How to Set Up Bi Weekly Payroll: A Simple Step-by-Step Guide

A surprising fact: more than 40% of U.S. businesses pay their employees biweekly. Education and health services lead this trend at 63%, while leisure and hospitality sectors follow at 54.9%.

Biweekly payroll can transform your payment processes and help your employees manage their finances better. This system creates 26 pay periods yearly, and employees get their wages every two weeks on a set day.

Companies of all sizes find biweekly payroll systems to be a great way to get multiple benefits. The process takes less time, reduces errors, and costs less in service provider fees compared to weekly payments. Your employees also get paid more often than monthly schedules, which helps them handle their regular expenses easily.

This piece shows you everything in setting up and managing biweekly payroll. You’ll learn how to maximize its benefits while staying within payroll regulations.

What Bi-Weekly Payroll Means for Your Business

Companies of all sizes pick bi-weekly payroll because it strikes a good balance between payment frequency and easy management. The right payment structure can make a big difference to your organization’s operations.

Definition of bi-weekly payroll

Bi-weekly payroll means your employees get paid every other week on the same day, like every other Friday. This creates 26 pay periods annually because there are 52 weeks in a year. Sometimes you might end up with 27 pay periods, depending on how the calendar falls that year.

Bi-weekly employee compensation program works well for everyone, motivating them work better and plan their cash flow better. Employees know exactly when they’ll get paid. Your staff can budget more easily because they always get paid on the same weekday every two weeks.

How bi-weekly is different from other pay schedules

Bi-weekly payroll stands out from other payment schedules in several ways:

- Bi-weekly vs. Semi-monthly: These might look similar but work quite differently. Semi-monthly payments happen twice per month (usually on the 15th and last day), giving employees 24 paychecks per year instead of 26. Bi-weekly periods always last 14 days, while semi-monthly periods can vary in length.

- Bi-weekly vs. Weekly: Weekly payments mean 52 paychecks each year and more processing work. Employees get money more often, but it takes more administrative resources.

- Bi-weekly vs. Monthly: Monthly payments result in 12 paychecks per year. This needs less administrative work, but employees often struggle to manage their monthly expenses.

Bi-weekly schedules create two months with three paychecks instead of two. This needs careful planning but employees often enjoy these “extra” payments.

Common industries using bi-weekly payroll

The Department of Labor shows some industries prefer bi-weekly payments more than others:

Education and health services lead the pack with about 63% of businesses using bi-weekly payroll. Schools, hospitals, and healthcare providers commonly use this system.

The leisure and hospitality sector comes next at 54.9%. Retail and hospitality businesses like this model because it handles changing hours and overtime calculations better.

Information services regularly uses bi-weekly payments. Professional and business services (42%) and financial activities (37.4%) also frequently use this payment structure.

Companies with both hourly and salaried employees find bi-weekly payroll especially useful because it makes overtime calculations simpler.

Essential Preparations Before Setup

A solid foundation helps create a successful bi-weekly payroll system. You’ll need to handle several vital elements to make sure everything runs smoothly and stays compliant.

Reviewing state payroll laws and regulations

Federal law doesn’t specify pay frequency requirements. Most states have specific rules about how often employees must receive their pay. Your state’s payday requirements need careful review because they differ by a lot across the country. Massachusetts requires hourly employees to receive their pay either weekly or bi-weekly. Nebraska simply asks employers to set a regular payday without dictating how often.

More than that, some states change their requirements based on industry or employee classification. Executive, Administrative, and Professional personnel in Illinois, Nevada, New Mexico, and Virginia can receive monthly pay. Other employees might need more frequent payments. Your bi-weekly schedule must meet or go beyond your state’s minimum frequency requirements.

Gathering necessary employee information

Your bi-weekly payroll needs organized employee data that includes:

- Basic information (name, address, Social Security number)

- Tax forms and withholding certificates

- Bank account details for direct deposit

- Job classification and exempt status

- Pay rates (hourly or salary)

- Benefits enrollment information

The accuracy of this information matters just as much. Data should match expected formats. Identification documents need verification against provided details. A secure system must store this sensitive information safely. A disaster recovery plan should protect payroll data if systems fail or breaches occur.

