A Guide to India’s Statutory Deductions

Statutory deductions are the mandatory contributions your employer legally has to withhold from your salary. These funds are channelled directly towards your social security and tax obligations.

Think of it this way: these deductions aren’t money you’re losing. Instead, they’re automated investments in your own financial security and contributions to the nation’s infrastructure.

What Are Statutory Deductions in Your Salary?

Ever looked at your payslip and wondered about the gap between your gross salary and your actual take-home pay? The culprits are statutory deductions. These are non-negotiable amounts your employer must deduct by law, acting as pre-planned contributions that build a financial safety net for your future.

Instead of seeing them as a dent in your earnings, it’s far more accurate to view them as the pillars supporting your long-term financial wellbeing. Each deduction has a distinct job, from funding your retirement to ensuring you have healthcare coverage when you need it most.

The Core Components of Your Deductions

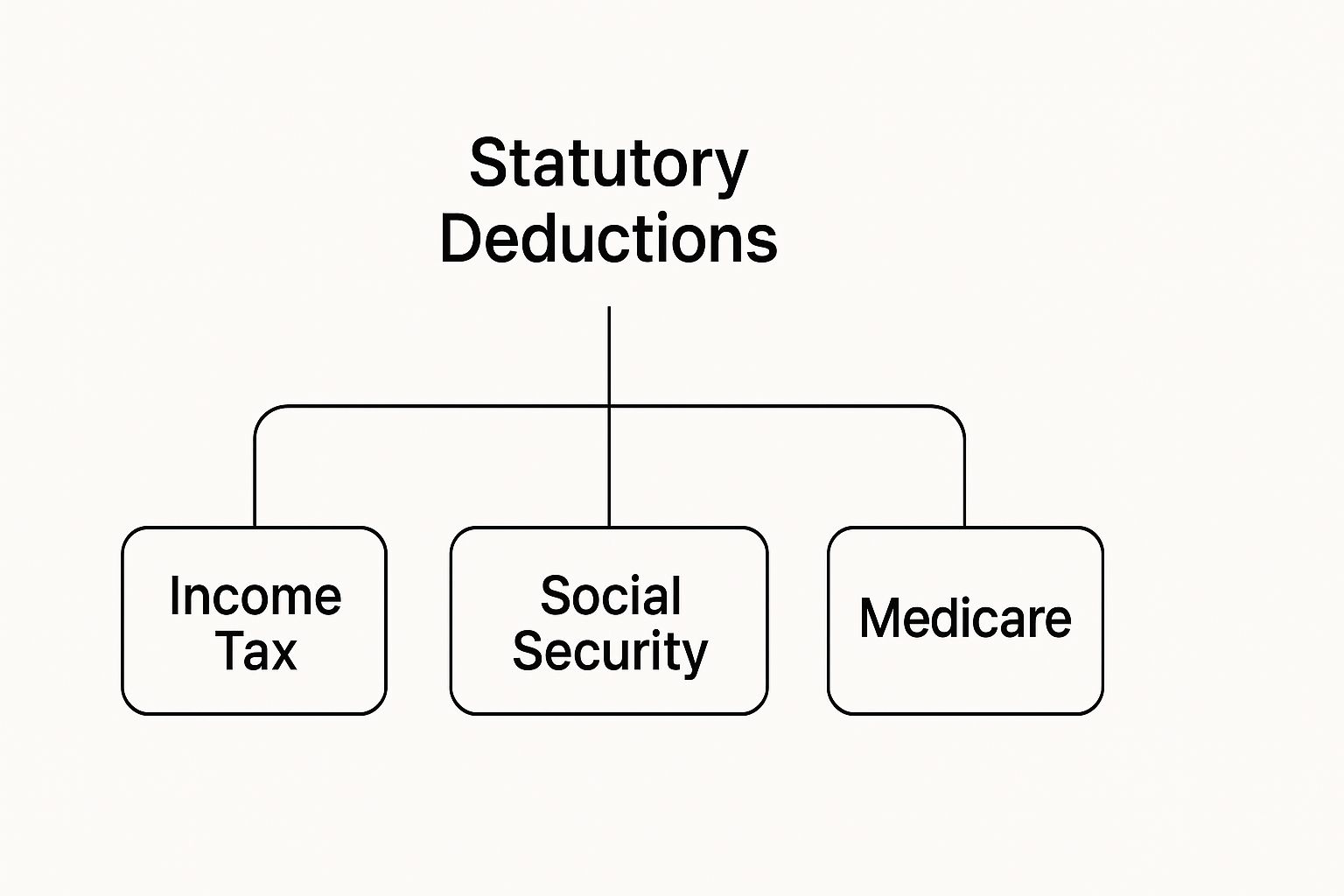

In India, these payroll deductions are built around three main pillars. Each is governed by specific laws and serves a unique function. The primary statutory deductions you’ll see are:

