India’s technology landscape is entering one of its most defining decades. As per Taggd’s India Decoding Jobs 2026, By FY 2026, the country is expected to have nearly 9.5 million tech professionals, and the industry itself is poised to reach $300 billion in value, with a clear trajectory toward $500 billion by 2030. Much of this momentum is coming from large-scale AI adoption, an expanding cloud ecosystem, and deeper digital consumption across enterprises and consumers.

India’s AI economy alone is forecast to touch $17 billion by 2027, and CEOs across sectors- about 77% of them– expect accelerated growth backed by AI-heavy investments. Complementing this rise, the public cloud market is on track to hit $17.8 billion by 2027, growing at a rapid 23% CAGR. In support of this shift, the Union Budget for 2025–26 earmarked ₹2,000 crore specifically for AI infrastructure and research.

Even with global disruptions, India’s IT–ITeS engine continues to show resilience. Industry bodies expect revenues to cross the $300 billion mark by FY2026 and move toward $350 billion by 2030. This forward movement is being shaped by four forces:

- AI becoming mainstream, not experimental

- Cloud-first engineering becoming a standard expectation

- Global capability centers (GCCs) building deeper tech capability in India

- Digital engineering demand rising across enterprise and government initiatives

Hiring Outlook in the Information Technology Industry

Despite mixed global macros, India’s IT hiring is projected to grow 7% in FY27. The demand stems from:

- Global tech companies expanding their India innovation centres

- A robust domestic talent pool already adept in next-gen skills

- Government-led digitalisation across sectors

- Friendlier business and compliance environments

At the same time, the industry is undergoing a structural reset. Companies are redesigning workflows around AI-first operating models, which is increasing demand for:

- AI/ML engineers

- Data scientists

- Cloud architects

- Cybersecurity specialists

Meanwhile, roles based on repetitive tasks are being rapidly automated.

This shift explains the “twin hiring pattern” in 2025- targeted hiring in advanced skills and selective rationalisation in legacy roles. For instance, TCS’s reduction of around 12,000 roles in July 2025 was widely seen as a necessary pivot toward skill alignment, cost efficiency and AI-driven productivity.

Fresh hiring has not disappeared; in fact, it picked up early in 2025. The sector’s hiring intent touched ~59% in H1 2025, and several companies indicated quarterly hiring spikes across AI, cloud and cybersecurity domains. By 2030, India’s tech workforce is expected to reach 7.5 million, even as job roles evolve due to rapid automation.

IT Hiring Trends

India’s tech landscape is entering a high-velocity growth phase powered by AI adoption across every layer of the industry- from GCCs and hyperscalers to startups and enterprise IT. The surge in AI and emerging tech skills, expansion of digital infrastructure like data centres and cloud platforms, and renewed momentum in startup innovation are collectively reshaping the country’s hiring needs.

With demand for AI-ready talent far outpacing supply, organisations are doubling down on skilling, platform engineering, cybersecurity, and product development. The result: a talent market where AI capabilities are becoming the core engine driving IT growth, digital transformation, and next-gen job creation.

1. AI & Advanced Tech Skills Demand

India’s appetite for AI and emerging tech skills continues to surge. Demand for AI talent is likely to cross 1 million roles by 2026, yet the country faces an AI skill deficit of nearly 53%, making large-scale upskilling a business necessity, not just an HR goal.

2. GCC Expansion & Value Acceleration

India’s GCC ecosystem is set to touch $100 billion by 2030, potentially employing 25 lakh professionals. GCCs are no longer back offices- they’re building product, cybersecurity, platform engineering and AI solutions for global markets.

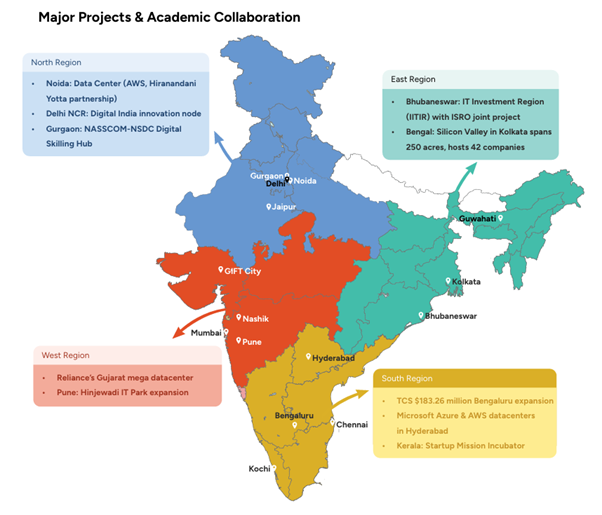

3. Data Centre Surge

India’s data centre capacity is expected to double to 2,000 MW by 2026. Hyperscalers are driving this push- Google alone has announced a 1 GW, $6 billion facility in Visakhapatnam.

