Understanding Your Conditions of Employment in India

Conditions Of Employment define the give-and-take between an employer and an employee. Think of them as the playbook that spells out everything from salary and work hours to leave policies and termination procedures.

What Are Conditions Of Employment Really

When you’re about to build a house, you don’t simply hand over cash and hope for the best. You sit down with a contractor and agree on a blueprint—materials, milestones, payment schedule. That careful planning avoids confusion down the road.

In the same way, conditions of employment are the professional blueprint for your role. They set expectations on both sides and reduce the chance of disputes. When everyone knows the rules, you create an atmosphere of clarity and mutual respect.

These aren’t just formalities tucked away in a drawer. Clear, fair terms help build a culture where people trust each other and feel secure.

Why Understanding Your Employment Conditions Matters

Employees who grasp their employment terms can step into their roles with confidence. They know exactly what they’re entitled to and what’s expected of them.

For organisations, well-defined conditions mean staying on the right side of labour laws. They also provide a consistent framework for managing performance, promotions, and even layoffs.

A clear set of employment conditions acts as a preventative measure, addressing potential issues before they escalate into serious workplace conflicts or legal challenges.

Below are the core pillars we’ll unpack in this guide:

- Legal Requirements: The must-have laws and regulations governing employment in India

- Contract Clauses: The detailed terms you’ll encounter in your offer letter

- Leave and Holiday Policies: How much time off you can count on each year

- Termination Processes: The steps and notice periods for ending the relationship

By breaking down each component, you’ll walk away with a practical roadmap to navigate your workplace rights and responsibilities.

The Legal Backbone of Your Employment

Think of employment law as the foundation of a building. You might not see it every day, but it’s the essential structure that keeps everything stable, safe, and fair for everyone inside. In India, your conditions of employment aren’t just suggestions from HR; they’re deeply rooted in a series of powerful laws that act as a safety net for employees and a compliance roadmap for employers.

These laws set the absolute minimum standards for how you’re treated at work. They make sure your work hours are reasonable, you get paid fairly and on time, and your workplace is secure. Without this legal backbone, the whole employer-employee relationship would feel unpredictable and could easily become unfair.

Key Laws Governing Your Work Life

Several major pieces of legislation form the core of India’s employment framework. While the names might sound a bit technical, their impact on your day-to-day job is direct and massive. Each one tackles a specific pillar of your employment conditions, from what you’re paid to how long you can be asked to work.

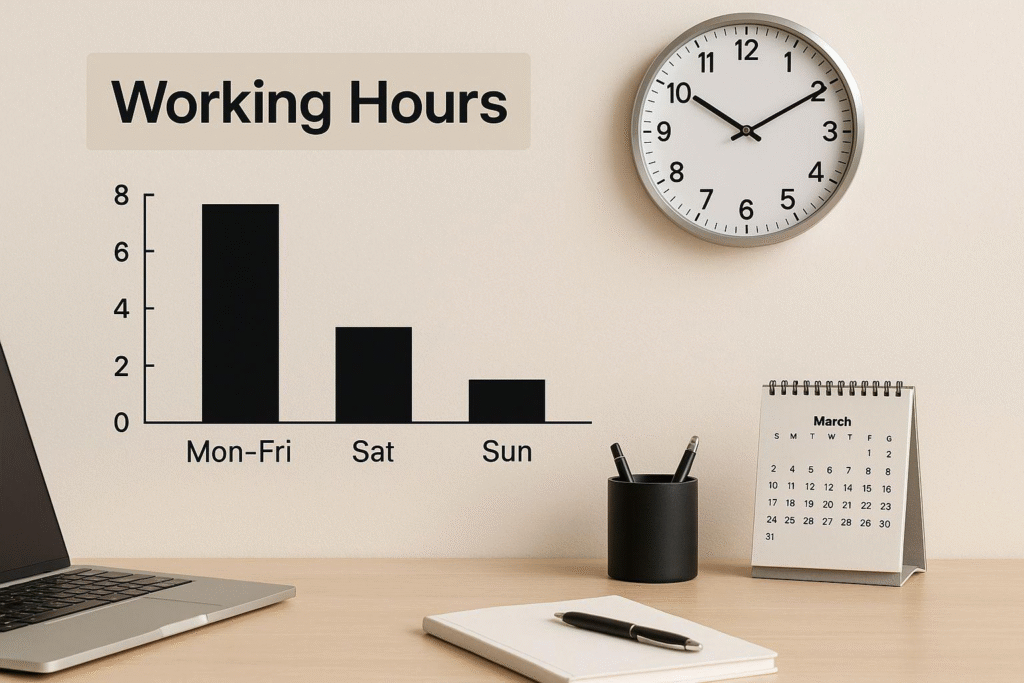

The image below zeroes in on one of the most crucial aspects these laws regulate—your working hours.

