A Guide to Modern BFSI Hiring in India

The hiring game in India’s BFSI sector has completely changed. It’s a high-stakes arena now, thanks to rapid digitalisation and a whole new generation of talent joining the workforce. To win, companies need to ditch the old playbook and get with a more agile, tech-driven programme.

The challenge isn’t just about filling seats anymore. It’s about finding professionals who can actually thrive in a complex, digitally-powered financial world.

Understanding the New BFSI Hiring Landscape

The Banking, Financial Services, and Insurance (BFSI) sector is no longer just a pillar of the Indian economy; it’s a buzzing hub of employment and innovation. This isn’t just growth for growth’s sake. We’re seeing a fundamental shift in the skills, roles, and strategies needed to stay competitive, forcing a total rethink of talent acquisition.

Think of the old way of hiring in BFSI as a traditional bus service—it gets you there, but it’s slow, rigid, and sticks to one route. The new approach? It’s more like a fleet of on-demand electric vehicles: fast, data-driven, and smart enough to navigate the busiest streets to get the best talent where they need to be, quickly.

The Forces Reshaping Talent Acquisition

Three big drivers are rewriting the rules for hiring in the BFSI space:

- Rapid Digital Transformation: The flood of AI, machine learning, and blockchain tech has created a massive, urgent need for tech-savvy talent. Roles like data scientists and cybersecurity analysts, which were barely on the radar a decade ago, are now absolutely critical.

- The Fintech Revolution: Scrappy fintech startups are going head-to-head with the big, established players for the exact same talent. This is forcing the legacy giants to seriously modernise their employer brand and recruitment process just to stay in the game.

- The Rise of Gen Z: This new generation isn’t just looking for a paycheque. They want purpose-driven work, endless opportunities to learn, and a recruitment experience that’s as seamless as their favourite app.

Together, these forces have created an intensely competitive market. Speed, agility, and a killer employer value proposition are no longer nice-to-haves; they’re essential for survival. For a deeper dive into these market shifts, our BFSI sectoral report is a great place to start.

The sheer scale of this sector’s employment power is staggering. India’s BFSI sector is on track to become one of the largest employers in the organised sector, projected to create around 9 million jobs by 2025. That means roughly one in every twelve organised-sector workers will be in BFSI.

This powerhouse sector already contributes nearly 6% of India’s GDP and is growing at a solid 8.5% CAGR. We’re also seeing a massive demographic shift. Gen Z now makes up 23% of the BFSI workforce—a number that has literally doubled in the past year alone. It’s clear proof that the sector is becoming a magnet for younger, digitally native talent.

Overcoming Key Challenges in BFSI Talent Acquisition

Recruiting in the BFSI sector isn’t like hiring anywhere else. We’re not just dealing with the usual talent shortages; we’re facing a perfect storm of unique obstacles. The industry is locked in a fierce battle for highly specialised skills, trying to plug massive skills gaps, and struggling with high employee turnover—all while navigating a labyrinth of strict regulations. To win, you need more than a standard recruitment plan; you need a proactive, specialist strategy.

The competition for talent has completely changed. It’s no longer just about beating rival banks or insurance firms. Today, BFSI companies are going head-to-head with global tech giants and nimble fintech startups, all chasing the same small pool of experts. This has turned bfsi hiring into a far more aggressive and strategic game.

The Intensifying War for Niche Skills

The single biggest headache for BFSI leaders? Finding and securing professionals with in-demand digital skills. Roles in data analytics, cybersecurity, and artificial intelligence are no longer siloed “tech jobs.” They are now core functions, absolutely essential for driving innovation and maintaining security in the world of finance.

This talent tug-of-war has created a market where the candidate is king. Top professionals have their pick of offers and aren’t afraid to walk away. To even get a seat at the table, BFSI firms have to offer more than just a fat paycheque. They need a magnetic employer brand, genuinely exciting projects, and a culture that speaks to people with a tech-first mindset. Just posting a job online and hoping for the best is a guaranteed recipe for failure.

