a brand reputation that takes years to rebuild.

The stakes are arguably even higher for a Tier 1 supplier. Here, the impact is less about public perception and more about survival. Failing to meet an OEM’s strict quality standards or missing a delivery window because of a mechatronics skills gap can mean losing a multi-million-dollar contract overnight. In the razor-thin margins of just-in-time manufacturing, one supplier’s failure can bring an entire OEM assembly line to a grinding halt.

Quantifying the Damage: Direct Hits and Hidden Costs

The financial drain from unfilled roles goes way beyond the cost of an empty chair. The true business impact is a painful mix of direct expenses and the more subtle, but equally corrosive, indirect costs. Getting a handle on this full picture is crucial for making a strong case for strategic talent investment.

While the costs show up differently, they hit both sides hard:

- Soaring Recruitment Bills: As the talent pool shrinks, the cost-per-hire is going through the roof. OEMs and suppliers are now locked in a constant battle, paying premium fees for head-hunters and dangling huge sign-on bonuses just to get candidates in the door.

- The Unwinnable Salary War: The fierce competition, especially for EV and software experts, has sparked an unsustainable salary war. Companies are being forced to offer inflated pay packages that wreck budgets and create serious internal pay equity problems, leaving existing loyal employees feeling undervalued.

- The Revolving Door of Attrition: When teams are short-staffed, the pressure mounts on your current employees. They’re hit with bigger workloads, which leads directly to burnout and, inevitably, they start looking elsewhere. This kicks off a vicious cycle where filling one vacancy creates three more.

This isn’t just an automotive problem; it’s amplified by a nationwide skills crisis. India’s broader talent shortage has created a hyper-competitive recruitment market across every sector, making the fight for auto specialists even more brutal.

This widespread challenge puts the intensity of the competition into stark relief. A recent survey revealed that nearly four in five employers in India—a staggering 80%—reported struggling to find the skilled talent they need. The automotive and manufacturing sectors are feeling the pinch especially hard, with 73% of employers reporting similar shortages. This national context adds a whole new layer of complexity for CHROs. You can read the full analysis on India’s talent shortages to get a better sense of these market-wide pressures.

The Innovation You’re Missing Out On

Perhaps the biggest, yet hardest-to-measure cost, is the opportunity you lose when innovation grinds to a halt. Every day a critical R&D role stays vacant is another day your competitor is pulling ahead. This is where the strategic consequences of the talent shortages in Auto OEM vs Tier 1 suppliers become painfully clear.

For an OEM, this could mean being six months late to market with a game-changing EV model or falling a generation behind in autonomous driving tech. The long-term damage to market share and brand leadership can be catastrophic. You miss the chance to define the future of mobility simply because you don’t have the people to build it.

For a Tier 1 supplier, this opportunity cost is an existential threat. Their entire business is built on supplying the next big thing to their OEM partners. Without the right talent, their product roadmap stalls. This leaves them wide open to more agile competitors who can deliver the cutting-edge components OEMs are clamouring for, risking the loss of foundational, long-term partnerships.

Deploying RPO as a Strategic Advantage

After digging into the deep-rooted causes and business impacts of talent shortages, the conversation has to shift from problems to solutions. Just acknowledging the challenge won’t cut it. CHROs need a powerful, strategic lever to actually win this talent war, and this is where Recruitment Process Outsourcing (RPO) comes in—not just as another hiring service, but as a genuine competitive advantage.

An expert automotive RPO partner is much more than a traditional recruitment agency. Think of them as an embedded extension of your own HR team, bringing specialised industry knowledge, advanced sourcing tech, and a data-driven methodology to the table. This kind of partnership is built from the ground up to tackle the very specific challenges faced by both Auto OEMs and Tier 1 suppliers.

For OEMs, the sheer scale and complexity of hiring can be overwhelming. An RPO partner thrives here, building and managing scalable talent pipelines for both high-volume manufacturing roles and those hard-to-fill, niche technology positions. They help you move from a reactive scramble for talent to a proactive, predictable function.

RPO Solutions Tailored for Auto OEMs

OEMs need a robust engine for talent acquisition, one that can handle vastly different needs all at once. A specialised RPO delivers this through a multi-pronged approach.

- Building Niche Tech Talent Pipelines: Instead of starting from square one every time a software or AI role opens up, an RPO partner proactively maps the market. They identify and nurture relationships with passive candidates at competing tech firms, creating a warm bench of talent that’s ready to engage when you need them.