Setting your payroll calendar

A well-laid-out bi-weekly payroll calendar keeps operations running smoothly. Your calendar needs to show:

- Pay period start and end dates

- Processing deadlines for time submissions

- Approval cutoffs for supervisors

- Actual payday dates

- Holiday adjustments

The cash flow cycle deserves attention when you create your payroll schedule. Watch out for challenging times like seasonal slowdowns. This planning ensures you’ll always have enough funds to pay employees. A carefully planned calendar gives structure that helps both your accounting team and employees. The result is a more predictable and efficient bi-weekly payroll system.

Step-by-Step Bi-Weekly Payroll Setup Process

A bi-weekly payroll system needs careful planning and precise execution. Your essential preparations must be ready before you take these practical steps to create a reliable bi-weekly payroll process.

Choosing the right payroll software

The right software forms the foundation of a quick bi-weekly payroll system. You need solutions that work with bi-weekly schedules and include features like automated calculations, tax processing, and blend with your existing systems. Look at prices from different providers. A slightly higher cost for complete features usually brings better results.

Good software should handle all calculations automatically. This reduces manual errors and saves valuable time. Today’s systems combine time tracking, scheduling, and payroll processing. This streamlines your workflow and makes sure employees receive accurate pay for their hours.

Creating a bi-weekly payroll schedule

The next step after installing your software is to make a detailed payroll calendar with specific dates for each pay period. You need to mark when pay periods start and end, which usually covers 80 working hours. Pick consistent processing deadlines and payday dates – most companies choose every other Friday.

Success depends on having a timeline with key milestones and deadlines. A pilot test with a small group of employees helps find problems before full rollout.

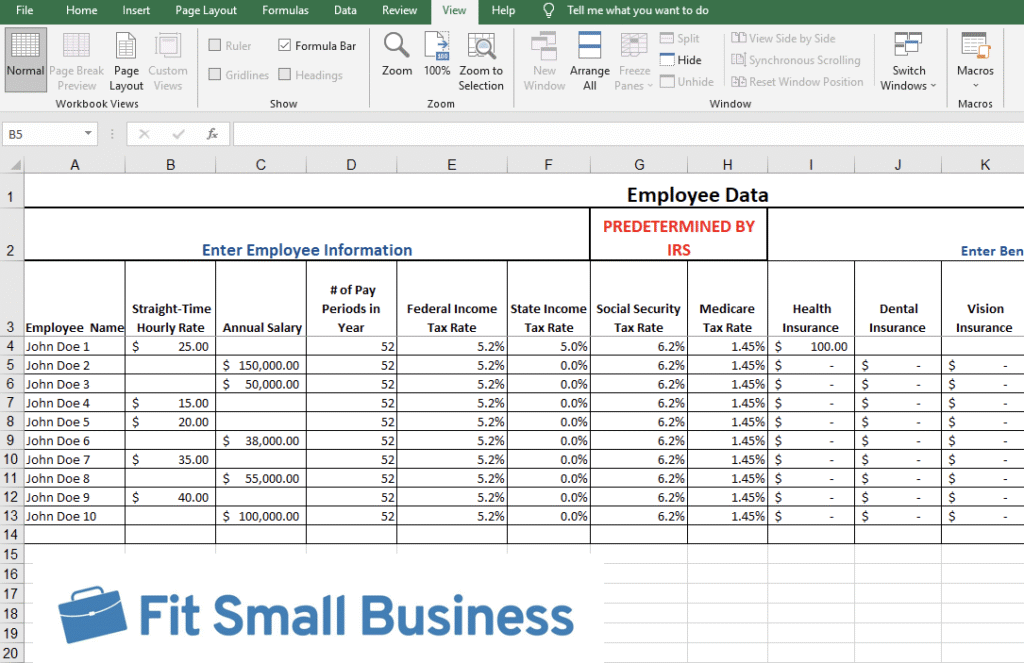

Setting up tax withholdings

Your system should calculate and withhold federal, state, and local taxes accurately. Make sure you have all essential tax forms from employees, including W-4s and state tax withholding forms.

Quality payroll software applies current tax rates to each paycheck automatically. This helps you stay compliant with changing regulations.

Configuring employee benefits deductions

The final step is to add appropriate deductions for health insurance, retirement contributions, and other withholdings. Bi-weekly payroll requires you to handle months with three paychecks differently. You can either skip deductions or spread them across all 26 pay periods.

Complex benefit structures need a system that lets you customize different earnings, allowances, and deductions for various employee types.

Calculating Bi-Weekly Pay Correctly

Precise payroll calculations are the foundations of a reliable bi-weekly payment system. Companies need to compute different types of employee compensation correctly. This will ensure they follow labor laws and keep their workforce happy.

