As we look towards the GCC Talent Market 2026: Salaries, a serious tension is brewing. On one side, we have robust hiring demand. On the other, constrained compensation budgets. The result? A significant retention challenge that’s about to hit boiling point.

While companies, especially in the UAE and Saudi Arabia, are expanding headcount, salary growth just isn’t keeping up. This is creating a major disconnect between what employees expect and what businesses can realistically offer, setting the stage for a very competitive and tricky talent market ahead.

An Executive Overview of the 2026 GCC Salary Landscape

For any busy Chief Human Resources Officer, getting to grips with the 2026 GCC talent market comes down to one core issue. We’re on a collision course: surging hiring plans are slamming into the hard wall of limited salary budgets. This isn’t just a number on a spreadsheet; it’s a direct threat to employee retention and your organisation’s stability.

Companies all over the region, particularly in major hubs like Dubai and Riyadh, are in growth mode and actively expanding their teams. The problem is, the compensation packages on the table often don’t meet the expectations being shaped by inflation and an intensely competitive job market. This creates an environment where attracting and, more importantly, keeping top performers requires a lot more than a standard offer.

The Growing Expectation Gap

The data tells a very clear story. Heading into 2026, the hiring momentum is undeniable, with a massive 66% of employers having expanded their headcount in 2025 and only 13% having no major hiring plans.

But here’s the catch: despite this, a staggering 60% of professionals feel their pay doesn’t match their responsibilities, even as general salary optimism is on the rise. It shows that while pay cheques are getting bigger for some, it’s not enough to satisfy the demands of today’s economic climate. For a much deeper dive, you can explore the complete GCC Report 2025.

This gap is hitting hardest for a few key groups:

- Technical and digital specialists with those critical, future-focused skills.

- Proven leaders who can navigate organisations through constant change.

- Agile, project-based staff needed to fuel ambitious national vision projects.

Key Market Indicators and Strategic Implications

The dynamics play out a bit differently between the region’s two economic powerhouses, the UAE and Saudi Arabia. Each presents unique challenges and opportunities, demanding a tailored approach from HR leaders. Understanding these nuances is the first step toward building a compensation strategy that’s both resilient and competitive.

The core issue for 2026 isn’t a lack of jobs, but a potential shortage of competitively compensated roles. Organisations that fail to bridge the gap between employee salary expectations and their own budget constraints will face a significant flight risk, losing key talent to competitors who get the value proposition right.

To help frame the strategic context, the following table provides a quick, high-level comparison of the talent markets in the UAE and KSA. Think of it as a snapshot of the critical indicators CHROs must keep an eye on to navigate the year ahead and position their organisations for success.

GCC Talent Market Snapshot 2026: Key Indicators

| Metric | United Arab Emirates (UAE) | Saudi Arabia (KSA) | Key Implication for CHROs |

|---|---|---|---|

| Hiring Momentum | Consistently high, driven by diversification into tech, tourism, and finance. | Explosive growth fuelled by Vision 2030 giga-projects and economic transformation. | KSA’s demand may outpace the UAE’s, requiring more aggressive talent attraction strategies and potentially higher premiums. |

| Talent Supply | Mature market with a large expatriate talent pool, but high competition for top-tier skills. | Rapidly growing local talent pool supported by Saudisation, but shortages in niche technical roles. | In the UAE, focus on retention. In KSA, balance localisation targets with sourcing scarce international expertise. |

| Salary Growth Pressure | Moderate but persistent, influenced by global inflation and cost of living. | High pressure, driven by intense project demand and the need to attract global talent. | Budgets in KSA will be stretched further. Creative, non-monetary benefits will be crucial in both markets. |

| Primary Retention Risk | Poaching from regional competitors and global markets offering remote work. | Flight risk to high-paying giga-projects and government-backed entities. | CHROs must benchmark not just against direct competitors, but against the most ambitious projects in the region. |

This snapshot underscores the need for a nuanced, market-specific compensation strategy. A one-size-fits-all approach simply won’t cut it in the dynamic and demanding GCC talent landscape of 2026.

