Accrued Payroll Guide for Indian Businesses | Easy & Accurate

Accrued payroll is essentially the money your company owes to its employees for work they’ve already put in, but haven’t been paid for yet. Think of it like a running tab of earned wages that builds up between paydays. It’s a core concept in accrual accounting, where it’s recorded as a current liability, ensuring your financial records are always up-to-date.

Decoding Accrued Payroll and Its Importance

Let’s use a simple scenario. Imagine your company’s financial month closes on the 31st, but your payday isn’t until the 5th of the next month. Your team worked those last few days of the month and earned their wages, but the actual cash won’t leave your bank account until the following month.

Accrued payroll is what bridges this timing gap. It’s the accounting practice of recording those earned-but-unpaid wages as an expense in the same month the work was actually performed.

This isn’t just a random bookkeeping quirk; it’s a fundamental part of the matching principle in accounting. This principle is straightforward: expenses should be recognised in the same period as the revenues they helped generate. By accruing payroll, you match your labour costs to the right accounting period. This gives you a true and fair view of your company’s profitability for that month. Without it, your expenses would look lower than they really are, making your profits seem artificially high.

Why It Is Crucial for Financial Accuracy

Properly accounting for these liabilities is what makes your financial statements reliable. For CHROs and finance leaders, this accuracy is non-negotiable for a few key reasons:

- True Financial Health: It provides stakeholders, from investors to your own management team, with a precise picture of your company’s short-term obligations.

- Budgeting and Forecasting: When you know your exact labour costs, you can create much more accurate financial forecasts and departmental budgets.

- Regulatory Compliance: It’s essential for adhering to accounting standards, which helps you avoid potential compliance headaches down the road.

Accrued payroll is more than just an accounting entry; it is a commitment to financial transparency. It reflects the true cost of labour in real-time, preventing financial surprises and enabling smarter strategic planning.

The Indian Employment Context

In India’s diverse employment landscape, the concept of accrued payroll takes on a unique significance. The labour market is a mix of salaried professionals, hourly workers, and a huge number of casual labourers.

For example, data from the International Labour Organization’s India Wage Report showed that of 195 million wage earners, about 62% (121 million) were classified as casual labourers. These workers often deal with irregular pay cycles. For them, and the businesses that employ them, accrued payroll is a critical tool. It ensures their earned wages are properly accounted for, even if payment is delayed, providing a more stable and accurate financial record for businesses that depend on a blended workforce. You can explore more about India’s workforce structure in the full report on ilo.org.

How to Calculate Accrued Payroll Accurately

Getting your accrued payroll calculation right isn’t about wrestling with complex maths; it’s about following a methodical process. Nail this, and you’ll avoid misstating your liabilities and keep your financial reports clean and accurate. The main idea is to pinpoint the exact value of work your employees have put in between the end of the last pay cycle and the close of the current accounting period.

At its core, the calculation is pretty straightforward. You multiply the number of workdays in the accrual period by each employee’s daily pay rate. The real trick, however, is accurately figuring out these two key numbers for your entire team, which might include a mix of salaried, hourly, and commission-based staff.

