The FMCG sector in India is entering a high-growth phase, driven by strong domestic consumption, the rise of rural markets, and an accelerated shift toward digital-first commerce.

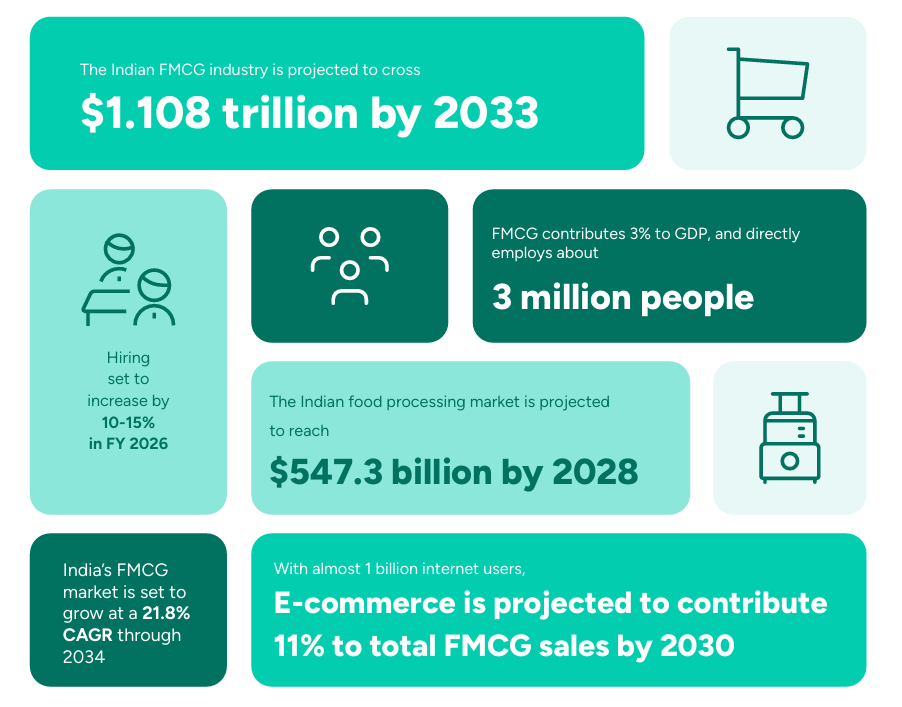

As one of India’s largest industries, contributing nearly 3% to the national GDP and employing over 3 million people, the FMCG ecosystem remains a cornerstone of consumption-led economic expansion.

Backed by government incentives, expanding e-commerce penetration, and strategic innovations such as D2C acquisitions and low-unit price packs, the sector is gearing up for a sharp rise in demand and talent needs.

As highlighted in Taggd’s India Decoding Jobs Report 2026, with hiring intent projected to grow 7% in FY27, organisations are increasingly seeking professionals skilled in customer acquisition, digital transformation, sustainability, and new product development.

This blog decodes the evolving landscape of opportunities, challenges, and workforce trends shaping the future of India’s FMCG industry.

Key Hiring Trends Reshaping the FMCG Sector in India

The FMCG sector is undergoing a major transformation, driven by rapid digital adoption, shifting consumption patterns, and expanding rural demand.

Below is list of top trends influencing jobs, skills, and workforce strategies in FMCG as per the India Decoding Jobs 2026 report:

1. Q-Commerce Growth Driving High-Volume Hiring

India’s quick-commerce market has expanded to ₹64,000 crore and is projected to reach ₹2 lakh crore by FY28. With BigBasket targeting nationwide 10-minute delivery by March 2026, hiring demand is rising sharply for:

- Delivery riders

- Warehouse staff

- Inventory & logistics planners

- Flexi/seasonal workers

2. D2C Boom Creating Digital & E-Commerce Job Opportunities

FMCG brands are investing heavily in direct-to-consumer (D2C) channels to boost margins and customer insights.

With the D2C market expected to exceed ₹5.1 lakh crore by 2027, companies are hiring for:

- Digital marketing & CRM

- E-commerce operations

- Consumer insights

- Product innovation roles

3. Hyperlocal Expansion & Rural Market Momentum

Tier II/III cities and rural India continue to power FMCG growth, outperforming urban markets for five consecutive quarters.

Hiring focus is shifting toward:

- Field sales and channel development

- Last-mile delivery

- Local marketing

- Region-specific product roles

Local language capability and cultural understanding are becoming competitive advantages.

