A Guide to Per Diem Allowance for Indian Businesses

A per diem allowance is a straightforward concept: it’s a set daily amount your company gives an employee to cover their living expenses when they’re on the road for business. Think of it as a daily travel budget.

Instead of the employee having to save and submit a receipt for every single meal or coffee, this approach simplifies life for everyone. It’s a system built on efficiency, designed to slash the administrative headache of expense reports.

What Is a Per Diem Allowance?

Let’s paint a familiar picture. You send an employee on a business trip. In the traditional model, they pay for everything out-of-pocket, diligently collecting a mountain of paper receipts for every meal, taxi, and coffee. When they get back, they spend hours filling out a detailed expense report, which your finance team then has to manually comb through, item by item. A per diem allowance throws that entire process out the window.

The term “per diem” comes from Latin, meaning “by the day.” That’s exactly what it is—a pre-determined daily stipend. This empowers your team members with a fixed amount of cash to manage their own daily costs, breaking the tedious cycle of collecting, submitting, and auditing dozens of tiny receipts. It’s a fundamental shift away from a direct reimbursement system where you pay back the exact amount spent.

Per Diem Allowance vs Actual Expense Reimbursement

At the heart of it, the main difference is how you handle the money. With a per diem allowance, you’re giving a fair, upfront budget and trusting the employee to manage it. This is a world away from the old-school method of tracking every single rupee.

Here’s a quick comparison to highlight the fundamental differences between the two main methods of handling travel expenses.

| Feature | Per Diem Allowance | Actual Expense Reimbursement |

| Payment Method | Fixed daily amount paid upfront or after the trip. | Employee is repaid the exact amount they spent. |

| Receipts | Generally not required for expenses covered by the per diem. | Required for every single expense. |

| Admin Effort | Minimal. Reduces paperwork for both employee and finance team. | High. Involves detailed expense reports and manual verification. |

| Budgeting | Predictable. Costs are known before the trip begins. | Unpredictable. Final cost is only known after the trip ends. |

| Employee Experience | More freedom and less hassle for the employee. | Can be tedious and time-consuming. |

As you can see, the per diem model shifts the focus from meticulous, after-the-fact tracking to predictable, upfront budgeting. It’s about simplifying the process while still maintaining financial control.

What Does Per Diem Typically Cover?

It’s crucial to understand that a per diem isn’t meant to cover every single travel cost. The big-ticket items are usually handled separately.

The purpose of a per diem is to simplify the management of smaller, variable daily expenses. It covers the costs an employee incurs simply by being away from home on business, not the major costs of getting to the destination or staying there.

Typically, a per diem allowance is designated for:

- Meals: This covers breakfast, lunch, and dinner.

- Incidental Expenses: These are the small, miscellaneous costs that pop up, like tips for hotel staff, laundry services, or other minor necessities that are hard to track.

Larger, more predictable expenses like flights, train tickets, and accommodation are almost always booked and paid for by the company directly or reimbursed based on the actual invoices. This hybrid approach really offers the best of both worlds: you maintain direct control over major costs while giving your employees the flexibility and simplicity of a per diem for their daily spending.

How to Calculate Per Diem Rates in India

Figuring out a fair and workable per diem allowance can feel like a puzzle, especially in a country as diverse as India where costs swing wildly from one city to the next. Unlike some countries with government-set rates, Indian companies have the freedom to set their own. This is a good thing—it allows for a much more practical approach, but it also means you need a clear, logical system to make sure the rates are enough for your employees without breaking the bank.

The most common and sensible method used across India is the city-tier system. It’s a simple concept, really. It just acknowledges that a meal in Mumbai costs a whole lot more than one in a smaller town. By grouping cities into tiers, companies can build a rate structure that’s easy to manage and defend.

The City-Tier System Explained

Think of it like creating different price bands based on the local cost of living. It’s a way to give the per diem allowance consistent buying power, no matter where an employee is travelling.

Most companies break cities down into a few common tiers:

- Tier 1 Cities: These are the big metro hubs—think Mumbai, Delhi, Bengaluru, and Chennai. They have the highest costs for everything from food to local transport, so they naturally get the highest per diem rates.

- Tier 2 Cities: This group includes major state capitals and other large cities like Pune, Ahmedabad, Hyderabad, and Kolkata. Costs here are a notch below Tier 1 but are still pretty significant.