4. Cloud & Digital Transformation

According to NASSCOM, cloud technologies could account for 8% of India’s GDP by 2026, a staggering fourfold jump in five years. The cloud ecosystem is also expected to generate 1.4 crore new jobs.

5. Startup Funding Momentum

In the first half of 2025, India secured $4.8 billion in tech investments third globally behind the US and UK. Funding in AI and deep-tech startups is accelerating the demand for product developers, R&D engineers and startup PM roles.

6. Campus Hiring Bounceback

After muted years, fresher hiring is returning. Top IT firms- TCS, Infosys, HCLTech, Wipro and others expect to onboard 82,000 graduates in FY2026, signalling recovery in entry-level demand.

Check out these trends in detail in our India Decoding Jobs 2026.

India’s New Technology Growth Pillars

India’s technology economy is shifting gears- moving beyond metros, beyond software-only growth, and into a phase led by AI-first startups, a national semiconductor build-out, and fast-advancing talent hubs outside the traditional IT corridors. Together, these forces are rewriting the rules of innovation, job creation, and skill demand in India’s digital industry.

Here’s a deeper look at how these three engines are shaping the next decade of tech careers:

AI & SaaS Startup Growth

Investment into AI-native companies is accelerating, signalling that India is no longer just a consumer of AI but a global builder. With AI funding touching $665M in 2025- a 50% YoY surge and enterprise SaaS investments rising 66%, startups are scaling products, teams, and global ambition simultaneously.

This growth is expanding hiring beyond core software roles into data engineering, AI/ML research, human-centred design, prompt engineering, product strategy, DevOps and R&D. SaaS founders are building with lean teams and shipping faster, and that speed is creating a talent ecosystem where experimental problem solvers are more valuable than traditional coders. India’s next wave of unicorns may not be fintech or e-commerce- they’re just as likely to be AI copilots, cybersecurity platforms, or developer-layer automation products built in a 10-person room in Bengaluru or Kochi.

Emerging City Clusters

The tech map of India is being redrawn. While Bengaluru, Hyderabad and Pune remain strong anchors, the rise of new tech clusters like Karnataka’s “Silicon Beach” marks a shift toward distributed innovation. The region is targeting 5,000 IT hires in FY 2025–26, reserving 60–70% of roles for fresh graduates. It is part of a larger blueprint aiming to create 2 lakh digital jobs by 2034, with a strong focus on applied engineering, cloud operations, and next-gen development skills.

This decentralisation is reducing hiring cost, improving retention, and unlocking talent that earlier migrated out seeking metro opportunities. As highlighted in India Decoding Jobs 2026- Fourth and Forward – Fuelled by Talent, Tier-2 and coastal cities from Mangalore to Coimbatore and Indore to Mohali are becoming startup landing pads, GCC mini-hubs and specialised R&D zones. The outcome: career opportunity is no longer defined by pin code.

Semiconductor Upsurge

India’s semiconductor mission is more than capex; it’s a workforce transformation. With 10 lakh new jobs projected by 2026, the industry is opening career doors that didn’t exist a decade ago.

The job spectrum spans chip design, VLSI, embedded systems, nanomaterials, AI-hardware optimisation, fabrication engineering, packaging & testing. For engineers who grow beyond software and into hardware-software intersections, this sector could become the biggest wealth-creation engine since IT services in the early 2000s.

The global chip shortage accelerated India’s position and government-backed incentives, private fab investments, and university-level semiconductor curriculum reforms are ensuring this isn’t a one-cycle boom. This is India preparing to power AI hardware for the world.

Key Challenges in India’s IT Industry Hiring

India’s IT sector is approaching a defining growth window- where talent scalability, AI maturity, and organisational agility will determine who stays ahead and who falls behind.