4. Rising Sustainability & ESG Requirements

FMCG companies are strengthening their sustainability and compliance frameworks, increasing demand for specialists in:

- ESG reporting

- Green supply chain management

- Responsible sourcing

- Sustainable packaging

Consumers are prioritising healthier, transparent, and eco-friendly products, driving this shift.

5. Automation & Cost Pressures Reshaping Workforce Structures

As automation expands and companies optimise costs, hiring is becoming more strategic.

Demand is increasing for:

- Analytics and data roles

- Supply chain digitisation experts

- Automation specialists

Leadership roles are increasingly being filled internally as organisations streamline structures.

6. Strong Value Growth Led by Rural & Semi-Urban Demand

The FMCG industry saw 11% YoY value growth, supported by a 5.1% volume increase and 5.6% price growth. Rural and semi-urban markets are driving demand, especially in food categories, while urban areas still contribute ~65% of revenue.

Explore Taggd’s FMCG hiring solutions to help organisations overcome recruitment challenges.

Key Industry Players Driving India’s FMCG Ecosystem

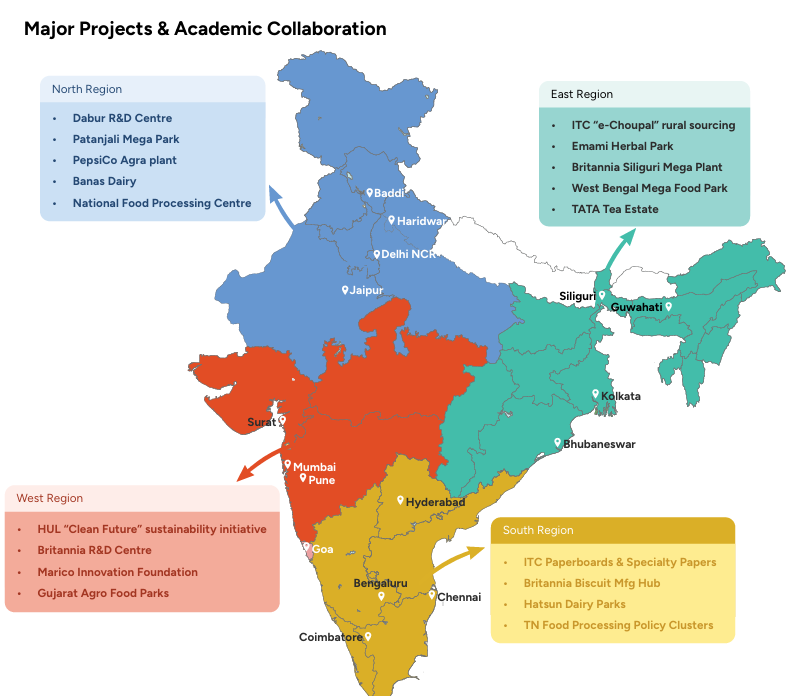

India’s FMCG ecosystem is powered by strong regional manufacturing hubs, expanding distribution networks, and strategic investments in innovation, sustainability, and rural reach.

Below is a breakdown of key FMCG regions, major companies, flagship projects, and focus areas shaping the sector’s growth.

1. North India: Consumer Hubs Driving Premiumisation & Rural Reach

Key Cities/Nodes: Delhi NCR, Chandigarh, Haridwar, Sonipat, Rajpura, Baddi, Nalagarh

Major FMCG Players: HUL, ITC, Dabur, Marico, Tata Consumer, P&G India

Key Projects & Initiatives:

- Dabur R&D Centre

- Patanjali Mega Park

- PepsiCo Agra Plant

- Banas Dairy

- National Food Processing Centre

Main Focus Areas: Premium product lines, deeper rural penetration, digital transformation, and faster supply chain integration.

2. South India: Innovation, Wellness & Export Manufacturing Powerhouse

Key Cities/Nodes: Chennai, Bangalore, Hyderabad, Coimbatore, Hosur, Tindivanam, Mysore

Major FMCG Players: HUL, Nestlé India, ITC, Dabur, Marico, Tata Consumer

Key Projects & Initiatives:

- ITC Paperboards & Specialty Papers

- Britannia Biscuit Manufacturing Hub

- Hatsun Dairy Parks

- Tamil Nadu Food Processing Policy Clusters

Main Focus Areas: Health and wellness products, regional flavour variants, ayurvedic and herbal categories, technology integration, and export-linked manufacturing.

