Salary Midpoint Mastery: Build Fair Pay That Actually Works

Why Salary Midpoint Is Your Compensation North Star

Imagine planning a road trip without a destination in mind. That’s what it’s like trying to manage compensation without a salary midpoint strategy. It’s the cornerstone of fair and competitive pay, acting as a guide for every compensation decision. Successful organizations understand that salary midpoint is more than just a number; it’s a strategic tool. It helps balance attracting and retaining talent with managing budget realities.

This single metric influences everything from recruiting top performers to keeping your team happy. A well-defined salary midpoint strategy prevents pay inequities, lowers costly turnover, and creates clear career paths. It’s the anchor that keeps your compensation program fair and competitive.

Salary Midpoint: The Foundation of Fair Pay

Think of salary midpoint as the “going rate” for a specific job in your organization. It’s the target salary you aim for when hiring someone with the right skills and experience. This isn’t a fixed number; it changes based on things like industry benchmarks, location, skills needed, and the overall economy. For example, a software developer in Bengaluru will likely have a different salary midpoint than a marketing manager in Hyderabad.

This midpoint becomes the center point for building your salary ranges. These ranges offer flexibility, allowing you to compensate people based on their experience, performance, and contributions within the role. This system ensures fair pay for both new hires and seasoned employees in the same job title.

Understanding the Indian Salary Landscape

Navigating the diverse Indian job market requires understanding salary midpoints. In India, the salary midpoint is closely tied to the average salary. As of 2025, the average salary is roughly ₹32,000 to ₹58,000 per month, or around ₹384,000 to ₹696,000 annually. This range reflects the varying income levels across sectors and regions.

For example, salaries in major cities are often 20-50% higher than in smaller towns. Factors like industry, experience, education, location, and even gender play a role. Sectors like IT, finance, and healthcare tend to offer higher salaries compared to education or retail. Understanding these nuances helps determine the salary midpoint, which can change significantly based on these factors. Discover more insights on average salaries in India.

Why Salary Midpoint Matters for Your Business

A well-defined salary midpoint strategy offers several benefits. It ensures internal equity, meaning employees in similar roles are paid fairly compared to one another. It also supports external competitiveness, helping you attract talent by offering market-rate salaries. This balance boosts employee satisfaction, reduces turnover, and contributes to a more productive and positive work environment.

Furthermore, a clear salary midpoint structure makes budgeting and forecasting more predictable. Having a target salary for each role allows you to manage compensation expenses and plan for future growth. It creates a framework for informed decisions about raises, promotions, and overall compensation adjustments. This strategic approach transforms the salary midpoint from a simple calculation into a powerful tool for driving business success and nurturing a thriving workforce. This transparency builds trust within your organization, demonstrating your commitment to fair and competitive pay.

Market Reality Check: Where Salary Midpoint Meets Real Data

Let’s talk about salary midpoints. It’s easy to assume they’re just the market average, but that’s not quite right. Think of it like this: true north and magnetic north on a compass are both important, but they’re distinct. Similarly, salary midpoint, median compensation, and your competitive position all play a role, but they’re different pieces of the puzzle.

Understanding Income Distribution

Why is understanding how income is spread out so important? Well, averages can be misleading. A few sky-high salaries can skew the average upwards, making it seem like everyone’s earning more than they actually are. The median salary, the middle value in a set of salaries, gives you a much clearer picture.

For example, the median salary in India offers a valuable snapshot of income distribution. As of 2025, it’s around ₹27,300 per month, or about ₹328,000 per year. This means half of all workers earn less than this amount, and half earn more. This is different from the average salary, which can be inflated by the earnings of a select few. Discover more insights on median salary in India. Understanding this difference is crucial for grasping income disparity.

This knowledge helps companies set realistic salary midpoints. A company aiming to be a fair-paying employer might set its midpoint at the median for a particular role. If attracting top talent is the priority, the midpoint might be set higher.