The next five years bring massive opportunity, but also structural challenges around skills, capacity, and workforce transformation. To compete globally, IT organisations must expand hiring and R&D investment while simultaneously upskilling at scale, building distributed talent hubs, and strengthening retention in core markets.

1. Deepening GenAI, Cloud & Cybersecurity Skill Shortfalls

The capability gaps in advanced technology roles are widening each year. India now reports a 90% shortage in GenAI-ready talent, a 55–60% deficit in cloud-native expertise, and a 25–30% shortage of mid-to-senior cybersecurity specialists—gaps that could persist well into 2030. As AI adoption accelerates, this talent imbalance threatens product velocity, transformation initiatives, and competitive differentiation.

2. AI-Driven Restructuring and Workforce Realignment

Generative AI is redefining work models across IT services. Projections indicate that 400,000–500,000 mid-career roles may be restructured or phased out by 2028, particularly in legacy delivery functions. Companies are shifting to leaner, automation-first operating structures, making reskilling in GenAI, platform engineering, cloud architecture, and cybersecurity both urgent and non-negotiable for workforce sustainability.

3. GCC Talent Wars and Compensation Escalation

India’s GCC landscape is now 1,700–1,900 centres strong with 19 lakh professionals is scaling aggressively. States like Karnataka are targeting up to 1,000 GCCs and 3.5 lakh new jobs by 2029, intensifying demand for specialised talent. This expansion is driving compensation spikes, faster attrition cycles, and a race to secure niche roles like R&D engineers, cybersecurity architects, product technologists, and AI developers.

4. Weak Entry-Level Hiring Funnel & Falling Campus Conversions

Despite rising demand for digital talent, entry-level recruitment pipelines are contracting. Campus intake has dropped sharply across top hiring seasons, resulting in fewer trained freshers entering the system just when industry demand is growing toward multi-million scale. The impact will be felt most in Bengaluru, Hyderabad, Pune and other major tech hubs, where volume hiring and early-career workforce supply are critical.

5. Capacity & Retention Strain in Major Tech Hubs

Bengaluru, Hyderabad and other IT corridors are expanding rapidly—but infrastructure, housing costs and attrition are stretching workforce capacity. Karnataka alone targets 1,000 GCCs and 350,000 additional jobs by 2029, which will tighten the talent loop even further. Higher salary inflation, poaching pressure, and decentralised workforce migration may push companies to diversify into Tier-2 hubs to stabilise cost and retention.

How Taggd Helps IT Organisations Win the Talent Battle

Taggd partners with IT leaders to solve hiring complexity at scale- whether it’s closing GenAI skill gaps, building early-career pipelines, or securing niche architects for cloud, cybersecurity and semiconductor roles.

With AI-driven talent intelligence, India-wide sourcing networks, and domain-deep hiring playbooks, Taggd accelerates time-to-hire, improves quality-of-hire, and unlocks access to specialised tech talent across emerging and established hubs. From volume tech roles to high-impact GCC and R&D hiring, Taggd’s RPO solutions for IT hiring helps organisations build future-ready tech teams faster, smarter, and more predictably.

Global IT Hiring Landscape & Where India Stands in 2026–2030

The world is entering one of the most transformative tech decades in history. AI, cybersecurity, cloud computing and advanced analytics are reshaping industries, redefining job roles, and accelerating talent demand. As digital adoption increases across enterprises, nations are racing to secure skilled tech talent and India is emerging as one of the strongest contenders.

Global Hiring Trends: AI Is Redefining the Workforce

The global tech industry is in hyper-growth mode. As per the World Economic Forum, 170 million new technology jobs could be created globally by 2030, delivering a net gain of nearly 78 million roles. The surge is being driven by large-scale AI adoption, data-driven transformation, cloud migration, and rising cybersecurity risks.