3. West India: Growth Fueled by Innovation, Ports & Digital Commerce

Key Cities/Nodes: Mumbai, Pune, Ahmedabad, Sanand, Nashik, Kandla

Major FMCG Players: HUL, Nestlé India, ITC, Marico, Tata Consumer, Britannia, Godrej Consumer

Key Projects & Initiatives:

- HUL “Clean Future” Sustainability Initiative

- Britannia R&D Centre

- Marico Innovation Foundation

- Gujarat Agro Food Parks

Main Focus Areas: Innovation centres, strong port connectivity, premium consumer segments, e-commerce logistics optimisation, and efficient manufacturing ecosystems.

4. East India: Traditional Strengths, Herbal Products & Port-Based Growth

Key Cities/Nodes: Kolkata, Rajahmundry, Bhubaneswar, Haldia, Siliguri

Major FMCG Players: HUL, ITC, Tata Consumer, Emami, Dabur

Key Projects & Initiatives:

- ITC “e-Choupal” Rural Sourcing Initiative

- Emami Herbal Park

- Britannia Siliguri Mega Plant

- West Bengal Mega Food Park

- Tata Tea Estate

Main Focus Areas: Traditional and herbal products, rural distribution, heritage brand expansion, port-based exports, and sustainable sourcing.

Rural Momentum & Entry-Level Hiring Trends

FMCG products now account for 50% of rural consumer spending, driven by rising awareness, lifestyle upgrades, and better market access. India’s growing middle class, larger than the US population and a young median age of 27 years are accelerating consumption nationwide.

Hiring trends reflect this momentum:

- As per the India Decoding Jobs Report 2026, the FMCG sector recorded a 6% rise in entry-level hiring in the past six months.

- Nearly 23% of fresher roles are concentrated in e-commerce operations, social commerce, data analytics, and digital marketing, highlighting the industry’s digital-first expansion.

India’s FMCG Sector’s Market Outlook & Evolving Talent Landscape

India’s FMCG sector is experiencing one of its strongest growth phases, supported by rapid digital adoption, rural consumption, and premiumisation trends. Employing nearly 30 lakh workers, the sector is projected to add 2.5 lakh more jobs next year, driven by expanding retail networks, D2C channels, and tech-enabled supply chains.

The FMCG market is expected to grow at an impressive CAGR of 21.8%, reaching $1.108 trillion by 2033. Government initiatives like the ₹10,900 crore PLI Scheme for Food Processing and the PM-SAMPADA scheme (₹4,600 crore) continue to boost manufacturing capacity and employment.

Market Demand Trends

In Q1 FY2025, FMCG retail value grew 11% YoY, with volumes rising 5.1%. Rural India is driving the momentum with 8.4% volume growth, outperforming urban markets (2.6%).

Meanwhile, quick commerce is expanding at nearly 75% annually, as brands accelerate online and D2C sales.

Premium and health-focused products are gaining traction, now contributing 30% of category sales, alongside rising demand for sustainable and eco-friendly packaging.

Shifts in Hiring & Workforce Priorities

Hiring is evolving to match the sector’s digital and consumption-led growth. About 63% of recruitment is happening across sales, distribution, and marketing, reflecting deeper rural penetration and omnichannel expansion.

Another 26% of hiring falls under blue-collar supply-chain and logistics, while 20% of new roles today demand IT and digital capabilities, including data analytics, marketing automation, and e-commerce operations.

Entry-level job openings have increased by 6%, largely in e-commerce, social commerce, digital marketing, and data-led roles. Companies are also strengthening capabilities in sustainability, consumer insights, and tech-driven supply chain optimisation.

To bridge skill gaps, FMCG firms are investing heavily in upskilling and reskilling, and are increasingly using contract or gig-based hiring for project-based tech and sustainability roles.

Diversity & Inclusion: A Growing Imperative

Diversity is becoming a major strategic focus. Although women currently represent only 13% of the FMCG workforce (3.9 lakh workers), leading companies are making significant progress:

- HUL: 42% women in the workforce

- Nestlé India: Gender parity on the board; 24% women in managerial positions

- Britannia: 44% women on the shopfloor; targeting 50% by FY2027 and 20% women in managerial roles

These initiatives reflect how major FMCG players are prioritising DEI, sustainability, and capability development to build future-ready teams aligned with global ESG expectations.

For the complete market outlook, detailed hiring forecasts, and talent trends, unlock the full insights in the India Decoding Jobs Report.

