At the heart of the matter, the recruitment challenges in biotech vs pharmaceuticals boil down to a single, critical difference. Biotech firms are in a desperate hunt for hyper-specialised R&D experts to fuel their next big breakthrough. Meanwhile, large pharmaceutical corporations are struggling to attract digital talent at scale to bring their legacy workforces into the modern era. This simple distinction creates two wildly different, and equally demanding, hiring battlegrounds.

The Strategic Divide in Biotech and Pharma Talent Acquisition

For any CHRO in the life sciences space, grasping the nuances between biotech and pharma recruitment isn’t just an operational box to tick – it’s a core strategic function. The talent pools, candidate motivations, and even the channels you use to find them are shaped by completely different market pressures, risk appetites, and growth models. A one-size-fits-all approach is a recipe for failure.

Biotech hiring is a study in contrasts. You’ll often hear about funding slumps a so-called ‘biotech winter’, leading to layoffs. Yet, at the same time, the demand for elite scientists in hot fields like bioinformatics and gene editing remains sky-high. This creates a volatile market where small, nimble companies are locked in a fierce competition for a very small pool of true innovators.

Pharma, on the other hand, offers the promise of stability and scale, but it’s facing its own seismic shift. The problem isn’t finding one brilliant scientist. It’s about figuring out how to onboard and integrate thousands of professionals with skills in data science, AI, and digital marketing into a corporate structure that was built decades ago. This isn’t just a hiring problem; it demands a complete overhaul of employer branding and talent management.

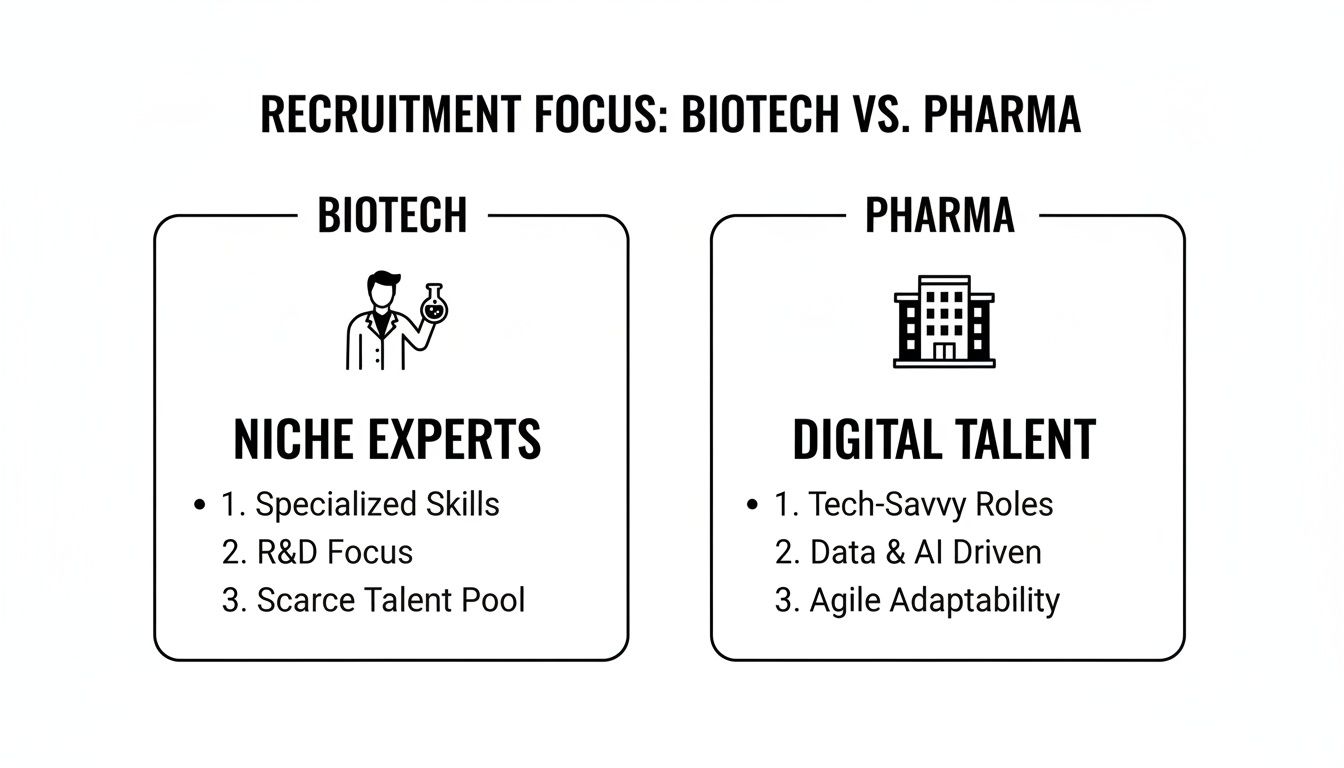

This graphic really drives home the core focus for each sector.

