Automotive manufacturing in India is entering a decisive phase. The shift toward electric vehicles, rising levels of automation, localisation mandates, and aggressive capacity expansion are fundamentally changing how plants operate and scale.

Capital investment is not the constraint. Most organisations have already committed to new facilities, advanced machinery, and digital manufacturing systems. What is proving harder to scale is shopfloor capability.

Across plants, production stability, first-time-right quality, and safety performance are now directly shaped by the quality of blue-collar talent, not just workforce size. Roles that were once execution-heavy are becoming decision-intensive. Operators are expected to work alongside automated systems, maintenance teams are required to handle increasingly complex breakdowns, and quality teams are accountable for tighter compliance and traceability standards.

This shift is exposing a deeper issue in automotive workforce planning. Hiring models are still largely headcount-led, while the business now requires capability-led workforce design. As a result, organisations are seeing persistent gaps in quality of hire, higher early-tenure attrition, and growing dependence on external hiring to plug immediate production risks.

The India Decoding Jobs Report 2026 reinforces this trend. While hiring intent across automotive manufacturing continues to rise, skill readiness, retention, and internal mobility remain structural challenges, particularly in blue-collar roles critical to production continuity. In many cases, increased hiring activity is not translating into improved workforce stability or stronger bench strength.

For CHROs and hiring leaders, this marks an important inflection point. Blue-collar hiring can no longer be treated as a volume exercise focused on fulfilment speed alone. It now sits at the intersection of workforce planning, talent pipeline development, attrition risk management, and operational resilience.

To understand why blue-collar hiring feels harder than ever despite sustained recruitment activity, it’s important to look first at how the automotive shopfloor itself is changing.

How the Automotive Shopfloor in India Is Evolving (2026–2030)?

Over the next five years, the automotive shopfloor in India will undergo more change than it did in the previous two decades. What was once a largely manual, experience-driven environment is rapidly becoming a technology-enabled production system, where consistency, data, and precision matter as much as physical execution.

This shift is redefining both how work gets done and what capability looks like on the ground.