- Employees’ Provident Fund (EPF): This is your long-term retirement savings plan. It’s designed to help you build a substantial nest egg for life after you stop working.

- Employee State Insurance (ESI): Think of this as a comprehensive health insurance scheme. It provides medical care and cash benefits if you’re unable to work due to sickness or injury.

- Tax Deducted at Source (TDS): This is simply your income tax, paid in advance. Your employer deducts and pays it on your behalf throughout the year, ensuring you stay on top of your tax obligations.

This diagram shows how these different deductions fit together under one system.

As you can see, “statutory deductions” is an umbrella term covering both your social security contributions and your tax liabilities, all handled directly through your payroll.

To give you a clearer picture, here’s a quick breakdown of the major deductions in India.

Quick Overview of Major Statutory Deductions in India

| Deduction Type | Primary Purpose | Applicable To |

|---|---|---|

| Employees’ Provident Fund (EPF) | Retirement savings and financial security | Employees in organisations with 20+ staff; mandatory for those earning up to ₹15,000/month |

| Employee State Insurance (ESI) | Medical, sickness, and disability benefits | Employees earning up to ₹21,000/month in applicable factories and establishments with 10+ employees |

| Tax Deducted at Source (TDS) | Pre-payment of annual income tax | All salaried individuals whose income exceeds the basic exemption limit |

| Professional Tax (PT) | State-level tax on professionals and trades | Varies by state; applicable to most salaried employees based on income slabs |

This table serves as a handy reference, but the real magic is in how these deductions work together to create a robust social security framework.

How These Deductions Work in Practice

The government has set clear, non-negotiable rules for these deductions to ensure every employee is treated fairly. For example, the Employees’ Provident Fund requires a contribution of 12% of your basic salary plus dearness allowance. Your employer then matches that 12% contribution, effectively doubling your investment for retirement.

Similarly, ESI involves smaller contributions from both you and your employer, specifically for those earning up to ₹21,000 per month, providing a crucial medical safety net. TDS, on the other hand, is calculated based on your income tax slab.

Together, these mechanisms form the very foundation of India’s employee welfare and tax revenue system. You can always explore more about these regulations on the official government press portal.

Your Financial Safety Net: EPF and ESI Explained

When you look at your payslip, you’ll see a few statutory deductions. Two of the most important ones, forming the very bedrock of social security in India, are the Employees’ Provident Fund (EPF) and Employee State Insurance (ESI). These aren’t just random subtractions from your salary; they are powerful tools designed to give you long-term financial stability and immediate healthcare protection.

Think of them as two distinct safety nets. One is built up slowly, thread by thread over your career, ready to catch you when you retire. The other is always there, ready to cushion the financial impact of unexpected medical bills for you and your family.

Understanding how these work is key to seeing the true value of your compensation package. It’s a joint effort—both you and your employer contribute, creating a system of shared responsibility that shores up your financial future and present well-being.

EPF: Your Mandatory Retirement Savings

The Employees’ Provident Fund (EPF) is essentially your personal, legally mandated retirement savings account. It’s a disciplined approach to building a substantial nest egg over your working life, ensuring you have a financial cushion long after you stop earning a regular salary.

The process itself is quite simple. Every month, a slice of your salary goes into your EPF account, and your employer matches it with an equal contribution. This consistent, two-way funding model is what helps the fund grow so significantly over the years, supercharged by the power of compounding interest.

Here’s the typical contribution breakdown:

- Your Contribution: 12% of your basic salary plus dearness allowance is deducted from your monthly pay.

- Employer’s Contribution: Your employer also contributes 12%. A portion of this (8.33%) is directed to the Employees’ Pension Scheme (EPS), with the rest going straight into your provident fund.