As you can see, even though they both fall under the life sciences umbrella, their immediate talent needs are pulling them in opposite directions. For a more detailed look at this dynamic, you can explore the specific biotechnology hiring trends in our related article.

Core Recruitment Differentiators Biotech vs Pharma

For life sciences leaders, understanding these fundamental differences is key to building a successful hiring strategy. This table provides a quick side-by-side comparison of where the two industries diverge most.

| Hiring Factor | Biotech Industry Focus | Pharmaceutical Industry Focus |

|---|---|---|

| Primary Talent Need | Niche scientific specialists (e.g., cell therapy, bioinformatics) | Digital, data, and commercial talent at scale (e.g., AI, data science) |

| Market Driver | Innovation, clinical trial success, and venture capital funding | Market access, patent lifecycle management, and digital transformation |

| Organisational Culture | Agile, high-risk, high-reward, mission-driven | Stable, process-oriented, globally structured, brand-focused |

| Compensation Model | Heavily reliant on equity, stock options, and bonuses tied to milestones | Structured salary bands, robust benefits, and performance bonuses |

Navigating these distinct environments requires a tailored approach, as the talent that thrives in a high-stakes biotech startup is often very different from the professional needed to drive change within a global pharma giant.

Analysing the Talent Supply and Critical Skills Gaps

The biggest factor shaping recruitment challenges in biotech versus pharma comes down to a stark difference in talent availability. While both sectors are chasing high-calibre professionals, the nature of their skills gaps creates two completely different hiring environments. One is a high-stakes hunt for incredibly rare specialists; the other is a massive integration of new, non-traditional skill sets.

For biotech firms, the challenge is laser-focused and intense. The industry’s blistering pace of innovation has created a severe shortage of talent in niche, pioneering fields. This leads to a fiercely competitive, candidate-driven market where a small number of experts are pursued by countless well-funded start-ups and established players.

In contrast, the pharmaceutical sector’s main skills gap is broader but just as complex. Their problem isn’t necessarily finding one elusive scientist, but rather attracting and integrating large numbers of professionals with backgrounds in data science, artificial intelligence, and digital marketing skills not traditionally found within the walls of “Big Pharma.”

Biotech’s Search for Scientific Pioneers

The biotech talent pool is exceptionally shallow for the critical roles that drive innovation forward. The supply of experts in fields like bioinformatics, gene editing (CRISPR), and cell therapy simply hasn’t kept up with the explosion of new companies and research. This scarcity has a direct, and often painful, impact on project timelines and investor confidence.

Hiring in this space is less about filling a vacancy and more about acquiring a core company asset. A single hire can literally determine the success or failure of a clinical trial or an entire research programme.

A significant recruitment challenge in biotech is the fierce competition for a limited number of “unicorns” scientists who possess a rare combination of deep technical expertise, strategic vision, and the ability to lead a team from discovery to clinical application.

The consequences for CHROs are serious, leading to:

- Prolonged Search Cycles: Finding and vetting candidates with the right mix of niche skills can take months, delaying critical R&D milestones.

- Inflated Compensation Packages: High demand and low supply force biotechs to offer premium salaries, substantial equity, and eye-watering sign-on bonuses.

- Global Headhunting: The required talent often isn’t available locally, forcing complex international searches and relocation packages.

This reality means that traditional recruitment methods are often useless. Success demands a proactive, network-driven approach focused on building relationships with passive candidates long before a role ever opens up.

Pharma’s Pivot to Digital and Data Expertise

While pharma also needs top-tier scientists, its most pressing skills gap is in technology. The industry is going through a massive transformation, trying to use data and AI to speed up drug discovery, optimise clinical trials, and personalise patient engagement. The problem? The professionals with these skills – data scientists, machine learning engineers, and digital health strategists are in high demand across every other industry too.