From Manual Execution to Technology-Enabled Manufacturing

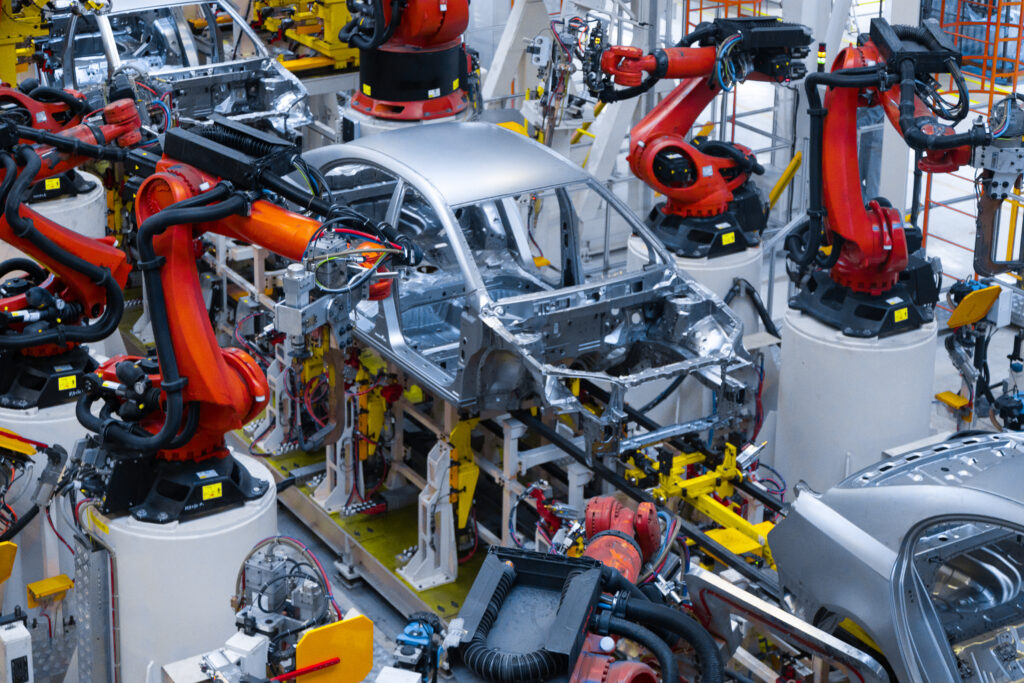

Automation is no longer confined to a few high-end plants. Robotics, programmable logic controllers (PLCs), Industrial Internet of Things (IIoT) sensors, and predictive maintenance systems are becoming standard across OEMs and Tier-1 suppliers.

As a result, shopfloor roles are changing in nature. Operators are no longer responsible only for executing tasks. They are increasingly expected to monitor systems, interpret dashboards, respond to alerts, and escalate exceptions.

Maintenance teams are moving from reactive breakdown handling to condition-based and predictive interventions. Quality checks are shifting from post-production inspection to real-time, in-line controls.

This evolution increases decision density on the shopfloor. It also raises the bar for baseline capability. Digital literacy, process adherence, and comfort with data-driven workflows are becoming essential components of job readiness, even in traditionally manual roles.

From a talent perspective, this means that experience alone is no longer a reliable proxy for competence. Workforce capability must now be assessed in terms of system interaction, process understanding, and error prevention, not just time spent on the line.

EV Manufacturing Is Redefining Shopfloor Work

The transition to electric vehicles is accelerating this shift even further. EV manufacturing introduces entirely new production processes, from battery assembly and electronics integration to thermal management and high-voltage safety protocols.

These processes demand higher precision, stricter compliance, and stronger safety discipline than many internal combustion engine (ICE) workflows. Materials behave differently, failure modes are less forgiving, and quality lapses carry higher downstream risk.

Crucially, there is limited skill overlap between ICE and EV roles. Mechanical familiarity does not automatically translate into EV readiness. Workers must adapt to electronics-heavy environments, new assembly sequences, and tighter tolerance thresholds.

This has significant implications for workforce planning. Hiring teams cannot assume lateral skill transfer at scale. Without structured reskilling and role-based assessment, organisations risk deploying workers into environments where they are technically present but operationally unprepared.

What the India Decoding Jobs Report Reveals About Skill Disruption

The India Decoding Jobs Report 2026 highlights this disruption clearly. While automotive hiring intent remains strong, the capability gap between traditional manufacturing roles and emerging smart factory requirements is widening.

The report points to only partial skill overlap between legacy roles and future-facing automotive jobs, particularly in EV manufacturing and automation-heavy environments. This gap cannot be bridged through incremental hiring alone. It requires large-scale reskilling, structured learning pathways, and stronger alignment between workforce strategy and production roadmaps.

For CHROs and hiring leaders, this insight is critical. It explains why increased recruitment activity is not always translating into improved productivity or reduced attrition. Without a clear view of future skill requirements, hiring risks becoming reactive, addressing immediate shortages without building long-term workforce resilience.

These changes have fundamentally altered what “skilled” means on the automotive shopfloor. As roles evolve and expectations rise, the real challenge for organisations is no longer hiring more workers, but building a workforce that can adapt, stay, and perform in increasingly complex production environments.

The Blue-Collar Talent Gap Automotive Leaders Are Underestimating

Despite sustained hiring activity across automotive manufacturing, many organisations are finding that workforce stability is not improving in proportion to recruitment volumes. Plants are staffed, yet production remains fragile. Quality issues persist. Attrition continues to climb.

This disconnect points to a deeper issue. The blue-collar talent gap facing automotive companies today is not primarily about availability. It is about capability continuity.

An Ageing Workforce and Breaking Skill Transfer

A significant portion of India’s automotive shopfloor expertise resides with senior technicians and operators who have spent decades mastering specific processes, machines, and failure patterns. Much of this expertise is tacit. It lives in judgment calls, workarounds, and an intuitive understanding of how systems behave under pressure.

