To get ahead of the skill gaps looming over the oil and gas industry, companies need a proactive, two-pronged strategy. This means aggressively upskilling the existing workforce in digital and specialised engineering competencies while, at the same time, deploying modernised recruitment tactics to bring in new talent. It’s a fundamental move away from reactive hiring toward strategic, long-term talent development.

The Dual Challenge Facing Oil and Gas Talent

The oil and gas industry is caught at a critical crossroads, squeezed between two massive forces: a demographic tidal wave and a technological revolution. This isn’t some far-off problem; it’s happening right now, impacting everything from operational stability to future growth. For CHROs, understanding this dual challenge is the first real step toward building a resilient organisation.

On one side, you have the “great crew change.” A huge portion of the workforce, the people with decades of hard-won institutional knowledge, is approaching retirement. This is creating a vacuum of experience that isn’t easy to fill. In India’s oil and gas sector alone, a staggering 27% of the workforce in oil, gas, and mining is aged 55 or older, signalling a retirement wave is imminent. You can see more data on core and energy sector hiring trends.

The Digital Disruption

At the exact same time, the industry’s rapid digital transformation is demanding skills that were barely on the radar a decade ago. Expertise in data science, AI-driven predictive maintenance, automation, and ESG reporting are now table stakes. The problem is, the available talent pool often hasn’t caught up.

This creates a dangerous disconnect:

- Legacy Knowledge Drain: As seasoned professionals hang up their hard hats, their hands-on expertise with complex machinery and operational nuances walks out the door with them.

- New Skill Scarcity: The next generation of workers, while digitally savvy, might not have the specific, high-tech engineering skills needed for today’s hyper-modernised rigs and refineries.

- Employability Gap: A worrying number of graduates just aren’t job-ready for these advanced roles, leaving critical positions open even with a large pool of applicants.

Before we dive deeper, it’s crucial to understand how these gaps translate into tangible business risks.

Table: Critical Skill Gaps and Their Business Impact

Here’s a quick look at the most pressing skill deficiencies in the Indian oil and gas sector and the direct fallout for business operations.

| Critical Skill Gap | Affected Operations | Business Impact |

|---|---|---|

| Data Analytics & AI | Predictive maintenance, reservoir modelling, production optimisation. | Increased downtime, inefficient resource extraction, higher operational costs. |

| Robotics & Automation | Drilling operations, pipeline inspection, safety monitoring. | Higher safety risks, reduced operational efficiency, inability to compete on cost. |

| Cybersecurity | Protection of control systems (SCADA), corporate data, and IP. | Vulnerability to operational shutdowns, data breaches, and regulatory fines. |

| ESG Competencies | Emissions monitoring, regulatory compliance, sustainable practices. | Reputational damage, loss of investor confidence, barriers to new projects. |

| Advanced Engineering | Subsea engineering, advanced materials, process simulation. | Inability to undertake complex projects, delayed timelines, cost overruns. |

These aren’t just HR problems; they are core business vulnerabilities.

This situation shifts the conversation about skill gaps from a simple HR line item to a major business risk.

When you can’t staff critical projects, or when operational downtime increases because you lack specialised maintenance skills, the talent gap becomes a direct and measurable threat to the bottom line. It affects everything from production targets to investor confidence.

Essentially, companies are fighting a war on two fronts. They have to find ways to capture and transfer the priceless knowledge of their departing veterans while simultaneously building a completely new set of digital skills to stay competitive. Focusing on just one of these won’t cut it. The path forward demands a deliberate plan that weaves together internal training, strategic recruitment, and the smart adoption of technology to bridge this widening chasm.

Pinpointing Your Unique Skill Deficiencies

Generic industry reports flagging talent shortages are a good starting point, but they won’t solve your specific operational headaches. To build a talent strategy that actually works, you have to shift from broad industry awareness to a precise internal diagnostic. This means rolling up your sleeves and conducting a proper skills gap analysis to see exactly what’s missing inside your own organisation.

You can’t build a strong future without a clear blueprint of the present. A thorough analysis means mapping your team’s current competencies against the skills you’ll need for future projects and strategic goals. We’re not just talking about today’s needs; this is about anticipating the demands of projects two, five, or even ten years down the road.