Understanding the Great Salary Expectation Disconnect

At the heart of the 2026 GCC talent market is a growing tension, a chasm widening between what employees feel they’re worth and what employers believe they can afford to pay. This isn’t just a small squabble over a few percentage points; it’s a fundamental disconnect that’s making top talent harder to attract and even harder to keep.

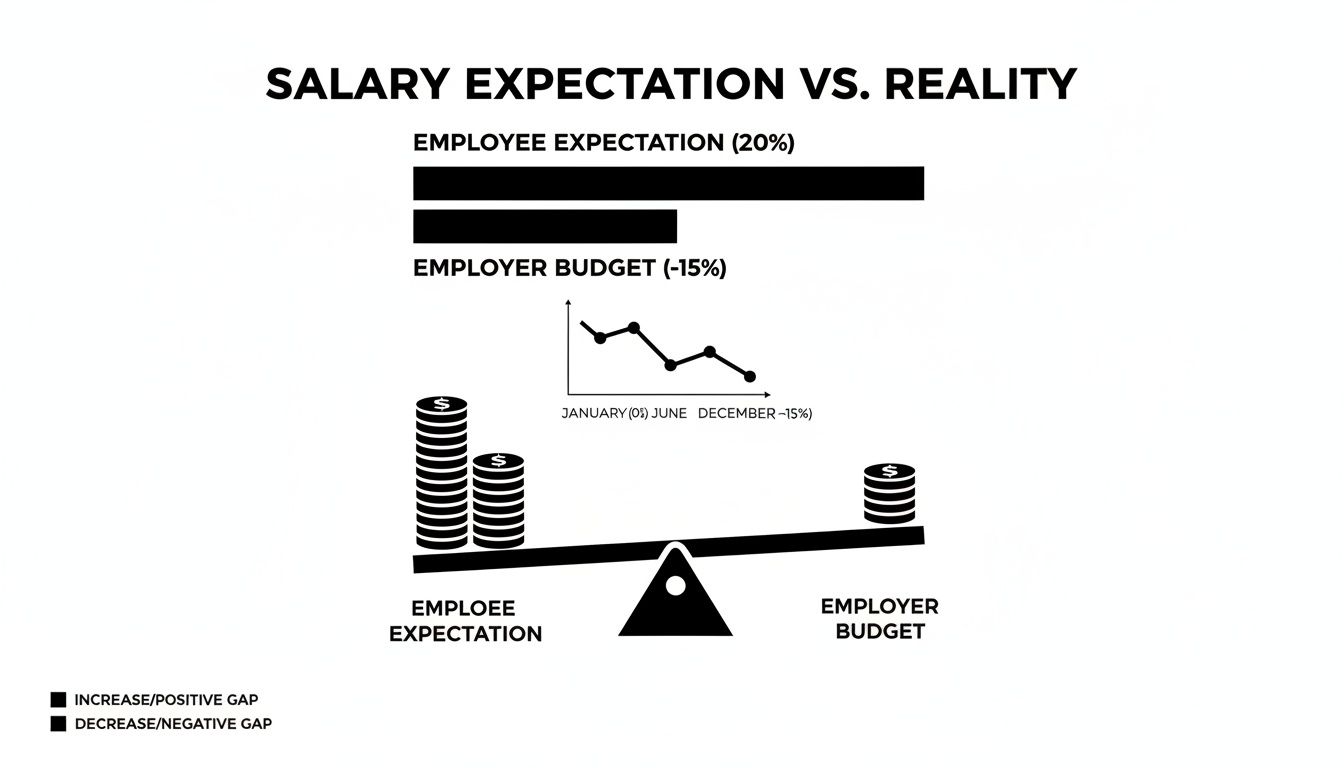

Picture a seesaw. On one side, you have employee salary expectations being pushed skyward by stubborn inflation and the rising cost of living across the region. On the other, you have employer budgets pinned down by economic caution and conservative growth forecasts. The result? A seesaw stuck awkwardly in the air, with a huge chunk of the workforce feeling undervalued and ready to jump ship.