Bi-weekly calculation examples for salaried employees

The bi-weekly pay calculation for salaried employees requires dividing the annual salary by 26 pay periods. This simple method creates steady paychecks throughout the year. To name just one example, let’s look at an annual salary of INR 4,387,783.44:

- Annual salary ÷ 26 = INR 168,760.90 bi-weekly

Some organizations use different divisors to get more exact results based on the year’s actual days. A divisor of 26.071428 gives more accurate results in non-leap years, while 26.142857 works better for leap years.

Handling hourly employees and overtime

Hourly workers’ pay depends on their total hours worked in each two-week period. The simple formula multiplies their hourly rate by total hours. Here’s an example:

- INR 1,687.61 hourly rate × 80 hours = INR 135,008.72 bi-weekly gross pay

Federal law states that each workweek must stand alone for overtime calculations. This means overtime must be calculated weekly, not bi-weekly, even with bi-weekly payroll. Let’s say an employee works 45 hours in week one and 35 hours in week two:

- Week one: 40 regular hours plus 5 overtime hours (at 1.5× rate)

- Week two: 35 regular hours (no overtime)

The employee gets overtime pay even if their total hours (80) don’t go over the bi-weekly standard.

Managing special payments and bonuses

Bi-weekly payroll systems need to handle various bonuses and special payments effectively. Bonuses fall into two categories: discretionary (not guaranteed) and nondiscretionary (guaranteed in employment contracts). These include profit-sharing, spot bonuses, sign-on bonuses, and holiday bonuses.

Tax withholding accuracy matters when distributing bonuses through bi-weekly payroll. Federal law requires non-discretionary bonuses to be part of overtime calculations for non-exempt employees. The first step is to determine if the bonus applies to specific pay periods or covers multiple periods. Then you can adjust calculations as needed.

Most payroll systems let you set up period activity pay for recurring special payments like stipends. This feature helps distribute payments evenly between specified start and end dates.

Conclusion

Businesses need careful planning and attention to detail to set up bi-weekly payroll, but the long-term benefits make this work worthwhile. Your organization can build the quickest way to pay employees by understanding state regulations and preparing properly. This system will serve both your company’s needs and your staff’s priorities.

Accurate calculations are the life-blood of successful bi-weekly payroll management. Your team must handle salaried staff, hourly workers, and special payments with precise computation to stay compliant and keep employees happy. The right payroll software will give a smoother process that cuts down errors and saves time.

Bi-weekly payroll gives many more advantages – you get simpler overtime calculations and predictable payment schedules. This payment structure adapts well as your business expands and helps employees manage their income better.

Take time to compare your current payroll system with these guidelines to spot areas you can improve. A well-managed bi-weekly payroll system keeps you compliant and builds stronger relationships with your team. This approach leads to smoother business operations overall.

FAQs

Q1. How do I calculate bi-weekly pay for salaried employees?

To calculate bi-weekly pay for salaried employees, divide the annual salary by 26 (the number of pay periods in a year). For example, if an employee’s annual salary is $52,000, their bi-weekly pay would be $2,000 ($52,000 ÷ 26).

Q2. What are the key steps in setting up a bi-weekly payroll system?

The key steps include reviewing state payroll laws, gathering employee information, setting up a payroll calendar, choosing appropriate payroll software, configuring tax withholdings, and setting up employee benefits deductions. It’s also important to create a detailed bi-weekly schedule and ensure accurate calculation methods for different types of employees.

Q3. How is overtime calculated in a bi-weekly pay system?

Even in a bi-weekly pay system, overtime is calculated on a weekly basis. If an employee works more than 40 hours in a single week, they must receive overtime pay for those extra hours, regardless of their total hours worked in the two-week pay period.

Q4. What industries commonly use bi-weekly payroll?

Bi-weekly payroll is common in various industries, with education and health services leading at about 63% adoption. Other sectors that frequently use bi-weekly pay include leisure and hospitality (54.9%), information services, professional and business services (42%), and financial activities (37.4%).

Q5. How do I handle bonuses and special payments in a bi-weekly payroll system?

When distributing bonuses through bi-weekly payroll, ensure accurate tax withholding and determine whether the bonus applies to specific pay periods or spans multiple periods. For non-exempt employees, non-discretionary bonuses must be factored into overtime calculations. Recurring special payments like stipends can usually be configured in payroll systems to distribute evenly between specified dates.