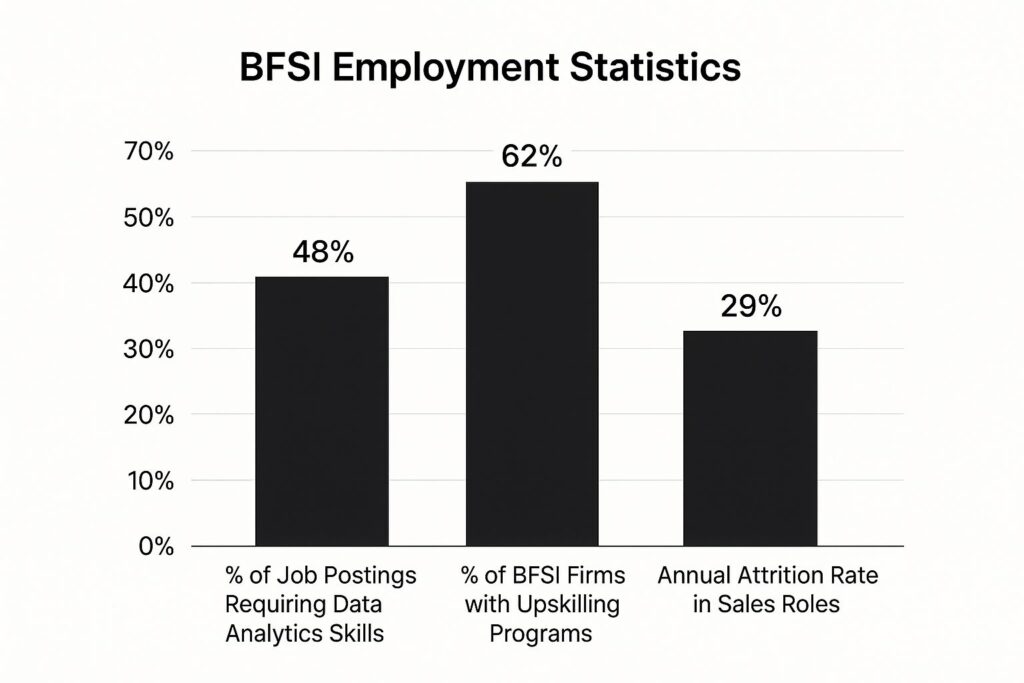

This infographic paints a clear picture of the skills gap, how the industry is trying to respond with upskilling, and the revolving door of attrition in critical roles.

The numbers tell a story. While companies clearly see the need for new skills and are putting money into training, the ridiculously high churn rate, especially in sales, keeps pulling the rug out from under these efforts.

Bridging the Widening Skills Gap

Technology is moving so fast that many existing employees simply don’t have the skills needed for tomorrow’s roles. Trying to fill every gap by hiring externally is not just expensive; it’s completely unsustainable. The only smart, long-term play is to build your talent from the inside out.

Forward-thinking BFSI organisations are getting ahead of this by creating powerful internal mobility and upskilling programmes. Think of it as developing your own talent pipeline instead of constantly trying to buy it from the market.

These initiatives are laser-focused on:

- Identifying Future Skills: Actively figuring out the critical skills the business will need in the next three to five years.

- Personalised Learning Paths: Offering tailored training in hot areas like AI, cloud computing, and advanced data analytics.

- Creating Internal Mobility: Building clear pathways for employees to move into new, high-demand roles right within the company.

By investing in your own people, you’re doing more than just closing skill gaps—you’re boosting morale and earning loyalty. An employee who sees a real future for themselves is far more likely to stick around than one who feels their skills are gathering dust.

Managing High Attrition Rates

Employee turnover is a chronic illness in the BFSI sector, especially in high-pressure jobs like sales and customer service. This constant cycle of hiring, training, and losing people is a massive drain on time, money, and productivity. High attrition isn’t just a statistic; it poisons team morale, damages customer relationships, and hits the bottom line hard.

Tackling turnover requires a strategy with many moving parts, and it’s about much more than money. It means improving the day-to-day work environment, offering genuine career growth opportunities, and making work-life balance a reality, not just a buzzword. For a deeper dive into what works, you can explore detailed analysis on BFSI employee attrition trends to get to the root causes and find effective solutions.

Navigating Regulatory and Ethical Hurdles

Finally, let’s not forget the red tape. Every single step of the bfsi hiring process is wrapped in a complex web of regulations. Compliance isn’t a “nice-to-have”; it’s the price of entry. From ensuring data privacy and conducting exhaustive background checks to upholding fair hiring practices, the legal and ethical tightrope is incredibly high.