- High-Volume Manufacturing Recruitment: When it comes to plant-level hiring, efficiency is everything. RPO providers use data analytics to pinpoint the most effective sourcing channels, fine-tune candidate screening, and dramatically slash the time-to-fill for critical shop-floor roles. This ensures your production lines stay fully staffed.

- Enhancing Employer Brand: An RPO partner can help an OEM sharpen its employer value proposition (EVP) so it truly resonates with tech talent. They can manage targeted digital campaigns that showcase the OEM’s innovation projects, helping it compete more effectively against the pull of pure-play technology companies.

A Force Multiplier for Tier 1 Suppliers

For Tier 1 suppliers, an RPO partner becomes a crucial force multiplier, levelling the playing field in the intense battle for talent. Without the brand recognition of an OEM, suppliers need a much more targeted and sophisticated strategy to attract top candidates. An RPO provides the expertise and resources to execute it flawlessly.

A skilled RPO can help a Tier 1 supplier punch far above its weight. They do this by zeroing in on the supplier’s unique strengths—like offering engineers greater project ownership or a faster career track—and weaving a compelling story around them.

The core value of an RPO for a Tier 1 supplier is access. They unlock passive candidate pools that are simply out of reach through standard job postings or an overworked internal HR team. This access is the key to finding specialists who aren’t actively looking but are open to a better opportunity.

An RPO partner also brings the market intelligence needed to compete smarter. Instead of getting dragged into unwinnable salary bidding wars with OEMs, suppliers can use RPO-driven data to find candidates motivated by more than just money, such as the technology, culture, or career growth. This strategic approach allows them to land top talent without breaking their budget. If you’re exploring this, our guide on how RPO can improve hiring results offers deeper insights.

Strategic RPO Services in Action

To really see the practical impact, let’s look at how specific RPO services solve the problems we’ve identified for both types of organisations.

OEM vs Tier 1 Supplier RPO Application

| RPO Service | Strategic Application for an OEM | Strategic Application for a Tier 1 Supplier |

|---|---|---|

| Talent Mapping | Identifies entire software engineering teams at competing tech firms, providing a strategic overview for future hiring. | Pinpoints niche mechatronics or battery chemistry experts within competitor suppliers or related industries. |

| Employer Branding | Creates and promotes content showcasing the OEM’s “tech-first” culture and flagship autonomous vehicle projects. | Develops a targeted EVP highlighting deep specialisation and the impact of supplying critical parts to multiple leading brands. |

| Analytics-Led Sourcing | Analyses data to optimise spending on job boards for high-volume roles, maximising ROI on recruitment advertising. | Uses market analytics to advise on competitive, yet sustainable, salary benchmarks, avoiding direct bidding wars. |

Ultimately, bringing in an RPO is about moving away from a reactive, transactional hiring model to a proactive, strategic talent acquisition function. It gives both OEMs and suppliers the specialised tools and expertise needed to navigate today’s complex talent market and build a workforce ready for future growth.

Building Your Future-Proof Talent Roadmap

It’s one thing to understand the talent crunch hitting Auto OEMs and Tier 1 suppliers; it’s another thing entirely to take decisive action. If you’re scrambling to fill roles reactively, you’ve already lost. A resilient, long-term talent strategy demands a structured approach.

This roadmap is a practical, phased guide for CHROs ready to partner with a Recruitment Process Outsourcing (RPO) provider. It’s about building a workforce that can actually weather future disruptions. This isn’t just about plugging gaps; it’s about constructing a sustainable talent acquisition engine that gives you a competitive edge. Think of this as your playbook, moving from high-level strategy to on-the-ground execution for both OEMs and their crucial supply chain partners.

Phase 1: Conduct an Internal Skills Audit

Before you can build anything, you have to know what your foundation looks like. The first step is a rigorous internal skills audit and gap analysis. It’s a straightforward but critical process: map your current team’s competencies against the skills you’ll need to hit your strategic goals over the next three to five years.

For an OEM, this often means staring down gaps in software development and data analytics. For a Tier 1 supplier, the shortfall might be in mechatronics or advanced materials experts.

- Action for OEMs: Pinpoint your talent deficits by focusing the audit on future vehicle programmes. How ready is your team for the inevitable shifts in autonomous driving, connectivity, and electrification?

- Action for Tier 1 Suppliers: Align your skills audit directly with your product roadmap and the demands of your key OEM clients. What specific engineering and manufacturing skills do you need to win those future contracts?

Phase 2: Define the Business Case for RPO

Once you have a crystal-clear picture of your talent gaps, it’s time to build a compelling business case for a strategic RPO partnership. This is where you connect the dots between talent acquisition and real business outcomes. You need to go way beyond simple cost-per-hire metrics.