As these workers exit the workforce, that knowledge is leaving faster than it can be codified or transferred. In many plants, structured succession planning for blue-collar roles is weak or nonexistent. Informal on-the-job learning, which once worked in stable environments, is proving insufficient in highly automated and EV-driven production settings.

The result is a growing capability vacuum. New hires may be present on the line, but they lack the depth of understanding required to manage variability, prevent defects, or respond effectively to exceptions. Over time, this increases dependency on a shrinking group of experienced workers, amplifying operational risk.

Why Younger Hires Struggle in Modern Plants

At the other end of the spectrum, younger workers are entering automotive plants with different expectations and preparedness levels. While many bring enthusiasm and baseline technical education, they often lack exposure to the realities of modern manufacturing environments.

Gaps are most visible in three areas: safety discipline, shift adaptability, and automation exposure. High-automation shopfloors demand strict adherence to protocols, comfort with repetitive processes, and sustained attention across long shifts. These expectations are rarely made explicit during hiring and onboarding.

There is also a growing mismatch between perceived and actual roles. Candidates hired for “operator” positions may expect predominantly manual work, only to find themselves required to monitor systems, interpret alerts, and interact with machines that offer little margin for error. When expectations are misaligned, engagement drops quickly.

Without structured onboarding, realistic job previews, and early-stage capability assessment, this mismatch translates into disengagement and early exits rather than skill development.

Attrition Is a Symptom, Not the Root Cause

High attrition in automotive manufacturing is often attributed to compensation pressure or labour market competition. While these factors play a role, they do not fully explain the pattern of early-tenure exits seen across many plants.

In most cases, attrition is the outcome of poor role fit, inadequate onboarding, and limited progression visibility. Workers leave not because work is unavailable, but because the work environment does not match their capabilities or expectations.

The India Decoding Jobs Report 2026 reinforces this insight. Manufacturing roles continue to see elevated attrition rates, particularly within the first few months of employment. The data suggests that volume-led hiring without structured assessment and capability alignment increases churn rather than solving workforce gaps.

For automotive leaders, this reframing is important. Attrition is not the core problem to be fixed in isolation. It is a signal that hiring, assessment, and workforce planning models are misaligned with how shopfloor roles are evolving.

As the nature of work changes and the talent gap widens, the question facing CHROs and hiring leaders becomes more specific: which roles matter most for production stability, and what capabilities do those roles now require?

The next section looks closely at the blue-collar roles that increasingly determine whether automotive plants operate smoothly or spend their time firefighting.

Critical Blue-Collar Roles Driving Production Stability Today

As automotive manufacturing becomes more complex, not all shopfloor roles carry the same level of operational risk. Some positions now act as stability anchors. When these roles are under-skilled or understaffed, the impact shows up immediately in downtime, rework, safety incidents, and missed production targets.

For hiring leaders, the challenge is no longer identifying roles in bulk. It is understanding which blue-collar roles disproportionately influence production outcomes, and how their capability requirements have evolved. Some of the high-impact shopfloor roles in automotive manufacturing –

Assembly Line Operators (ICE, EV, Body, Final Assembly)

Assembly roles remain the backbone of automotive production, but their nature has shifted significantly. Operators today are expected to manage tighter tolerances, follow complex sequencing, and work alongside automated systems. In EV lines, this includes handling sensitive components, adhering to stricter safety protocols, and ensuring zero-defect assembly in high-risk zones.

CNC Machinists and Tool Room Technicians

These roles directly affect dimensional accuracy, tool life, and throughput. Modern CNC environments demand more than manual machining skills. Operators must interpret machine data, manage tool offsets, and respond to deviations before defects propagate downstream. Tool room technicians, in particular, play a critical role in preventing cascading production issues.