This combined effort means your retirement savings grow much faster than they would if you were saving on your own. It’s a forced saving habit with a potent, employer-backed boost.

By automatically funnelling a part of your income into a locked savings vehicle, the EPF scheme instils a level of financial discipline that builds a secure foundation for your post-retirement life, safeguarding you from market volatility and impulsive spending.

ESI: Your Comprehensive Health Shield

While EPF looks after your future, Employee State Insurance (ESI) is here to protect your present. It’s a wide-ranging social security and health insurance scheme, providing a critical buffer against medical emergencies for both you and your dependents.

This particular statutory deduction is for employees whose gross salary is up to ₹21,000 per month. The goal is to make quality healthcare accessible and affordable for a huge segment of India’s workforce.

The contributions are much smaller than EPF, but the value they provide is immense. You contribute a mere 0.75% of your wages, while your employer puts in 3.25%. In exchange, the ESI scheme delivers extensive benefits that go far beyond just basic hospitalisation.

These benefits often include:

- Medical Care: Complete medical care for you and your family, starting from day one of your employment.

- Sickness Benefit: Cash compensation during certified periods of illness, usually at 70% of your average daily wages.

- Maternity Benefit: Paid leave for expecting mothers, offering crucial support during pregnancy and after childbirth.

- Disablement Benefit: Financial aid in the event of temporary or permanent disability resulting from an employment-related injury.

Another critical piece of your payslip puzzle is the Tax Deducted at Source (TDS). As per Section 192 of the Income Tax Act, employers are required to deduct tax from your salary before paying it out. For the financial year 2024-25, this applies to anyone earning over ₹3 lakh under the new tax regime. Your employer calculates this based on your chosen tax slab and any deductions you’ve claimed, remitting the amount to the government each month.

Navigating the job market means getting to grips with these financial details. When you’re weighing job offers, remember that a strong benefits package with solid EPF and ESI contributions is a crucial part of your overall compensation. To better position yourself, check out our guide on improving your candidate experience.

Navigating Tax Deducted at Source on Your Salary

While EPF and ESI are all about building your financial future, Tax Deducted at Source (TDS) handles your immediate duty as a citizen. It might sound intimidating, but TDS is just the government’s way of implementing a “pay-as-you-earn” tax system. Think of it as paying your annual tax bill in small, manageable monthly instalments. This approach ensures a steady stream of revenue for the country’s development and saves you from the shock of a massive tax payment at the end of the financial year.

While EPF and ESI are all about building your financial future, Tax Deducted at Source (TDS) handles your immediate duty as a citizen. It might sound intimidating, but TDS is just the government’s way of implementing a “pay-as-you-earn” tax system. Think of it as paying your annual tax bill in small, manageable monthly instalments. This approach ensures a steady stream of revenue for the country’s development and saves you from the shock of a massive tax payment at the end of the financial year.

Essentially, your employer acts as a collection agent for the Income Tax Department. They estimate your total tax liability for the year, divide it by 12, and deduct that slice from your salary each month. This systematic deduction is one of the most significant statutory deductions you’ll see on your payslip, designed to make tax compliance a smooth, automated part of your work life rather than a yearly headache.

How Your Employer Calculates Your TDS

This isn’t just a random number plucked from thin air; the calculation is a personalised assessment based on the financial details you provide. At the start of every financial year, your HR team will ask you to share your investment and expense plans. This is your chance to take control and actively manage your tax outgo.

Your declarations on Form 12BB are absolutely critical here. This form is your official channel to let your employer know about the tax-saving investments you intend to make and the eligible expenses you’ll incur. Based on this information, your employer can factor in legitimate deductions, which lowers your overall taxable income and, in turn, reduces your monthly TDS.

Here are some of the most common declarations that can make a real difference:

- House Rent Allowance (HRA): If you’re living in a rented home, you can claim an HRA exemption. This is often one of the biggest ways to bring down your taxable income.

- Section 80C Investments: This popular section covers a range of investments, including your EPF contributions, Public Provident Fund (PPF), life insurance premiums, and more, up to a total limit of ₹1.5 lakh.

- Other Deductions: This is a catch-all for other claims you can make, like those under Section 80D for health insurance premiums or Section 80E for interest paid on an education loan.