Quantify the financial bleeding from vacant roles—think project delays, lost revenue, and the staggering cost of attrition when your best people burn out from carrying extra weight.

Your business case should frame an RPO not as a cost centre, but as a strategic investment. It’s about mitigating risk and fuelling growth by securing the specialised talent needed to innovate and compete.

Phase 3: Select the Right RPO Partner

Choosing an RPO provider is a make-or-break decision. You need a partner with proven, on-the-ground experience in the Indian automotive sector. They must genuinely understand the nuances between hiring for a global OEM and a specialised Tier 1 supplier.

During selection, dig into their tech stack, their methods for sourcing passive candidates who aren’t actively looking, and their ability to help shape your employer brand. A true partner acts as a strategic advisor, not just a service provider filling orders.

Phase 4: Co-create a Sourcing Strategy

With the right partner on board, you can move to co-creating a bespoke sourcing and engagement strategy. This has to be a collaborative effort. Your deep internal knowledge, combined with the RPO’s market expertise, is a powerful combination.

The strategy needs to define target candidate personas, key sourcing channels, and the exact messaging that will resonate. For suppliers, this often means crafting a compelling story around deep specialisation and project ownership to pull top talent away from the big OEM brands.

Phase 5: Measure ROI and Drive Improvement

Finally, you need to establish clear Key Performance Indicators (KPIs) to measure success and ensure you’re always getting better. Your metrics have to move beyond traditional HR data like time-to-fill, which tells you very little about the real impact.

Focus on business-impact KPIs:

- Quality of Hire: Don’t just get them in the door. Track the performance and retention rates of new hires over their first year.

- Hiring Manager Satisfaction: Regularly survey your managers. Are they getting the support and the talent they need from the RPO partnership?

- Cost Mitigation: Calculate the actual savings from reduced agency fees, lower attrition, and getting projects completed on time.

This data-driven approach allows you to show a tangible return on investment from your RPO partnership and continuously fine-tune your talent strategy. By following this roadmap, you can stop fighting talent fires and start building a future-proof workforce that drives a real, sustained competitive advantage.

Frequently Asked Questions

When you’re navigating the complexities of automotive talent shortages, you need clear, direct answers. We’ve gathered some of the most pressing questions from CHROs at both Auto OEMs and Tier 1 suppliers to offer some straightforward guidance.

How Can a Tier 1 Supplier Compete with an OEM for Software Talent?

This is a classic David vs. Goliath scenario, but Tier 1s absolutely have a fighting chance. The key is to lean into your unique strengths. Suppliers often give engineers much more project ownership and a chance to work on a wider range of technologies across different OEM platforms. This means faster skill development and a more diverse portfolio of experience.

A sharp RPO partner knows how to frame this Employee Value Proposition (EVP). They can reach passive candidates who are more driven by tangible technical impact and innovation than just a big brand name on their CV.

The trick is to shift the conversation away from brand prestige and towards career velocity. For the right software engineer, the chance to become a true specialist on a critical component used by several major car brands is far more compelling than playing a smaller part in a massive OEM machine.

What Are the First Steps Before Engaging an RPO for EV Talent?

Don’t jump the gun. Before you even think about bringing in an RPO partner, an OEM needs to do its homework with a thorough internal talent audit. This isn’t just a headcount; it’s a precise mapping of your current skills against your future EV development needs. Think battery technology, power electronics, and embedded systems roles.

Once you know exactly where the gaps are, you can define the project’s scope, set clear key performance indicators (like time-to-fill and quality-of-hire), and figure out how the RPO will integrate with your internal HR team. This groundwork is non-negotiable—it ensures your RPO partner can hit the ground running and deliver targeted results from day one.

Is Upskilling a Better Solution Than External Hiring for Tier 1 Suppliers?

It’s not an either/or situation. Thinking of upskilling and external hiring as competing strategies is a mistake; they’re two sides of the same coin. Upskilling is a brilliant long-term play for building loyalty and making the most of your institutional knowledge, particularly for advancing skills in areas like manufacturing and mechatronics.

However, when you need highly specialised, new-domain expertise in fields like AI or battery chemistry right now, strategic external hiring is essential. An RPO partner can inject that critical expertise quickly, helping you accelerate innovation cycles. The most successful organisations have mastered the art of blending both approaches seamlessly.

Ready to build a future-proof talent pipeline and move past the talent shortages in Auto OEM vs Tier 1 suppliers? Taggd provides specialised RPO solutions built for the specific demands of the automotive sector. Contact us today to build your strategic advantage.