This is a great reminder that your time at work is a legally protected condition of your employment, not just something left to company policy.

Now, let’s look at some of the foundational laws that every employee and employer in India should know.

Key Indian Labour Laws at a Glance

To give you a clearer picture, here’s a quick summary of the major laws that shape the employment landscape in India. Think of this as your cheat sheet to understanding the rules of the game.

| Legislation | Key Area Governed | Primary Impact on Employment Conditions |

|---|---|---|

| The Shops and Establishments Act | Working Conditions in Offices & Shops | Sets daily/weekly work hours, rest intervals, holidays, and overtime pay rules (varies by state). |

| The Minimum Wages Act, 1948 | Baseline Salary | Ensures employees in scheduled jobs receive a minimum wage to prevent exploitation. |

| The Payment of Wages Act, 1936 | Timely & Correct Salary Payment | Regulates pay cycles and prevents employers from making unauthorised deductions from your salary. |

This table shows how different laws cover specific aspects of your job, creating a comprehensive legal safety net.

Here’s a little more on what these mean for you:

- The Shops and Establishments Act: This is a state-specific law, which means the rules are different depending on where you work. It governs the working conditions in a huge number of workplaces, from IT offices to retail stores. It’s the law that dictates rules for work hours, rest breaks, opening and closing times, holidays, and overtime pay. So, the rules in Mumbai might not be the same as those in Bengaluru.

- The Minimum Wages Act, 1948: This one is straightforward—it’s about making sure people get a fair baseline wage. It applies to certain scheduled jobs and is designed to prevent exploitation by guaranteeing an income that supports a basic standard of living. These minimum wage rates are revised from time to time to keep up with inflation.

- The Payment of Wages Act, 1936: This law is simple but absolutely vital. It’s all about getting paid on time and in full. It regulates when you should receive your wages and makes sure your employer can’t just make random, unauthorised deductions from your salary.

Knowing these laws helps you understand your rights. For example, if your employer keeps delaying your salary without a good reason, they are likely violating The Payment of Wages Act. Similarly, if you’re being forced to work 12 hours a day without any overtime pay, that could easily be a breach of The Shops and Establishments Act in your state.

The Shift Towards New Labour Codes

The Indian government has been working on a massive project to simplify this complex web of laws. The plan is to consolidate dozens of central labour laws into four streamlined codes, making it easier for businesses to comply while still protecting workers’ rights.

The new Labour Codes represent a significant effort to modernise India’s employment laws, aiming for greater clarity and uniformity across the country. They cover wages, industrial relations, social security, and occupational safety.

This transition means that while the core principles—like fair pay and reasonable hours—will stick around, the specific rules and paperwork might change. For instance, the definition of “wages” is set to become more standardised, which will directly impact how things like provident fund (PF) and gratuity are calculated.

For any business trying to navigate these changes, getting a handle on payroll and compliance is more important than ever. To stay ahead of the curve, many organisations are looking to better understand the responsibilities of an employer in India to ensure they’re fully prepared.

Ultimately, whether we’re talking about the old acts or the new codes, this legal framework provides the essential rules of engagement for the workplace. It transforms the employment relationship from a simple handshake agreement into a structured partnership with clear rights and duties for both sides.

Breaking Down Your Employment Contract

Your employment contract is the single most important document defining your role and relationship with an employer. Think of it as the detailed blueprint for your job—while the law sets the foundation, this contract lays out the specifics of your day-to-day professional life. It’s what turns the promises made during an interview into legally binding commitments.

This is where the broad conditions of employment get personal and specific to you. A well-written contract offers clarity and security for both you and your employer. For you, it spells out your rights and benefits; for the company, it defines expectations and responsibilities. Let’s pull apart the key clauses you’re likely to find inside.

Decoding Your Job Responsibilities and Role

This clause needs to be much more than just a job title. A good contract will clearly map out your main duties, who you report to, and where you fit into the bigger picture of the organisation. Vague descriptions like “assisting with departmental tasks” are a red flag for “scope creep,” where you could find yourself juggling tasks far beyond your original role.

A solid job responsibilities clause will:

- List core duties: It should detail the main tasks and functions you’re actually expected to perform.

