Unlock Success with Variable Pay Strategies

Mastering Variable Pay: Beyond Fixed Compensation

Traditional salary structures are losing their effectiveness in today’s competitive business world. This raises a crucial question: what exactly is variable pay, and why is it transforming compensation strategies across India? This section explores the key elements of variable pay and their impact on organizations, particularly within India.

Understanding Variable Pay and Its Components

Variable pay includes any compensation beyond an employee’s base salary, directly tied to performance or company success. This can involve performance bonuses, commissions, profit-sharing, and other incentives. Strategically implemented, these components become powerful motivators, encouraging employees to go the extra mile.

For instance, sales teams might earn bonuses for exceeding quarterly targets, while manufacturing teams could benefit from profit-sharing linked to overall company performance.

The Psychology Behind Variable Pay

Variable pay’s effectiveness stems from its psychological impact. By connecting rewards to measurable results, organizations tap into the human drive for recognition and accomplishment. This cultivates a sense of ownership and accountability, as employees see a clear link between their efforts and their earnings.

Furthermore, variable pay fosters a merit-based culture, rewarding those who contribute most significantly to the organization’s success. This motivates high-achievers and inspires others to excel.

Current Trends in Variable Pay in India

Variable pay trends in India reveal a growing focus on performance-linked incentives. Recent data highlights the increasing significance of these incentives at higher levels. In 2024, top executives (CXOs) received the largest share of variable pay, reaching nearly 27% of their total compensation, a significant increase from previous years. This represents a strategic shift towards rewarding high-level contributions with a greater proportion of at-risk pay, which includes bonuses, commissions, and comprehensive incentive plans. For more detailed statistics, visit: Statista

This trend reflects the increasing complexity of business operations and the demand for strategic leadership. By tying executive compensation more closely to company performance, organizations ensure leadership is fully invested in achieving strategic objectives and driving sustainable growth.

This also acknowledges the competitive landscape for executive talent in India, where variable pay is a crucial factor in attracting and retaining high-performing leaders. Understanding these evolving trends is essential for organizations developing effective variable pay strategies in the Indian business environment.

The Evolution of Variable Pay: From Outlier to Essential

The story of variable pay in India is a compelling look at how our workplaces have changed. It’s not just about shifting economic realities; it reflects a fundamental shift in how we recognize and reward employee contributions. Let’s explore how this once unusual practice became a core part of modern compensation.

Economic Liberalization and the Seeds of Change

Before the 1990s, Indian compensation models were primarily traditional. Fixed salaries and seniority were the dominant factors. The economic liberalization of India, however, introduced global competition and changed everything. Companies needed new ways to attract and keep talented employees, leading them to explore different compensation models. This marked the beginning of variable pay in India.

The Rise of Performance-Based Culture

Multinational companies (MNCs) entering India brought with them global best practices, including performance-based pay. These MNCs introduced sophisticated variable pay structures, influencing local companies to follow suit. This shift moved away from fixed salaries and towards a system where earnings were tied to individual performance.

The Indian Adaptation: Balancing Global and Local

Indian organizations didn’t simply copy global practices. They adapted variable pay to fit their own cultural context. Some companies incorporated elements reflecting local values, like recognizing long-term service or offering team-based incentives. These hybrid models blend global best practices with the specifics of Indian work culture.

From Management Levels to Wider Adoption

Variable pay initially focused on management roles. Over time, the portion of compensation linked to performance increased, especially for managers. In 2018, top executives in India received an average of 21.3% of their pay as variable compensation. Projections suggested a rise to 22.1% in the following years. However, 2024 data shows a significant jump to 27% for CXOs. Find more detailed statistics here. The success at the management level paved the way for wider adoption across various roles and industries.

Variable Pay Today: A Look Ahead

Variable pay is now a key component in many Indian organizations. This evolution mirrors the changing nature of work itself, where agility, innovation, and performance are highly valued. Looking ahead, understanding the history of variable pay in India helps us build compensation strategies that attract today’s workforce and prepare for future trends.

Variable Pay Realities: Opportunities and Pitfalls

Variable pay is now a key part of many compensation strategies, especially in India’s dynamic business environment. But its success depends on careful planning and execution. This section explores the real impact of variable pay, highlighting both its potential benefits and the challenges it presents.

The Power of Well-Designed Variable Pay Programs

Effective variable pay programs can be strong tools for connecting employee actions with company goals. Well-designed programs attract top talent and motivate current employees. For example, a clear link between individual performance and bonuses encourages employees to exceed targets and contribute significantly to company success.