Strategic Positioning in the Talent Market

Smart organizations use market data to position themselves strategically. Imagine two companies competing for the same software engineers. Company A sets its salary midpoint at the market average. Company B, however, analyzes income distribution and notices a shortage of senior engineers with a particular skill set. They decide to set their midpoint above the average for these specific roles, making themselves more attractive to those in-demand individuals. Even with a smaller budget, Company B can outperform competitors by focusing on crucial roles.

Salary Midpoint and Internal Equity

Salary midpoint is also essential for internal equity. Clear midpoints for each role demonstrate a commitment to fair pay, fostering transparency and reducing potential conflicts or feelings of unfairness among employees. This is especially important in India’s diverse workforce where fairness and transparency are highly valued. You might find this interesting: India Skills Report

To better understand how salary midpoint relates to other market metrics, take a look at the following comparison:

Salary Midpoint vs Market Metrics Comparison

A comprehensive comparison showing the differences between salary midpoint, median salary, and average salary with practical applications

| Metric Type | Definition | Primary Use | Advantages | Limitations |

|---|---|---|---|---|

| Salary Midpoint | The center point of a salary range for a specific job. | Internal pay structure and compensation planning. | Helps maintain internal equity and manage salary budgets. | Doesn’t directly reflect external market competitiveness. |

| Median Salary | The middle value in a sorted set of salaries for a given role. | Understanding typical earnings and income distribution. | Less susceptible to outliers than average salary. | May not reflect the full range of market rates. |

| Average Salary | The sum of all salaries divided by the number of salaries. | General market benchmarking and broad comparisons. | Easy to calculate and understand. | Can be skewed by extremely high or low salaries. |

This table highlights how each metric offers a different perspective on compensation. While average salary provides a broad overview, median salary offers a more accurate representation of typical earnings. Salary midpoint, on the other hand, is primarily used for internal compensation management.

Real-World Examples of Midpoint Strategy

Real-world examples illustrate the power of midpoint strategy. A growing startup might initially set midpoints slightly below market average to conserve cash flow while offering other perks like equity or flexible work arrangements. As they grow, they can adjust midpoints to match or exceed market rates to retain key employees and attract experienced professionals.

Another example is a large company with high turnover in a specific department. By analyzing market data and raising midpoints, they can address compensation concerns and improve retention. These examples show that salary midpoint isn’t just a number; it’s a dynamic tool for achieving business goals.

Calculating Salary Midpoint That Actually Reflects Reality

Forget dry formulas. Thinking about salary midpoint is like pricing a house. You wouldn’t just pick a number out of thin air. You’d look at comparable homes in the area, consider the unique features of your property, and then settle on a price that feels right. Salary midpoint works similarly. It’s about understanding the market and your company’s specific needs.

Gathering Reliable Market Data

Your first step? Gather solid market data. Think of resources like Payscale and salary surveys as your real estate agent. They offer valuable insights into current salary trends—a crucial starting point for competitive compensation.

This screenshot shows a salary survey platform in action. These platforms provide granular data, breaking down salaries by job title, location, experience, and other key factors. It’s like having a detailed report on comparable house prices, helping you zero in on the right range for your open roles.

But remember, market data is only the beginning. Just as two houses on the same street can have different values, your company’s unique circumstances—industry, size, location—require adjustments to the market average.

Adjusting for Regional Differences

Location, location, location! It’s a mantra in real estate, and it’s just as important for salaries. A software engineer in San Francisco likely earns more than a counterpart in Boise. Factor these regional variations into your midpoint. If your company is in a high-cost area, your midpoint needs to reflect that reality.

Factoring in Your Company’s Position

Your company’s market position also plays a role. Are you a startup vying with established giants? Or a well-known brand that attracts top-tier talent? Your position influences how competitive your midpoint needs to be to attract the right people. Think of it like a desirable neighborhood impacting property values.