The first move is to get past assumptions. Many leaders think they know where their team’s weaknesses are, but the data often tells a completely different story. This process demands a systematic approach, using workforce analytics to get a real, unbiased picture.

Start with Competency Modelling

Competency modelling is the framework for your entire analysis. It’s all about defining the precise skills, knowledge, and behaviours needed for someone to succeed in your most critical roles. Don’t stop at technical abilities; you have to include the softer skills that truly drive project success, like collaborative problem-solving and cross-functional communication.

For example, a major upstream company gearing up for a new deepwater project might define its “Senior Subsea Engineer” competency model to include:

- Technical Proficiency: Advanced knowledge of ROV operations and subsea processing systems.

- Digital Skills: Expertise in using digital twin simulation software for performance modelling.

- Project Management: Proven ability to manage multi-million dollar budgets and coordinate international vendor teams.

- ESG Acumen: Deep understanding of marine environmental regulations and mitigation strategies.

Once you have clear competency models like this for your mission-critical roles, you can start accurately assessing your current workforce against these benchmarks.

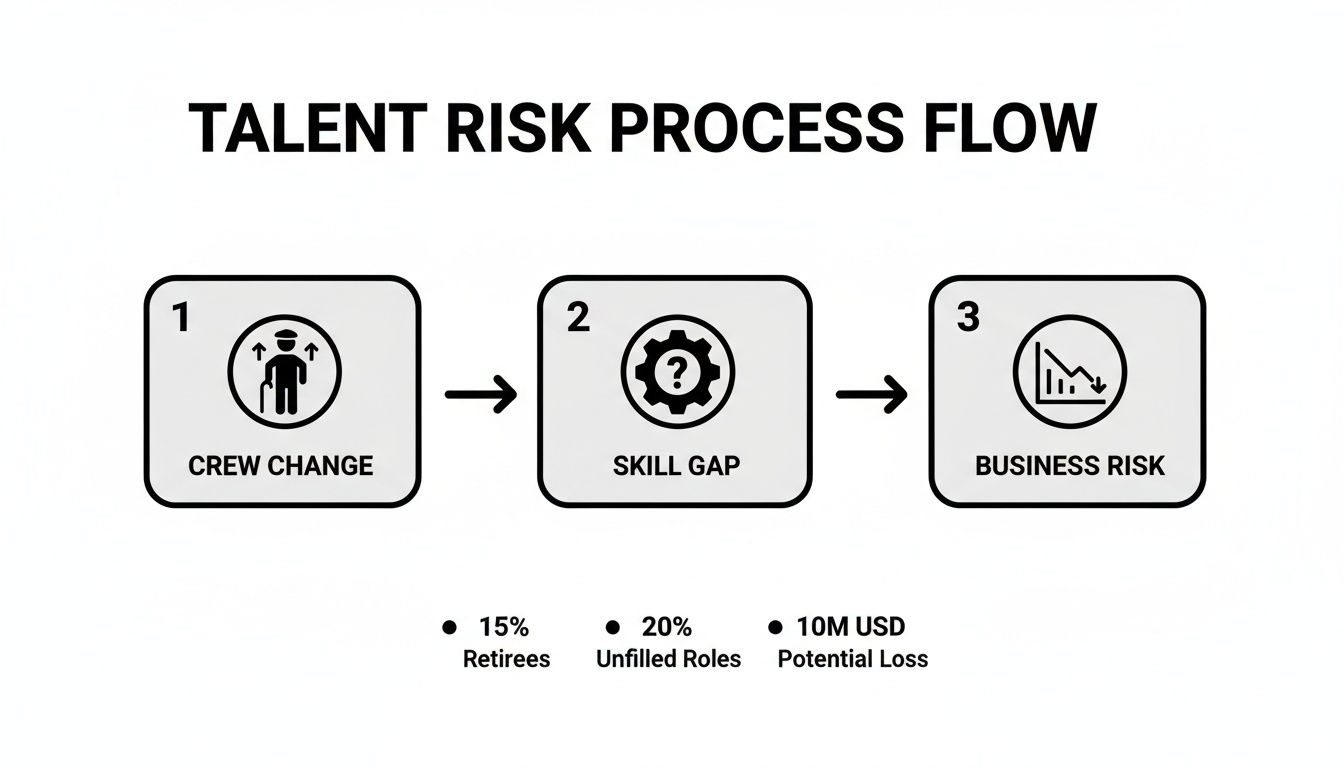

This visual shows the direct line from personnel changes and the resulting skill gaps to tangible business risks—a connection every CHRO has to get right.

