A Complete Guide to Accrued Leave in India

Accrued leave is a form of paid time off that employees earn over time, based on their service. You can think of it as a ‘leave savings account’ where time is deposited with every pay period or year of work. It has become a core component of employee compensation in India.

What Is Accrued Leave in the Indian Workplace?

At its heart, accrued leave is a system designed to reward employee loyalty and tenure. Unlike a fixed chunk of time off handed out at the start of the year, this type of leave builds up progressively. This earned time is a fundamental right that gives employees much-needed breaks for rest, holidays, and personal matters, playing a huge role in their work-life balance and overall well-being.

In the Indian context, what most people call “accrued leave” is better known as Earned Leave (EL) or Privileged Leave (PL). It’s important to distinguish this from other leave types, like Sick Leave (SL) or Casual Leave (CL), which are meant for different purposes and have their own set of rules.

- Earned Leave (EL/PL): This is your main accrued leave, intended for holidays and planned time off. It has to be earned through service and is generally payable as cash when an employee leaves the company.

- Casual Leave (CL): Meant for sudden personal emergencies, CL is usually a fixed number of days per year and often can’t be carried forward to the next year.

- Sick Leave (SL): This is specifically for health-related absences. Much like CL, it’s typically a fixed annual amount and isn’t something you can encash.

Understanding this distinction is critical. Earned leave is a vested benefit—it’s an asset the employee accumulates over time. This structure ensures that long-serving team members are rewarded with more opportunities to rest and recharge, directly linking their tenure to tangible benefits.

The Legal Foundation of Earned Leave

The entire framework for this benefit is deeply embedded in India’s labour laws. The Factories Act of 1948, for instance, lays down specific accrual rates for workers. In India, the law states that workers are entitled to one day of paid leave for every 20 days worked, which works out to about 15 days of annual leave.

To even be eligible, an employee must have worked for at least 240 days in a calendar year, tying the benefit directly to sustained employment. To get the finer details right, you can explore more about these specific leave regulations and their calculations to ensure your policies are fully compliant.

At its core, accrued leave functions as a commitment between an employer and employee. It acknowledges that consistent work earns the right to rest, making it a powerful tool for fostering loyalty and preventing burnout.

Getting a firm grip on these fundamentals is the first step for any CHRO aiming to build a fair and compliant leave management system. It’s not just about tracking days off; it’s about recognising and rewarding the continuous effort of your workforce.

Core Components of Accrued Leave in India

To help clarify these ideas, I’ve put together a simple table breaking down the core components that define accrued leave policies in India. Think of it as a quick reference guide for HR leaders.

| Component | Description | Common Standard |

| Purpose | Intended for planned time off, such as vacations, personal events, or rest. | Vacation and personal use. |

| Eligibility | Typically begins after a minimum service period, often 240 days in a calendar year. | Based on sustained employment, not short-term roles. |

| Accrual Rate | The rate at which an employee earns leave (e.g., per month, per year). | 1 day per 20 days worked, or 1.25-1.5 days per month. |

| Encashment | The process of paying out unused earned leave, usually at the time of resignation or retirement. | Legally mandated for earned leave. |

With these foundational elements in place, you can start designing a leave policy that not only meets legal requirements but also supports your employees’ well-being and strengthens your company culture.

How to Calculate Accrued Leave Balances Correctly

Figuring out accrued leave doesn’t need to feel like you’re solving a complex maths problem. When you have the right system, it becomes a simple, transparent process for you and your employees. The trick is to understand the different ways you can credit leave and then pick the one that fits your company’s operational rhythm.

Think of it like putting money into a savings account. You could make one big deposit at the start of the year or add smaller amounts regularly. Both methods get you to the same end goal—a healthy balance—but the timing is what makes them different.

Let’s look at the common approaches used in India.

The Annual Lump-Sum Method

The most straightforward way is to credit the entire year’s leave entitlement at once. This is usually done on the first day of the calendar or financial year, giving employees their full leave balance right from the get-go.

- How it works: If an employee is entitled to 15 days of earned leave, all 15 days appear in their account on January 1st.

- Best for: Companies looking for administrative simplicity. It also empowers employees by giving them the flexibility to plan longer holidays early in the year.