Maintenance Technicians (Electrical, Mechanical, Automation)

Maintenance has moved from reactive firefighting to uptime assurance. Technicians are now responsible for diagnosing faults across mechanical systems, electrical components, PLCs, and automated lines. Their ability to respond quickly and correctly often determines whether a minor issue becomes a full-scale shutdown.

Quality Inspectors and Process Auditors

Quality roles have shifted upstream. Instead of only inspecting finished output, inspectors and auditors are increasingly embedded within the production process. They are responsible for monitoring compliance, identifying early warning signals, and ensuring traceability across stages. Weak capability here results in rework, recalls, and long-term brand risk.

Material Handling and Line-Feeding Operators

Often underestimated, these roles are critical to just-in-time production models. Errors in sequencing, handling, or line feeding can halt entire sections of the plant. As production cadence increases, these operators must manage accuracy, timing, and safety under pressure.

How These Roles Have Evolved Over the Last Five Years

Across all these roles, three consistent shifts stand out.

First, there is greater decision-making responsibility on the shopfloor. Operators and technicians are expected to recognise deviations, make judgment calls, and escalate issues proactively rather than wait for supervision.

Second, there is increased interaction with automated systems. Whether it is reading dashboards, responding to alerts, or working alongside robots, human-machine collaboration is now central to daily work.

Third, there are higher compliance and quality expectations. Regulatory standards, customer audits, and internal quality benchmarks have tightened. Small errors now carry larger consequences.

These changes mean that job titles have remained familiar, but the capability demanded by those titles has changed materially.

As roles evolve in complexity and accountability, hiring success increasingly depends on capability, readiness, and adaptability, not experience alone. The next question for automotive leaders is what skills truly define a future-ready blue-collar workforce,and how those skills can be identified and built at scale.

Skills That Define a Future-Ready Automotive Blue-Collar Workforce

As automotive manufacturing environments become more automated and tightly controlled, the definition of a “skilled” blue-collar worker is changing. Experience on its own is no longer a reliable indicator of readiness. What matters now is the ability to operate within complex systems, follow discipline under pressure, and adapt as processes evolve.

For CHROs and hiring leaders, this requires a fundamental mindset shift: from experience-led hiring to capability-led workforce planning.

Core Technical and Behavioural Skills Now Required

Digital literacy and comfort with automated systems

Even in roles that remain physically intensive, workers are increasingly required to interact with machines, interfaces, and dashboards. Comfort with basic digital tools, alerts, and system feedback is now a baseline requirement, not a specialised skill.

SOP adherence, quality checkpoints, and traceability discipline

Modern automotive plants operate with minimal tolerance for deviation. Workers must be able to follow standard operating procedures precisely, understand where quality checks sit in the process, and maintain traceability across production stages. This discipline directly impacts rework, recalls, and audit outcomes.

Multi-skilling across machines, lines, or shifts

Production volatility and frequent changeovers have increased the value of workforce flexibility. Multi-skilled operators who can move across machines, processes, or shifts help stabilise output during ramp-ups, absenteeism, and demand fluctuations. From a workforce planning perspective, multi-skilling also improves bench strength and reduces single-point dependency.

Safety-first mindset in high-automation environments

As automation increases, safety risks become less visible but more severe. High-voltage systems, robotic cells, and automated lines require workers who consistently follow safety protocols and understand the consequences of non-compliance. Safety awareness is no longer enforced only through supervision; it must be embedded at the individual level.

Reliability, attendance consistency, and shift readiness

In tightly sequenced production environments, reliability is a skill. Irregular attendance or poor shift adaptability can disrupt entire lines. Hiring models that assess only technical ability but ignore behavioural reliability often struggle with hidden productivity losses.

What the India Decoding Jobs Report Signals About Skill-First Hiring

The India Decoding Jobs Report 2026 reinforces the importance of this capability shift. Organisations that are investing in multi-skilled operator models, structured apprenticeships, and continuous learning pathways are seeing better workforce stability than those relying on single-skill, role-specific hiring.