What’s Driving Global Demand?

| Growth Vector | Outlook |

| AI & GenAI | AI, ML and LLM-driven jobs expected to grow –40%+ in 2025 |

| Cybersecurity | One of the fastest-expanding job clusters globally |

| Cloud Engineering | Multi-cloud & hybrid deployments fueling new roles |

| Data & Analytics | Core skill requirement for future digital delivery |

However, the opportunity comes with risk. 40% of current tech skill sets may become obsolete within a few years, and IDC warns that skill shortages could cost the world economy $5.5 trillion by 2026. Nearly 90% of organisations are already facing talent scarcity, pushing 77% of employers to invest in upskilling & retraining, especially in domains like:

- AI engineering & model ops

- Cybersecurity & threat intelligence

- Cloud architecture

- Advanced data science & analytics

Global Big Tech Signals the Next Wave of Hiring

| Company | Hiring & Tech Investment Highlights |

| NVIDIA | Q1 FY26 revenue $44.1B (+69% YoY) powered by Blackwell NVL72 supercomputing |

| Microsoft | Scaled Azure + Copilot investments with multi-year enterprise/government deals |

| Expanding Vertex AI & multimodal AI for production-scale deployments | |

| AWS | Growing Bedrock + Titan/Nova model stack to strengthen enterprise AI workloads |

AI-led jobs are forecast to cross 7.8 crore globally by 2030, with digital roles, especially remote-first projected to grow 25% to reach 92 million.

India’s Rising Tech Dominance: A Workforce Superpower in Motion

India stands out as one of the world’s strongest talent engines with 80% of the IT workforce in formal employment- the highest among all industries. Analysts predict 20 lakh new tech jobs by 2030, powered by innovation in:

- AI and Generative AI

- Blockchain and edge computing

- Cloud and cybersecurity

- Semiconductor & advanced hardware manufacturing

India’s IT Talent Outlook: Fast, Skilled & Digital-First

| Hiring Indicator | Status |

| Current IT workforce | 58 lakh professionals in 2025–26 |

| Net new jobs expected FY26 | 1.26 lakh |

| AI-specific hiring forecast | 10 lakh+ roles by 2026 |

| Tech hiring share by Bengaluru | 43.5% (over 10 lakh employees) |

Major IT leaders are shifting to AI-native business models:

- Infosys → AI-first delivery with Topaz + BFS innovation programs

- TCS → Strengthening digital engineering + JLR partnership for SDVs

- Wipro → Expanding semiconductor design through Intel Foundry alliance

- HCLTech → GenAI upskilling + 2030 sustainability alignment

- Tech Mahindra → Aerospace & Defence digital platforms powered by Industry 4.0

Yet, 81% of recruiters struggle to hire for critical tech skills, driving organisations to:

- Increase L&D spending by 10–20%

- Scale AI and cybersecurity training tracks

- Build accelerated fresher-to-engineer pathways

- Expand hiring in Tier-2 talent clusters

India is also turning into a startup powerhouse– unicorn count projected to rise from 120 to 280–1,000 by 2030, potentially contributing $1 trillion to GDP. Fintech alone may create 150 unicorns’ worth $500B.

IT Skill Matrix- Where Hiring Is Hard vs. High-Value

As India accelerates toward a digital-first economy, organisations are expanding tech teams faster than the talent supply can keep up. While capabilities like full-stack development, DevOps, and cybersecurity deliver high strategic value, they are also the most talent-scarce and cost-intensive to hire for.

Emerging roles in GenAI, semiconductor engineering, cloud architecture and platform engineering sit at the top of the priority pyramid, but also rank highest in hiring difficulty, time-to-fill and salary inflation.

This skill matrix maps the real hiring landscape of IT in India: where demand is surging, roles are evolving, and companies must rethink sourcing, training, and retention to stay competitive over the next decade.

Wrapping Up

The next five years will separate technology organisations that hire, build and transform boldly from those who remain reactive. India sits on the edge of its most powerful innovation cycle yet- fuelled by AI-native engineering, cloud infrastructure at scale, deep GCC capability, semiconductor expansion and startup acceleration across non-metro talent hubs.

But growth will only convert to value if companies close skill gaps, deploy AI-first operating models, strengthen university-to-industry pipelines, and diversify hiring beyond legacy corridors.

The opportunity is clear: India is not just participating in the global tech race, it is leading it.

With the right combination of talent intelligence, skilling velocity, and strategic hiring, the country has the potential to deliver the world’s most advanced digital workforce by 2030.

Want deeper insights into IT hiring trends, AI-based workforce transformation, and India’s talent demand outlook?

Download the full India Decoding Jobs 2026 report- complete data, hiring charts, industry forecasts & strategic recommendations.

Download Now- India Decoding Jobs 2026