This means pharmaceutical companies must compete directly with tech giants, financial institutions, and agile start-ups for this talent. That’s a tough sell for organisations often seen as slow-moving and bureaucratic. Attracting these professionals requires a fundamental shift in employer branding and corporate culture. For a deeper analysis, you can learn more about the future of pharmaceutical talent and the key skills in demand.

This talent gap is becoming especially clear in key growth markets. For instance, in India’s booming life sciences sector, biotech’s need for specialised tech talent is growing far faster than in pharma. Research shows that while tech-focused roles in Indian pharma grew by 35-45% between 2020 and 2023, biotech saw an explosive 65% increase. Despite a large pool of engineering graduates, this has created a talent deficit of up to 105,000 positions annually. Discover more insights about India’s pharma and biotech workforce expansion on einpresswire.com.

This forces pharma CHROs to focus on a different set of recruitment priorities. They have to build a compelling story around the impact tech professionals can have on human health, offering them the chance to solve meaningful problems at an immense scale. This involves redesigning roles, creating clear career paths for non-scientific talent, and fostering a more agile, data-first culture to keep them.

Navigating Market Volatility and Its Impact on Hiring

Beyond specific skills, the market volatility shaping each sector presents entirely different recruitment hurdles for biotech and pharma. The predictable stability of a large pharmaceutical giant versus the high-risk, high-reward nature of a biotech startup are direct outcomes of the market forces they answer to. For any CHRO, grasping this context is fundamental to building a resilient and effective talent strategy.

Think of it this way: one environment is a marathon that demands long-term workforce planning, while the other is a series of sprints dictated by funding rounds and clinical trial results. This core difference in business rhythm cascades down to everything from hiring freezes and budget allocation to the very type of candidate you can attract and keep.

Biotech’s High-Stakes Funding Cycles

The biotech world is notorious for its boom-and-bust cycle, often called the “biotech winter.” It’s a paradoxical climate where one company might be announcing widespread layoffs, while another, fresh off a successful funding round, is aggressively headhunting for the exact same talent. This isn’t an anomaly; it’s the norm.

Here, hiring is directly tethered to investor confidence and scientific milestones. A single negative trial result can slam the brakes on recruitment overnight. Conversely, a positive one can trigger an urgent, massive demand for dozens of specialist roles. This creates a reactive, almost chaotic hiring environment where agility is everything.

For biotech HR leaders, the core challenge is building a recruitment function that can scale up or down almost instantly. This means relying on flexible talent solutions and maintaining a warm pipeline of candidates even during hiring lulls, anticipating the next wave of growth.

This cycle makes long-term workforce planning incredibly difficult. Instead of forecasting annual hiring needs, biotech leaders have to plan around specific project milestones, creating a much shorter and more intense planning horizon.

Pharma’s Steady Growth and Digital Urgency

In sharp contrast, pharmaceutical companies operate with far more predictability. Their growth is steadier, driven by established product pipelines, patent lifecycles, and sprawling global market access. But this stability brings its own massive hiring challenge: the need to modernise a colossal, legacy workforce at an unprecedented scale.

The main driver here isn’t a single clinical trial but a sweeping, industry-wide push toward digital transformation. This has created a surge in demand for roles that simply didn’t exist in pharma a decade ago, fuelling intense but sustained competition for talent.

This market dynamic has created a significant talent crunch, especially in emerging hubs. For example, pharma recruitment in India is grappling with a staggering 62% year-over-year surge in job openings. This growth is largely driven by advancements where it’s expected 30% of new drugs will be discovered using AI, which has spiked demand for data scientists and digital health experts by 25% for entry-level roles. Even so, 80% of employers struggle to find qualified talent for compliance-heavy positions. This is a world away from biotech, where job postings dropped 36% in the last year amid ongoing layoffs. You can read the full analysis of these pharmaceutical recruitment trends on acarasolutions.in.