- Tier 3 Cities: This covers all the smaller towns, industrial zones, and more remote locations. Here, the cost of living is much lower, so the per diem is adjusted down to match.

This tiered system is pretty much the backbone of corporate travel policy in India. Since there’s no official government rate, companies create their policies based on these on-the-ground expense estimates. The system is so popular because it reflects the real economic differences across the country. For a deeper dive into how HR teams approach this, you can find some great discussions on forums about establishing travel policies in India.

A well-structured tier system gets rid of the “one-size-fits-all” problem. It makes sure an employee heading to a major metro has enough cash, while preventing overpayment for travel to a cheaper location.

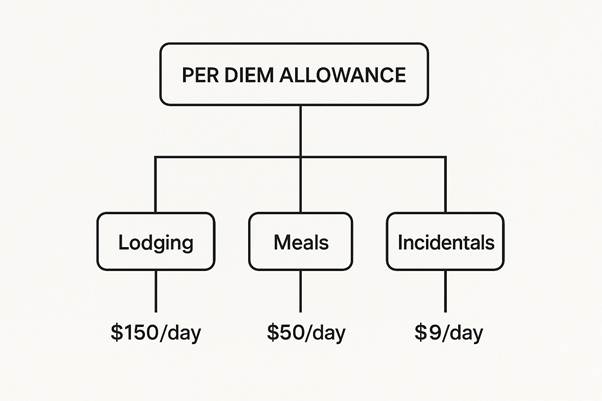

This image gives a good visual breakdown of what a per diem allowance typically covers.

As you can see, the total allowance is a mix of estimated costs for lodging, meals, and those small incidental expenses, all of which change depending on the location.

Setting Practical Per Diem Rates

Once you have your city tiers sorted, the next job is putting some numbers to them. While you won’t find official government figures to guide you, industry standards offer a solid starting point.

Here’s a look at some typical daily allowance ranges you’ll see in the market:

- Tier 1 (e.g., Mumbai, Delhi): ₹2,000 to ₹4,000 per day. This range reflects the reality of expensive meals and pricier local transport.

- Tier 2 (e.g., Pune, Hyderabad): ₹1,500 to ₹2,500 per day. This is a comfortable amount for the moderate cost of living in these fast-growing cities.

- Tier 3 (Smaller Towns): ₹800 to ₹1,500 per day. This rate is set to match the lower costs you’d find outside the major urban centres.

Keep in mind, these figures are usually meant to cover meals and incidentals, as accommodation is often booked and paid for separately by the company.

Other Factors That Influence Rates

Just using the city isn’t always enough. A truly fair per diem policy has a bit more nuance and considers the employee and the trip itself.

Here are a few other key things to factor in:

- Employee’s Role or Grade: It’s standard practice to have different per diem rates based on seniority. A senior manager who might need to host clients for dinner will often get a higher allowance than a junior team member.

- Purpose of Travel: Why is the person travelling? Someone attending a big industry conference will have different expenses than an engineer visiting a remote factory for a technical check.

- Industry Benchmarks: It never hurts to know what your competitors are doing. Keeping an eye on the per diem rates in your sector helps you stay competitive, which is a big deal for keeping your employees happy.

- Inclusion of Local Conveyance: You need to decide if local transport is covered in the per diem. Some policies roll it all into one consolidated amount for food and travel, while others provide a separate travel allowance based on actual receipts.

By blending the city-tier system with these other factors, you can build a per diem structure that’s flexible, fair, and makes sense for both your company and your team.

Navigating Indian Tax Rules for Per Diem Allowances

This is where things can get a little tricky. Understanding the tax side of a per diem allowance is often where both companies and their employees start to feel uncertain. The rules, which fall under the Indian Income Tax Act, might seem complicated at first glance, but they’re built on one simple, foundational idea. Get this right, and your policy will be both helpful and perfectly compliant.

At its heart, a per diem allowance is generally considered tax-exempt for an employee. But—and this is a big but—that exemption only applies up to the amount the employee actually spends on legitimate business duties. This single rule shapes everything about how your team should handle their travel expenses.

So, what does this mean in practice? If an employee gets a per diem but spends less than the full amount, the leftover cash is technically part of their taxable income. It’s a small detail that’s easy to miss, but it’s crucial for keeping the books clean for everyone involved.