- Consideration: You’ll need crystal-clear policies for new hires who join mid-year and for employees who leave before the year is up. In these cases, you’ll have to prorate their entitlement to be fair.

While this method is direct, it does require careful management when an employee exits to make sure you don’t end up paying for unearned time off.

The Per Pay Period Method

A far more common and dynamic approach is to accrue leave with each pay cycle, usually monthly. This method directly ties leave earning to the service an employee provides during that period. It’s essentially a “pay-as-you-go” model for time off.

This is arguably the most popular method in Indian companies. It aligns perfectly with payroll processing, making it predictable and much easier to manage from a financial standpoint. It also neatly avoids situations where a new employee takes a full year’s worth of leave and then resigns a month later.

To work this out, you just divide the total annual leave by the number of pay periods in a year.

Formula: (Total Annual Leave Days) / (Number of Pay Periods in a Year) = Leave Accrued Per Period

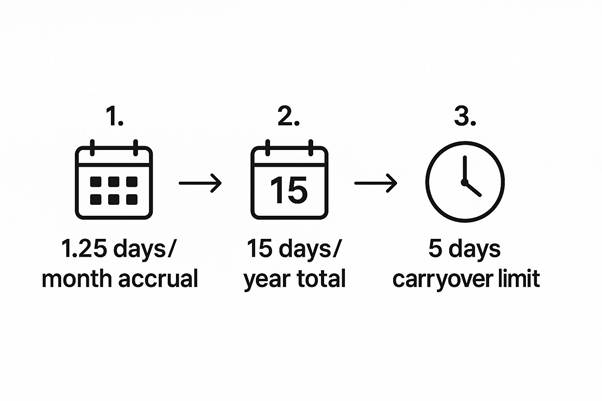

For a standard monthly payroll and an entitlement of 15 days: (15 Days) / (12 Months) = 1.25 days of accrued leave per month.

The infographic below shows how this typically works for an Indian company, illustrating how small monthly gains build up to a yearly total and are subject to carry-over rules.

This visual shows just how a steady, monthly accrual creates a leave balance that’s predictable and easy for everyone to manage.

The Daily or Hourly Method

The most detailed method involves calculating leave accrual on a daily or even hourly basis. While it’s less common for salaried employees in India, this approach is crucial for contract workers, part-time staff, or in industries where work hours can vary wildly.

It delivers the highest level of accuracy because leave is earned for the exact amount of time an employee has worked.

- Calculate the Annual Accrual Rate: First, convert the total annual leave days into an hourly rate.

- Apply to Hours Worked: Then, multiply this rate by the number of hours an employee has put in during a specific period.

This method really depends on having a robust HRIS or payroll system to track hours accurately and automate the sums, otherwise the administrative work can be overwhelming. As more companies embrace a flexible workforce, getting to grips with these granular calculations is becoming increasingly important. You can discover more about the latest talent and workforce trends in the India Skills Report 2023.

Navigating the Legal Rules for Accrued Leave

It’s one thing to create a leave policy that feels fair and keeps your team happy. It’s another thing entirely to make sure it’s legally airtight. In India, leave policies aren’t just a matter of company preference—they are governed by a network of central and state-level laws that establish the absolute minimum standards for every employer.

For any CHRO, getting to grips with this legal framework is step one in managing risk. A policy that misses the mark can trigger serious penalties, spark legal battles, and tarnish your company’s reputation. It’s absolutely essential to build your leave structure on a solid foundation of compliance.

The Key Labour Laws to Know

In India, two main types of legislation call the shots on accrued leave. While they operate on similar principles, how they apply depends on your industry and where your business is located. A one-size-fits-all approach is a recipe for non-compliance.

- The Factories Act, 1948: This central law covers any business defined as a ‘factory’. It sets the floor for earned leave, requiring that any adult worker who has put in at least 240 days in a calendar year is entitled to paid leave.

- State-Specific Shops and Establishment Acts: For businesses outside the Factories Act—think most offices, IT companies, and retail stores—these state-level laws take over. Each state has its own act, which means you’ll see variations in the rules from one office location to another.

For example, the rules for leave entitlement and carry-forward in Maharashtra can be quite different from those in Karnataka or Delhi. This makes it crucial for companies with a multi-state footprint to localise their HR policies and ensure compliance everywhere they operate.