This imbalance isn’t just a numbers problem, it has a real psychological impact. When an employee’s pay cheque doesn’t match their perceived contribution, it breeds resentment. It’s no wonder, then, that a staggering 60% of professionals across the GCC feel their salary just doesn’t keep up with their responsibilities.

The Forces Tilting the Compensation Seesaw

This gap didn’t appear overnight. Several powerful market forces are piling weight onto the employee-expectation side of the seesaw while holding the employer-budget side firmly on the ground. For any CHRO aiming to restore some balance, understanding these root causes is the critical first step.

A primary driver is the ferocious competition for specialised skills. As the region goes all-in on digital transformation and economic diversification, the demand for experts in fields like AI, data science, and renewable energy has exploded. This creates mini-economies where top talent can essentially name their price, which in turn skews the salary expectations for everyone else.

On top of this, a chronic lack of transparency around pay structures only fuels suspicion. When people don’t understand how their salary is calculated, they’re far more likely to assume they’re getting a raw deal, especially when they see eye-watering figures being thrown around for roles in hot sectors.

This dissatisfaction is a powerful motivator for change. The data shows an almost universal readiness to walk, with an incredible 98% of professionals confirming they are open to new job opportunities. That number should be a massive red flag for any business that thinks its current pay strategy is enough to hold onto its best people.

The real risk for 2026 isn’t just losing employees over a salary bump. It’s losing the trust and engagement of your entire workforce because they feel their value is being ignored in a market that’s constantly telling them they are worth more.

Breaking Down the Root Causes of Dissatisfaction

To fix this disconnect, CHROs need to look past the surface-level grumbling and get to the core issues. These drivers are often tangled together, creating a complex problem that needs a multi-pronged solution.

Here are the key drivers in play:

- Intense Niche Skill Demand: The “war for talent” in tech and engineering is setting salary benchmarks that are tough for other sectors to match. But that doesn’t stop them from influencing what the entire workforce expects to earn.

- Cost of Living Pressures: Even with a pay rise, many professionals feel they are standing still, or even going backwards. When you factor in the rising costs of housing, education, and daily life in hubs like Dubai and Riyadh, their real-terms pay has stagnated.

- Opaque Pay Structures: Without clear salary bands or visible career paths, employees are left to guess their market value. This often leads to feelings of being treated unfairly and a constant hunt for another job offer just to get some external validation.

- The “Giga-Project” Effect: The massive salaries linked to the region’s headline-grabbing national projects create a halo effect. They raise compensation expectations across the board, even for jobs in completely unrelated industries.

Ultimately, this salary disconnect is more than just an HR headache; it’s a sign of a talent market in flux. Employees are more informed about their market value than ever, and they won’t hesitate to act if they feel unappreciated. For companies, closing this gap means moving away from old-school compensation models and towards a more transparent and holistic total rewards strategy.

Benchmarking Salaries Across Key GCC Industries

To really get a handle on the GCC talent market in 2026, CHROs need to look past the big regional numbers and get into the nitty-gritty of what’s happening in specific industries. A one-size-fits-all pay strategy is a surefire way to miss the mark, especially when sectors are moving at completely different paces. The forces driving up tech salaries are a world away from what’s influencing pay in construction or finance.

Getting these sector-specific details right is everything. It’s how you benchmark your own pay scales accurately, making sure your offers are competitive enough to attract top talent without blowing up your budget. This focused approach shows you where to go all-in for scarce skills and where a more steady, measured approach will do the job.

The Construction Conundrum: Growth Without the Pay Boom

The GCC construction scene is a classic paradox right now. It’s in the middle of a massive hiring spree, thanks to giga-projects like NEOM and the incredible urban expansions in Dubai and Doha. But here’s the twist: despite this huge demand for people, salary growth is expected to be surprisingly sluggish, hovering around a mere 0-5% in 2026.