The Core Principle of Tax Exemption

The way per diem is treated for tax purposes is designed to be fair. The whole point is to make sure employees aren’t taxed on money that was just meant to cover necessary business costs. Think of it this way: the allowance isn’t a bonus or extra salary; it’s a straightforward reimbursement for expenses they had to incur while doing their job.

For the allowance to stay tax-free, it has to check a couple of boxes:

- Purpose: It must be given specifically to cover expenses that are wholly and exclusively for official duties.

- Expenditure: The employee must have actually spent the money for that intended purpose.

This is exactly why the idea of “unspent allowance” becomes so important. Any amount an employee manages to save from their per diem is seen by the tax authorities as a personal benefit, and just like any other perk, it becomes taxable.

The tax-free status of a per diem allowance is not automatic. It is directly tied to the actual expenditure incurred by the employee. If the allowance exceeds the genuine business expenses, the surplus becomes taxable income in the hands of the employee.

Why Record-Keeping Still Matters

This tax rule puts everyone in an interesting position. On one hand, a huge benefit of a per diem system is that employees don’t have to chase down and submit every single little receipt to the company. On the other hand, they should absolutely be encouraged to keep their own records.

Let’s walk through an example. Say an employee receives a ₹10,000 per diem for a four-day business trip. They end up spending ₹8,500 on meals and other small costs. That leftover ₹1,500 is now considered taxable income. If the Income Tax Department ever decided to audit them, that employee would need to show how much they spent to justify the tax-free portion of the allowance. Without any receipts or records, that becomes a very tough conversation.

So, even if your company policy says “no receipts required,” it’s a smart move to educate your employees on why they should hang on to them for their own tax purposes. This simple bit of advice protects them from potential tax headaches later and helps them confidently back up their expenses if they’re ever questioned.

Consequences of Non-Compliance

For any employer, getting these rules right is essential for building a per diem policy that works. When you clearly explain the tax situation to your employees, you set the right expectations from day one and build a culture of transparency.

If you don’t account for the tax on unspent allowances, it can create problems for your employees when they file their personal taxes. It can also lead to confusion and chip away at the trust a good per diem system is supposed to create. By giving clear guidance, you empower your team to handle their allowances responsibly, ensuring the system simplifies expenses without accidentally creating a tax mess. This is just good management for any employee travel programme.

The Benefits for Both Employers and Employees

Putting a per diem allowance in place is much more than a simple administrative tweak—it’s a smart move that benefits everyone involved. Think of it as replacing a clunky, receipt-driven process with a modern system built on clarity and trust. This shift away from chasing down every last coffee receipt has some pretty powerful advantages for both the business and its travelling team members.

For the company, the biggest immediate win is how much easier financial forecasting becomes. When you have a fixed daily rate, travel budgets suddenly become incredibly predictable. No more guesswork or nasty surprises when the expense claims roll in.

This newfound predictability also brings a huge reduction in administrative headaches. The finance team is no longer bogged down auditing dozens of tiny receipts for every single trip. This frees them up to focus on work that actually drives the business forward.

Advantages for the Employer

A well-designed per diem policy does more than just save time; it brings a level of efficiency and control that directly impacts your bottom line.

- Cost Control and Budgeting: With a set allowance, you know the exact daily cost for an employee before they even pack their bags. This makes building and sticking to travel budgets a breeze.

- Reduced Administrative Burden: No more collecting receipts for daily expenses means less paperwork for employees and less grunt work for your finance and HR teams.

- Lower Risk of Inflated Claims: By giving a fixed, fair amount, you cut down on the chances of employees submitting inflated or questionable expenses for meals and other small items.

- Improved Employee Relations: A clear, fair policy is a signal of trust. It shows you respect your team’s autonomy and judgment. This progressive approach can even become a selling point in your hiring process. In fact, you can dive deeper into top hiring strategies in our article on recruitment trends.

A per diem system transforms expense management from a reactive, paper-heavy chore into a proactive, predictable financial function. It’s a fundamental shift that streamlines operations from top to bottom.

Empowering the Employee

The benefits for employees are just as compelling, centring on flexibility, convenience, and a much better travel experience. They are finally free from the chore of tracking every single small purchase.

This freedom lets them focus on what they’re actually there to do, whether that’s closing a deal or managing a project on-site. The employee is empowered to manage their daily budget as they see fit, which gives them a sense of control that’s often missing in old-school expense systems.