Core Legal Mandates for Your Policy

Despite the regional differences, a few core principles are consistent across the board. Your accrued leave policy must address these three areas to stay on the right side of the law. Think of them as your non-negotiables.

- Minimum Entitlement: The law dictates a baseline for how many leave days an employee must earn. The Factories Act sets this at one day of leave for every 20 days worked. Most Shops and Establishment Acts follow a similar pattern, resulting in a typical base of about 15-18 days of earned leave per year.

- Carry-Forward Rules: Employees don’t always use up all their leave, and the law accounts for this. It allows them to carry forward unused accrued leave to the following year. The Factories Act caps this accumulation at 30 days, but state laws often have their own specific limits.

- Encashment on Exit: This is a fundamental employee right. When an employee leaves the company, for any reason, you are legally obligated to pay out their entire unused earned leave balance. This is not open to negotiation.

A robust and transparent leave policy is more than just a benefit; it’s a reflection of a company’s commitment to ethical practices. Ensuring compliance also helps build a culture of trust, which can be supported by clear communication channels. For more on this, you might be interested in our guide on establishing an effective whistle-blower policy.

Looking at the broader picture in India, employees typically accrue between 15 and 18 days of annual leave each year, based on the one-day-for-every-20-days-worked formula. On top of that, Indian workers generally receive about 7 to 12 days of sick leave annually. However, sick leave is often capped and doesn’t usually carry forward. For more details on these norms, you can review further employee benefits research for India.

Designing a Competitive Accrued Leave Policy

A truly effective accrued leave policy does a lot more than just tick legal boxes; it acts as a powerful magnet for attracting and keeping the best people. In a competitive talent market, the way you handle time off speaks volumes about your company culture. It’s a strategic balancing act—designing a policy that’s both generous to your team and sustainable for the business.

This isn’t just some administrative task to be checked off a list. It’s a real opportunity to show your employees you value their well-being and trust them to manage their own time. A clear, well-structured policy prevents confusion, guarantees fairness, and becomes a cornerstone of a positive work environment.

Let’s walk through the essential components you’ll need to define to build a policy that is clear, fair, and works for both your employees and your bottom line.

Defining Your Policy’s Core Elements

To avoid any grey areas, your accrued leave policy document needs to be specific and thorough. Every single employee should be able to read it and know exactly what they’re entitled to and how the whole process works. Think of it as a user manual for taking well-deserved breaks.

Here are the key pillars you absolutely have to define:

- Eligibility: Clearly state who is eligible for accrued leave and when their entitlement kicks in. Do new hires start accruing from day one, or is it after their probation period? Be explicit to head off any misunderstandings down the road.

- Accrual Rate: Specify precisely how much leave is earned and how often it’s credited to their account. For example, “1.25 days of leave accrued per completed month of service.” This kind of precision leaves no room for misinterpretation.

- Maximum Accrual Cap: You must set a limit on the total amount of leave an employee can bank. This is absolutely crucial for managing your financial liability, as uncapped leave balances can quickly become a significant hidden cost.

- Leave Request Procedure: Outline the exact steps an employee needs to follow to request time off. Who do they notify? How much advance notice is required? Is there a specific system or form they need to use?

A well-defined policy is your first line of defence against disputes. It ensures rules are applied consistently across the organisation and shows you’ve thought through the details, cementing your commitment to a fair process for everyone.

Setting Carry-Over and Encashment Rules

Two of the most critical parts of any accrued leave policy are what happens to unused time at the end of the year and when an employee decides to move on. Getting these rules right is non-negotiable for both compliance and smart financial planning.

The rules for carrying leave over from one year to the next must be crystal clear. While Indian law mandates a minimum carry-over, many companies choose to offer more generous terms as a competitive perk. A typical policy might state something like, “Employees can carry over a maximum of 30 unused leave days into the next calendar year.”

An attractive leave policy is a key differentiator in the war for talent. Going beyond the statutory minimums signals that you are an employer of choice, invested in employee health and work-life balance.

Similarly, your policy has to detail the rules for leave encashment. Legally, you are required to pay out all unused earned leave when an employee leaves the company. Your policy should state this clearly and explain how the final amount will be calculated—usually based on their last drawn basic salary. A transparent policy here builds trust and shows a commitment to fair and ethical employee relations. For those aiming to build a top-tier workforce, understanding what motivates top talent is key. You can explore what today’s best candidates are looking for on our careers page.