When employees see a direct connection between their work and financial rewards, they’re more likely to take ownership and strive for better results. Variable pay programs can also create a culture of meritocracy, where high achievers are recognized and rewarded. This benefits individual employees and contributes to a more productive and engaged workforce.

The Pitfalls of Poorly Implemented Variable Pay

However, if not implemented correctly, variable pay programs can have the opposite effect. Poorly chosen metrics, unclear communication, or flawed implementation can damage trust and motivation. If employees perceive the metrics for variable pay as unfair or impossible to reach, it can lead to resentment and lower productivity. Read also: How COVID-19 impacted companies looking to raise variable pay component

Lack of transparency can also create suspicion and erode employee confidence. This is especially important in the Indian business context, where cultural nuances and communication styles are key factors. Overcoming these challenges requires careful consideration of cultural aspects and a commitment to open communication.

Maximizing the Upside and Avoiding the Traps

To get the most out of variable pay and avoid common problems, organizations need a strategic approach. This involves clearly defined objectives, relevant metrics, and a transparent process. The program should also be reviewed and updated regularly to meet changing business needs.

Variable pay isn’t a one-size-fits-all solution. What works for one company might not work for another. It’s essential to tailor the program to the specific organization and its employees, considering cultural factors and industry best practices.

To understand the complexities of implementing variable pay, let’s look at the benefits and challenges:

The table below, “Variable Pay Realities: Benefits vs. Challenges,” provides a comprehensive analysis of the impact of variable pay, along with proven strategies to maximize its effectiveness and minimize potential risks.

| Benefits | Challenges | Mitigation Strategies |

|---|---|---|

| Attracts and retains top talent | Poorly chosen metrics can demotivate employees | Clearly define performance metrics and tie them directly to business objectives |

| Incentivizes employees to exceed targets | Lack of transparency can erode trust | Communicate the variable pay program clearly and regularly to all employees |

| Creates a culture of meritocracy | Implementation blunders can damage morale | Pilot test the program before full implementation and gather feedback from employees |

| Aligns employee actions with business objectives | Cultural sensitivities can impact program effectiveness | Consider cultural factors when designing and implementing the program |

| Improves overall workforce productivity | Difficult to manage and administer | Use technology and automation to streamline program administration |

This table summarizes the key benefits and challenges of variable pay, emphasizing the importance of strategic planning and thoughtful implementation. By addressing the challenges with the suggested mitigation strategies, organizations can effectively leverage variable pay to drive performance and growth.

By taking a structured and transparent approach, organizations can unlock the true power of variable pay and make it a strong driver of performance and growth.

Tailoring Variable Pay Across Organizational Levels

Why does an executive’s variable pay look so different from a frontline employee’s? It all comes down to impact, responsibility, and market dynamics. This section explores how to design fair variable pay systems that reflect these differences, building trust and transparency with everyone.

Aligning Variable Pay with Impact and Responsibility

Variable pay should mirror an individual’s contribution to the company’s success. For executives, whose decisions can heavily influence overall performance, a larger portion of their compensation is often tied to company-wide goals. For instance, a CEO’s bonus might be linked to hitting specific revenue targets or increasing market share.

For frontline employees, variable pay is often connected to individual or team performance metrics directly related to their day-to-day work. This could include sales targets for a sales representative or production goals for a factory worker. This approach ensures fairness and recognizes contributions at every level.