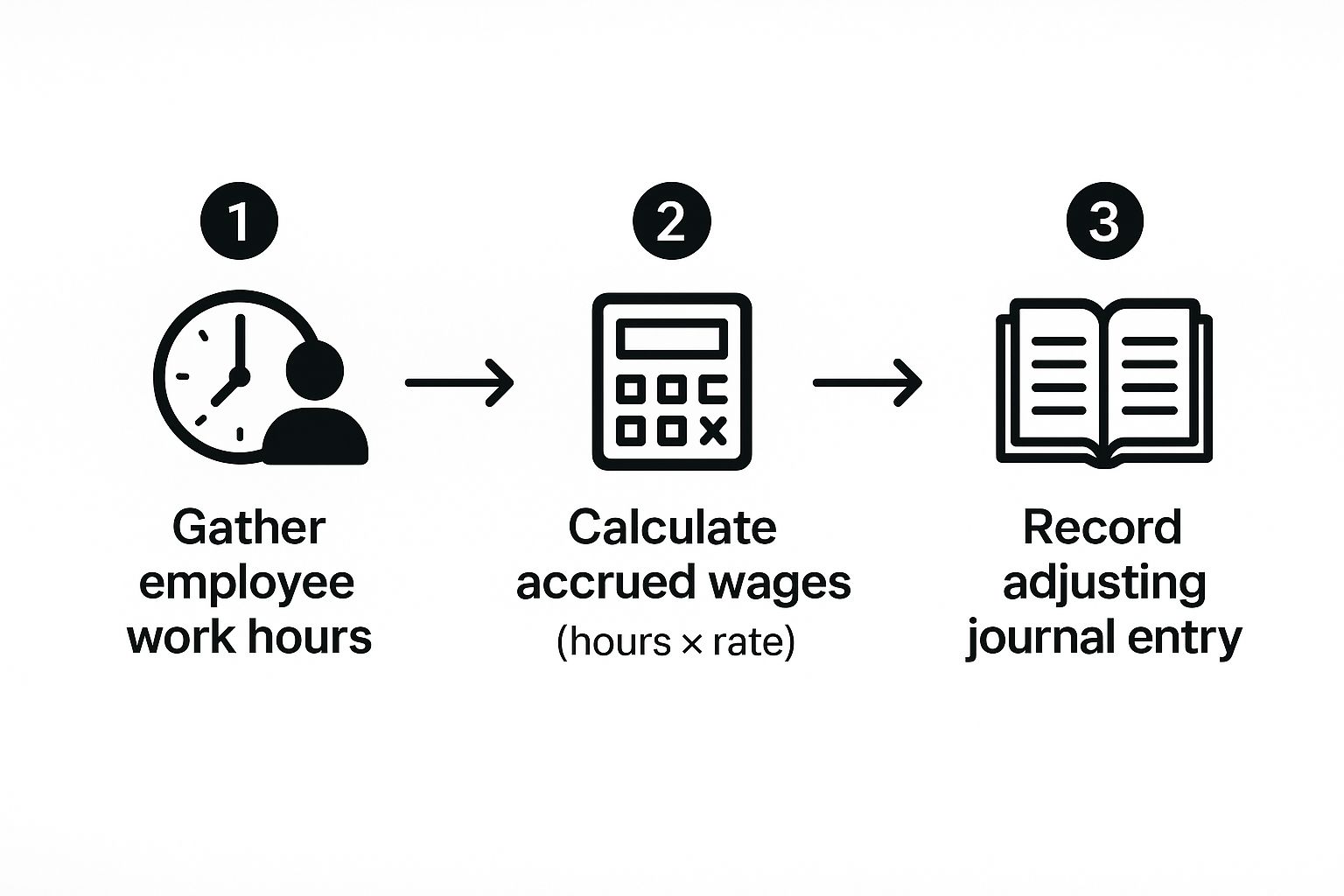

This simple infographic breaks down the core workflow into three manageable steps.

This visual shows how raw work data gets turned into a proper accounting entry, making sure your expenses are matched to the right period.

Step-by-Step Calculation Guide

Let’s break the process down into actionable steps. The goal is to build a reliable system that works every single time, no matter how your pay structures or accounting periods line up.

- Pinpoint the Accrual Period: First, you need to find the exact number of days between the last day of the previous payroll run and the final day of the current accounting period. For instance, if your accounting month closes on the 31st but your last payday was on the 25th, your accrual period is six days. Don’t forget to account for weekends and public holidays based on your company’s work policy.

- Calculate the Daily Pay Rate: This step is a bit different depending on how an employee is paid.

- For Salaried Employees: Just divide their monthly salary by the total number of working days in that specific month.

- For Hourly Employees: Their daily rate is simply their hourly wage multiplied by the standard number of hours they work per day.

- Calculate Total Accrued Wages: Now, multiply the number of accrual days by each employee’s daily pay rate. Add up these individual amounts, and you’ve got the total gross accrued payroll for your whole team.

To illustrate, let’s walk through a quick example for a salaried employee.

