Your Guide to Understanding Back Pay in India

Think of back pay as a delayed payment for work you’ve already done. Simply put, it’s the money you are owed when you’ve been paid less than your rightful salary, and it’s a critical issue of fair compensation.

What Is Back Pay And Why It Matters

Here’s a simple analogy: imagine you discover your utility company has been overcharging you for months. Once you prove the error, they have to refund you the difference. Back pay works on the same principle, but instead of a refund, it’s about getting the wages that were rightfully yours all along.

This isn’t just some minor clerical error; it’s a fundamental crack in the employer-employee relationship. It means an employee didn’t receive their full, correct wages for a period, which is a big deal. Understanding this is the first step for any employee to recognise if they’ve been short-changed and claim what they’re owed.

For employers, getting to grips with the ins and outs of back pay is just as vital. It’s all about staying on the right side of labour laws, building trust with your team, and dodging potentially massive legal headaches down the road.

Common Scenarios That Can Lead To Back Pay Claims

A whole host of situations can trigger a back pay claim. It’s important to remember that these aren’t always intentional moves by an employer. Sometimes, they’re the result of simple admin slip-ups or a misunderstanding of complicated pay rules. But the reason doesn’t change the reality: an employee is due money for their work.

Back pay is essentially a course correction. It’s designed to make an employee “whole” by giving them the compensation they should have received in the first place, squaring things up legally and contractually.

To help you spot potential issues, we’ve outlined some of the most frequent situations where back pay becomes necessary. Recognising these scenarios can help employees identify discrepancies and empower employers to put preventative measures in place.

Common Scenarios That Can Lead to Back Pay Claims

| Scenario | Brief Explanation |

|---|---|

| Delayed Pay Scale Revisions | A government-mandated wage hike (like a Dearness Allowance adjustment) isn’t implemented on time, creating a gap between the effective date and the implementation date. |

| Payroll Processing Errors | Simple human mistakes, such as incorrect data entry, miscalculating hours, or software glitches that result in underpayment. |

| Misclassification of Employees | An employee is incorrectly labelled as an independent contractor, often to avoid paying overtime, benefits, or minimum wage. |

| Unpaid Overtime | An employee works more than their standard hours but isn’t compensated at the legally required overtime rate (often 1.5 times the regular pay). |

| Wrongful Termination | A court rules an employee was fired unlawfully and awards damages, which often include the wages they would have earned from termination to the judgement date. |

Let’s dig a little deeper into these common causes. Being aware of them is the best defence for everyone involved.

The Legal Framework for Back Pay in India

When an employer fails to pay you correctly, it’s not just poor form—it’s a violation of Indian law. Your right to the correct wage is a legal entitlement, and when a payment shortfall results in back pay, your employer is breaking established statutes. This legal framework is in place to ensure your hard work is always fairly compensated.

Think of these laws as the official rulebook for compensation, one that both employers and employees must follow. They establish clear, non-negotiable expectations for timely and accurate wage payments, forming the very foundation of employee pay rights in India.

Key Laws Governing Timely Wages

The most critical laws in this area are designed to prevent wage disputes before they even begin. By setting minimum standards and strict payment deadlines, they leave no room for ambiguity.

Two of the most important acts that protect your earnings are:

- The Payment of Wages Act, 1936: This cornerstone law is all about ensuring wages are paid on time and without any unapproved deductions. It mandates a regular pay schedule, making it illegal for employers to delay payments indefinitely.

- The Minimum Wages Act, 1948: This act guarantees a baseline income for employees in specific industries. When the government revises these minimum wage rates upwards, employers are legally required to adjust salaries to match.

If an employer doesn’t implement a revised pay scale from its effective date, the difference owed to employees builds up. This accumulated amount is what we call back pay, and it creates a direct legal liability for the company. With the average monthly salary reaching 21,103 INR in the second quarter of 2024, even small delays in revisions can lead to significant arrears. You can dive deeper into these figures in the full report on Indian wage statistics.

The legal obligation is crystal clear: when wage rates are officially updated—whether through minimum wage hikes or Dearness Allowance (DA) adjustments—employers must act. Any delay in putting these changes into practice automatically results in a back pay liability.

Consequences of Non-Compliance

Failing to meet these legal obligations is a serious matter with real repercussions for employers. The law isn’t just a friendly suggestion; it has teeth. Labour authorities take non-compliance very seriously, and the financial penalties can be substantial.

These consequences are designed to do more than just punish; they act as a strong deterrent against payroll negligence and reinforce the importance of getting payments right the first time.