Considering Market Benchmarks and Industry Practices

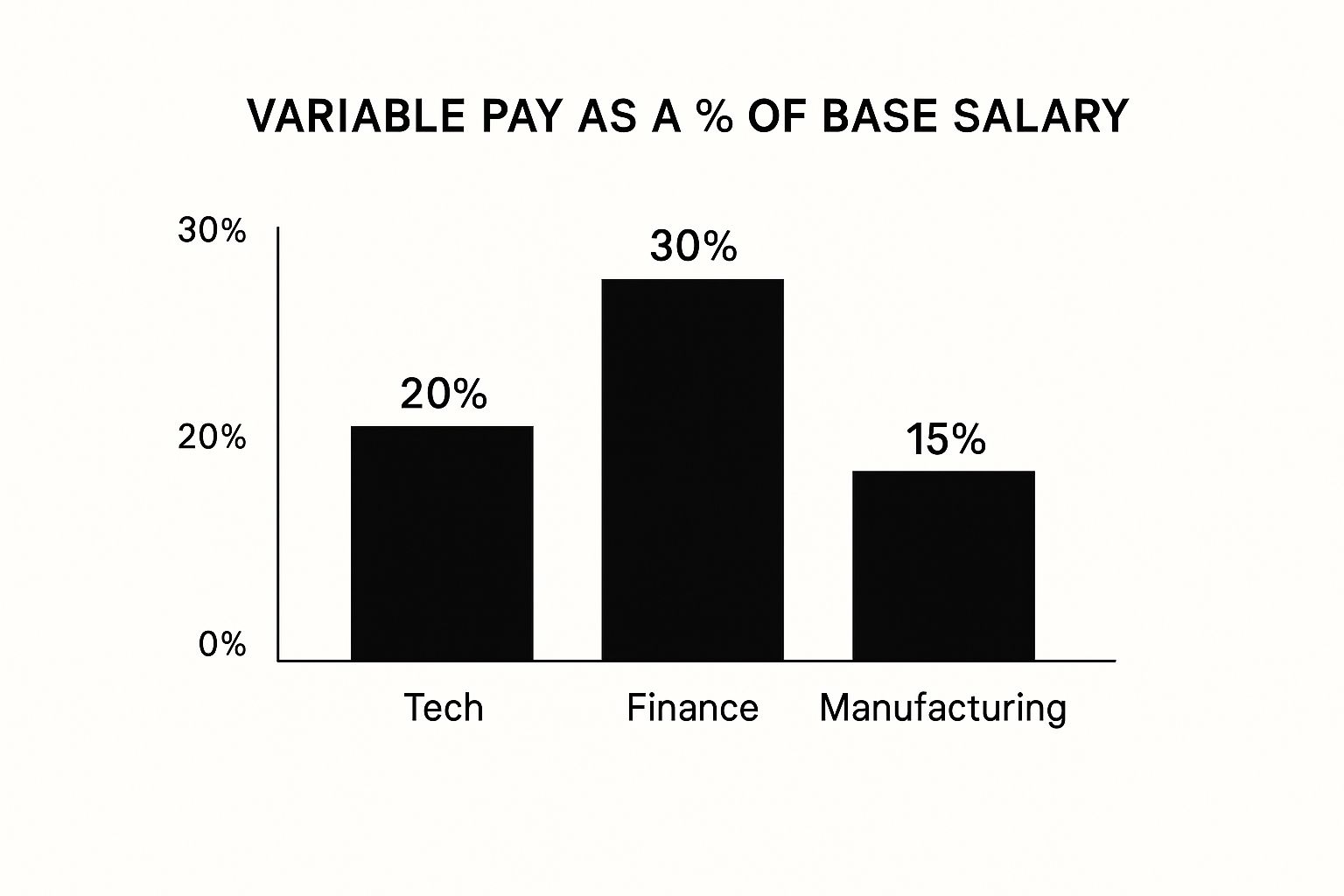

Market benchmarks play a vital role in setting competitive variable pay. Some industries, like finance and technology, tend to have higher variable pay percentages than others, like manufacturing. The infographic below illustrates these differences:

As the infographic shows, variable pay can range from 15% to 30% of base salary depending on the industry. These benchmarks offer valuable insights for organizations aiming to attract and retain top talent. Staying up-to-date on these industry trends is crucial for a competitive compensation strategy.

To understand how these variations play out across different organizational levels, let’s take a look at the following table.

Variable Pay Distribution Across Organizational Levels Comprehensive breakdown of typical variable pay percentages across employee tiers, with industry-specific variations and implementation considerations.

| Employee Level | Average Variable Pay (%) | Industry Variations | Year-over-Year Trends |

|---|---|---|---|

| Entry-Level | 5-10% | Retail, Hospitality often lower | Steady or slight increase |

| Mid-Level Management | 10-15% | Technology, Finance often higher | Moderate increase |

| Senior Management | 15-25% | Executive positions significantly higher in Finance | Potential for large fluctuations based on company performance |

| Executive | 25-50%+ | Varies widely based on performance and industry | Can vary dramatically year to year |

This table provides a general overview, and the specific percentages can shift based on company performance, individual achievements, and location.

Creating Transparent and Equitable Frameworks

Transparency is essential for building trust. Clearly communicate performance metrics, targets, and how payouts are calculated. Organizations should also have clear guidelines for performance reviews and provide regular feedback.

Fair frameworks should consider more than just financial metrics. Recognizing teamwork and contributions to company culture can strengthen positive behaviors and values. This creates a more engaged and motivated workforce.