The path from an ageing workforce to a skill deficiency and, finally, to operational risk is a critical chain of events that directly hits both productivity and safety.

Gather Actionable Data

With your framework in place, it’s time to collect the data. The goal here is to get a multi-faceted view of what your team can actually do. Relying on just one method won’t cut it; a combination almost always gives you the most accurate picture.

Consider what one mid-sized operator did. They suspected a looming shortage in predictive maintenance skills for their new automated facilities. Instead of a generic company-wide survey, they sent targeted questionnaires specifically to plant managers and senior engineers. This gave them granular data, revealing that while their team was great at traditional maintenance, fewer than 15% had any experience with the AI-driven diagnostic software they were about to install.

This isn’t just a data-gathering exercise. It’s about turning raw numbers into a clear, prioritised action list. Your analysis should end with a definitive statement of your most urgent skill gaps in oil & gas.

Here are some effective methods for getting this crucial data:

- Targeted Surveys: Ask employees and their managers to rate proficiency against the specific competencies you’ve already defined.

- Performance Reviews: Dig into existing performance data. Look for patterns that point to skill weaknesses across certain teams or departments.

- Skills Assessment Tools: Use validated, third-party platforms to test for specific technical skills, from cybersecurity protocols to data analytics.

- Focus Groups: Get your team leads and top performers in a room for structured conversations. This is where you’ll get qualitative insights into the real-world challenges they’re facing.

Blending quantitative and qualitative data like this creates a comprehensive and defensible analysis. It changes the conversation from “we think we have a problem” to “we have a 35% deficit in data analytics skills in our reservoir engineering team, which is delaying Project Alpha.” That’s the kind of specific, hard-hitting insight that drives focused action and secures the budget you need.

Building Upskilling Programmes That Actually Work

Once you’ve pinpointed the specific skill gaps across your teams, the most powerful and immediate move is to invest in the talent you already have. This isn’t about ticking boxes on generic training modules. Real, effective upskilling means designing focused, practical learning pathways that build tangible capabilities, boosting both employee retention and operational readiness.

Investing in your current team sends a clear signal: you value their contribution and see a long-term future for them within the organisation. It’s almost always faster and more cost-effective than trying to poach scarce talent from competitors, especially for those roles that need a blend of deep institutional knowledge and brand-new skills.

This approach directly tackles the challenge of bridging legacy operations with future demands, equipping your loyal workforce with the tools they need to succeed.

Design Customised Learning Pathways

One-size-fits-all training is a recipe for disengagement and wasted resources. Think about it: a veteran field operator and a recent engineering graduate have completely different starting points, even if they both need to get their heads around new automation systems. The answer is to create customised learning journeys tailored to specific roles, experience levels, and career stages.

Let’s look at two distinct examples:

- For Early-Career Engineers: The focus should be on foundational digital literacy and practical application. This could look like certifications in data analytics platforms like Tableau, modules on interpreting IoT sensor data, and hands-on project work using digital twin software.

- For Veteran Operators: Here, you need to emphasise the practical benefits of the new tech. Training could involve hands-on sessions with new automated control interfaces, virtual reality (VR) simulations for handling system failures, and modules showing how their deep expertise is critical for interpreting AI-driven maintenance alerts.

This targeted approach makes the training immediately relevant, which dramatically increases how well it’s adopted and the impact it has. To build a more versatile team, you might also want to explore the power of combination skills for upskilling and growth in your organisation.

The challenge is significant, especially in regions facing a stark disconnect between what’s taught in education and what the industry actually needs. India’s oil and gas sector, for example, is grappling with widening skill gaps in oil & gas digital operations. A concerning 56.35% of the workforce is considered employable for these modern roles. This is made worse by the fact that 80% of recruiters struggle to find candidates with real-world skills, a major bottleneck for the sector’s digitalisation efforts.