Accrued Payroll Calculation Example

| Metric | Value | Calculation/Explanation |

|---|---|---|

| Accounting Period Ends | March 31st | The date the books close for the month. |

| Last Pay Period Ended | March 26th | The last day covered by the previous salary payment. |

| Accrual Period | 5 days | March 27th, 28th, 29th, 30th, 31st. |

| Monthly Salary | ₹88,000 | The employee’s gross monthly pay. |

| Working Days in March | 22 days | The total number of business days in the month. |

| Daily Pay Rate | ₹4,000 | ₹88,000 / 22 days. |

| Total Accrued Wages | ₹20,000 | ₹4,000 (Daily Rate) * 5 (Accrual Days). |

This table shows how to calculate the ₹20,000 in gross wages earned but not yet paid, which needs to be recorded as a liability.

Crucial Reminder: This calculation is for gross wages. The total accrued payroll liability must also include the employer’s share of associated costs, such as contributions to the Provident Fund (PF) and Employees’ State Insurance (ESI), that have been incurred during this period.

Handling Different Pay Structures

Your workforce is likely a mix of different compensation types, so your calculations need to be flexible.

- Hourly Workers: For hourly employees, the calculation is direct. Multiply the total unpaid hours they worked during the accrual period by their hourly rate. Make sure you factor in any overtime hours at the correct, higher rate.

- Commission-Based Staff: If your sales team has earned commissions during the accrual period that won’t be paid until the next cycle, you have to include these amounts. Calculate the earned commission and add it to your accrued payroll liability. This is vital for sales-driven companies where commissions are a big chunk of compensation.

By applying this structured approach, you create a clear and auditable trail for every accrued payroll entry, locking in financial accuracy and compliance.

Recording Your Accrued Payroll Journal Entries

Once you’ve calculated the total accrued wages, the next step is to translate that number into the language of accounting: journal entries. This is where you formally record the expense and the corresponding liability on your books, making sure your financial statements are spot-on at the period’s end.

The process boils down to two key entries. First, the all-important adjusting entry, and second, the optional—but incredibly useful—reversing entry.

The adjusting entry is the most critical piece of the puzzle. You make it at the end of an accounting period to recognise labour costs that your company has incurred but hasn’t paid out yet. Think of it as officially telling your financial records, “We’ve used our employees’ labour this month, and we owe them for it.”

This simple action upholds the matching principle by putting the expense in the correct period. It has a direct impact on both your income statement and balance sheet.

The Adjusting Journal Entry

The mechanics here are actually quite straightforward. You will debit your expense account and credit your liability account. In accounting terms, a debit increases an expense, while a credit increases a liability.

Let’s stick with the ₹20,000 in accrued wages from our previous example. On 31st March, the journal entry would look like this:

- Debit: Wages Expense Account for ₹20,000

- Credit: Accrued Payroll (or Wages Payable) Account for ₹20,000

This single entry increases your total expenses on the income statement, which in turn reduces your net income for that period. At the same time, it increases your current liabilities on the balance sheet, reflecting what the company owes its employees.

By recording this entry, you ensure that anyone reading your financial reports gets a true and fair view of your profitability and short-term debts. It prevents the overstatement of profits and provides a transparent look at outstanding obligations.

The Power of the Reversing Entry

So, what happens when the calendar flips to the next month? You could manually track that ₹20,000 and painstakingly split the next payroll payment. But there’s a much cleaner, more elegant solution: the reversing entry.

This is an optional entry made on the very first day of the new accounting period (say, 1st April). It does exactly what its name suggests—it reverses the adjusting entry you just made.

- Debit: Accrued Payroll (or Wages Payable) Account for ₹20,000

- Credit: Wages Expense Account for ₹20,000

This might seem a bit strange. Why record an expense just to immediately reverse it? The reason is purely for administrative convenience. This entry zeroes out the liability account and creates a temporary negative balance in your Wages Expense account.

When you run your next regular payroll, you can simply record the entire payroll amount as a normal debit to Wages Expense. You don’t have to worry about the headache of splitting the cost between two different periods. The temporary credit balance is wiped out, and the net effect on the Wages Expense account for the new period is perfectly correct. This simple technique can dramatically simplify the payroll process and significantly cut down the chance of errors, especially in large organisations.