Comparing Market Impact on Recruitment Strategy

The distinct market forces acting on each sector demand completely different strategic responses from talent leaders. A successful recruitment plan has to be built on these foundational differences.

| Strategic Factor | Biotech Recruitment Response | Pharmaceutical Recruitment Response |

|---|---|---|

| Pacing | Reactive and sprint-based, tied to funding and trial outcomes. | Proactive and marathon-based, aligned with long-term digital roadmaps. |

| Risk Profile | High-risk; hiring freezes are common and can be sudden. | Low-risk; hiring is more consistent and budget cuts are less frequent. |

| Candidate Focus | Attracting talent comfortable with ambiguity and equity-based rewards. | Attracting talent seeking stability, scale, and structured career progression. |

| Planning Horizon | Short-term, often planned quarter-to-quarter around specific milestones. | Long-term, with multi-year workforce plans tied to business transformation goals. |

Ultimately, a CHRO in biotech must be an expert in agile resource management, ready to seize opportunities the moment funding lands. In pharma, a CHRO must be a master of large-scale change management, strategically weaving thousands of new digital professionals into a deeply established corporate culture.

Crafting Compelling Employer Brands and Compensation Models

In the high-stakes world of life sciences, it’s not always the biggest paycheque that wins the best talent. The recruitment challenges in biotech versus pharmaceuticals are deeply connected to the stories companies tell and the value they promise. For any CHRO, a magnetic employer brand and a smartly structured compensation model are indispensable tools.

For biotech firms, the employer value proposition (EVP) often hinges on a compelling, singular mission. It’s the chance to be part of a small team that could discover the next revolutionary therapy, driven by raw science and a palpable sense of urgency. In contrast, pharmaceutical giants build their EVP on a foundation of stability, global reach, and the prestige that comes with an established name.

The Biotech Proposition: Mission and Equity

Let’s be realistic – biotech start-ups can rarely go head-to-head with Big Pharma on salary alone. So, they compete differently. They attract talent by offering something more intangible but incredibly motivating: a direct line of sight to scientific impact. Candidates who flock to biotech are often willing to trade the security of a large corporation for a front-row seat to pioneering research in a fast-paced environment.

Their compensation packages mirror this high-risk, high-reward culture, leaning heavily towards long-term incentives that tie personal success directly to company milestones.

The heart of the biotech offer is ownership. By providing significant equity or stock options, these companies don’t just hire employees; they create partners. This fosters a powerful drive to push innovation forward and see a project all the way from the lab bench to the market.

This model is a magnet for entrepreneurial scientists and leaders who are energised by the potential for a substantial financial payoff linked directly to their work. Of course, this introduces volatility, as the value of that equity is at the mercy of funding rounds and clinical trial outcomes.

The Pharmaceutical Promise: Stability and Scale

Pharmaceutical companies build their employer brand on a different set of pillars entirely. They offer the security of a global organisation, well-defined career ladders, and the opportunity to work on blockbuster drugs that impact millions of lives. Their brand is one of legacy, reliability, and immense resources.

This stability is reflected in their compensation models, which are built for predictability. They depend on structured salary bands, comprehensive benefits packages, and annual performance bonuses. This appeals to professionals who value clear career progression and financial security.

While this traditional model is great for attracting a broad spectrum of talent, it can sometimes be a sticking point when trying to hire digital and tech experts, who are more accustomed to the equity-heavy offers of the tech industry.

Comparing Compensation Philosophies

The divergence in compensation strategy is a direct reflection of each sector’s business model and risk appetite. For CHROs, understanding this difference is key to crafting offers that are both competitive and genuinely appealing to the right candidates.

| Compensation Element | Biotech Approach | Pharmaceutical Approach |

|---|---|---|

| Primary Driver | High-risk, high-reward; aligned with scientific milestones. | Low-risk, predictable growth; aligned with corporate performance. |

| Base Salary | Competitive, but often secondary to equity. | Highly structured and market-aligned, a primary incentive. |

| Variable Pay | Dominated by stock options and long-term equity grants. | Centred on annual cash bonuses and established incentive plans. |

| Candidate Appeal | Attracts entrepreneurial talent motivated by ownership and impact. | Attracts professionals seeking stability, clear progression, and security. |

In the end, the most successful talent leaders – whether in biotech or pharma – are those who can authentically tell their company’s unique story. For a biotech CHRO, that means selling a vision and a stake in the future. For their pharma counterpart, it’s about showcasing the power of scale, stability, and the chance to contribute to a global health legacy.

Designing RPO Strategies for Biotech and Pharma

When it comes to Recruitment Process Outsourcing (RPO), a one-size-fits-all approach is a recipe for failure. The hiring needs of biotech and pharma are fundamentally different, and a generic RPO model simply won’t cut it. CHROs need to think in terms of distinct playbooks – one designed for surgical precision and agility, the other for sheer efficiency and scale.