Leverage Specialised Ed-Tech Partnerships

Your internal L&D team doesn’t have to build everything from the ground up. Partnering with specialised educational technology platforms can give you instant access to high-quality, industry-vetted content and certifications in high-demand fields.

These platforms offer cutting-edge curricula in areas where your internal expertise might be thin, such as:

- AI-driven plant management

- Green energy technologies and carbon capture

- Advanced industrial cybersecurity

- Robotics and process automation

By bringing in these external resources, you can offer your employees best-in-class training that’s constantly updated to reflect the latest industry advancements.

The goal isn’t just course completion; it’s certified competency. When an employee earns a recognised certification in a high-demand area, it provides verifiable proof of their new skill set, building confidence for both the employee and the organisation.

Formalise Knowledge Transfer with Mentorship

One of the biggest risks of the “great crew change” is watching decades of unwritten, hands-on knowledge walk out the door. A formal mentorship programme is one of the most effective ways to make sure this critical expertise is passed down from your retiring experts to the next generation of leaders.

This needs to be more than just pairing a senior employee with a junior one. A structured programme should include:

- Clear Objectives: Define what the mentee should learn over a specific period. Is it understanding the nuances of a particular reservoir? Or mastering a complex negotiation process with suppliers?

- Structured Interactions: Schedule regular check-ins, “shadowing” opportunities on key projects, and even reverse mentoring sessions where junior employees can share their digital skills with senior leaders.

- Recognition: Acknowledge and reward the senior employees who step up as mentors. This reinforces a culture where sharing knowledge is a valued and celebrated part of the job.

By building robust upskilling, tapping into external expertise, and formalising mentorship, you create a powerful internal talent engine. This proactive strategy not only closes immediate skill gaps in oil & gas but also fosters a culture of continuous learning, which will dramatically improve employee engagement and long-term retention.

Modernizing Recruitment with an RPO Partner

When your internal upskilling programmes can’t move fast enough to fill every critical vacancy, you have to get smarter about how you bring in external talent. Let’s be honest, the old “post and pray” approach to hiring is a dead end for the highly specialised, in-demand roles that define today’s oil and gas sector.

This is exactly where a strategic partnership with a Recruitment Process Outsourcing (RPO) provider becomes a game-changer.

An RPO partner does more than just fill jobs; they embed themselves in your talent strategy, acting as an extension of your own HR team. They bring deep industry knowledge, extensive networks, and specialised sourcing technologies that most internal teams just don’t have the bandwidth or budget to maintain. It’s a way to tackle the most stubborn skill gaps with real speed and precision.

Adopting a Skills-First Hiring Model

One of the most powerful shifts an RPO partner helps you make is the move towards a skills-first hiring model. What does this mean? It’s about prioritising a candidate’s verified competencies and practical abilities over traditional credentials like university degrees or years of service. For an industry that has long relied on conventional career paths, this is a major—but necessary—evolution.

A skills-first approach instantly widens your talent pool. It allows you to look beyond the usual suspects and consider talented people from adjacent industries who have the core technical skills you need. This is something RPO providers excel at.

For instance, they might see that a data analyst from the financial sector has the perfect skill set to optimise reservoir modelling, or that an automation specialist from manufacturing can bring fresh insights to your drilling operations. This is a proactive way to inject new expertise into your organisation. You can find out more about the strategic advantages of recruitment process outsourcing and how it can reshape your talent acquisition efforts.

By focusing on what a candidate can do rather than where they’ve worked, you break free from the constraints of a shrinking talent pool. It’s about hiring for capability, not just for a familiar CV.

Reaching Niche Specialists with Advanced Sourcing

Your internal recruitment team is likely juggling dozens of roles across the entire organisation. They can’t possibly dedicate the time needed to hunt for a niche subsea robotics engineer or a carbon capture specialist. RPO providers, on the other hand, have dedicated teams and tools built for exactly this kind of surgical sourcing.

They use a mix of advanced techniques that go far beyond standard job boards:

- Deep Industry Networks: RPO teams are constantly mapping the market and building relationships with top talent—including passive candidates who aren’t actively job hunting but are open to the right opportunity.

- Targeted Digital Sourcing: They use sophisticated tools to search professional networks, technical forums, and industry-specific databases to find individuals with the precise skill combinations you need.