What gives? This disconnect points to a market in flux. While the project pipelines are overflowing, many are locked into long-term, fixed budgets that were signed off before the recent waves of inflation hit. This financial reality puts a tight lid on pay rises, creating a tough spot for companies. They have to staff these monumental projects without being able to dangle massive pay cheques. It’s a unique situation that’s pushing many professionals to think more about long-term career growth than immediate salary jumps. You can explore the detailed findings in the 2026 GCC Salary Guide.

This infographic perfectly captures the growing tug-of-war between what employees are hoping for and what employers have actually budgeted for.

As you can see, the gap is significant. Employee expectations are soaring well beyond the modest increases most companies are prepared to offer.

Tech and Digital: The Skill Shortage Premium

Flip the coin from construction, and you land in the tech and digital world, where the story couldn’t be more different. Here, the driver isn’t project volume; it’s a severe shortage of specialised skills. The entire region is charging ahead with its digital transformation goals, and the demand for experts in fields like AI, cybersecurity, and data analytics is completely outstripping the supply.

This fierce competition for a very limited talent pool has handed skilled professionals all the bargaining power. They can, and absolutely do, demand premium salaries. For roles like a Lead Data Scientist or a Cybersecurity Architect, companies often find themselves in bidding wars, pushing salary growth well into the double digits.

In high-demand tech roles, salary isn’t just pay; it’s a strategic weapon. If a company can’t compete on the base salary, they have to get creative and build an offer that’s impossible to refuse, think equity, big bonuses, and career development opportunities you just can’t get anywhere else.

A Comparative Look at Sectoral Salary Growth

To give CHROs a practical tool for planning, let’s put the projected salary increases side-by-side. The differences aren’t small, they’re a direct reflection of the economic engines and talent pressures unique to each industry. This data is absolutely essential for calibrating your offers and making sure your organisation stays competitive in the 2026 GCC talent arena.

The table below breaks down the forecasted salary growth for high-demand roles across four key industries. It provides a clear snapshot of where the salary pressures will be most intense, helping you make smarter, more strategic compensation decisions.

Projected 2026 Salary Growth by GCC Sector and Role

| Sector | Sample High-Demand Role | Projected Salary Increase Range (2026) | Driving Factors |

|---|---|---|---|

| Construction & Real Estate | Senior Project Manager | 2-5% | Long-term project budgets, high volume of available talent for traditional roles, pressure on margins. |

| Technology & Digital | AI/ML Engineer | 12-18% | Acute skill shortages, intense competition from global and local firms, critical role in national diversification. |

| Healthcare & Life Sciences | Clinical Research Associate | 7-11% | Government investment in healthcare infrastructure, growing demand for specialised medical expertise. |

| Finance & Banking | Fintech Product Manager | 9-14% | Digital transformation of financial services, rise of neobanks, demand for digital payment specialists. |

This data makes one thing crystal clear: a standard, company-wide annual salary review is no longer going to cut it. A 4% bump might be perfectly competitive for a construction role, but it would be laughed out of the room by a sought-after AI specialist. Strategic compensation planning in 2026 absolutely requires this level of industry detail to win, and keep, the talent you need to succeed.

Building a Total Rewards Package Beyond the Paycheque

In a market where salary budgets are stretched thin, simply throwing more money at candidates is no longer a winning game. It’s just not sustainable. The entire GCC Talent Market 2026: Salaries conversation is forcing a much-needed rethink. Smart companies are moving beyond base pay and expanding their definition of ‘compensation’ to cover everything that contributes to an employee’s professional journey and personal well-being.

Think of it like creating a ‘benefits mosaic’. Instead of relying on one big, monetary piece, you assemble a compelling picture from many smaller, often non-monetary, tiles. Each tile, whether it’s flexibility, a clear career path, or solid family support, adds value. Together, they create a unique Employee Value Proposition (EVP) that a competitor can’t easily beat just by upping their salary offer.

This approach isn’t just clever; it’s essential. What top talent values can change dramatically from one GCC country to another. A one-size-fits-all benefits package is almost guaranteed to miss the mark when employee priorities are so distinctly local.

Understanding Regional Benefit Preferences

The differences between what professionals prioritise in the UAE versus Saudi Arabia are stark. They reveal deeper cultural and economic drivers that, if ignored, mean you’re probably funding perks nobody really wants.