Adapting Variable Pay Strategies to Organizational Size

Variable pay strategies differ depending on company size. Startups with limited resources might focus on profit-sharing or equity-based incentives. Larger corporations often have more complex systems with tiered bonus structures and various performance metrics.

No matter the size, the key is a system that is easy to understand, administer, and aligns with company objectives. By effectively tailoring variable pay, companies can attract and retain talent, boost performance, and achieve sustainable growth.

Designing Variable Pay Metrics That Actually Work

The success of any variable pay program depends heavily on the metrics used. Choosing the right performance indicators can mean the difference between a program that drives positive change and one that becomes an expensive failure. This section provides practical guidance on selecting metrics that motivate desired behaviors and avoid unintended negative outcomes.

Choosing the Right Metrics: A Balanced Approach

Picking the right metrics requires a balanced approach, much like a balanced scorecard. Rather than focusing solely on financial results, think about incorporating measurements of customer satisfaction, innovation, and even sustainability. For instance, a customer service team’s variable pay might be tied to customer satisfaction scores, while a product development team’s might be linked to the number of new features released.

This wider view helps ensure employees are motivated to contribute to the organization’s overall success, not just their own department’s performance. Leading Indian companies are increasingly adopting this comprehensive strategy to connect individual contributions with wider business goals.

The SMART Framework for Effective Metrics

Effective metrics should adhere to the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound. A specific metric clearly defines what needs to be accomplished. It must be quantifiable and have a defined measurement process.

The metric should also be challenging yet attainable, encouraging employees to strive for success. Relevance is crucial; the metric must directly relate to the employee’s job responsibilities. Finally, a clear timeframe provides a deadline for achieving the target.

Practical Examples of Variable Pay Metrics in Action

Consider a sales team. A SMART metric might be “Increase sales of product X by 15% in the next quarter.” This metric is specific, measurable, achievable (assuming 15% is a realistic goal), relevant to their role, and time-bound. For a marketing team, a SMART metric could be “Generate 100 qualified leads through online campaigns within the next two months.”

These examples illustrate how the SMART framework helps create metrics that produce desired results. By using these principles, you can create a variable pay program that truly motivates employees and contributes to the organization’s success. Learn more in our article about How to use creative compensation to boost your recruiting.

Avoiding Gaming and Unintended Consequences

While incentives are powerful motivators, poorly chosen metrics can lead to undesirable outcomes. For instance, if a sales team is rewarded only for the number of deals closed, they might prioritize quantity over quality, potentially damaging customer relationships. Likewise, rewarding a customer service team solely on the number of calls handled might encourage speed over thoroughness.

To avoid such traps, carefully consider potential downsides when designing metrics. A more effective approach for sales might be to reward based on revenue generated and customer retention rates. This balances acquiring new business with maintaining existing customer relationships. For customer service, combining customer satisfaction ratings with call resolution rates might be a better approach.

Adapting to Your Organization and Objectives

A successful variable pay program requires metrics tailored to the specific organization and its strategic goals. What works for a large corporation may not be suitable for a small startup. Consider industry benchmarks and your company culture when choosing metrics. Regularly review and adjust the program to keep it in line with your changing business needs. A thoughtful approach to designing metrics will result in a variable pay program that truly delivers.

Variable Pay Across Industries: What’s Working Now

Across India, different sectors face unique challenges, demanding tailored approaches to variable pay. This exploration delves into how leading organizations, from IT to retail, are adapting their variable compensation strategies for optimal results.

Variable Pay in IT: Attracting and Retaining Top Tech Talent

India’s IT sector is a hotbed of competition for skilled professionals. Variable pay is crucial for attracting and retaining top tech talent. Companies leverage performance bonuses, stock options, and profit-sharing to incentivize innovation and reward high performers.

Payouts are often quarterly or annual, aligning with project milestones and company performance. For example, software developers might receive bonuses tied to successful product launches. Additionally, companies are increasingly integrating skill-based pay, rewarding employees for acquiring new skills and certifications, ensuring they stay current with the latest technologies.

Manufacturing: Driving Productivity and Efficiency

In manufacturing, variable pay programs often center on metrics like production output, quality control, and cost reduction. Team-based incentives encourage collaboration and boost overall productivity.

For instance, production line workers might receive bonuses based on team achievements in production targets and quality standards. Payout frequencies are typically monthly or quarterly, linked to production cycles, providing regular reinforcement and motivating consistent performance.