- Competitive Intelligence: A good RPO partner can give you valuable insights into what your competitors are offering for similar roles, helping you make sure your compensation packages are both attractive and effective.

This focused effort means they can find and engage the handful of qualified experts your internal team would struggle to even identify.

A Real-World Scenario in Action

Picture this: a company is launching a critical offshore project that requires an entire team of highly specialised subsea engineers. The timeline is tight—just six months. The internal HR team, already stretched thin, quickly realises they don’t have the network or niche expertise to staff these roles without causing serious project delays.

So, they bring in an RPO partner. Here’s how it plays out:

- Deep Dive & Strategy: The RPO team sits down with the project leaders to define the exact competencies needed for each role, creating incredibly detailed candidate profiles.

- Market Mapping: They immediately tap into their global network of subsea professionals, identifying and discreetly approaching top-tier talent in key regions.

- Efficient Screening: Using technical assessors, they conduct rigorous, skills-based interviews. This ensures only the most qualified candidates are presented to the hiring managers, saving everyone time.

- Accelerated Onboarding: The RPO partner manages the entire offer and negotiation process, streamlining paperwork and pre-onboarding checks to get the new team in place quickly.

The result? The company successfully staffs the entire team in just four months, beating the deadline by 33%. This not only prevents costly project delays but also ensures the team is composed of top-quartile talent. The return on investment is clear: reduced time-to-hire, a higher quality of talent, and the ability to execute a mission-critical project on schedule. This is the strategic power of a modern recruitment partnership.

Using Technology as a Talent Multiplier

Technology isn’t just the reason we have new skill demands; it’s also our best tool for building those very skills inside our own walls. When you integrate the right tech and forge smart partnerships, you can fundamentally change how you develop and attract talent.

It’s about building an ecosystem where learning is constant, personalised, and tied directly to your most urgent operational needs. This isn’t about just ticking training boxes. It’s about using technology to close existing skill gaps in oil & gas and build a workforce that’s ready for whatever comes next. The right tools don’t just teach—they multiply the potential of your people.

Deploying AI-Driven Learning Systems

The era of one-size-fits-all training catalogues is well and truly over. Today, AI-driven Learning Management Systems (LMS) can create highly personalised learning pathways for every single employee. Think of these platforms as a personal career navigator, assessing an individual’s current skills and then recommending the exact modules and resources needed to fill their specific gaps.

For example, imagine a junior process engineer who needs to get up to speed on predictive maintenance analytics. An intelligent LMS won’t just point them to a generic library. It can automatically assign foundational courses on data interpretation, then follow up with advanced simulations using real-world data from your own facilities. This makes the learning immediately applicable, not just theoretical.

This kind of personalised approach delivers huge benefits:

- Real-Time Skill Tracking: You get a live dashboard of your company’s competencies. You can see exactly where skills are growing and, just as importantly, where new gaps might be opening up.

- Increased Engagement: When training is directly relevant to someone’s job and career path, they are far more likely to actually engage with it and see it through.

- Efficient Resource Allocation: Your training budget gets focused where it will have the biggest impact, cutting out the waste on irrelevant or generic courses.

This isn’t just an efficiency play. It’s about building a smarter, more capable organisation from the inside out.

Forging Industry-Academia Collaborations

One of the smartest long-term moves for building a sustainable talent pipeline is to work directly with the institutions that are shaping the next generation. Proactive collaborations between industry and academia allow you to influence curricula, ensuring graduates walk into the workforce with the practical, job-ready skills you desperately need.

You’re essentially co-creating your future talent pool. Instead of just waiting to see who applies for a job, you can partner with top engineering universities to develop specialised courses on subsea robotics or carbon capture technologies. This gives you a direct line to the brightest students and dramatically cuts down the time it takes for a new hire to become a productive team member.

By shaping the curriculum, you are essentially pre-skilling your future employees. This transforms universities from simple recruitment sources into strategic talent development partners, creating a reliable pipeline of professionals who are ready to contribute from day one.

A fantastic real-world example is sponsoring a university’s digital twin laboratory. Your company provides the software and project data, and the university integrates it into their final-year engineering programme. The students get invaluable hands-on experience, and you get to cherry-pick the top performers who are already trained on your systems.