Policy Design Checklist for Accrued Leave

Crafting a robust policy from the ground up can feel like a massive task. To make it easier, we’ve created this checklist. It breaks down the essential elements to consider, helping you create or update a policy that is both compliant and compelling for your workforce.

| Policy Element | Key Consideration | Compliance Note |

| Accrual Method | Will leave be credited monthly, annually, or daily? | Monthly accrual is often the fairest and easiest to manage financially. |

| Minimum and Maximum Leave | Define rules for taking leave. Is there a minimum (e.g., half-day) or maximum (e.g., 15 consecutive days) limit? | Ensure these limits don’t indirectly stop employees from using their earned leave. |

| Approval Workflow | Who approves leave requests? What’s the expected turnaround time for a decision? | A clear, multi-level approval process prevents operational bottlenecks. |

| Blackout Periods | Are there any business-critical periods (e.g., year-end closing) when leave is restricted? | Communicate these periods well in advance and provide a clear business reason. |

By thoughtfully addressing each of these points, you can design a policy that not only meets legal requirements but also becomes a valuable part of your employee value proposition, helping you attract and retain the people who will drive your business forward.

Managing Leave Encashment and Carry-Forward

Once you’ve sorted out your accrual rates and how employees request time off, the next puzzle piece is figuring out what to do with any accrued leave that’s left over. This is where two concepts, leave encashment and carry-forward, enter the picture. For most HR leaders, this is where things get tricky, as you have to balance what your employees want with what the company can financially handle.

Get this part wrong, and you could be looking at a significant financial liability hiding on your balance sheet, or even operational chaos. But if you create clear, well-communicated rules for both, you can give your team valuable flexibility while keeping a firm grip on your budget and workforce planning. It’s a delicate balance, but an absolutely essential one to strike.

Understanding Leave Encashment

At its core, leave encashment is the process of paying an employee for their unused earned leave. You can think of it as the company buying back the paid time off an employee earned but didn’t use. In India, this isn’t just a “nice-to-have” perk; under certain circumstances, it’s a legal obligation.

The most common situation where encashment is mandatory is during an employee’s final settlement. Whether an employee resigns, is let go, or retires, the company is required to pay out the entire balance of their unused earned leave. This is a non-negotiable part of their final payment. Some organisations also offer the choice to encash leave every year, but this is a policy decision, not a legal requirement.

Figuring out the payout is quite straightforward. It’s usually calculated based on the employee’s most recent salary.

Calculation Formula: (Last Drawn Basic Salary + Dearness Allowance) / 30 * Number of Unused Earned Leave Days

This ensures the payment fairly reflects the value of the leave at the time the employee leaves the company.

The Importance of Carry-Forward Limits

While encashment deals with leave at the end of employment, carry-forward rules manage the balance from one year to the next. Carry-forward lets employees roll over their unused accrued leave into the following year. It’s a great way to ensure they don’t lose a hard-earned benefit just because they couldn’t take time off.

However, letting employees carry forward leave indefinitely is a huge financial risk. A constantly growing leave balance for every employee creates a large and unpredictable liability on your books. Indian labour laws recognise this and set limits. The Factories Act, for example, puts a cap on carrying forward earned leave at 30 days. Many state-level Shops and Establishment Acts have similar restrictions.

Setting an internal cap on carry-forward isn’t just good practice—it’s vital for financial stability. It also nudges employees to take regular breaks, which is great for their well-being and prevents a massive payout liability from building up over the years.

Managing these leave balances proactively is a key responsibility. The financial and operational weight of accrued leave in India is substantial. On average, the cost of leave benefits can make up as much as 16.75% of total payroll expenses, showing just how significant this component of employee compensation is. You can find more insights on leave-related employment costs in India.

Best Practices for Your Policy

To build a system that is fair for employees, legally compliant, and financially smart, your policy should be built on a few core best practices. These will help you dodge common mistakes and create a structure that works for everyone.

- Be Explicit in Your Policy: Don’t leave anything to interpretation. Clearly document your rules for both encashment and carry-forward. State the maximum number of days that can be rolled over and lay out the exact formula for encashment payouts.