The Calculation Process

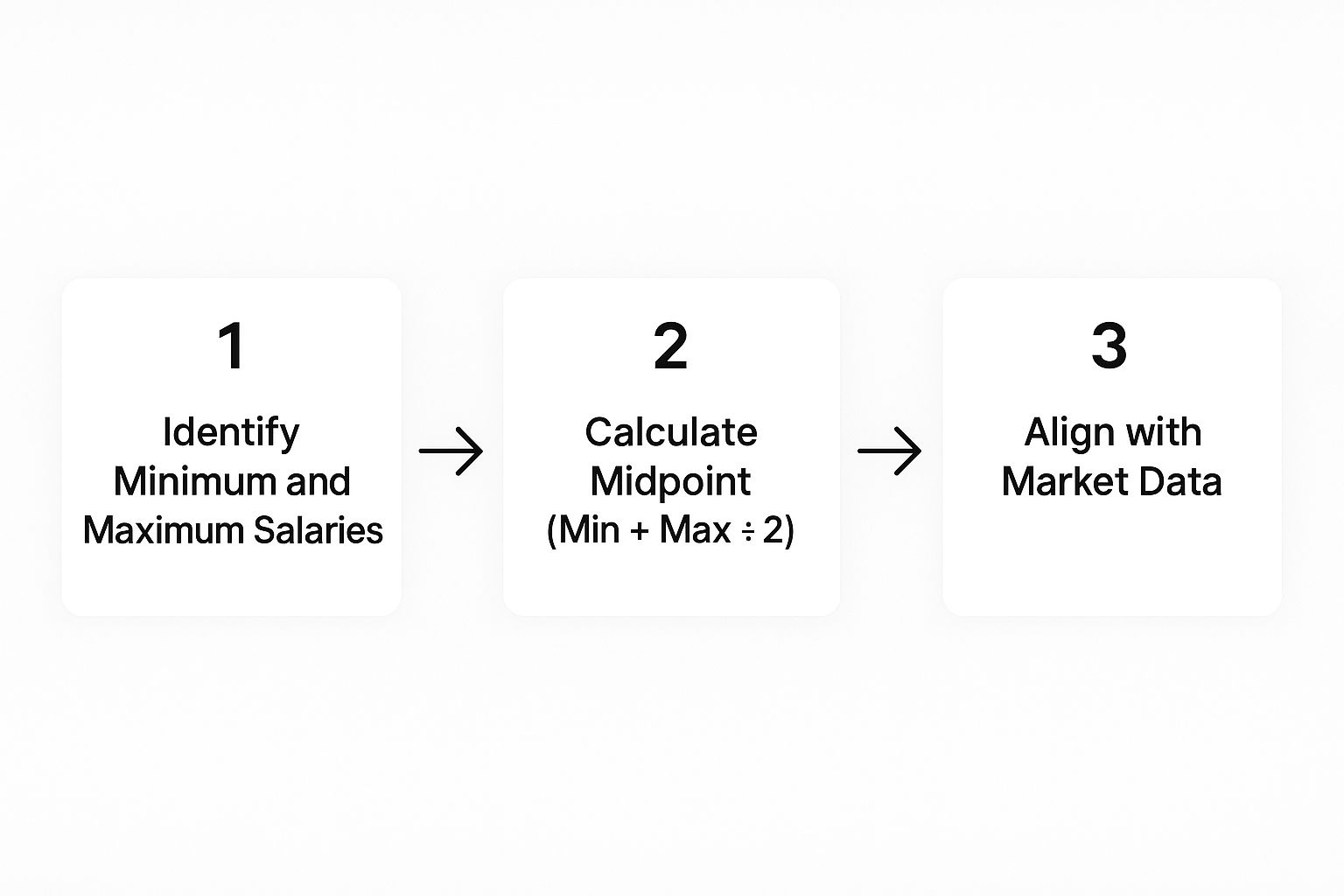

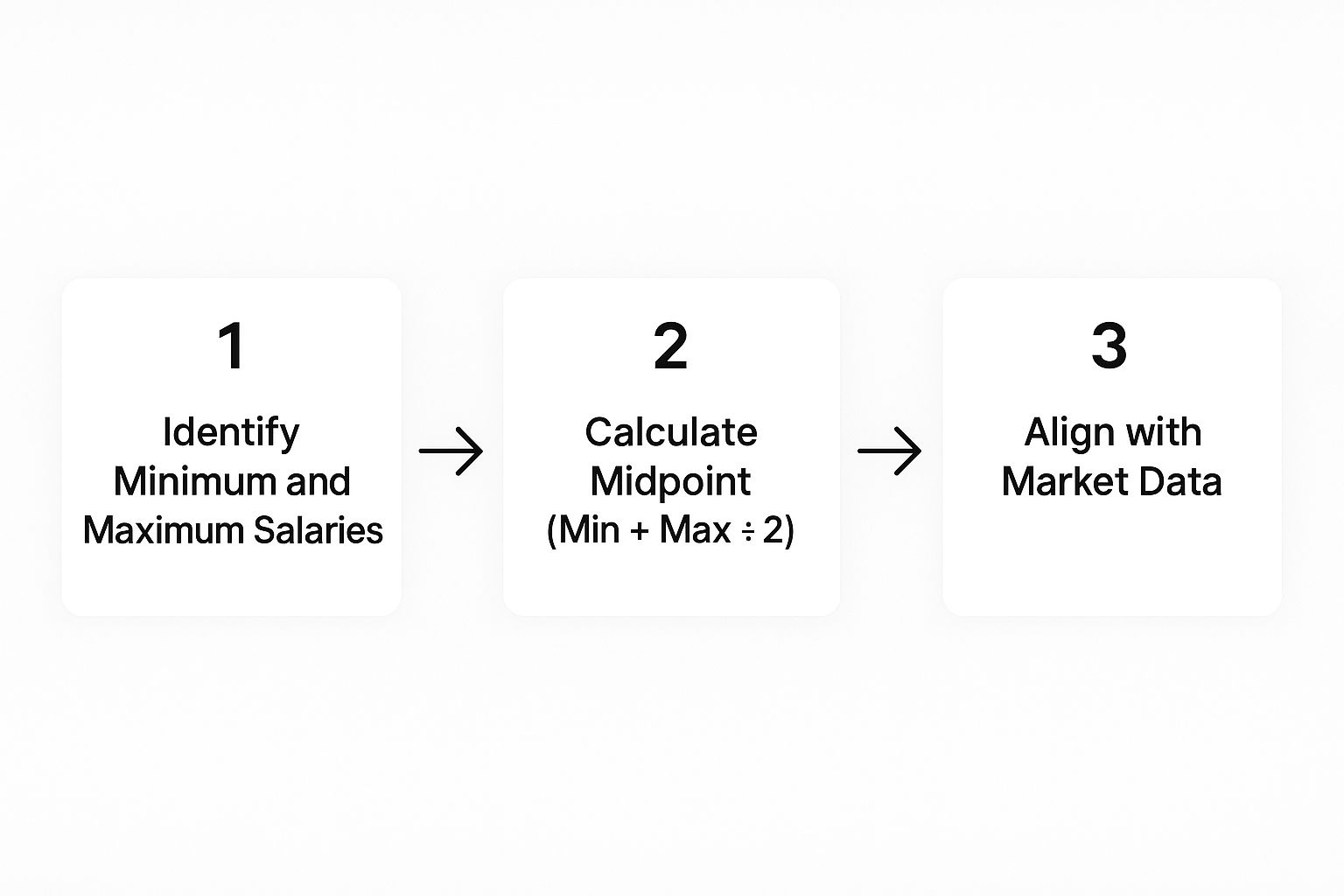

The basic formula for calculating midpoint is simple: (Minimum Salary + Maximum Salary) / 2. But the real work lies in determining those minimum and maximum salaries. They need to accurately reflect both the market and your company’s strategy.

This infographic shows the process: identify minimum and maximum salaries, calculate the midpoint, and then check it against market data. This final step ensures your midpoint isn’t just a number, but a strategic tool for attracting and retaining the best people.

Avoiding Common Mistakes

Two common pitfalls to watch out for:

- Outdated Data: Just like housing prices fluctuate, so does the job market. Regularly update your salary data.

- Internal Inequity: Ensure fairness across different roles within your company. A senior engineer should generally earn more than a junior engineer.

By understanding the nuances of salary midpoint and avoiding these common errors, you create a compensation structure that not only supports your business goals but also draws in the best talent. You’re not just calculating a number; you’re building a foundation for success.