By forecasting these investments and expenses accurately from the get-go, you ensure your TDS is calculated on a lower, more precise income right from the first month of the financial year.

Choosing Your Tax Path: Old vs. New Regime

Another major decision that directly shapes your TDS calculation is your choice between the old and new tax regimes. This choice dictates which deductions and exemptions you’re eligible for, fundamentally altering your tax liability.

The old tax regime is the traditional route, allowing you to claim a whole host of exemptions and deductions like HRA, Leave Travel Allowance (LTA), and everything under Section 80C. It’s often the better choice for people who make significant investments and have expenses that fall squarely into these tax-saving buckets.

On the other hand, the new tax regime offers lower, simplified tax rates but comes with a catch: you have to give up most of the common deductions and exemptions. This path is much simpler and can be more beneficial if you don’t typically make large tax-saving investments. The regime you pick tells your employer exactly how to compute your monthly TDS.

Your choice between tax regimes is a strategic financial decision. It’s not just about paying tax; it’s about optimising your salary structure to align with your personal financial habits and goals, which in turn defines your monthly statutory deductions.

Your Proof of Tax Paid: Form 16

Once the financial year wraps up, your employer will issue you Form 16. This document is far more than just another piece of paper; it’s your official certificate that proves the tax deducted from your salary has been successfully deposited with the government.

Form 16 serves as a complete summary of your income and the taxes paid on your behalf. It’s broken down into two main parts:

- Part A: This section details the TDS amounts deducted and deposited quarterly, along with your and your employer’s PAN information.

- Part B: Here you’ll find a detailed breakdown of your salary, any other declared income, the deductions you’ve claimed, and your final tax calculation.

This document is the cornerstone for filing your annual Income Tax Return (ITR). It provides all the figures you need, making the ITR process transparent and straightforward. Taking the time to understand your Form 16 empowers you to confirm that your tax obligations have been handled correctly all year long.

Of course! Here is the rewritten section, crafted to sound like it was written by an experienced human expert, following all the specified requirements.

Exploring Other Key Payroll Deductions

Once you’ve wrapped your head around big-ticket items like EPF and TDS, you’ll notice a few other, smaller deductions on your payslip. They might not seem like much, but they’re mandatory and absolutely crucial for keeping the company on the right side of the law. These often change depending on which state your office is in, which adds an interesting layer of complexity to payroll.

This is a direct result of India’s federal system, which gives individual states the power to levy certain taxes and run their own welfare programs. For anyone managing payroll, getting a grip on these state-specific rules is essential to see the full picture and make sure every legal box is ticked.

Understanding Professional Tax

One of the most common state-level deductions you’ll come across is Professional Tax (PT). Think of it as a small tax levied by the state government on anyone earning a professional income. It’s essentially a fee for practising your profession or trade within that state.

The catch is that the amount isn’t the same everywhere. It varies quite a bit from one state to the next, with each having its own income slabs and rules. So, the PT deducted for an employee in Maharashtra will look different from one in Karnataka or West Bengal.

A key thing to remember is that the total Professional Tax you can pay in a single financial year is legally capped at ₹2,500. You might see a deduction of ₹200 for eleven months, with the final month’s deduction adjusted to hit this exact annual limit.

To give you a clearer idea, here’s a quick comparison of how Professional Tax slabs can differ across a few states. It really highlights how state-specific this deduction is.

State-Wise Professional Tax Slabs (Illustrative Examples)

This table shows how Professional Tax, a statutory deduction, varies across different Indian states, illustrating its state-specific nature.

| State | Monthly Salary Range | Monthly Professional Tax |

|---|---|---|

| Maharashtra | Above ₹10,000 | ₹200 (₹300 in Feb) |

| Karnataka | Above ₹15,000 | ₹200 |

| West Bengal | ₹15,001 to ₹40,000 | ₹150 |

| West Bengal | Above ₹40,000 | ₹200 |

As you can see, both the salary threshold and the tax amount are decided at the state level.

The Labour Welfare Fund Contribution

Another state-specific deduction you might see is the Labour Welfare Fund (LWF). This is a three-way contribution from the employee, the employer, and sometimes the state government itself. The goal is to fund social security and welfare programs for workers in that state.

The money collected through LWF goes directly into worker-centric initiatives, such as:

- Providing medical aid and housing facilities.