For a biotech startup, an RPO partner is a strategic weapon in the fierce war for rare scientific minds. For a pharmaceutical giant, it’s an operational engine built to manage complexity and high-volume hiring. The goals, tactics, and KPIs for each are worlds apart, which means your strategy has to be customised right from the start.

The Biotech RPO Playbook: Precision and Agility

In the fast-moving, high-stakes world of biotech, an RPO partner has to act as a seamless extension of the core scientific leadership. Their value isn’t measured by processing applications, but by their ability to pinpoint and secure the handful of global experts who can drive a critical research programme forward. The entire strategy is built on depth, not breadth.

The main focus for a biotech-centric RPO must be:

- Global Headhunting for Niche Roles: Your RPO partner needs a deep, active network within specific scientific circles. This allows them to identify and engage passive candidates – the specialists in fields like cell therapy or bioinformatics who aren’t even looking for a new role.

- Proactive Talent Pipelining: The biotech sector is notoriously volatile. A smart RPO will constantly map the market and build relationships with high-potential talent, creating a warm bench of candidates ready to engage the moment funding lands or a new project gets the green light.

- Market Intelligence and Compensation Advisory: A truly valuable RPO provides real-time data on what competitors are doing and how they’re compensating people. This helps you craft compelling offers that cleverly balance cash and equity to land those top-tier candidates.

An effective RPO for a biotech firm acts less like a recruiter and more like a strategic talent advisor. Their success is measured not by the number of hires, but by their ability to secure the one “un-findable” scientist who becomes the cornerstone of a new discovery.

This model demands an RPO provider with specialised life sciences recruiters – people who actually understand the science and can hold a credible conversation with PhD-level candidates. It’s a high-touch, relationship-driven approach where Quality of Hire is the only metric that truly matters.

The Pharmaceutical RPO Playbook: Scale and Efficiency

For large pharmaceutical companies, the recruitment challenge is one of immense scale and tangled complexity. Here, an RPO partner’s job is to deliver efficiency, consistency, and compliance across thousands of hires every single year, spanning commercial, corporate, and, increasingly, digital roles.

This playbook is all about optimising a high-volume talent acquisition engine. For leaders looking to go down this path, our guide on filling niche roles in the pharma industry with RPO offers more detailed strategies.

Key parts of a pharma-focused RPO strategy include:

- High-Volume Recruitment Management: The RPO takes full ownership of sourcing, screening, and coordinating interviews for hundreds of roles at once, especially for sales teams, manufacturing sites, and corporate support functions.

- Technology Implementation and Candidate Experience: The partner will manage your recruitment tech stack (like an ATS) to create a smooth, positive experience for a massive number of applicants. This is crucial for protecting the employer brand at scale.

- Global Compliance and Standardisation: A global pharma company can’t afford missteps. The RPO ensures hiring processes are consistent and compliant with local labour laws in every country you operate in, significantly reducing risk.

This approach is heavily data-driven, zeroing in on KPIs like Time-to-Fill, Cost-per-Hire, and Candidate Satisfaction Scores. The RPO provider becomes a master of process optimisation, using technology and standardised workflows to bring predictability and control to a sprawling, global hiring function.

Choosing the Right RPO Partner

Ultimately, your choice of RPO partner comes down to the core business challenge you’re trying to solve. The table below breaks down the key decision criteria for CHROs in each sector.

| RPO Selection Criteria | Ideal for Biotech | Ideal for Pharmaceuticals |

|---|---|---|

| Core Expertise | Deep scientific niche specialisation and executive search capabilities. | Large-scale process management and recruitment technology expertise. |

| Primary Value | Access to rare, passive talent and strategic market insights. | Operational efficiency, cost reduction, and brand consistency at scale. |

| Key Metrics | Quality of Hire, Offer Acceptance Rate for critical roles. | Time-to-Fill, Cost-per-Hire, Candidate Experience Score. |

| Engagement Model | High-touch, consultative partnership. | Process-driven, technology-enabled service delivery. |

For a biotech CHRO, the right RPO is a strategic ally in a highly targeted talent hunt. For a pharma CHRO, it’s an operational powerhouse that brings order and efficiency to a massive, multifaceted recruitment ecosystem.