For example, an employer found in violation might have to pay the full back pay amount plus additional compensation or interest for the delay. In more serious cases, authorities can levy hefty fines. This powerful legal backing empowers you, the employee, by providing a clear and enforceable path to recover any wages you are rightfully owed.

How To Calculate The Back Pay You Are Owed

Trying to figure out the exact amount of back pay you’re owed can feel intimidating, but it really just boils down to a clear, step-by-step process. By breaking it down, you can put together a solid and accurate calculation for your claim. The main idea is simple: find the difference between what you should have been paid and what you actually received.

This process starts with defining the specific timeframe when you were underpaid. This is often called the lookback period. It kicks off on the date the underpayment first happened and ends on the day the mistake was corrected—or should have been.

Identify the Correct Pay Rate

Once you’ve locked down the lookback period, your next job is to pin down your correct rate of pay for that time. This could be a new minimum wage that the government mandated, a revised pay scale from a company-wide update, or simply the salary you both agreed to in your employment contract.

Start gathering any documents that prove this correct rate, such as:

- An official government notification about a wage increase.

- A company memo announcing new pay scales for everyone.

- Your official offer letter or employment agreement.

Having this paperwork is absolutely vital. It forms the factual foundation for your entire back pay calculation, removing any guesswork and making your case much stronger. If you’re reporting a wider, systemic issue of underpayment at your company, it’s also smart to know your rights. You can learn more about how a proper whistle-blower policy can offer protection in these kinds of situations.

Compare and Calculate the Difference

Now for the main event—the calculation itself. For every single pay period within that lookback window, you’ll need to compare your correct earnings with the amount you were actually paid.

Let’s walk through an example. Suppose the government updated the minimum wage, and your hourly rate was supposed to jump from ₹150 to ₹175, effective from 1st January. But, your employer didn’t update the payroll system until 1st April.

- Determine the lookback period: This would be from 1st January to 31st March (a total of 3 months).

- Calculate the monthly shortfall: Let’s say you work 160 hours per month. The difference is ₹25 per hour (₹175 – ₹150). That means the monthly shortfall is ₹4,000 (₹25 x 160 hours).

- Calculate the total back pay: Over the three months, the total amount owed comes to ₹12,000 (₹4,000 x 3 months).

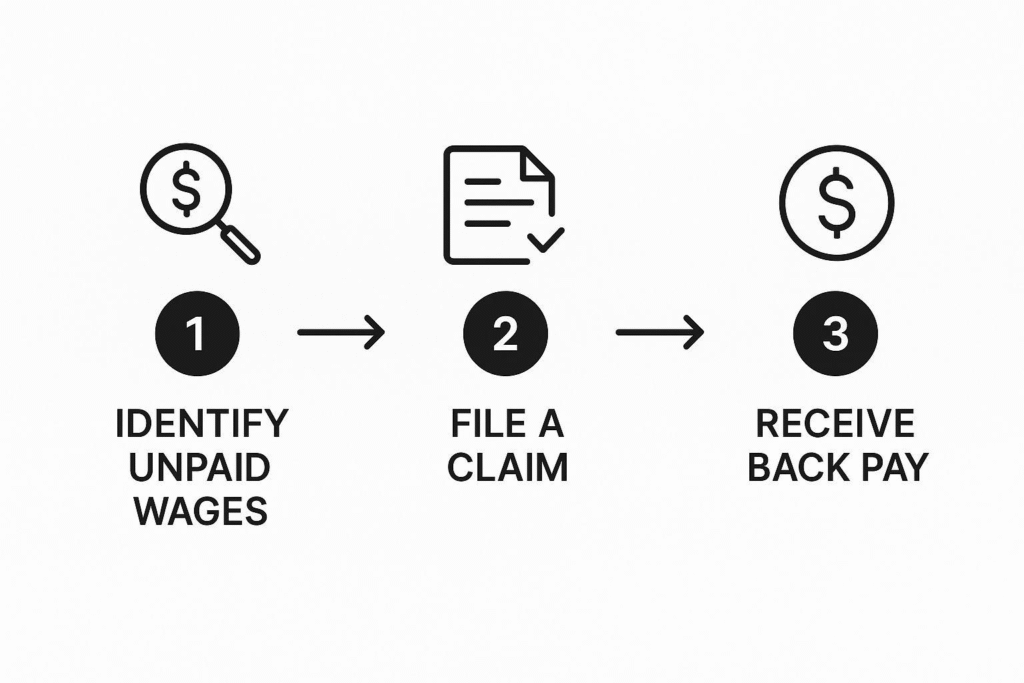

This process maps out the journey, from spotting the problem to getting the money you’re rightfully owed.