Building Pay Ranges That Motivate and Retain

Once you’ve figured out your salary midpoint, the next big thing is building pay ranges that actually work. Think of the midpoint like the ground floor of a building – your pay ranges are the different levels where employees can progress and grow in their careers. They’re much more than just numbers in a spreadsheet; they directly impact how motivated, how well they perform, and how long they stick around.

Structuring Pay Ranges for Success

So, how do you create pay ranges that get the job done? It’s a balancing act between rewarding good work and managing your budget. Imagine a company where people rarely leave – chances are, they have a smart pay range system that lets employees see a clear path to grow and move up within the company.

One important piece of this is the range spread – the difference between the lowest and highest salaries in a range. This spread usually changes depending on the job level. Entry-level jobs might have smaller spreads, while senior roles could have wider spreads to reflect more responsibility and influence. For instance, a new marketing executive might have a 30% spread, but a senior marketing manager might have a 50% spread.

The Psychology of Effective Pay Ranges

Getting the psychology of pay ranges is essential. Employees need to know they can earn more based on their performance and what they bring to the table. A well-defined range gives them that visibility, making them more motivated and creating a sense of fairness.

Picture two people in the same role. One constantly goes above and beyond, while the other just meets the minimum requirements. The pay range lets you reward the high-performer with a salary closer to the top of the range, while the other employee might be closer to the midpoint. This encourages better performance and shows you value individual contributions.

Real-World Applications

Companies use pay ranges strategically for a few key reasons: internal promotions, rewarding top performers, and keeping things fair within teams. When someone gets promoted, their salary usually gets adjusted within the range of their new role. This allows for career growth without immediately hitting the salary ceiling. High performers can be rewarded by bumping their salary closer to the top of their current range, acknowledging their great work. Check out our guide on Career Guidance.

Maintaining Team Equity

Pay ranges also help keep things fair within teams. By having clear rules for how salaries are set within a range, companies can avoid situations where people feel like things are unfair or biased. This transparency builds trust and a positive work environment.

Think about a team of software developers. By having a set range for their roles, the company can make sure people with similar skills and experience are paid fairly, no matter their background or how long they’ve been there. This helps prevent pay gaps and creates a sense of equality within the team. This kind of structure lets companies attract and keep good people while staying on budget and making sure compensation is fair and transparent. It’s about creating a system that rewards effort, recognizes contributions, and helps individuals succeed in their roles.

Keeping Your Salary Midpoint Strategy Current

Your salary midpoint isn’t a fixed number etched in stone. Think of it more like a plant you need to nurture – it needs regular attention and adjustments to thrive. Just like a gardener tending to a prized rose bush, you need to constantly monitor the market, make informed adjustments, and anticipate changes to ensure your compensation strategy stays competitive and attracts top talent.

Staying Ahead of the Curve

Imagine the job market as a river. It’s always flowing, changing direction with the currents of economic conditions, industry trends, and new technologies. To keep your salary midpoint strategy afloat and not get swept away, you need to anticipate these shifts. The most successful companies don’t just react to change, they proactively monitor the market, analyze data, and adjust their midpoints accordingly.

For instance, during times of high inflation, companies might need to raise their midpoints to help employees maintain their purchasing power. On the other hand, during a downturn, a more cautious approach to adjustments is usually warranted. This proactive approach keeps your salary midpoint strategy aligned with the realities of the market.

Learning from Real-World Examples

Many organizations have successfully navigated significant market shifts by maintaining adaptable salary midpoint strategies. Take the rise of remote work as an example. Some companies adjusted their midpoints to reflect location-based pay differences. This clever move allowed them to attract and retain talent in competitive markets without overspending.

Similarly, companies facing skills shortages in certain areas have strategically increased midpoints for those particular roles to lure qualified candidates. This targeted approach ensures they secure the talent they need while optimizing their compensation budget.

Incorporating Emerging Trends

The workplace is constantly evolving. Things like remote work premiums, the growing demand for specialized skills, and generational shifts all play a role in shaping salary expectations. Smart companies factor these trends into their midpoint strategy.