- Define reporting lines: Knowing who your manager is and your team structure is vital for accountability.

- Mention flexibility (within reason): Most contracts include a line like “and other duties as assigned.” This is standard, but make sure it doesn’t completely overshadow your primary role.

This section essentially sets the benchmarks for your performance, so getting this right is crucial for your career growth.

Understanding Your Salary Structure and CTC

For most of us, this is the first—and sometimes only—part of the contract we look at. But just focusing on the big “Cost to Company” (CTC) number can be seriously misleading. Your CTC is the total cost the company incurs for employing you, which is very different from your take-home pay.

It’s vital to get the full breakdown:

- Basic Salary: This is the fixed, core part of your pay. It’s also the base for calculating other components like your Provident Fund (PF).

- Allowances: This bucket includes things like House Rent Allowance (HRA) and Leave Travel Allowance (LTA), some of which come with tax benefits.

- Deductions: Your PF contribution, professional tax, and Tax Deducted at Source (TDS) are all subtracted from your gross salary.

- Employer Contributions: The company’s contribution to your PF and any insurance premiums are part of your CTC, but they don’t land in your bank account each month.

Your actual take-home salary is what’s left after all deductions are taken from your gross monthly pay. Always ask for a detailed salary structure to see the complete picture before you say yes to an offer.

Getting this clarity upfront saves you from any nasty surprises on your first payday and helps you plan your finances.

Navigating Work Hours, Leave, and Probation

These clauses are all about your time—your work-life balance hinges on them.

Working Hours and Overtime: The contract must state your standard working days and hours, which should align with the relevant state’s Shops and Establishments Act. It also needs to be clear on the company’s overtime policy—is it paid, and if so, at what rate?

Leave Policies: Your entitlement to paid leave (earned leave), sick leave, and casual leave should be clearly spelled out. Look for details on how you accrue leave, if you can carry it forward to the next year, and the rules for leave encashment if you leave the company.

Probation Period: Almost every job starts with a probation period, usually lasting three to six months. This is an evaluation phase where your performance is reviewed. During probation, the notice period for termination is often shorter on both sides. Your contract should state the exact duration and what happens—like confirmation—once you complete it successfully.

Understanding these general terms and conditions is a critical step in properly evaluating any job offer.

Protecting Company Interests: Confidentiality and NDAs

In our information-driven world, companies are fiercely protective of their data, client lists, and internal processes. This is where the Confidentiality Agreement, often called a Non-Disclosure Agreement (NDA), steps in.

When you sign an NDA, you are making a legal promise not to share any of the company’s proprietary information that you learn on the job. This responsibility doesn’t just end when you hand in your notice; it usually continues for a period after you’ve left.

Key things to look for in an NDA include:

- A clear definition of what counts as “confidential information.”

- How long your obligation to keep secrets lasts.

- The consequences of breaking the agreement, which can be quite severe.

Breaching an NDA can result in legal action and heavy financial penalties. It’s a serious commitment that reflects the trust your employer is placing in you. Take the time to read these clauses carefully so you know exactly what your legal and ethical duties are from day one.

Managing Work Hours, Holidays, and Leave

Salary is just one part of the equation. The rules that govern your time—when you work, when you rest, and when you can take a break—are just as critical to your employment conditions. These policies aren’t just about punching a clock; they are the bedrock of a fair and sustainable work-life balance, protecting your fundamental right to rest and recharge.

Getting a firm grip on your work hours, holidays, and leave entitlements is essential. It’s not only about your well-being but also about ensuring legal compliance for your employer. Let’s break down how your time is managed under Indian employment regulations.

Standard Work Hours and Overtime Pay

In India, your work hours are typically set by the Shops and Establishments Act in your state. While there can be slight variations, the general rule is an 8-hour workday and a 48-hour work week. Anything you work beyond these standard hours is officially considered overtime.

And when you do work overtime, you are legally entitled to extra pay—often double your ordinary wages. This isn’t just a company perk; it’s a legal safeguard designed to prevent burnout and fairly compensate you for your additional time and effort.

A common myth is that salaried employees aren’t eligible for overtime pay. The law, however, often bases eligibility on your specific role and wage level, not just whether you receive a monthly salary. It’s always a good idea to check your employment contract and the local state laws to know exactly where you stand.

Your Right to Holidays and Leave

Time off is a non-negotiable part of any job. It ensures you have the chance to rest, recover from illness, and celebrate important cultural and national events. This is usually broken down into a few key categories.