- Offering educational support for the children of workers.

- Organising sports, cultural, and other recreational activities.

LWF isn’t mandatory in every Indian state. Just like Professional Tax, the contribution amount and how often it’s deducted (monthly, half-yearly, or annually) are decided by the state government. The amounts are usually small but are vital for supporting local labour communities.

Voluntary vs Mandatory Deductions

Finally, it’s really important to draw a line between statutory (mandatory) deductions and voluntary ones. Everything we’ve discussed so far is required by law. But your payslip might also show deductions you’ve chosen to make.

Common examples of voluntary deductions include contributions to the National Pension System (NPS), buying extra coverage with a corporate health insurance top-up, or even donating to a company-supported charity. These are entirely up to you and reflect your personal financial planning, giving you direct control over that portion of your pay.

How Policy Updates Impact Your Take-Home Pay

The rules that dictate statutory deductions aren’t set in stone. They shift with every government budget and new policy announcement. For both employees and HR leaders, keeping up with these changes is non-negotiable, as they have a direct line to the amount that lands in your bank account each month.

Think of your salary structure like a building, with its foundations poured from tax law. When the government decides to renovate—perhaps by adjusting tax slabs or changing deduction limits—the entire structure feels the impact, directly altering your take-home pay.

The Ripple Effect of Budget Changes

Annual budget announcements are the biggest drivers of change for statutory deductions, especially when it comes to Tax Deducted at Source (TDS). Even small tweaks can create significant ripples for millions of salaried individuals across India. These adjustments are often designed to reflect the country’s economic goals, whether that’s offering relief to the middle class or pushing certain types of investments.

A perfect example is how a policy update can directly boost your disposable income. The budget for the fiscal year 2024-25 brought in a few key changes, most notably bumping up the standard deduction from ₹50,000 to ₹75,000 for anyone under the new tax regime.

This one change means salaried employees can now shave an extra ₹25,000 off their gross taxable income. The result? A lower tax bill and more money in their pocket every month.

How Tax Regimes Shape Your Deductions

The choice between the old and new tax regimes is a classic example of how policy directly shapes your monthly deductions. Which path you choose gives your employer the exact formula they must use to calculate your TDS.

- Old Tax Regime: This route is known for its wide menu of deductions (think HRA, LTA, and Section 80C investments). It’s for those who are willing to plan their investments proactively to maximise their tax savings.

- New Tax Regime: This option simplifies things with lower tax slabs but asks you to give up most of the major deductions. It’s often the go-to for its straightforwardness.

As government policies evolve, the appeal of each regime can change. For instance, when the standard deduction was also applied to the new regime, it suddenly made that option much more attractive for a lot of people.

Staying on top of these shifts isn’t just about ticking a compliance box; it’s a strategic move. For HR leaders, it means running a payroll process that’s accurate and legally sound. For employees, it provides the clarity to make smart financial choices.

Understanding these dynamics has become a core competency in today’s professional world. To explore broader workforce trends, you might find the latest insights from the India Skills Reports valuable. After all, knowing how tax policies impact employee earnings is a crucial part of modern talent management.

A Guide for Employers on Managing Deductions

For any HR leader or employer, managing statutory deductions is a high-stakes game. Precision isn’t just a goal; it’s a necessity. A single slip-up—a minor miscalculation or a missed deadline—can snowball into hefty penalties and, just as importantly, can erode the trust you’ve built with your employees. Think of this guide as your strategic playbook for building a payroll system that’s not only compliant but also completely transparent, turning a complex legal duty into a real source of organisational strength.

Your most critical responsibility is the accurate and timely remittance of all statutory funds. This means ensuring contributions for EPF, ESI, and TDS are calculated perfectly and deposited with the government authorities well before the deadline. In this area, punctuality is non-negotiable. Delays will attract financial penalties and legal headaches.

Building a Bulletproof Payroll Process

A flawless compliance record starts with a robust system. Let’s be honest, manual calculations on spreadsheets are a relic of the past. They are notoriously prone to human error and simply can’t keep up with the constant stream of legislative updates. This is where embracing technology stops being an option and becomes essential for any serious employer.

Modern payroll software is built specifically to automate these complex calculations, drastically cutting down the risk of mistakes. These platforms are constantly updated to reflect the latest shifts in tax laws and contribution rates, so your payroll stays compliant without you having to manually track every change. It’s a smart investment in accuracy and your own peace of mind.