What’s more, a per diem allowance gives employees a chance to be frugal and potentially save a bit of their daily stipend. If they opt for more economical meals, the unspent portion is theirs to keep (though it may be taxable). This creates a natural incentive for responsible spending without needing strict oversight—a system that respects their financial choices while they’re on the road for the company.

Building an Effective Per Diem Allowance Policy

Crafting a solid per diem allowance policy isn’t just about crunching numbers. It’s about building a framework of clarity, fairness, and trust that works for everyone. Think of it as a playbook for your travelling employees—it cuts through the confusion and gets everyone on the same page, making the whole system run smoothly.

Without a clear, written policy, you’re practically inviting misunderstandings, inconsistent payments, and headaches for both your employees and the finance team. The real goal here is to create a document that’s detailed enough to handle most situations but simple enough for anyone to understand in a minute.

Defining What Is Covered and What Is Not

First things first: you have to draw a clear line in the sand about what the per diem allowance is meant for. This simple step prevents employees from making wrong assumptions and makes sure the allowance is used exactly as intended. Your policy needs to be crystal clear about what’s included.

Typically, this covers the essentials:

- Meals: All three daily meals—breakfast, lunch, and dinner.

- Incidental Expenses: The small, everyday costs that add up, like tips for hotel staff, laundry service, or quick phone calls.

Just as important is listing what the per diem does not cover. These are expenses that are either handled separately or are just considered personal costs.

Common exclusions are:

- Personal Entertainment: Things like movie tickets, sightseeing tours, or a bit of personal shopping.

- Souvenirs and Gifts: Any items bought for personal use or for family and friends back home.

- Major Travel Costs: Flights, train tickets, and hotel rooms are almost always booked directly by the company or reimbursed based on actual receipts.

Getting this right from the start ensures the per diem is used strictly for necessary business travel expenses.

Setting Rates and Outlining the Process

Once you’ve defined the scope, it’s time to get into the nitty-gritty of how it all works. This means formalising your rate structure and walking employees through the claims process from start to finish. You need to document how rates are decided to keep things consistent and fair.

Your policy should lay out:

- Rate Structure: Clearly explain your city-tier system and the specific per diem rates for each tier. It’s also a good idea to mention if rates vary by employee grade or seniority.

- Claims Process: Detail the exact steps an employee needs to take to get their allowance. Will they get it upfront before the trip, or will it be reimbursed afterwards? What forms do they need to fill out?

- Rules for Travel Days: Define how you handle the first and last days of a trip. A common and fair approach is providing a prorated amount, like 75% of the full-day rate, for these partial days.

A policy isn’t just a set of rules; it’s a guide that empowers employees. By clearly outlining the rates and processes, you remove ambiguity and help your team manage their travel expenses with confidence.

Communicating and Reviewing the Policy

A brilliant policy is useless if no one knows it exists or if it becomes outdated. The final pieces of the puzzle are effective communication and regular reviews. Make sure the policy is easy for everyone to find, maybe on the company intranet or as a section in the employee handbook.

Consider holding quick training sessions for new hires or whenever you update the policy. This kind of proactive communication can save you from answering the same questions over and over. Maintaining a strong talent pipeline means ensuring your internal processes are clear and efficient, a principle that applies to everything from travel policies to your broader strategy for high-impact hiring driven by data.

Finally, a per diem policy should never be a “set it and forget it” document. Inflation and changing travel costs mean your rates need a regular check-up.

For example, looking at international benchmarks can be a useful reference. U.S. government travel rates for India show that lodging in New Delhi can be around ₹15,000 per night, with meals close to ₹6,700 daily. While your domestic rates will obviously be different, this data shows just how important it is to keep your figures in line with current economic realities.

Schedule an annual review to see how your per diem rates stack up against the market. This simple step ensures your policy stays fair, competitive, and effective for years to come.

To help you get started, here is a checklist of the core components every effective per diem policy should include.