Types of Leave and Holidays:

- Paid Leave (or Earned Leave): Think of this as your vacation time, which you accumulate as you work. The exact amount you earn varies by state, but it’s a fundamental right for every employee.

- Sick Leave: This is specifically for those days when you’re unwell and need to recover. Your contract will lay out how many sick days you get each year.

- Casual Leave: Meant for short-term, unexpected personal matters that don’t quite fit into sick or paid leave categories.

- National and Festival Holidays: Every employee is entitled to paid time off on national holidays like Republic Day, Independence Day, and Gandhi Jayanti. You’ll also get a certain number of festival holidays, which are determined by company policy and state guidelines.

Understanding these policies is vital, especially as more people join the workforce. In fact, recent government data showed India’s labour force participation rate climbed to 54.9% in July for people aged 15 and above. This growing workforce relies heavily on these protections. You can learn more about India’s rising employment figures to see the bigger picture.

How Leave Is Calculated and Put Into Practice

Figuring out your leave balance can seem tricky, but most companies follow a standard, legally-mandated process.

Example: Calculating Paid Leave

Let’s take Priya, an employee working in a state where the law grants one day of paid leave for every 20 days worked. If Priya puts in 240 days of work in a year, her leave calculation is simple:

240 days worked / 20 = 12 days of paid leave

This means Priya has earned 12 days of vacation time for the year. Companies are required to keep precise records of days worked and leave accrued for every employee. Thankfully, most modern HR systems handle this automatically, letting you track your leave balance easily through an online portal. Company policies will also detail the rules for carrying forward unused leave into the next year or cashing it out when you leave the organisation.

Navigating Resignation and Termination

When an employment relationship comes to an end, whether it’s the employee’s choice or the company’s, it kicks off a sensitive process governed by a clear set of rules. These procedures are a core part of the conditions of employment, designed to make sure the separation is handled fairly, professionally, and legally. A well-managed exit not only protects both sides but also minimises the chance of disputes down the road.

The whole thing really hinges on two things: clear communication and sticking to the terms laid out in the employment contract. For both voluntary resignations and involuntary terminations, having a structured approach prevents confusion and helps maintain a respectful tone, even when things are difficult.

The Critical Role of the Notice Period

The notice period is that formal buffer between the decision to end employment and the employee’s last day on the job. Think of it as a professional handover phase. Its main purpose is to give the employer enough time to find a replacement while allowing the departing employee to properly transfer their responsibilities. It’s all about ensuring a smooth operational transition.

This isn’t just a formality; it’s a legally binding obligation for both the employee and the employer. The length of the notice period is usually spelled out in the employment contract, often ranging from 30 to 90 days, depending on the seniority of the role.

During this time, the employee is expected to keep performing their duties with the same professionalism. In return, the employer must continue to provide their full salary and all other contractual benefits right up until their final day.

Understanding Payment in Lieu of Notice

Sometimes, an immediate split is necessary for business reasons. This is where payment in lieu of notice (PILON) comes into play. It’s a mechanism that allows either party to bypass the notice period by paying the equivalent salary for that time.

- For Employers: If a company needs an employee to leave right away, it can pay them the salary they would have earned during the notice period and make the exit immediate.

- For Employees: If an employee wants to leave before their notice period is up (and the employer agrees), they might have to pay the company the salary for the time they’re cutting short.

This clause offers flexibility, but it’s only enforceable if it’s explicitly written into the employment contract. It ensures that even if the timeline is cut short, the financial obligations tied to the notice period are still honoured.

The Full and Final Settlement Process

After the notice period is served, the last step is the full and final (F&F) settlement. This is the official process of calculating and paying out all outstanding dues to the departing employee, formally closing the financial chapter between them and the company.

The F&F settlement usually includes a few key components:

- Final Salary: Payment for the last working month, calculated up to the very last day of employment.

- Leave Encashment: Payment for any earned but unused paid leave, based on company policy and state laws.

- Gratuity: A statutory benefit that’s payable to employees who have put in at least five continuous years of service.

- Bonuses or Incentives: Any outstanding performance-based payments that have been earned but not yet paid out.

This entire cycle of hiring and separation is, of course, tied to the broader economy. A fluctuating unemployment rate often dictates how frequently these settlements occur. For example, recent data showed India’s unemployment rate fell to 5.2% in July from 5.6% the month before, signalling shifts in the job market. You can explore more about India’s latest employment trends to get a bigger picture.

Finally, every employee is entitled to receive an experience letter when they leave. This document confirms their job title and tenure and serves as a vital record of their professional history.