The Impact of Accruals on Financial Health

Getting a handle on accrued payroll is so much more than a routine accounting task. It’s about feeling the real-time financial pulse of your organisation. When you get accruals right, you connect the day-to-day reality of your workforce directly to your company’s strategic financial health, shining a light on what would otherwise be dangerous blind spots.

The impact is clearest when you look at your two main financial statements. On the income statement, properly recording accrued payroll honours the matching principle. This simply means that the labour costs linked to generating revenue are recognised in the same period, giving you a true picture of your monthly or quarterly profitability. Without this, your profits can look artificially high, which can easily lead to flawed business decisions.

At the same time, over on the balance sheet, it gives you a transparent and honest view of your current liabilities. This number tells investors, lenders, and internal leaders exactly what the company owes in the short term—a critical sign of financial stability.

How Mismanagement Warps Financial Reality

When accrued payroll is mismanaged, or worse, ignored, the fallout ripples through all your financial reporting. It completely distorts the metrics that your leadership team relies on to make critical decisions.

- Skewed Financial Ratios: Key performance indicators like the current ratio (current assets divided by current liabilities) become totally unreliable. If you understate your liabilities, your liquidity looks much stronger than it really is, masking potential cash flow problems just around the corner.

- Misleading Stakeholders: Inaccurate statements can paint a false picture for investors, the board of directors, and even potential acquirers. This erodes trust and can lead to poor strategic choices that are based on faulty data.

- Compliance Risks: In India, not sticking to the mandated Indian Accounting Standards (Ind AS) can open your business up to serious penalties. It also creates risks related to labour laws, which demand timely and accurate accounting for wages.

An inaccurate balance sheet is like a faulty GPS for your business—it tells you that you are in a safe position when you might be heading straight for a cliff. Proper payroll accruals are essential for navigating your financial journey with confidence.

Ultimately, mastering accrued payroll is what bridges the gap between a technical accounting chore and strategic leadership. It turns a routine bookkeeping task into a powerful tool for genuine financial insight and risk management. This kind of financial discipline often goes hand-in-hand with operational excellence. For instance, organisations that manage their internal processes this well are often better positioned to work with external partners. You can explore more about how a data-driven approach improves hiring in our guide on the benefits of Recruitment Process Outsourcing. By ensuring financial data is precise, leaders can make smarter, more informed decisions across every single function, from hiring to capital allocation.

Best Practices for Managing Payroll Accruals

Getting accrued payroll right goes way beyond just crunching the numbers. It’s about building a solid framework that guarantees consistency, accuracy, and transparency every single time. For CHROs and finance leaders, mastering this process transforms a simple accounting task into a real strategic advantage, bolstering your company’s financial health and earning employee trust.

The real goal here? To create a smooth, error-proof system that gives you a crystal-clear, real-time snapshot of your labour liabilities. And that journey starts with a rock-solid foundation.

Standardise Your Accrual Policy

First things first: you need a consistent, written policy for how your organisation calculates and records accrued payroll. This document isn’t just a suggestion; it’s the definitive guide that eliminates any guesswork and ensures everyone follows the exact same steps, every single month.

Think of it as the rulebook. Your policy should spell out:

- The precise method for calculating the daily pay rate for all employee types—salaried, hourly, and everyone in between.

- How you’ll handle tricky variables like public holidays, weekends, and leave days that fall within the accrual period.

- The exact timing and steps for recording the adjusting and reversing journal entries.

A standardised policy is the bedrock of reliable financial reporting. It ensures your calculations are not just correct, but also repeatable and easy to audit.

A clear accrual policy acts like a well-drawn map for your finance and HR teams. It guarantees everyone reaches the same, correct destination every month, eliminating guesswork and preventing detours into financial misstatement.

Embrace Automation and Technology

Let’s be honest—manual payroll calculations are a breeding ground for human error. They’re also incredibly time-consuming. This is where modern payroll software and ERP systems come in, automating the entire accrual process from start to finish.