This kind of partnership is a true win-win. It strengthens the university’s programmes, makes students more employable, and gives your company a steady flow of qualified, pre-vetted talent—tackling the core challenge of finding people with the right mix of knowledge and practical skills head-on.

Measuring the ROI of Your Talent Strategy

You’re investing heavily in upskilling, recruitment, and new tech. It’s a massive commitment. But how do you actually prove it’s paying off? A data-driven approach to measuring the return on investment (ROI) of your talent strategy is no longer a nice-to-have; it’s non-negotiable. This is how you shift the conversation from HR being a cost centre to a clear driver of business value.

This isn’t about fuzzy metrics or numbers that just look good on a slide. It’s about drawing a direct, undeniable line from your talent initiatives to tangible business outcomes. When you can prove that value, you secure future budgets, earn your seat at the leadership table, and create a cycle of improvement that builds real workforce resilience against future skill gaps in oil & gas.

Defining Your Key Performance Indicators

First things first, we need to move beyond simple completion rates. It’s great that 90% of employees finished a training course, but that number tells you absolutely nothing about its impact on the ground. Instead, your focus should be on KPIs that are tied directly to operational performance and, ultimately, the bottom line.

A solid measurement framework needs a mix of leading and lagging indicators:

- Time-to-Competency: How quickly are new hires or recently upskilled employees hitting full productivity? A drop in this number is a direct win. It shows your onboarding and training are getting sharper and more effective.

- Retention Rates in Critical Roles: Are you holding onto the specialists you’ve poured resources into? High retention in crucial roles like subsea engineering or data science is a powerful sign that your development programmes are hitting the mark.

- Internal Mobility Rates: How many senior or specialised roles are you filling from within? A rising internal fill rate is proof positive that your upskilling programmes are building a sustainable talent pipeline.

These metrics paint a clear, quantifiable picture of how well your strategy is building capability from the inside out.

Connecting Talent Initiatives to Business Outcomes

This is where your measurement strategy really gains its power. You have to connect your HR metrics to the core operational and financial metrics that the rest of the C-suite lives and breathes. It’s about translating talent development into the language of your CFO and CEO.

Think about a real-world scenario. Let’s say you’ve just rolled out a major upskilling programme for your plant operators, focusing on predictive maintenance with new AI software. Tracking course completions is easy, but it’s not the goal. The real goal is to measure the operational impact.

The true measure of success isn’t that an operator finished a training module. It’s seeing a measurable increase in operational uptime and a direct decrease in unplanned maintenance costs, all because of the skills they learned.

To forge this link, you need to track specific business outcomes before your initiative kicks off and then measure them again afterwards.

Table: Linking Training to Tangible Business Impact

| Talent Initiative | HR Metric to Track | Business Outcome to Measure |

|---|---|---|

| Upskilling plant operators in predictive maintenance | Certified competency in new diagnostic software. | 15% reduction in unplanned equipment downtime. |

| RPO partnership to hire subsea engineers | Decreased time-to-hire for critical project roles. | Reduction in project delays caused by talent shortages. |

| Mentorship for junior geologists | Faster progression to senior-level responsibilities. | Improved accuracy in reservoir modelling and exploration success rates. |

This kind of data-driven proof shows that your talent strategy isn’t just an HR activity—it’s a core driver of operational excellence and profitability.

Creating a Continuous Improvement Loop

Measuring ROI isn’t a one-and-done report you create once a year. It should be the engine for a continuous improvement loop. The data you collect must feed directly back into your strategy, helping you fine-tune your programmes and double down on what’s delivering results.

If you find that a particular VR training module is dramatically cutting down safety incidents, you have an airtight business case for expanding it across the organisation. On the flip side, if an upskilling path isn’t moving the needle on performance, you have the hard data you need to pivot and reinvest those resources where they’ll make a real difference.

This iterative process keeps your talent strategy agile and tightly aligned with the shifting needs of the business. By proving its value with hard numbers, you not only build a more resilient workforce but also a powerful, data-backed case for continued investment in your people.

Closing the skill gap requires a strategic, multi-faceted approach, and the right recruitment partner can make all the difference. At Taggd, we specialise in RPO solutions that connect oil and gas companies with the niche talent needed to drive future success. Discover how our skills-first hiring model can build your resilient workforce at https://taggd.in.