The report also highlights that reskilling is emerging as a long-term necessity, not a temporary intervention. As EV manufacturing, automation, and smart factory practices expand, skill requirements will continue to evolve. Hiring strategies that focus only on immediate fit risk falling behind within a few production cycles.

For automotive leaders, the implication is clear. Building a future-ready blue-collar workforce requires hiring frameworks that identify learning ability, adaptability, and discipline alongside technical competence. Without this shift, even high hiring volumes will struggle to deliver sustained production stability.

As capability requirements rise, automotive hiring is no longer shaped only by what happens inside the factory. External forces- from competing industries to shifting workforce aspirations are also influencing who enters and stays in manufacturing roles. The next section examines why automotive hiring is increasingly competing beyond the factory gate.

Why Automotive Hiring Is Competing Beyond the Factory Gate?

Automotive companies are not hiring in isolation. The talent market they operate in is increasingly shaped by forces well beyond manufacturing, many of which were not part of workforce planning conversations even five years ago.

One of the most significant of these forces is the rapid expansion of Global Capability Centers (GCCs) across India.

The GCC Effect on Automotive Talent Markets

GCCs have become major employers of engineering, analytics, and digital talent, particularly in automotive-adjacent domains such as product engineering, embedded systems, data analytics, and automation.

As global OEMs and suppliers expand their India-based capability centers, they are drawing attention, investment, and leadership focus toward higher-end, globally integrated roles.

For automotive organisations, this shift has two important consequences.

First, leadership bandwidth is increasingly absorbed by global transformation agendas. Senior leaders are often tasked with building digital, engineering, or analytics capabilities that support global operations. While these initiatives are strategically important, they can unintentionally divert attention away from plant-level workforce stability.

Second, GCC-driven growth reshapes internal talent narratives. Career progression, visibility, and investment are perceived to sit higher up the value chain, which can influence how manufacturing roles are positioned and prioritised within the organisation.

Indirect Impact on Plant-Level Hiring and Retention

The downstream effects of this shift are felt most acutely on the shopfloor. As competition for skilled talent intensifies, wage inflation and aspiration shifts begin to ripple across the automotive ecosystem, including blue-collar roles. Even when shopfloor workers are not directly moving into GCC roles, expectations around pay progression, work conditions, and career mobility change.

At the same time, reduced leadership bandwidth at the plant level can weaken workforce governance. Hiring decisions become more reactive. Workforce planning horizons shorten. Investments in structured onboarding, reskilling, and engagement are deferred in favour of immediate production needs.

Over time, this creates a fragile equilibrium. Plants remain operational, but workforce stability depends on continuous hiring rather than capability building. Blue-collar recruitment becomes a firefighting exercise, absorbing time and resources without delivering lasting improvement.

For CHROs and hiring leaders, recognising this external pressure is critical. The challenge is not to compete with GCCs directly, but to re-anchor manufacturing roles within a clear workforce strategy that values shopfloor capability as a core business asset.

As external pressures intensify and internal focus fragments, the limitations of traditional blue-collar hiring models become more visible. The next section examines why conventional approaches are no longer sufficient to support the scale and complexity of modern automotive manufacturing.

Why Traditional Blue-Collar Hiring Models Are Falling Short

For many automotive organisations, blue-collar hiring models have not fundamentally changed in years. They have been optimised for speed, continuity, and short-term fulfilment. In a relatively stable manufacturing environment, these models worked well enough.

That context no longer exists.

As production systems become more complex and skill requirements evolve faster, the limitations of traditional hiring approaches are becoming harder to ignore.

Speed-Led, Contractor-Heavy Hiring Has Limits

Contractor-led hiring has long been the default model for meeting shopfloor demand quickly. It delivers on volume and responsiveness, especially during ramp-ups or seasonal peaks. However, speed often comes at the cost of role fit and capability alignment.

Candidates are assessed primarily on availability and basic experience, with limited evaluation of system readiness, safety discipline, or adaptability to automated environments. As a result, many hires are technically present but operationally unprepared.