How State Laws Impact Your Job Conditions

Think of India’s employment law not as a single, national rulebook, but more like a collection of regional guides. Each state has its own distinct flavour of regulations. This means the conditions of employment you experience in Mumbai could be worlds apart from those in Bengaluru, even if you’re working for the very same company.

This patchwork of rules exists mainly because of the Shops and Establishments Act. It’s a piece of state-level legislation that sets the ground rules for working conditions in most offices, shops, and commercial businesses. And since every state has its own version, you get crucial differences in pretty important areas.

For instance, the cap on maximum weekly work hours or how overtime pay is calculated can change quite a bit from one state border to the next. One state might set the limit at 48 hours a week, while its neighbour might have entirely different rules for certain industries. This is exactly why companies with offices across India can’t just copy-paste their HR policies; they have to create a localised playbook for each location.

Why Localised Knowledge Is Non-Negotiable

For businesses, ignoring these state-specific details isn’t just a headache—it can lead to serious compliance troubles. For employees, it can be just plain confusing. Imagine an employee who gets transferred from Karnataka to Maharashtra. Their leave entitlements and overtime pay might suddenly change, and it’s on both them and their employer to be clued in on these legal shifts.

This regional complexity isn’t just about laws; it also bleeds into the local economic scene, which directly shapes the job market in different states.

You see huge swings in unemployment rates across India. In a recent report, Haryana recorded the highest unemployment rate at a staggering 37.4%, while Odisha had the lowest at just 0.9%. This really paints a picture of the diverse economic realities that shape local job opportunities. You can dive deeper into these unemployment rates across India on Forbes India.

This economic gap is a clear signal of why a deep understanding of local laws and market conditions is so critical. For companies, it means crafting recruitment strategies and compliance plans that fit each state’s unique environment. For employees, it’s a reminder that their rights and workplace standards are ultimately defined by local, not national, rules.

Getting a handle on this regulatory maze is essential, whether you’re building a career or a business in India. To see who’s getting it right, take a look at our guide on the best companies to work for in India. These top employers are masters at navigating these complexities, creating fair and compliant workplaces no matter their address. They truly set the standard for adapting to India’s diverse legal landscape.

Frequently Asked Questions

When it comes to your job, it’s the details that matter. It’s perfectly normal to have questions pop up about your employment conditions once you’re settled in. This section tackles some of the most common queries we see in India, giving you straightforward answers for real-world work situations.

Can My Employer Change My Job Conditions Without Asking Me?

The short answer is no, not for the big stuff. Your employer generally can’t unilaterally make significant, negative changes to the core of your job—think your salary, your main role, or your work location—without getting your consent first. These are foundational terms spelled out in your contract.

While minor administrative tweaks might be permissible, any major shift requires a proper discussion and, ideally, a revised contract that you agree to. If a fundamental change is pushed on you without your agreement, it could be seen as a breach of your employment contract. That gives you solid ground to raise a formal dispute.

What Is the Real Difference Between CTC and My Take-Home Pay?

This is a classic point of confusion, and getting it right is key to managing your finances. Let’s break it down simply.

Cost to Company (CTC): This is the total amount your employer spends on you for the year. It includes your gross salary (your basic pay, HRA, etc.) plus the company’s contributions towards things like your provident fund (PF), any insurance premiums they pay, and gratuity.

Take-Home Pay: This is the net salary—the actual cash that hits your bank account every month. It’s what’s left of your gross salary after all deductions are made, like your own PF contribution, income tax (TDS), and professional tax.

Think of CTC as the entire cost of the ingredients for a meal, while your take-home pay is the final dish served on your plate. Your in-hand salary will always be less than your CTC.

What if My Employer Isn’t Following My Contract?

If you feel your employer isn’t holding up their end of the bargain, there’s a clear process you can follow to sort things out.

The best first step is always to raise the issue formally with your manager or the HR department. When you do, make sure to point to the specific clauses in your employment contract that are being violated. It’s crucial to document this conversation in writing, even if it’s just a follow-up email summarising your discussion.

If talking it out internally doesn’t solve the problem, you can escalate it. Sometimes, a formal written complaint or a legal notice sent via a lawyer is enough to get things moving. For specific problems like unpaid wages or unfair termination, you also have the right to approach the Labour Commissioner’s office in your area for help and mediation.

Navigating the complexities of recruitment and making sure fair conditions of employment are set from day one is absolutely critical.

At Taggd, we specialise in Recruitment Process Outsourcing to help you build a talented and fully compliant workforce. Find out how we can support your HR needs at https://taggd.in.