One wrong move can lead to crippling fines and a PR nightmare. This is exactly why having a defensible, transparent, and standardised hiring process is non-negotiable. It ensures fairness, minimises risk, and builds trust with both candidates and regulators, creating a solid foundation for sustainable growth.

The Geographic Shift in BFSI Recruitment

The map of BFSI hiring in India is being completely redrawn. For decades, recruitment was a story centred in the sprawling metros—Mumbai, Delhi, and Bengaluru. That narrative is now shifting, and fast. Companies are pushing into the nation’s burgeoning tier-II and tier-III cities, and it’s changing everything.

This isn’t just a minor course correction; it’s a fundamental strategic pivot. Imagine a major river branching out into countless smaller streams to irrigate new, fertile lands. That’s what BFSI firms are doing—deliberately decentralising to tap into vast, underserved customer bases and unlock fresh talent pools.

The Rise of New Hiring Hotspots

The days of metro-exclusive growth are numbered. The new frontier for financial services lies in cities that were once considered secondary markets. A powerful combination of market saturation in the big cities, lower operational costs, and a national push for greater financial inclusion is driving this expansion.

The numbers tell a compelling story. Nearly half (48%) of all new BFSI jobs are now being created in tier-II and tier-III cities. Places like Indore, Coimbatore, Nagpur, and Jaipur are witnessing a recruitment surge of 15–18%, as financial institutions race to capture these underpenetrated markets.

These emerging hubs aren’t just becoming back-office support centres, either. They are quickly evolving into strategic locations for a whole range of functions, building a more distributed and resilient operational network for the entire industry.

In-Demand Roles Beyond the Metros

The kind of talent BFSI firms are hunting for in these smaller cities is diverse and absolutely critical for growth. While the head office in Mumbai might be focused on complex financial modelling, the demand in tier-II and tier-III cities is firmly rooted in market expansion and customer acquisition.

To truly understand what’s happening on the ground, it helps to see which roles are in high demand and what skills are non-negotiable.

Top In-Demand Roles and Skills in BFSI

| Role Category | Specific Job Titles | Key Skills Required |

|---|---|---|

| Sales & Business Development | Relationship Manager, Sales Executive (Loans & Insurance), Financial Advisor | Local market knowledge, strong interpersonal skills, regional language fluency, network building, product knowledge |

| Branch Operations | Branch Manager, Operations Officer, Customer Service Representative | Service orientation, process management, cash handling, regulatory compliance, problem-solving |

| Credit & Risk | Credit Analyst, Underwriter, Collections Officer | Analytical skills, financial assessment, local economic understanding, decision-making, negotiation skills |

| Digital Enablement | Digital Literacy Trainer, Fintech Product Specialist | Tech proficiency, communication skills, customer training, familiarity with digital payment ecosystems |

This shift has created a significant hiring spike, largely fuelled by the talent available right there in these smaller cities. You can dig deeper into this trend by reading our study on the talent boost from smaller cities.

This strategic decentralisation does more than just cut costs; it embeds the organisation directly into the local economic fabric. Hiring local talent isn’t just a recruitment strategy—it’s a powerful business development tool that builds immediate community trust and market credibility.

Leveraging the Power of Local Talent

The real competitive advantage here lies in the unique strengths of local talent. Hiring professionals who are from the region brings benefits that an outsider, no matter how qualified, simply can’t match.

The impact is immediate.

- Deep Market Understanding: Local candidates have an intuitive grasp of the regional economy, cultural nuances, and consumer behaviour. They just get what resonates with the community.

- Regional Language Proficiency: Speaking the local dialect fluently is a massive asset. It breaks down barriers and fosters a genuine connection with customers.

- Grassroots Network Access: Local hires often bring established personal and professional networks, which can be invaluable for lead generation and business development right out of the gate.

Candidates with these hyperlocal skills are gold dust. In fact, they are 2.5 times more likely to be shortlisted for customer-facing roles and can command 10–15% higher compensation than their metro-based peers. By prioritising local talent, BFSI firms can accelerate market penetration and build a sustainable competitive edge that’s tough to beat.

Building a Modern BFSI Hiring Strategy

Knowing the challenges in BFSI hiring is one thing, but actually building a strategy to beat them is what separates the leaders from the pack. A modern talent plan isn’t about small tweaks. It’s a total redesign of how you find, attract, and keep your people. This means getting proactive and blending technology, brand building, and smart partnerships.