Financial Services: Performance-Driven Culture

Variable pay is deeply embedded in financial services. Performance-based bonuses and commissions are standard, reflecting the focus on financial targets. Investment bankers, for example, often see bonuses tied to the value of deals closed. You might be interested in: Pharmaceutical Sectoral Report 2022

However, there’s a growing recognition of the need to balance financial metrics with other crucial factors like risk management and customer satisfaction. This ensures that the pursuit of financial goals doesn’t compromise long-term stability and ethical practices.

Healthcare, Retail, and Emerging Sectors: Adapting Variable Pay Models

Variable pay is gaining traction in healthcare, retail, and emerging sectors. In healthcare, medical professionals’ performance bonuses are often linked to patient outcomes and quality of care. In retail, sales associates’ commissions are tied to sales targets and customer service metrics. Emerging sectors are adapting variable pay models from established industries, tailoring them to their specific needs.

Cross-Industry Best Practices and Adaptability

While each sector has its nuances, several cross-industry best practices stand out:

- Transparency: Clearly communicate the metrics, targets, and payout structures of the variable pay program.

- Fairness: Ensure the program is perceived as equitable, rewarding contributions fairly.

- Simplicity: Keep the program design and administration straightforward and easy to understand.

- Alignment: Align the program with the company’s overall strategic objectives and cultural values.

By adapting these best practices and tailoring them to specific circumstances, companies across sectors can use variable pay to drive performance, attract and retain talent, and achieve their business goals. This requires continuous monitoring and adjustment to ensure the program’s effectiveness in a dynamic business environment. This ongoing adaptation ensures that variable pay remains a key driver of success in the Indian business landscape.

Implementing Variable Pay That Drives Real Results

Even the most well-designed variable pay programs can fail without proper implementation. This section offers a practical guide for launching a successful program, from securing leadership support to fostering employee understanding and acceptance, particularly within the Indian context.

Gaining Leadership Commitment and Building a Foundation

First, success hinges on strong leadership commitment. Leaders must actively support the program, clearly communicating its purpose and advantages to the entire organization. This involves explaining how variable pay aligns with company goals and its potential impact on individual earnings, setting the stage for a performance-driven culture.

Next, understand your company’s current compensation structure. Assess existing fixed pay, any informal bonus programs, and the overall compensation philosophy. This knowledge is crucial for designing a variable pay program that complements current practices and addresses specific company needs.

Designing a Transparent and Equitable Variable Pay System

Transparency is essential. Employees need to grasp how their performance translates into rewards. Clearly define the performance metrics, the targets that trigger payouts, and how those payouts are calculated. For instance, sales team bonuses could be tied to specific revenue goals, with clear formulas showing bonus amounts for exceeding targets by various percentages.

Equity is just as important. Fairness is crucial for acceptance and motivation. Design a system that rewards contributions equitably, considering role, responsibility, and market benchmarks. This builds trust and fosters a positive work environment.

Training Managers to Effectively Administer Variable Pay

Managers are vital to a variable pay program’s success. They need training to set clear goals, conduct fair performance reviews, and provide constructive feedback related to variable pay. This includes coaching them on handling sensitive compensation discussions with clarity and empathy.

Within the Indian context, training should address cultural nuances and communication styles. Guidance on framing feedback respectfully and motivatingly is key. Equipping managers with these skills ensures effective program administration and maximizes variable pay’s positive impact.

Communicating Effectively and Addressing Cultural Sensitivities

Open communication is vital, especially given cultural sensitivities around compensation in India. Address potential concerns proactively and clearly explain the program’s rationale. Regularly share program updates, successes, and adjustments. Town hall meetings and internal newsletters are effective communication channels.

Acknowledge cultural nuances. Tailor communication to resonate with the Indian workforce. For example, emphasize the collective benefits of variable pay in addition to individual rewards, aligning with the strong team orientation often seen in Indian work culture. This culturally sensitive approach fosters understanding and builds program support.

Maintaining Momentum and Adapting to Evolving Business Needs

Launching a variable pay program is an ongoing process, requiring continuous monitoring and refinement. Regularly review the program’s effectiveness, gather feedback from employees and managers, and adjust as needed to align with changing business needs.

This could involve revising metrics, adjusting payout structures, or refining communication. Flexibility and responsiveness are key to ensuring the program stays relevant and drives positive results.

Are you ready to transform your talent acquisition strategy? Visit Talent Hired – The Job Store Private Limited to learn more about our Recruitment Process Outsourcing services and how we can help you build a high-performing team.