- Communicate Regularly: Don’t wait until the end of the year to talk about leave. Send out quarterly reminders encouraging employees to plan their holidays. This simple step can prevent the last-minute scramble of leave requests in December.

- Automate Tracking: Use a modern HRIS to handle leave tracking automatically. Giving employees a self-service portal to check their own balances builds trust, makes them feel more in control, and cuts down on administrative tasks for your HR team.

By tackling these elements head-on, you can turn your leave policy from a simple administrative chore into a strategic tool that boosts employee well-being while protecting the company’s financial health.

Common Questions About Accrued Leave in India

Even with a detailed guide in hand, the day-to-day realities of managing leave policies can throw up some tricky questions. This final section tackles some of the most common queries we hear from both employers and employees across India. Think of it as your quick-reference guide for those lingering points of confusion.

Our goal here is to get straight to the point, clearing up common misunderstandings and reinforcing the core principles of fair and compliant leave management. With these answers, you’ll be better equipped to handle leave situations with confidence.

One of the first hurdles is often just understanding how different leave types work together. It’s a common misconception among employees that all time off falls under one big umbrella, but the system is far more nuanced. The purpose behind each type of leave is what really dictates its rules.

What is the difference between accrued leave and sick leave?

Accrued leave, which you’ll usually see called Earned Leave (EL) or Privileged Leave (PL) in India, is time off that an employee earns as a direct reward for their service. It’s meant for planned events like a family vacation or personal commitments. This leave is a vested benefit—it has a real monetary value, can often be carried over into the next year, and is paid out when an employee leaves the company.

Sick Leave (SL), however, is a different beast entirely. It’s a fixed amount of time off given specifically for health reasons. You don’t “earn” it based on days worked in the same way as EL. Its sole purpose is recovery from illness, which is why unused sick leave typically expires at the end of the year and can’t be encashed.

The real difference comes down to purpose and value. Think of Earned Leave as a form of deferred payment for rest and recreation, while Sick Leave is a safety net for your health.

Getting this distinction right is crucial for both writing policy and communicating it to your team. When everyone understands that EL is for planned rest and SL is for unplanned illness, it prevents misuse and helps keep your workforce healthy and productive. Your policy document should spell this out in black and white to avoid any confusion.

Can a company refuse to pay for unused accrued leave?

In a word: no. Under Indian labour laws, accrued or earned leave is legally considered part of an employee’s wages. It’s a right they have earned through their service.

This means that whether an employee resigns, is laid off, or retires, the company is legally required to pay them for all the unused earned leave in their account. This payout is a non-negotiable part of the final settlement process.

– Protected Benefit: This legal protection is specifically for earned leave (EL/PL).

– Non-Encashable Leave: This rule generally doesn’t apply to other leave types like sick or casual leave, which usually can’t be encashed and simply lapse if unused.

Failing to pay out the earned leave balance is a direct violation of labour laws. It can expose the company to legal action and hefty penalties, highlighting just how important it is to track leave accurately and budget for this liability.

Do employees on probation accrue leave?

Yes, absolutely. Employees start accruing leave from their very first day on the job, even during their probationary period. The right to earn leave is tied to service, and probation is part of that service. Legally, the clock starts ticking on day one.

However, a company can set its own policy about when an employee can start using that accrued leave. It’s very common for organisations to have a rule that employees can only start taking their earned leave after they have successfully completed their probation.

This is a subtle but important distinction: earning leave is a statutory right, but the timing of when you can take it is a matter of company policy. Make sure this is clearly stated in the employment contract and covered during onboarding to avoid any confusion with new hires.

How do public holidays affect an accrued leave request?

Public holidays are completely separate from an employee’s personal accrued leave balance. They are a statutory entitlement and should never be deducted from an employee’s earned leave.

If a declared public holiday falls during an employee’s approved leave period, that day should not be counted as a day of leave.

For example, if an employee takes a week off from Monday to Friday, and Wednesday is a public holiday like Diwali or Independence Day, you should only deduct four days from their accrued leave balance, not five. This practice is a critical part of fair and compliant leave management, making sure employees get the full benefit of both their earned time off and public holidays.

At Taggd, we understand that managing the complexities of HR, from leave policies to talent acquisition, is crucial for building a world-class team. Our Recruitment Process Outsourcing solutions are designed to handle these challenges, allowing you to focus on strategic growth.