Answering Key Recruitment Questions for CHROs

As a Chief Human Resources Officer, you know that navigating the unique hiring landscapes of biotech and pharma isn’t about high-level theory. It’s about getting practical answers to the tough questions you face every day.

This section dives into the common operational hurdles, from timelines and costs to the real-world impact of remote work, giving you direct insights to sharpen your talent acquisition game.

How Do Recruitment Timelines and Costs Differ Between Biotech and Pharma?

The time and money it takes to land top talent are worlds apart in these two sectors, and it all comes down to the scarcity and specialisation of the roles.

In biotech, hiring for vital R&D positions is a long, high-stakes game. A search for a niche scientific expert, especially one requiring a global executive hunt, can easily stretch beyond six months. The rarity of this talent drives up costs, not just from recruiter fees but from the hefty compensation packages needed to pull them away from competitors.

For pharmaceuticals, hiring timelines for high-volume commercial roles like sales reps are usually shorter and more predictable. The real challenge comes with the mass recruitment of digital and data science talent, which can create serious bottlenecks and slow down critical transformation projects. While the cost-per-hire for one role is lower than in biotech, the sheer volume means the overall recruitment spend is massive.

A smart RPO partner helps you get a handle on these variables. For a biotech, they build pre-vetted pipelines of passive talent, dramatically cutting down search times for those hard-to-find roles. For a pharma giant, they bring in the right tech to manage high-volume sourcing efficiently, optimising both speed and cost at scale.

What Are the Most Critical KPIs for Recruitment Success in Each Sector?

While some metrics are universal, the Key Performance Indicators (KPIs) that really matter reflect the unique business drivers of each industry.

For a biotech firm, the most revealing KPIs are:

- Time-to-Fill for Critical Scientific Roles: This isn’t just a number; it directly impacts your R&D timelines and how investors see you.

- Quality of Hire: The ultimate measure. Is the new hire actually moving the needle on project milestones and innovation?

- Offer Acceptance Rate: A high acceptance rate is a clear sign that your mission, culture, and equity-heavy compensation are hitting the mark with the best candidates.

In the pharmaceutical world, the focus shifts to efficiency and protecting the brand across massive operations:

- Source of Hire: When you have a large recruitment budget, you need to know exactly which channels are delivering the best candidates.

- Candidate Experience Score: With thousands of applicants every year, ensuring a positive experience is absolutely vital for protecting your employer brand.

- Cost-per-Hire: This is a non-negotiable metric for managing budgets and keeping global hiring functions efficient and accountable.

How Can an RPO Partner Help Strengthen Our Employer Brand?

A great RPO partner does so much more than just fill jobs. They become a powerful ambassador for your employer brand, carefully tailoring their approach to what each sector needs.

For a biotech company, an RPO partner is essentially a storyteller. They know how to communicate your unique scientific mission and potential for groundbreaking impact to passive candidates who aren’t even looking for a new role. By acting as a credible extension of your leadership, they can attract experts who might otherwise never have considered a smaller, lesser-known organisation.

For a large pharmaceutical company, the RPO’s job is to deliver brand consistency at an enormous scale. They standardise the candidate journey, making sure every single applicant has a professional and modern experience. They also run targeted employer branding campaigns to attract tech and data specialists, effectively bridging the perception gap for professionals who may not have thought a career in pharma was for them.

How Has Remote Work Changed the Geographic Scope of Hiring?

Remote work has completely redrawn the talent map for both sectors, but the challenges and opportunities look very different.

In biotech, it’s created a hybrid hiring puzzle. While remote work has opened up a global talent pool for computational and data-driven roles like bioinformatics, the core lab-based positions are still tied to physical research hubs. This means you have to compete globally for remote talent and, at the same time, fight fiercely on a local level for on-site scientists.

For pharmaceuticals, remote work has been a game-changer for corporate, commercial, and support functions. It has allowed big companies to find talent far beyond the usual metropolitan centres. The flip side? Competition has intensified dramatically. Pharma companies are now battling for the same remote talent as the tech, finance, and consulting industries. A skilled RPO provider is essential for navigating these complicated, multi-layered geographic dynamics.

At Taggd, we specialise in designing RPO solutions that tackle the distinct recruitment challenges in biotech and pharmaceuticals head-on. Discover how our expertise can help you secure the right talent to drive your organisation forward.