More and more, companies are recognizing the value of remote work premiums to attract and retain talent in a distributed workforce. Likewise, with the increasing demand for digital skills, salary midpoints for those roles are naturally facing upward pressure. Adapting to these changes helps companies remain competitive. Salary trends in India are a prime example. In 2025, the average salary increase is expected to be around 8.8%, slightly lower than the 9% seen in 2024. However, the demand for digital skills and remote work is projected to drive a 9.5% salary growth in some sectors. You can learn more about Indian salary trends here. This isn’t uniform; some sectors will see bigger jumps due to the need for specialized skills. The salary midpoint can shift based on these increments, especially where performance-based compensation is on the rise.

Maintaining Competitiveness Without Budget Disasters

Staying competitive with compensation doesn’t mean you have to empty your coffers. Smart salary midpoint adjustments are all about finding a sweet spot: attracting and retaining talent while managing your budget effectively. One strategy is to combine competitive base salaries with attractive benefits, such as health insurance, retirement plans, or professional development opportunities.

Another approach is to focus on internal equity. This means ensuring fair pay differences between roles within your organization. It prevents situations where some roles are significantly underpaid or overpaid compared to the market. By carefully analyzing market data, company performance, and employee contributions, you can make strategic midpoint adjustments that both attract and retain top talent while staying within budget. This proactive and informed approach ensures your compensation strategy remains a powerful tool for achieving your business goals.

Let’s take a closer look at how different industries approach this with a helpful table:

Salary Midpoint Adjustment Frequency by Industry

Data showing how often different industries review and adjust their salary midpoints based on market dynamics

| Industry | Review Frequency | Average Adjustment % | Key Drivers | Best Practices |

|---|---|---|---|---|

| Technology | Annual/Bi-Annual | 5-10% | High competition for talent, rapid technological advancements | Continuous market monitoring, skills-based pay |

| Finance | Annual | 3-5% | Financial performance, regulatory changes | Performance-based incentives, retention bonuses |

| Healthcare | Annual | 2-4% | Demand for specialized roles, government regulations | Competitive benefits packages, emphasis on work-life balance |

| Manufacturing | Annual | 2-3% | Automation, economic fluctuations | Skills development programs, pay for performance |

| Retail | Annual | 1-2% | Consumer spending, seasonal demands | Competitive hourly rates, performance bonuses |

The table above illustrates the variability in how industries approach salary midpoint adjustments. Factors like competition for talent, industry-specific regulations, and overall economic conditions all play a significant role. Notice how the fast-paced tech industry tends to adjust more frequently and with higher percentages than more stable sectors like manufacturing or retail. Understanding these nuances is crucial for developing a competitive and effective compensation strategy.

Avoiding Salary Midpoint Pitfalls That Derail Strategy

Even seasoned HR pros can stumble when setting salary midpoints. Think of it like navigating a tricky road – even experienced drivers need to watch out for potholes. There are some common traps to avoid if you want a compensation program that truly works. Let’s explore some of these pitfalls, drawing on lessons learned by compensation experts.

Over-Reliance on Outdated Data

Imagine trying to buy a house based on real estate prices from five years ago. You’d be way off! The same principle applies to salary data. Using outdated information leads to inaccurate midpoints, making your offers uncompetitive. Regularly refreshing your data is key.

Ignoring Internal Equity Red Flags

Internal equity is another critical piece of the puzzle. Imagine a marketing manager with a higher midpoint salary than a similarly experienced engineering manager. This kind of discrepancy can create resentment and even legal issues. Maintaining internal consistency is vital for a healthy and fair workplace. For more insights on maintaining fairness, consider our guide on Whistle-Blower Policy.

Succumbing to Executive Pressure

Sometimes, executives might push for exceptions to the rules, especially for certain employees. While some flexibility is important, constantly bending the rules weakens your entire compensation program. Clear guidelines, consistently applied, are your best defense.

Budget Constraints vs. Fairness

Budget is always a factor, but letting it completely dictate salary midpoints can backfire. Underpaying employees damages morale and impacts retention. The challenge is striking a balance between budgetary realities and fair compensation.