Essential Components of a Company Per Diem Policy

This table summarises the key elements that should be clearly defined in your per diem allowance policy to ensure it is comprehensive, clear, and compliant.

| Policy Component | Key Considerations |

| Purpose & Scope | State the policy’s purpose and define which employees and types of travel it applies to. |

| Covered Expenses | Explicitly list what is included (e.g., meals, incidentals) and what is not (e.g., entertainment). |

| Rate Structure | Detail the per diem rates, specifying different tiers for cities and any variations by employee grade. |

| Travel Day Rules | Clarify the allowance for partial travel days, such as providing 75% for the first and last day. |

| Claims & Payment Process | Outline the step-by-step procedure for submitting claims and the timeline for payment (advance vs. reimbursement). |

| Receipt Requirements | Specify when, if ever, receipts are required (e.g., for lodging, which is often separate). |

| Policy Review Schedule | State that the policy will be reviewed periodically (e.g., annually) to adjust for inflation and changing costs. |

| Contact Information | Provide a point of contact (e.g., HR or Finance department) for any questions or clarifications. |

Having these components clearly laid out will not only make life easier for your employees but also streamline the administrative process for your finance and HR teams. It’s all about creating a system that is transparent, easy to follow, and fair for everyone involved.

Frequently Asked Questions About Per Diem Allowances

As companies and employees get used to the idea of a per diem allowance, a few practical questions always pop up. While the system is certainly simpler than drowning in expense reports, it has its own quirks. Let’s walk through some of the most common queries that arise during business travel in India.

Getting these details right ensures your per diem policy is applied fairly and consistently, which is key to keeping everyone on the same page.

What Happens if an Employee Spends More Than Their Per Diem?

This is probably the first question everyone asks, and for good reason. In a standard per diem model, the employee is responsible for covering any costs that go over their fixed daily allowance. The whole point is to give them a reasonable, predictable budget that they manage themselves.

However, any good policy needs a bit of flexibility for exceptional situations. Let’s say an employee has to host a client for an unexpected business dinner that blows their daily budget. They shouldn’t have to pay for that out of their own pocket. Your policy must have a clear process for getting these kinds of necessary business expenses pre-approved. This keeps things fair without undermining the simplicity of the per diem system.

Are Per Diem Allowances Different for Domestic and International Travel?

Absolutely, and they have to be. Companies always maintain separate—and significantly higher—per diem rates for international travel. It’s a simple necessity. The cost of living, currency exchange rates, and local prices can vary dramatically from one country to another.

For instance, a per diem allowance for a business trip to a major hub like Zurich or Tokyo is going to be worlds apart from one for travel within India.

International rates aren’t just pulled out of a hat. They are usually set using external data and cost-of-living indices for the specific destination city. This data-driven approach ensures the allowance is fair and adequate, letting the employee focus on their work without worrying about their finances abroad.

How Should Companies Handle Per Diem for Partial Travel Days?

Handling the first and last days of a trip requires a clear, consistent rule. Employees are in transit for part of these days, so they naturally spend less on meals and incidentals. The standard and most accepted practice is to simply prorate the allowance.

A very common method is to provide a fixed percentage of the full-day rate, like 75%, for both the day of departure and the day of arrival. This approach is easy to calculate and is widely considered an equitable solution. Whatever method you land on, make sure it’s spelled out clearly in your travel policy to avoid any confusion and ensure it’s applied the same way for everyone.

Do Employees Need to Keep Receipts with a Per Diem Allowance?

This question brings up an important difference between company policy and tax law. One of the biggest perks of a per diem system is that, for company reimbursement, employees generally don’t need to submit a pile of receipts for every meal and coffee. It’s what makes the whole process so much faster.

However, when it comes to Indian tax law, it is highly recommended that employees hold onto their receipts. The per diem allowance is only tax-exempt up to the amount an employee actually spends on official business duties. If the tax authorities ever decided to conduct an audit, the employee would need proof of their expenses to justify the tax-free status of their allowance.

So, the short answer is:

– For the Company: No, receipts usually aren’t needed for per diem expenses.

– For the Employee: Yes, they should keep receipts for their own tax compliance and peace of mind.

Being proactive and explaining this detail to your team can prevent a lot of headaches down the road. When employees feel informed and looked after, they’re happier and less likely to look for work elsewhere. For more on this, check out our guide on how to prevent employee attrition. Educating your team on these small but crucial details builds trust and shows you have their best interests at heart.

At Taggd, we specialise in creating strategic recruitment solutions that build strong, loyal teams. Discover how our Recruitment Process Outsourcing services can help you attract and retain top talent by visiting us at https://taggd.in.