A well-implemented payroll system does more than just run the numbers; it creates a clear, auditable trail of every single transaction. This meticulous record-keeping is your best friend during internal or external audits, offering concrete proof of your organisation’s commitment to due diligence.

Fostering Employee Financial Literacy

Your job isn’t just about compliance; it’s also about empowering your employees with financial clarity. A payslip filled with cryptic codes and unexplained numbers can easily create anxiety and mistrust. When you proactively take the time to explain each component of their salary slip, you’re building a powerful culture of transparency.

This educational role is crucial. You can bring your team along by:

- Holding regular info sessions to demystify statutory deductions like EPF, ESI, and TDS.

- Providing clear, easy-to-read documents that walk through how each deduction is calculated.

- Issuing Form 16 on time and offering guidance on how employees can use it for their income tax filing.

This commitment shows you see your employees as genuine partners. When your team understands exactly where their money is going and why, it solidifies their confidence in the organisation. Exploring comprehensive guides can equip you to become a preferred employer by mastering these best practices.

Streamlining Reporting and Record-Keeping

Meticulous record-keeping is the final, crucial piece of the puzzle. You are required to maintain organised, audit-proof records of all deductions, payment challans, and official filings. This isn’t just about keeping monthly payment receipts; it also includes the quarterly and annual returns you file.

A streamlined process ensures you have all the necessary paperwork at your fingertips, making any potential audit smoother and far less disruptive. It also gives you a clean historical record that can quickly resolve any questions from employees or government authorities. By mastering these practices, you’re not just protecting your organisation from legal risk—you’re building a solid reputation as a responsible and trustworthy employer.

Frequently Asked Questions About Statutory Deductions

Even when you think you’ve got a handle on statutory deductions, a few nagging questions always seem to pop up. Staring at a payslip can feel like trying to solve a puzzle, but getting these common doubts cleared up is the final step to feeling truly in control of your finances.

This section gets right to the point, tackling the most common questions and sticking points employees have about their deductions. We’ll give you direct, simple answers to help you manage your money with more confidence.

Can I Opt Out of ESI if I Have Private Insurance?

This is probably one of the most common questions we hear, and the answer is a firm no. If your monthly salary is ₹21,000 or less and your company falls under the ESI Act, your contribution is non-negotiable. The law simply doesn’t allow you to opt out, even if you’ve got a fancy private health insurance policy on the side.

Think of ESI as more than just health insurance; it’s a social security net. It covers things like sickness and disability benefits, which most private plans don’t touch. Because of this wider safety net, it’s a mandatory deduction for every eligible employee.

Is Professional Tax a Must for Everyone in India?

Nope, Professional Tax isn’t a nationwide rule. It’s a state-level tax, meaning whether you pay it or not depends entirely on the state you work in. Big states like Maharashtra, Karnataka, and West Bengal have it, but many others don’t.

The amount you pay also changes from state to state, with each having its own income brackets and tax rates. The good news? There’s a cap. No state can charge more than ₹2,500 per year.

Key Takeaway: Don’t panic if you don’t see Professional Tax on your payslip. It’s not a mistake by your employer; it just means your state doesn’t levy it.

What Happens to My EPF When I Switch Jobs?

Your Employees’ Provident Fund (EPF) is designed to move with you. It’s linked to your Universal Account Number (UAN), so your hard-earned savings are safe and sound when you change jobs. You have two main options:

– Transfer Your Balance: This is the best move. You simply transfer your EPF balance from your old company to your new one. It keeps your retirement savings growing in one place without any hiccups.

– Withdrawal (With Strings Attached): You can pull your EPF money out if you’re unemployed for over two months after leaving a job. But honestly, it’s not a great idea. It messes with your long-term retirement goals and can come with some hefty tax consequences.

Your UAN is your career-long companion, making it easy to keep your retirement fund growing as you climb the professional ladder.

At Taggd, we know that a transparent and compliant payroll is the foundation of a great employer-employee relationship. Our Recruitment Process Outsourcing solutions empower CHROs to build fantastic teams, confident that every detail—including tricky statutory deductions—is handled like clockwork. See how we can strengthen your organisation at https://taggd.in.