Take the UAE, for instance. In its mature and fiercely competitive market, flexibility is king. Almost half of the professionals there, 49% to be exact, put flexible or hybrid working at the top of their list. This points to a workforce that craves better work-life integration and autonomy in a fast-paced global hub.

Now, shift your focus to Saudi Arabia. The talent market there places a much heavier emphasis on security and family. A massive 70% of professionals prioritise comprehensive family benefits, including dependent visas and top-tier medical cover. This makes perfect sense when you consider the Kingdom’s social fabric and the influx of expatriates relocating with their families for huge Vision 2030 projects.

In 2026, the winning total rewards strategies will be the ones that actually listen to the market. Investing in high-demand, region-specific benefits shows that you understand and respect what your people truly need, building a kind of loyalty that money alone can’t buy.

The Overlooked Driver of Turnover: Career Growth

While benefits like healthcare and flexibility are table stakes, one of the biggest reasons top performers walk away has nothing to do with their paycheque or their schedule. A striking 62% of professionals across the GCC say a lack of career development and growth opportunities is a primary reason for looking for a new job.

That statistic should be a wake-up call for every CHRO. Employees, particularly the ambitious ones you want to keep, need to see a future for themselves at your company. They’re looking for clear pathways to promotion, chances to learn new skills, and opportunities to tackle new challenges. If they can’t see that path with you, they’ll find an organisation that will show them one.

Conducting a Strategic Benefits Audit

To build that compelling benefits mosaic, you first have to know which tiles you’re working with and which ones are missing. This is where a strategic ‘benefits audit’ comes in, helping you align your spending with what actually matters to the talent you want to attract and keep.

Here’s a straightforward way to approach it:

- Survey Your Current Workforce: Stop assuming. Use anonymous surveys to ask your people directly what they value. Have them rank existing benefits and suggest new ones.

- Analyse Competitor Offerings: Do your homework. See what your direct competitors in your specific industry and country are offering. Look for the gaps where you can stand out.

- Map Benefits to Regional Priorities: Take what you offer and hold it up against the known preferences in your key markets. Are you offering flexibility in the UAE? Is your family support package competitive in KSA?

- Calculate the ROI of Each Perk: Look beyond the cost. Assess the perceived value and the impact each benefit has on retention and attraction. A low-cost, high-impact perk like a mentorship programme can often deliver far more value than an expensive one that goes unused.

By strategically investing in a mix of monetary and non-monetary rewards, organisations can create a powerful and resilient EVP. For a deeper dive, it’s worth exploring the factors to consider for crafting customized compensation strategies. Ultimately, this balanced approach is the key to winning the war for talent in the competitive GCC landscape of 2026.

How RPO Gives You the Upper Hand in Today’s Talent and Salary Tussle

Trying to navigate the GCC talent market right now feels less like standard recruiting and more like a high-stakes chess match. To win, you need more than just a recruitment team; you need a strategic, data-driven engine. This is exactly where Recruitment Process Outsourcing (RPO) has stepped up, evolving from a simple cost-cutter into a vital weapon for companies facing fierce talent wars and spiralling salary demands.

Think of an RPO partner as a true extension of your own HR department, one that manages the entire recruitment lifecycle from start to finish. But its real value today goes way beyond just filling jobs. It’s about delivering the market intelligence, the direct access to talent, and the sheer agility you need to thrive when every single hire is critical.

For CHROs who are right in the thick of it, battling intense candidate competition, flying blind on salary data, and dealing with persistent skills gaps, RPO offers a direct and powerful solution. It tackles these pain points head-on, turning recruitment from a reactive, fire-fighting function into a proactive, strategic advantage.

Gaining an Unfair Advantage with Real-Time Salary Data

One of the biggest headaches in the GCC Talent Market 2026: Salaries conversation is the glaring lack of reliable, real-time compensation data. Relying on those big annual salary surveys is like trying to navigate Dubai’s fast-moving traffic with a map from last year; by the time you get the information, the entire landscape has changed.