FMCG Future Hiring Trends

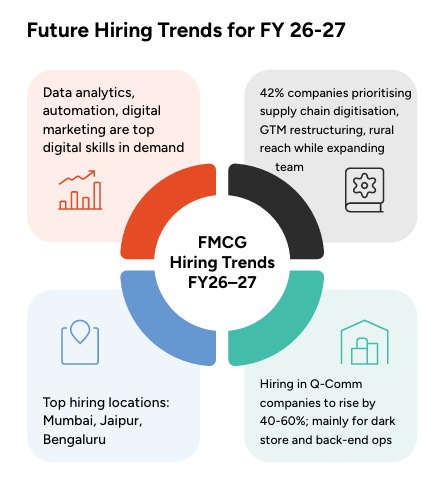

The FMCG sector is entering a pivotal transformation phase, where hiring trends reflect a balance of cautious optimism, digital acceleration, and strategic workforce realignment. Although recovery remains steady, companies are becoming more selective, focusing on roles that directly impact growth, efficiency, and market expansion.

Sales and marketing continue to dominate hiring, accounting for 63% of all recruitment, driven by aggressive expansion into Tier-2/Tier-3 cities and rural markets. With rural households contributing over 40% of premium FMCG sales, talent with strong understanding of rural consumer behaviour, demand cycles, and distribution models is in especially high demand.

Digital-first capabilities are another major priority. FMCG companies are actively seeking experts in data analytics, automation, digital marketing, and AI-driven personalisation. Skills in predictive analytics and tech-led customer segmentation are becoming essential for staying competitive in an increasingly digital marketplace.

Around 42% of FMCG companies are expanding their teams, but with extreme selectiveness, focusing on supply chain digitisation, GTM restructuring, and rural expansion models rather than broad-based hiring.

The rise of quick commerce is creating a parallel hiring boom. India’s leading q-commerce platforms are expected to increase staffing by 40–60%, adding 80,000–100,000 new roles across dark-store operations and back-end support.

When it comes to geography, the top FMCG hiring hubs are:

- Mumbai (28%) – financial, corporate, and leadership roles

- Jaipur (24%) – a fast-growing regional distribution and logistics hub

- Bengaluru (22%) – technology, analytics, and digital transformation roles

Another noteworthy trend is the growing demand for Revenue Growth Management (RGM) specialists. FMCG companies are leaning heavily into data-driven pricing, portfolio optimisation, pack-size strategy, and promotional ROI, making RGM one of the most strategically critical roles in the sector.

Wrapping Up

India’s FMCG sector is at a defining moment. As digital adoption accelerates, rural consumption rises, and quick commerce scales nationwide, companies are rethinking how they hire, train, and retain talent. The shift toward premiumisation, sustainability, analytics-driven decision-making, and rural expansion is reshaping job roles across sales, supply chain, and digital functions.

To stay competitive, FMCG companies need agile hiring models, stronger employer branding, and a future-ready workforce strategy that blends frontline execution with data-led insights.

FAQs

What are the top hiring trends in India’s FMCG sector for 2025–2026?

The biggest FMCG hiring trends as highlighted in Taggd’s India Decoding Jobs Report 2026 include rising demand for digital skills, rapid expansion into Tier-2/Tier-3 cities, premiumisation-led product growth, and a surge in quick-commerce hiring. Companies are prioritising roles in sales, distribution, supply-chain analytics, digital marketing, and Revenue Growth Management (RGM).

Which FMCG job roles are in highest demand today?

The most in-demand FMCG roles include field sales executives, area sales managers, supply-chain planners, category managers, digital marketers, data analysts, and RGM specialists. Quick-commerce platforms are also hiring extensively for dark-store operations and last-mile logistics.

Why is digital talent becoming so important in the FMCG industry?

FMCG companies are increasingly relying on AI-driven personalisation, predictive analytics, automation, and e-commerce to reach consumers. As digital channels grow, companies need experts who can optimise online sales, manage data-led campaigns, and build tech-enabled supply chains.

What hiring challenges are FMCG companies facing in India?

Key challenges include high attrition (especially among younger employees), shortage of frontline sales talent, competition from D2C and tech companies for digital skills, and difficulty attracting Gen-Z workers who prioritise flexibility, purpose, and faster growth.

How is rural growth influencing FMCG hiring?

Rural and semi-urban India now contribute significantly to FMCG volume growth and account for over 40% of premium product sales. As a result, companies are hiring more field sales professionals, rural distribution managers, last-mile delivery staff, and local marketing specialists with strong regional understanding.

Want deeper insights into FMCG hiring trends, AI-based workforce transformation, and India’s talent demand outlook?

Download the full India Decoding Jobs 2026 report- complete data, hiring charts, industry forecasts & strategic recommendations.

Download Now- India Decoding Jobs 2026