The real goal here is to create a hiring engine that’s not just efficient and compliant, but one that’s a magnet for the diverse talent the sector desperately needs. Your strategy has to speak to everyone, from tech wizards to seasoned financial minds. It’s about shifting from a reactive, process-heavy function to a strategic, people-first powerhouse.

Embracing Technology and AI in Recruitment

Relying on old-school, manual processes today is like showing up to a Formula 1 race in a bullock cart. You’re guaranteed to be slow, inefficient, and left in the dust. Technology, especially Artificial Intelligence (AI), is the engine that will accelerate and sharpen your entire recruitment cycle, from the very first contact to the final offer.

AI-powered tools can sift through thousands of applications in minutes, pinpointing the best-fit candidates based on real skills and experience, not just keywords. This intelligent screening helps push unconscious bias out of the picture and makes sure top talent doesn’t get buried in a mountain of résumés. In fact, research shows that 50-55% of early-career workloads are now AI-augmented, letting new hires jump into complex projects right from day one.

Think about what this looks like in practice:

- Automated Screening: AI algorithms can scan résumés to shortlist candidates who match specific, complex criteria far beyond what a human could do at scale.

- Skill Assessments: Platforms can run real-world tests for technical roles, giving you hard data on a candidate’s actual abilities.

- Virtual Onboarding: Smooth, digital onboarding processes make a great first impression and get new hires up to speed and productive faster.

By handing over the repetitive tasks to automation, you free up your HR team to do what they do best: building relationships with promising candidates and making sharp, strategic hiring decisions.

Creating a Magnetic Employer Brand

In a market where top candidates are juggling multiple offers, a powerful employer brand is your secret weapon. It’s the story you tell the world about your organisation—your culture, your values, and the unique opportunities you provide. This is absolutely critical when you’re competing with both tech giants and nimble fintechs for the very same people.

Your employer brand needs to be genuine and consistent everywhere, from your careers page to your social media posts. It must clearly answer the question: “Why should I build my career here?”

A compelling employer brand is more than just a slick careers page. It’s the sum of every experience a candidate has with your organisation, from the first job ad they see to the final interview feedback they receive.

To build a brand that clicks with both finance veterans and tech innovators, you have to showcase your commitment to innovation, professional growth, and a genuinely supportive work culture. Getting this dual appeal right is essential for attracting the blended workforce that modern BFSI firms need to thrive.

Fostering Internal Mobility and Upskilling

Often, the best way to close a skills gap is to look right inside your own walls. Building strong internal mobility and upskilling programmes isn’t just a retention play; it’s a core part of modern BFSI hiring. When you invest in your current employees, it sends a clear message that you’re committed to their long-term growth.

This approach pays off in several ways:

- Cost-Effectiveness: It’s far cheaper to reskill a current employee than to find, hire, and onboard a new one.

- Higher Retention: People are much more likely to stay when they see a clear path for career development.

- Preservation of Institutional Knowledge: Keeping your experienced employees means you don’t lose valuable, company-specific know-how.

Create clear pathways for employees to move into new, in-demand roles. Offer personalised training in critical areas like data analytics, cybersecurity, and AI. This is how you build a future-ready workforce from the inside out.

The Strategic Role of Recruitment Process Outsourcing

For many BFSI firms, trying to manage the entire hiring lifecycle—especially during rapid growth or a push into new markets—can feel overwhelming. This is where Recruitment Process Outsourcing (RPO) can be a game-changing partnership. An RPO provider becomes an extension of your own HR team, taking on all or part of your recruitment process.

Don’t think of an RPO partner as just another vendor; see them as a specialist co-pilot. They bring deep industry knowledge, better technology, and access to vast talent networks. This partnership lets you scale your hiring up or down on a dime, find niche talent more effectively, and ensure every step of your process is compliant with complex regulations. For leaders focused on building a high-performing talent function, exploring Recruitment Process Outsourcing can provide the exact expertise and agility needed to win.

Future-Proofing Your BFSI Workforce

The BFSI sector has always been a bit of a rollercoaster, riding the highs and lows of economic tides and regulatory waves. Too many organisations get caught in a reactive hiring loop—frantically hiring during the good times and slamming the brakes on when things cool down. This approach doesn’t just slow you down; it makes you vulnerable.

