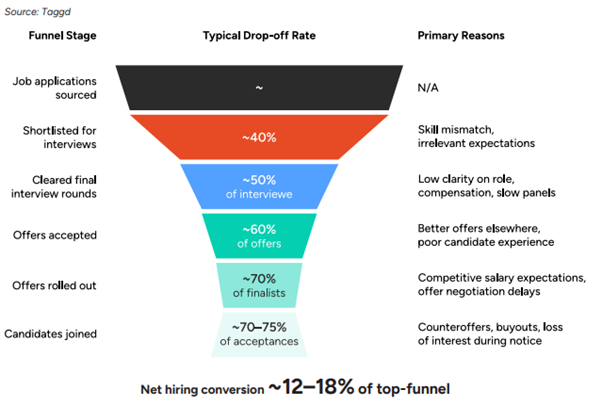

The Resume-Reality Gap: The first major drop-off occurs during initial screening due to inflated credentials, especially in high-demand tech roles. Limited resume verification creates inefficiencies and extends time-to-hire significantly.

The Notice Period Dilemma: India’s unique professional landscape creates a strategic challenge, 60-90 day notice periods are standard for mid-to-senior professionals. During this extended window, candidates become highly susceptible to counteroffers, retention bonuses, and competing employer outreach.

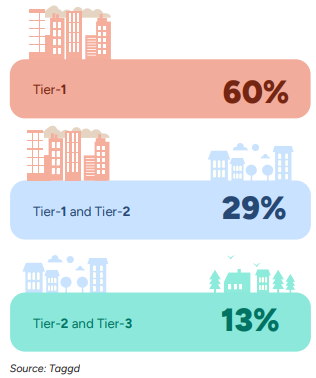

The Relocation Resistance: Flexibility has evolved from perk to foundational expectation. Professionals increasingly prioritize proximity to family and familiar environments over career advancement, regardless of tier-city location.

The Speed Imperative

Six in ten candidates drop out if the hiring process exceeds three weeks. In India’s competitive talent market, speed isn’t just efficiency, it’s strategy. Long, ambiguous hiring cycles have become primary deterrents to top talent.

Before candidates even apply, they’ve formed impressions through LinkedIn posts, Glassdoor reviews, and peer referrals. Authenticity, speed, and clarity now define employer appeal more than compensation packages.

The New Talent Expectations: Gen Z + Millennials

India’s talent economy driven by Gen Z and younger millennials requires fundamentally new engagement rules:

Gen Z Expectations (18-24 months per role):

- Career acceleration overcompensation

- AI-powered tools and real-time feedback

- Personal alignment: “Does this role reflect who I am?”

- Structured mentorship and clear career paths

Millennial Motivations (Higher stability at 10+ years):

- Professional trajectory amplification

- Bridge between legacy systems and new technologies

- Learning and leadership coexistence

For GCCs, the message is clear: India’s top talent is looking for more than employment

/>

/>