This infographic simplifies the path, showing that once you’ve identified unpaid wages, the logical next steps are filing a formal claim and, ultimately, receiving your back pay.

Factor In All Compensation Components

But hold on—back pay isn’t just about your basic salary or hourly wage. A complete calculation has to include every part of your compensation that was hit by the incorrect pay rate.

A true back pay calculation should make you financially whole. This means accounting for all earnings you missed out on, including overtime, allowances, and any performance-based bonuses tied to your rate of pay.

Make sure you review your entire pay structure and include any shortfalls from:

- Overtime Pay: Overtime is almost always calculated as a multiple of your regular rate. If your base pay was wrong, your overtime pay was wrong, too.

- Bonuses and Commissions: If these are calculated as a percentage of your earnings, they will also need to be adjusted upwards.

- Allowances: Things like Dearness Allowance (DA) or House Rent Allowance (HRA), which are often linked to your basic pay, must be recalculated.

By carefully digging into each of these elements, you can be sure that your final back pay figure is truly comprehensive. It will reflect the full amount you are legally and rightfully owed.

Understanding the Common Causes of Back Pay Disputes

The best way to steer clear of back pay problems is to understand where they come from in the first place. More often than not, these disputes aren’t born from deliberate wrongdoing, but from simple oversights or misunderstandings. The end result for the employee, however, is the same: they haven’t been paid correctly.

By digging into the usual suspects, both employers and employees can learn to spot the red flags early. Think of it this way: a tiny clerical error made during a payroll run might seem minor, but it can snowball over months, leading to a significant financial mess. Likewise, just misinterpreting a complex overtime rule can cause underpayment for an entire team.

These examples really drive home why careful and accurate payroll management is non-negotiable. For employees, knowing these common pitfalls is the first step to making sure you’re paid what you’ve rightfully earned.

Errors in Classification and Calculations

One of the most common triggers for a back pay dispute is getting an employee’s classification wrong. A classic example is when someone is incorrectly labelled an independent contractor when, legally, they should be a full-time employee. This single mistake can mean they miss out on minimum wage, overtime pay, and other crucial benefits, paving the way for a substantial back pay claim.

Another major culprit is getting overtime calculations wrong. An employer might pay for the extra hours, but they could be using the wrong rate—failing to apply the legally required time-and-a-half multiplier to the employee’s regular pay.

These kinds of errors are more than just costly. They erode employee trust and expose the business to serious compliance risks.

Delayed Implementation of Wage Revisions

In India, another frequent source of back pay disputes is the delayed rollout of mandatory wage updates. When the government revises the minimum wage or Dearness Allowance (DA), employers are legally required to implement these changes from the exact date they take effect. Any lag, no matter how short, automatically creates a back pay liability for the entire shortfall period.

A promised raise or promotion that never materialises on a payslip is more than just a broken promise—it’s a potential back pay dispute waiting to happen. If a new salary was formally agreed upon but never paid, the employee is owed the difference.

Historically, these delays have had major financial fallout. For instance, revisions under the Minimum Wages Act, 1948, have sometimes led to workers receiving back pay that covers periods of up to two years. To put this in perspective, data from 2019 showed that over 15,000 industrial disputes involved wage payment issues, including back pay. This highlights just how critical fair pay is to maintaining a harmonious workplace. You can find more details in these labour and employment statistics on MOSPI.

By getting to grips with these common causes, employers can proactively audit their payroll processes and prevent issues before they start. At the same time, employees can become more vigilant about checking their payslips. This shared awareness helps foster a more transparent and fair environment for everyone involved.

How Employers Can Proactively Prevent Back Pay Issues

When it comes to back pay, the best offence is a good defence. Instead of waiting for a claim to land on your desk, taking proactive steps can protect your business, build employee trust, and keep morale high. Think of compliance not as a burden, but as a core business function—it’s the key to avoiding serious legal and financial headaches down the road.

The entire foundation of prevention boils down to two things: meticulous record-keeping and staying informed. It’s like performing regular maintenance on your car to prevent a major breakdown on the motorway. By consistently checking your systems, you can catch small issues before they snowball into big problems.

Conduct Regular Payroll Audits

One of the most powerful moves you can make is to conduct regular, internal payroll audits. These aren’t about finding fault; they’re about ensuring accuracy. Think of them as a systematic health check for your payroll processes, designed to spot and fix errors before they ever impact an employee’s payslip.

During an audit, you should:

- Verify wage rates: Double-check that employee pay rates match their contracts, promotion letters, and any relevant minimum wage laws.

- Check overtime calculations: Make sure all non-exempt employees are being correctly paid for extra hours worked, using the right multipliers.