The outcome is visible in high early-tenure attrition. Workers exit within weeks or months, not because work is unavailable, but because the role demands exceed what they were prepared for. Plants compensate by hiring again, reinforcing a cycle of churn without improving stability.

Fragmented Hiring Across Plants and Partners

Another structural weakness lies in fragmentation. Hiring is often managed independently across plants, contractors, and geographies, each with its own standards and processes.

This fragmentation leads to:

- inconsistent assessment criteria

- uneven onboarding and safety induction

- variable compliance adherence

- limited sharing of workforce insights

From a leadership perspective, this makes it difficult to answer basic questions around workforce readiness, bench strength, or future demand. Hiring becomes reactive, driven by immediate shortages rather than informed by production roadmaps or attrition trends.

Without consolidated workforce visibility, even well-intentioned interventions struggle to scale.

What Industry Data Reveals About External Dependency

Industry data points to another compounding issue: low internal mobility within blue-collar roles. Limited pathways for progression or cross-skilling mean that organisations rely heavily on external hiring to meet changing needs.

This dependence increases exposure to market volatility. When demand spikes, talent availability becomes uncertain. When demand softens, excess capacity is difficult to redeploy. Over time, the organisation loses the ability to shape its own workforce capability.

For CHROs and hiring leaders, the takeaway is clear. Traditional models prioritise continuity of headcount, but modern automotive manufacturing requires continuity of capability. Bridging that gap calls for a shift in how blue-collar hiring is designed, governed, and scaled.

Recognising these limitations is the first step. The next question is how automotive leaders are responding,what changes are being made to rebuild blue-collar hiring as a long-term capability rather than a recurring operational challenge.

How CHROs Are Rethinking Automotive Blue-Collar Hiring

As the limitations of traditional hiring models become clearer, automotive CHROs and hiring leaders are beginning to rethink how blue-collar workforce strategies are designed. The focus is gradually shifting away from short-term fulfilment toward building workforce capability that can support scale, complexity, and change.

This shift is not about doing more hiring. It is about hiring differently.

Moving From Role-Based to Skill-First Workforce Planning

One of the most important changes underway is the move from role-based hiring to skill-first workforce planning. Instead of recruiting against static job descriptions, leading organisations are aligning hiring plans to production ramps, model launches, and technology transitions.

This approach starts with a clearer articulation of the capabilities required at each stage of the production roadmap. For example, an EV launch may demand higher electronics handling capability, stronger safety discipline, or greater familiarity with automated processes than an existing ICE line.

By planning workforce demand around capability clusters rather than titles, CHROs are better able to anticipate skill gaps, sequence hiring, and prioritise reskilling. This reduces last-minute hiring pressure and improves overall quality of hire.

Standardising Assessment, Onboarding, and Early Tenure

Another critical area of change is the standardisation of how blue-collar workers are assessed, onboarded, and supported during their early tenure.

In many plants, assessment criteria vary by contractor or location, onboarding is compressed due to production urgency, and early tenure receives limited structured attention. This creates avoidable risk during the first 60–90 days, when safety incidents and attrition are most likely.

Forward-looking organisations are introducing role-specific assessments, consistent safety induction, and structured early-tenure monitoring. The objective is not only to improve compliance, but to ensure that workers are genuinely ready for the environments they are entering.

The impact of these changes is tangible. Better assessment and onboarding reduce early exits, improve safety outcomes, and accelerate time to productivity,benefits that compound as hiring scales.

Linking Leadership Hiring to Shopfloor Stability

Perhaps the most overlooked lever in blue-collar workforce stability is leadership. Plant heads, operations leaders, and production managers play a critical role in setting expectations, enforcing discipline, and sustaining engagement on the shopfloor.

CHROs are increasingly recognising that leadership hiring and development must be aligned with shopfloor complexity. Leaders who lack exposure to automated environments, EV processes, or high-mix production struggle to translate strategy into execution.