A strategic RPO partner completely flips this script. Instead of using lagging indicators, they give you access to live salary benchmarks pulled from actual job offers made just weeks or even days ago. This isn’t theoretical data; it’s what the market is actually paying for specific roles, in specific cities, right now.

By tapping into an RPO’s current placement data, a CHRO can stop guessing what a competitive offer looks like and start knowing with precision. This empowers you to make confident, data-backed offers that land top talent without needlessly inflating salary budgets across the board.

This level of granular insight is a game-changer. For example, knowing that a Project Manager role in NEOM is commanding a 15% premium over a similar job in Dubai allows for surgical precision in your compensation strategy. It stops you from overpaying in one market and, more importantly, prevents you from under-offering and losing a critical candidate in another.

Accessing Vetted Talent Pools Instantly

In a market where the best candidates are gone in a matter of days, speed and access are everything. The old-school methods of posting on job boards and waiting for applications to trickle in are simply too slow and passive to secure top-tier professionals for your most important roles.

RPO providers solve this by maintaining and constantly nurturing their own proprietary, pre-vetted talent pools. Picture it as having a “bench” of qualified, engaged candidates who are already primed for their next move, even before you have an open vacancy.

This proactive approach means that when a hiring need pops up, you’re not starting from scratch. You’re starting with a curated shortlist of professionals who have already been assessed for skills, cultural fit, and career goals. It dramatically slashes the hiring timeline and boosts the quality of who you bring on board.

Overcoming Critical Skills Gaps with Agility

Let’s be clear: the talent shortages are real and they are pressing. As we look towards 2026, a massive 90% of organisations across the GCC are wrestling with significant skills gaps. The main culprits? Inadequate pay and benefits (38%), intense competition for the same people (31%), and a lack of clear career paths (28%). To win this battle, RPO clients get access to monthly-updated wage data for key hubs like Saudi Arabia (NEOM, Riyadh), the UAE (Dubai, Abu Dhabi), and Qatar (Doha) across more than 40 high-demand roles. You can find more data on the GCC salary landscape on indexbox.io.

This is especially true for project-based work, like staffing a new tech implementation or a major construction phase. An RPO partner gives you the agility to scale your hiring efforts up or down in response to these fluctuating business needs.

This scalability is a huge advantage:

- Rapid Project Staffing: You can quickly assemble specialised teams for fixed-term projects without adding to your permanent headcount.

- Reduced Time-to-Hire: Fill roles much faster, ensuring your projects stay on track and you hit your business targets.

- Access to Niche Experts: An RPO can tap into its extensive network to find professionals with those rare, in-demand skills you just can’t find through traditional channels.

Ultimately, RPO acts as the bridge between the market’s biggest challenges and your company’s talent needs. It delivers the data to make competitive offers, the access to secure top candidates, and the flexibility to adapt to whatever comes next. You can learn more about the fundamentals in our guide on everything you need to know about RPO.

Frequently Asked Questions

When you’re trying to navigate the twists and turns of the GCC Talent Market in 2026, a lot of practical questions come up. If you’re a CHRO trying to attract and keep the best people, you need clear answers. This section gets straight to the point on some of the biggest concerns we’re hearing from leaders like you.

We’ll tackle the real-world headaches of budgeting for pay rises in a ridiculously high-demand market, how to compete for talent when you can’t just throw money at the problem, and what an RPO partner actually brings to the table right now.

How Should We Budget for Salary Increases in 2026?

Let’s be honest, budgeting for salary hikes in the GCC right now feels like trying to hit a moving target. Inflation is squeezing from one side, and intense competition for specific skills is driving wages up on the other. The old way of applying a standard, across-the-board percentage increase just won’t cut it anymore. Your strategy has to be much smarter and backed by solid data.

The trick is to stop thinking about a single, massive salary budget. Instead, treat it like an investment portfolio. You need to be surgical, allocating the biggest increases to the roles and individuals who are absolutely critical to your business goals and are most likely to get poached.