- Review employee classifications: Confirm that everyone is correctly classified (for example, as an employee versus a contractor) to head off misclassification disputes.

Maintain Meticulous Records and Clear Communication

Accurate and organised records are your best defence, period. Keeping detailed logs of hours worked, pay rates, and every payment made isn’t just good practice—it’s a legal requirement. These documents are your proof if a dispute ever arises.

Proactive compliance is more than just avoiding penalties; it’s about showing respect for your employees’ contributions and building a foundation of trust. A transparent and accurate payroll system is a cornerstone of a healthy company culture.

Just as crucial is transparent communication. Whenever there are changes to pay—like a new salary scale or a different bonus structure—communicate them clearly and immediately. A well-documented communication plan ensures everyone is on the same page and cuts down on misunderstandings that could easily lead to back pay claims. For more insights on building a fair workplace, check out our guide on what makes a great employer.

Finally, it’s worth looking into modern HR and payroll software. These tools can automate the tricky calculations for wages, taxes, and deductions, which drastically reduces the risk of human error. Automation helps you stay compliant with ever-changing labour laws and delivers a reliable, accurate payroll every single time. It’s an investment that protects both your company and your team.

Your Top Questions About Back Pay, Answered

Let’s be honest, dealing with back pay can feel like wading through legal jargon. Whether you’re an employee trying to figure out what you’re owed or an employer aiming to stay on the right side of the law, you need clear, straightforward answers.

This section cuts through the confusion. We’ll tackle the most common questions head-on, giving you the confidence to handle your specific situation.

Is There a Time Limit for Claiming Back Pay in India?

Yes, absolutely. You can’t wait forever to claim unpaid wages. This time limit is legally known as a statute of limitation, and the clock starts ticking from the moment the payment was due.

Generally, the Limitation Act of 1963 gives you a three-year window to file a lawsuit to recover money you’re owed. However, don’t take this as a universal rule—different labour laws can have their own specific timelines.

Because of this, you really need to act quickly. Speaking with a labour law expert is your best bet to understand the exact deadline for your case so you don’t miss your chance to make a claim.

Procrastination can be costly. While the law gives you a fair amount of time to act, that window isn’t open indefinitely. Figuring out the specific statute of limitations for your situation is the most critical first step in getting the money you’ve earned.

Is Back Pay Taxable in India?

It certainly is. Any back pay or salary arrears you receive counts as income, which means it’s taxable. The key thing to know is that it’s taxed in the financial year you actually receive it, which can sometimes throw a wrench in the works.

For example, getting a large lump-sum payment could easily push you into a higher income tax bracket for that year. The result? A much bigger tax bill than you were probably expecting.

Thankfully, there’s a fix. The Income Tax Act provides relief under Section 89(1). To claim it, you just need to file Form 10E online before you file your income tax return. This clever provision lets your tax be calculated as if the money was paid out in the years it was supposed to be, which can dramatically reduce your tax liability.

What Should I Do If My Employer Refuses to Pay?

If your employer is digging in their heels and refusing to pay what you’re rightfully owed, don’t lose hope. There’s a well-defined path you can follow, and it starts with making things official.

Your first move should be sending a formal written demand for payment. This is usually done through a legal notice that clearly states your claim, the amount owed, and the reason for it. This isn’t just about showing you’re serious; it creates a crucial paper trail.

If that doesn’t get a response, your next step is to go to the labour authorities. You can file a formal complaint with the Labour Commissioner in your area. This might kick off conciliation meetings. If that fails, the issue can be taken to a Labour Court or Industrial Tribunal for a binding decision. It’s also wise for job seekers to know their rights from day one; you can find helpful resources for any prospective candidate to make sure your next job starts off on solid ground.

Does Back Pay Only Include Basic Salary?

Not at all. This is a huge misconception that often leads to employees getting less than they deserve. The whole point of back pay is to make you “whole” again, which means it has to cover every single part of your compensation that was underpaid.

The calculation must include the total earnings you would have pocketed if you’d been paid correctly from the beginning.

This means adding up all components of your salary, such as:

– House Rent Allowance (HRA)

– Dearness Allowance (DA)

– Overtime Pay

– Commissions

– Performance Bonuses

– Any other allowances that were part of your agreement.

When you’re working out your claim, make sure you account for every single piece of your compensation package. That’s the only way to ensure the final number truly reflects what you are legally owed.Navigating the complexities of talent acquisition and payroll requires expertise. At Taggd, we specialise in Recruitment Process Outsourcing to ensure your organisation not only finds the best people but also manages compensation with precision and compliance. Learn how our services can protect your business and support your team.