By strengthening leadership capability alongside blue-collar hiring, organisations create stronger workforce anchors. Clear accountability, consistent communication, and better escalation pathways help stabilise teams and reduce dependency on constant hiring to solve operational issues.

As hiring strategies mature and workforce planning becomes more structured, the next challenge is execution at scale. For many automotive organisations, this is where internal capacity reaches its limits and where RPO begins to play a strategic role in building sustainable blue-collar talent pipelines.

The Role of RPO in Building Scalable Automotive Talent Pipelines

As automotive hiring becomes more complex and less predictable, many organisations are reaching the limits of what internal teams and contractor-led models can sustainably manage. The challenge is no longer just filling roles. It is building and maintaining a talent pipeline that can flex with production demands without compromising capability or compliance.

This is where Recruitment Process Outsourcing (RPO) is increasingly being viewed not as outsourcing, but as hiring infrastructure.

Why RPO Works for High-Volume, High-Variability Hiring

Automotive manufacturing operates in cycles. Plant expansions, new model introductions, EV launches, and seasonal production ramps all create sharp fluctuations in workforce demand. Traditional hiring models struggle to scale up and down without creating instability, either by overburdening internal teams or by relying heavily on short-term contractors.

RPO provides a different operating model. By embedding dedicated hiring capacity aligned to production timelines, RPO enables organisations to scale recruitment volume without diluting assessment quality or process discipline. Hiring becomes proactive rather than reactive, planned against known ramps instead of triggered by shortages.

For CHROs, this translates into better control over workforce timing, reduced last-minute hiring pressure, and improved coordination between HR, operations, and plant leadership.

Creating Consistent, Future-Ready Hiring Systems

Beyond scale, the real value of RPO lies in consistency. Automotive organisations often struggle with fragmented hiring standards across plants, vendors, and regions. RPO helps address this by introducing standardised screening, role-based skill validation, and compliance-led onboarding across locations.

This consistency improves quality of hire and reduces early-tenure attrition, particularly in high-risk roles. It also creates a foundation for workforce analytics. With centralised hiring data, organisations gain visibility into demand patterns, attrition trends, and skill gaps.

Over time, this enables workforce planning and attrition forecasting rather than continuous firefighting. Hiring decisions can be informed by production roadmaps, skill evolution, and historical outcomes, not just immediate vacancies.

In this sense, RPO shifts blue-collar hiring from a transactional activity to a managed talent pipeline, designed to support both current operations and future growth.

With the right hiring infrastructure in place, the focus shifts from managing recruitment complexity to strengthening execution. The next section looks at how Taggd supports automotive organisations in translating RPO-led hiring into workforce reliability at scale.

How Taggd Helps Automotive Companies Build Workforce Reliability?

As automotive organisations rethink blue-collar hiring as a long-term capability, execution becomes the differentiator. Strategy without scale quickly breaks down on the shopfloor. This is where Taggd operates- not as a staffing provider, but as a strategic talent partner embedded into workforce planning and delivery.

Workforce Planning Informed by India Decoding Jobs Insights

Automotive workforce challenges are not uniform across roles, locations, or time horizons. Skill demand varies sharply by region, plant maturity, product mix, and technology adoption.

Taggd’s approach is anchored in India-specific talent intelligence, including insights from the India Decoding Jobs Report. This allows workforce planning to move beyond reactive requisition fulfilment toward anticipating skill demand, location-wise availability, and attrition risk.

By aligning hiring plans with production ramps, EV transitions, and expansion timelines, organisations gain clearer visibility into future workforce needs and avoid last-minute hiring pressure that compromises quality.

Structured Blue-Collar Assessments and Bulk Hiring Execution

Scale without structure is one of the most common failure points in automotive hiring. Taggd addresses this by combining structured, role-specific candidate assessments with large-scale execution capability.

Across OEMs, Tier-1s, and Tier-2 suppliers, Taggd supports bulk hiring programmes that prioritise:

- capability and readiness, not just availability

- consistent screening and compliance standards

- faster time to productivity through better role fit

This ensures that as hiring volumes increase, workforce stability improves rather than erodes.