Future-proofing your workforce is about breaking that cycle. It means shifting from just filling seats to building a truly resilient and agile talent strategy. It’s about creating a talent engine that can navigate market turbulence, predict what skills you’ll need next, and even turn economic downturns into a competitive advantage. The real goal is to build a team that’s ready for tomorrow’s challenges, not just today’s to-do list.

Riding the Market Cycles and Regulatory Shifts

The BFSI world is in constant motion, influenced by everything from central bank policies to global economic headwinds. But a market slowdown isn’t a sign to halt all hiring. It’s a signal to hire smarter. Instead of panicking and freezing recruitment, savvy leaders use these moments to snag critical, hard-to-find talent while the competition is distracted.

This is also the perfect time to build out your warm talent pipeline. This means keeping in touch with high-potential candidates even when you don’t have an immediate role for them. Think of it like a well-stocked pantry. When the market picks up and you need to scale quickly, you’re not starting from an empty cupboard. You’ve got a network of pre-vetted, engaged professionals who are ready to talk.

Taking a proactive approach during slower periods turns a potential weakness into a massive strategic strength. By keeping the hiring momentum going for key roles, you ensure your organisation is in pole position to accelerate the second market conditions improve.

This forward-thinking mindset is more important than ever right now. Even with a temporary slowdown in FY25 due to tighter regulations and increased automation, the long-term outlook for BFSI hiring in India is strong. While general sentiment has cooled a bit, demand for roles in cybersecurity, analytics, sales, and collections keeps climbing, with hiring expected to pick back up in Q2 FY26. You can find more insights on the BFSI hiring outlook at The Economic Times.

The Next Wave of Essential BFSI Skills

As technology continues to rewire the financial industry, the skills needed to succeed are changing faster than ever. To future-proof your workforce, you have to look beyond today’s job descriptions and start thinking about the capabilities your team will need five or ten years from now. The rise of Artificial Intelligence is a perfect example.

AI isn’t just an automation tool anymore; it’s becoming a core team member. This means we need people who can work with intelligent systems, who can make sense of AI-driven insights, and who can use them to tackle complex business challenges.

Here are a few key skills that will define the future-ready BFSI professional:

- AI and Machine Learning Literacy: Not everyone needs to be a data scientist, but they do need to understand how AI models work, where they can be applied in finance, and what their limitations are.

- Advanced Data Analytics and Interpretation: The ability to look at mountains of data and pull out a clear, actionable business strategy is becoming priceless.

- Cybersecurity and Digital Trust: With every transaction and interaction moving online, expertise in protecting sensitive data is no longer optional.

- Human-Centric Skills: Critical thinking, creative problem-solving, and emotional intelligence—these are the uniquely human skills that machines can’t replicate.

Embracing New Ways of Working

Let’s be clear: the future of work in the BFSI sector is not a return to 2019. Hybrid work is here to stay, and that requires a whole new playbook for collaboration, management, and company culture. Any future-proofing strategy that ignores this reality is doomed to fail.

This means investing in the right tech to make collaboration seamless, whether your team is in the office or working from home. It also means training your managers to lead distributed teams effectively, shifting the focus from physical presence to actual outcomes. Ultimately, building a strong, cohesive culture that isn’t tied to a specific location will be the key differentiator for attracting and keeping top talent who now see flexibility as a given.

Your BFSI Hiring Action Plan

It’s time to move your BFSI hiring from a reactive, fire-fighting function to a strategic powerhouse. But let’s be honest, turning theory into action can feel like a massive task. The key is breaking it down into a clear, step-by-step plan that you can actually implement.

Think of this as your blueprint for building a talent acquisition engine that doesn’t just fill empty seats, but actively drives business growth. Each step builds on the last, creating a solid, future-ready strategy.

Step 1: Conduct a Thorough Skills Gap Analysis

Before you can build for the future, you have to get a brutally honest look at your present. A comprehensive skills gap analysis isn’t just a nice-to-have; it’s the essential first move in any modern BFSI hiring strategy. This isn’t just about listing what you lack. It’s about mapping the skills you currently have against the real capabilities your business will need in the next three to five years.