Switching to automation delivers huge benefits. It drastically cuts down the risk of expensive mistakes, frees up your finance and HR teams for more strategic work, and keeps your reporting on schedule. An automated system can handle even the most complex pay structures with ease and integrates directly with your general ledger, feeding you real-time data for smarter decisions.

Foster Collaboration Between HR and Finance

Here’s a non-negotiable truth: accurate accrued payroll is impossible without a strong partnership between HR and Finance. These two departments are the twin pillars holding up the entire process.

Finance is completely reliant on HR for accurate, up-to-the-minute data on everything from employee work hours and pay rates to new hires, terminations, and leave balances. If that data is late or wrong, the accrual calculation will be wrong. It’s that simple.

To lock in data integrity, set up a regular rhythm for communication and data sharing. Use shared systems or integrated platforms that let information flow seamlessly between the two teams. When HR and Finance are perfectly in sync, you create a powerful defence against the kinds of inaccuracies that can wreak havoc on your financial statements and sour employee relations.

Finally, don’t forget to communicate clearly with your employees. Taking a moment to explain why a paycheque looks different when a pay period crosses two months can go a long way in building trust. After all, transparent communication and fair pay are the cornerstones of employee satisfaction. You can dive deeper into designing attractive pay structures in our guide on using creative compensation to boost recruiting.

Common Questions About Accrued Payroll

Even after you’ve got the basics down, a few practical questions always pop up when it’s time to actually implement accrued payroll. Nailing down the answers to these common queries will solidify your understanding and keep your processes compliant and running smoothly.

Let’s clear up some of the most frequently asked questions.

What is the difference between Accrued Payroll and Accounts Payable?

This is a big one. Both show up as current liabilities on your balance sheet, but they track fundamentally different obligations. The simplest way to think about it is who you owe the money to, your internal team or your external partners.

– Accrued payroll is an internal obligation. It is the pot of money that covers everything your employees have earned but have not been paid yet, including wages, salaries, bonuses, and benefits.

– Accounts payable deals with external debts. This is what you owe to outside suppliers and vendors for goods or services bought on credit, such as raw materials or consulting fees.

The key distinction is the recipient. Accrued payroll is for your people, accounts payable is for other businesses.

Accrued payroll reflects the company’s commitment to its team, while accounts payable reflects its commitment to its business partners. Both are essential for a complete financial picture, yet they must never be mixed.

How Often Should Accrued Payroll Be Recorded?

For maximum accuracy, you need to record accrued payroll at the end of every single accounting period, right before you generate your financial statements. For most companies, this means making an adjusting journal entry at the end of each month.

This consistent monthly habit is essential for honouring the matching principle. It ensures your labour costs are recognised in the exact period the work was done, giving you a true and fair view of your company’s performance and financial health for that month.

Does Accrued Payroll Include Taxes and Benefits?

Yes, absolutely. A proper accrued payroll calculation is much more than an employee’s gross wages. To get an accurate view of your liability, you must include every cost the company has incurred. This means accounting for:

– The employer’s share of statutory contributions like the Provident Fund (PF) and Employees’ State Insurance (ESI).

– Any other benefits that have been earned but not yet paid, such as accrued vacation time, sick leave, or performance bonuses.

Why Is a Reversing Entry for Payroll Accruals Useful?

A reversing entry is an optional but highly recommended accounting step you take on the first day of the next accounting period. Its purpose is to make your life simpler by streamlining the next payroll run. By reversing the accrual, you clear the slate. This allows the payroll team to process the entire next payroll as a single, standard expense. It saves time, streamlines the workflow, and reduces the risk of mistakes.

This kind of procedural efficiency is a hallmark of well run organisations where people can thrive. In fact, many find that the best workplaces are the result of visionary leadership that values both financial precision and operational simplicity.

At Taggd, we understand the complexities of managing a modern workforce. Our Recruitment Process Outsourcing (RPO) solutions help you build the high-performing teams that drive business success, while you focus on strategic growth. Discover how we can help you at https://taggd.in.