Leadership Hiring Aligned to Operational Complexity

Workforce reliability is shaped as much by leadership as by hiring volume. Taggd’s leadership hiring capability focuses on identifying plant heads and operations leaders who can operate effectively in high-automation, EV-led, and high-mix production environments.

By aligning leadership capability with shopfloor complexity, organisations strengthen accountability, improve engagement, and reduce dependence on constant hiring to solve execution issues.

Looking Ahead to 2030: What Workforce Control Looks Like

As the automotive industry moves toward 2030, the distinction between leaders and laggards will be increasingly visible on the shopfloor.

Organisations that invest early in workforce capability will experience:

- predictable production ramp-ups without last-minute hiring surges

- lower attrition and safer shopfloors due to better role fit and onboarding

- higher quality, compliance, and uptime, even as complexity increases

Most importantly, leadership teams will spend less time firefighting hiring issues and more time focusing on growth, innovation, and long-term competitiveness.

In automotive manufacturing, the future will not be defined only by products or plants. It will be defined by the reliability of the workforce that runs them.

Wrapping Up

As the automotive industry moves deeper into the EV and automation era, one reality is becoming harder to ignore: technology investments alone will not determine competitive advantage. Workforce readiness will.

Between now and 2030, automotive companies in India will face increasing pressure to launch faster, operate leaner, and meet higher quality and safety standards. In this environment, blue-collar roles are no longer support functions. They are central to production stability, compliance, and customer outcomes.

The organisations that succeed will be those that move early. Those that shift from reactive, volume-led hiring to skill-first workforce planning. Those that treat blue-collar talent as a system to be built and sustained, not a problem to be solved plant by plant.

The challenge is significant, but it is predictable. And that means it can be planned for.

FAQs

What are the biggest blue-collar workforce challenges in the automotive industry today?

Automotive companies are grappling with skill mismatches driven by automation and EV manufacturing, high early-tenure attrition, ageing shopfloor workforces, and fragmented hiring models. While hiring volumes are increasing, workforce readiness and retention remain persistent challenges.

Why is blue-collar attrition so high in automotive manufacturing?

Attrition is often a symptom of poor role-fit, inadequate onboarding, and limited skill progression rather than compensation alone. As shopfloor roles become more complex, workers hired without proper skill validation or clear expectations are more likely to exit early.

How are EVs and automation changing blue-collar skill requirements?

EV manufacturing introduces new processes, materials, and safety protocols, while automation requires operators to interact with digital systems and machinery. This shifts hiring focus from purely mechanical experience to digital literacy, multi-skilling, and safety awareness.

Why are traditional contractor-led hiring models becoming less effective?

Contractor-led models prioritise speed and volume, but often lack structured skill assessment, onboarding, and workforce planning. In a high-complexity manufacturing environment, this leads to higher attrition, safety risks, and production instability.

Is RPO effective for large-scale blue-collar hiring in automotive?

Yes. RPO enables automotive companies to build structured, scalable talent pipelines with consistent assessment, compliance, and onboarding processes. It also provides workforce visibility and planning capabilities that are difficult to sustain internally at scale.

How can CHROs build long-term blue-collar talent pipelines?

By adopting skill-first hiring frameworks, standardising assessments and onboarding, integrating leadership hiring with shopfloor stability, and partnering with specialised RPO providers who understand automotive workforce dynamics.

Ready to build a stable automotive workforce? Building a skilled blue-collar workforce in automotive is no longer about filling roles faster. It’s about creating workforce reliability at scale.

Taggd works with automotive OEMs and suppliers to design RPO-led hiring systems that combine workforce planning, structured assessments, and large-scale execution. Backed by India-specific talent intelligence and deep industry understanding, Taggd helps organisations move from reactive hiring to future-ready workforce strategy.

Explore how Taggd can help build your automotive talent pipeline.