Take a hard look at your current teams. Where are the real gaps in critical areas like data analytics, cybersecurity, and AI literacy? This process does more than just show you where to hire externally. Crucially, it also highlights where you can upskill the talent you already have on board. A clear skills map gives you the data-driven foundation you need for every hiring and development decision that follows.

Step 2: Audit and Upgrade Your Recruitment Tech Stack

Your technology stack is the central nervous system of your entire hiring operation. If it’s outdated or clunky, it’s creating bottlenecks, frustrating great candidates, and putting you at a serious competitive disadvantage. It’s time for a ruthless audit of your current tools.

Go through every platform, from your Applicant Tracking System (ATS) to your assessment software. Are they integrated? Do they use AI to screen intelligently? Most importantly, do they offer a smooth, modern experience for your candidates?

Your recruitment technology should be an accelerator, not an anchor. Investing in a modern, AI-powered tech stack isn’t a luxury anymore—it’s non-negotiable for hitting the speed, efficiency, and compliance standards the market demands.

Step 3: Refine Your Employer Brand and Value Proposition

In a market where top candidates have all the power, your employer brand is your most valuable asset. It’s the story you tell about your culture, your values, and the real career opportunities you offer. This story has to be strong enough to pull in both seasoned finance pros and the innovative tech talent you now need to compete.

Start by defining a crystal-clear Employer Value Proposition (EVP) that answers one simple question: “Why should a top performer choose to build their career with us instead of our competitors?” Then, make sure this message is blasted consistently across every single touchpoint, including:

- Your careers page

- Every job description

- Your social media presence

- The entire interview process

By nailing these first steps, you’re not just ticking boxes. You’re laying a solid foundation for a more strategic and effective BFSI hiring function, setting up your organisation to win the talent you need to thrive.

Frequently Asked Questions

As you navigate the tricky landscape of BFSI hiring, a few common questions always seem to pop up. Let’s tackle them head-on, giving you some quick, practical insights to help shape your talent strategy and stay ahead of the curve.

Think of this as a quick reference guide, building on everything we’ve talked about to give you actionable takeaways for today’s market.

What Are the Most In-Demand Skills Right Now?

While the fundamentals of finance will always have their place, the real scramble is for people who can bridge the gap between finance and technology. Traditional skills just aren’t enough anymore.

Right now, the talent organisations are fighting for have a blend of technical and analytical know-how:

– Data Analytics and AI Literacy: It’s no longer a niche skill. The ability to read complex data and grasp AI-powered insights is essential for almost every role, from the risk team to the customer service desk.

– Cybersecurity: With every service moving online, the professionals who can shield sensitive financial data and fortify digital systems are worth their weight in gold. Demand here is through the roof.

– Digital Product Management: Customers now expect seamless digital experiences. That means you need people who are experts at creating and managing the digital banking apps and insurance platforms that define the modern customer journey.

How Can We Attract Tech Talent to a Traditional BFSI Firm?

Winning over tech professionals is a completely different game than traditional finance recruiting. They aren’t just looking for a stable job; they’re drawn to companies that are genuinely committed to innovation and have a culture that feels more like a tech hub than a bank vault.

To stand a chance against the tech giants and nimble fintech startups, you’ve got to change the narrative. Show off your most ambitious projects. Talk about the opportunities for growth in truly cutting-edge fields. You need to build an environment where creativity and agile thinking are celebrated, not stifled. Your employer brand has to scream “technology-driven financial powerhouse,” not just “old-school bank with an IT helpdesk.”

The real secret weapon? Offer work that matters. A tech pro wants to see their code and analysis make a real difference—to the business, to the bottom line, and most importantly, to the customer.

Is It Better to Hire Externally or Upskill Internally?

Honestly, it’s not an either/or question. The smartest, most resilient strategy is a healthy mix of both. You simply can’t afford to lean on just one.

– Upskilling your current team is fantastic for building loyalty and keeping valuable institutional knowledge in-house. It’s also a cost-effective way to fill roles where your employees already have a solid foundation to build upon.

– Hiring from the outside is crucial when you need fresh ideas or highly specialised skills that you just don’t have internally. This is especially true when it comes to brand-new or rapidly evolving technologies.

A truly effective BFSI hiring plan weaves

Ready to build a winning talent acquisition strategy? Taggd provides expert Recruitment Process Outsourcing solutions designed for the unique challenges of the BFSI sector.