This is what that looks like in practice:

- Segment Your Workforce: Not every role carries the same market heat. Break your team down into logical groups: high-demand tech roles (think AI, data science), critical leadership, stable operational functions, and your high-potential rising stars.

- Apply Variable Increases: Give each segment its own budget pool. For instance, your AI and cybersecurity teams might need a 10-15% pool just to stay in the game. Meanwhile, more stable administrative roles might be fine with a 3-5% pool.

- Double Down on High Performers: Within each of those segments, make sure your top performers get the lion’s share of the raises. This isn’t just about fairness; it’s a powerful retention tool. When people see that high performance is directly rewarded, they’re motivated to stay and deliver.

By taking this segmented approach, you make your salary budget work smarter, not just harder. You’re putting your money exactly where it will give you the best return: keeping and attracting the talent that matters most.

How Can We Attract Talent If We Are Not the Top Payer?

In a market where giga-projects and tech giants can offer salaries that make your eyes water, it’s easy to feel outgunned. But the truth is, salary is only one piece of the puzzle for top candidates. When you can’t win on base pay, you have to win on the total experience. This is where your ‘benefits mosaic’ becomes your secret weapon.

Your goal should be to turn up the volume on all the non-monetary parts of your offer that bigger competitors might be overlooking. It means really getting inside the heads of the people you want to hire, figuring out what they truly value beyond a paycheque, and building your story around that.

A compelling career path can often outweigh a slightly higher salary offer. Candidates aren’t just looking for a job for today; they’re looking for a platform for their future. If you can clearly show them how joining your company will fast-track their skills and career, you create an advantage that money can’t always buy.

Think about these powerful differentiators:

- Career Velocity: Don’t just talk about growth; show them the roadmap. Offer mentorship programmes, pay for certifications, and highlight internal mobility success stories. Prove you’re invested in their professional journey.

- Impact and Autonomy: Skilled professionals don’t want to be a small cog in a giant machine. They want to make a difference. Emphasise how their work will directly shape the company’s success and give them real ownership of important projects.

- Work-Life Integration: Offer flexibility that’s more than just a buzzword. This could be a hybrid model that actually works, compressed work weeks, or generous leave policies. A better life balance is a huge selling point, especially in the fast-paced UAE.

- A Genuinely Good Culture: Build and shout about a positive, inclusive, and supportive place to work. A great culture is incredibly hard for competitors to copy and is a massive driver of long-term satisfaction and retention.

When you focus on these areas, you change the conversation from “who pays the most?” to “where can I build the best career and have the best experience?”

What Are the Tangible Benefits of Using an RPO Partner?

Bringing in a Recruitment Process Outsourcing (RPO) partner in the GCC today gives you concrete, measurable advantages that go way beyond just filling jobs. In a market this tight, where talent is scarce and salaries are all over the place, an RPO provides the strategic intelligence and operational muscle you need to get ahead.

First and foremost, you get access to real-time market data. Forget relying on annual salary surveys that are out of date the moment they’re published. A good RPO partner gives you live salary benchmarks from actual placements they’ve made in the last month, or even the last week. This lets you make competitive, data-backed offers with confidence, so you’re not overpaying or losing a great candidate over a few thousand dirhams.

Second is immediate access to curated talent pools. RPO providers don’t start from scratch every time you have a vacancy. They are constantly building and nurturing deep networks of pre-vetted, passive candidates. When you have a critical role to fill, you get a high-quality shortlist almost instantly. This massively cuts down your time-to-hire and raises the quality of candidates you see.

Finally, an RPO gives you scalability and agility. Need to staff a new project fast? Need to dial back hiring for a quarter? An RPO model flexes with your business needs, without the fixed cost of a large internal recruitment team. In the project-driven economies of Saudi Arabia and the UAE, that kind of flexibility is priceless. It lets you jump on market opportunities with speed and efficiency.

At Taggd, we provide the strategic RPO partnership you need to cut through the complexity of the GCC talent market. We deliver the data, access, and agility to help you build a world-class team. Find out how we can help you win the war for talent by visiting us at https://taggd.in.