Neglecting Geographic Differences

Just like the cost of living, salaries change depending on location. Ignoring these regional differences can make it hard to attract and retain talent in certain areas. A software engineer in Bengaluru, for instance, likely has different salary expectations than one in a smaller city.

Failing to Communicate Effectively

Finally, if you don’t clearly communicate your salary midpoint strategy, it can breed mistrust. Transparency about how midpoints are determined, and how they fit into overall compensation, builds confidence and a sense of fairness.

Practical Frameworks for Midpoint Decisions

So, how do you build a robust framework for setting salary midpoints? Here’s a starting point:

- Market Data: Keep your data fresh and relevant.

- Internal Equity: Ensure fairness and consistency across roles.

- Budget Considerations: Balance budget realities with fair pay.

- Geographic Location: Adjust for regional salary variations.

- Company Performance: Link adjustments to company success, rewarding contributions while staying financially sound.

By weaving these elements into your decision-making, you create a more adaptable and resilient salary midpoint strategy. This allows you to attract and retain top talent while managing compensation effectively, ultimately contributing to a more positive and productive work environment.

Your Salary Midpoint Implementation Roadmap

Knowing about salary midpoints is great, but putting them into practice is where the real magic happens. Think of it like planning a garden: you can read all the books, but until you get your hands dirty and start planting, you won’t see any blooms. Implementing a salary midpoint strategy is all about blending best practices with the unique needs of your organization.

Building Leadership Buy-In

Before anything else, get your leadership team excited about salary midpoints. Explain how they directly impact the company’s bottom line. For example, attracting top talent, keeping your best people, and ensuring everyone is paid fairly are all crucial for success. Show leadership how a structured approach to salaries can actually save money in the long run by reducing turnover costs and avoiding potential legal headaches.

Communicating With Your Team

Once you have leadership on board, it’s time to talk to your employees. Transparency is absolutely essential. Clearly explain how salary midpoints are calculated, how they relate to the overall pay ranges, and how performance can influence salary adjustments within those ranges. Open communication builds trust and shows your team you’re committed to fair compensation.

Training Your Managers

Your managers are the key to making this work. They need thorough training on using salary midpoints consistently and fairly. Give them the resources they need to answer employee questions confidently and explain compensation decisions clearly. Consistency is key to ensuring fairness across the organization.

Rolling Out Your Salary Midpoint Plan

Implementing a salary midpoint plan is a step-by-step process. Here’s a simple roadmap:

- Phase 1: Assessment: Begin by analyzing your current compensation practices. Where are the gaps? What’s working, and what needs improvement? It’s like taking inventory before starting a new recipe.

- Phase 2: Design: Develop your salary structure. This involves defining the midpoint and range for each role within the company. Think of this as drafting the blueprint for your compensation plan.

- Phase 3: Implementation: Start rolling out the new system. Consider a pilot group first to get feedback and refine the process. This is where you start building.

- Phase 4: Communication: Clearly communicate the changes to all employees, highlighting how the new system benefits them. This is the grand opening of your new compensation structure.

- Phase 5: Monitoring and Adjustment: Regularly review your salary midpoints. Make sure they stay competitive and fair as the market changes. Think of this as regularly checking in and making adjustments.

Handling Special Cases and Exceptions

Every organization has unique situations. You might need to offer a higher salary to attract a highly sought-after candidate, or you might have a long-tenured employee whose salary is below the midpoint. Create clear guidelines for these exceptions, and always document decisions to maintain fairness and transparency.

Measuring Program Effectiveness

How do you know if your salary midpoint strategy is working? Keep an eye on these key metrics:

- Time-to-fill for open positions: Are you filling open roles faster?

- Employee turnover rates: Are employees staying with the company longer?

- Internal pay equity: Are similar roles compensated fairly in relation to each other?

- Salary competitiveness: Are your salaries in line with market rates?

Tracking these metrics helps you demonstrate the value of the program and identify areas for ongoing improvement. It’s like checking the vital signs of your compensation program.

Real-World Examples and Timelines

Look at other companies who have successfully implemented salary midpoint strategies. What did their timelines look like? What results did they achieve? Learning from their experiences can give you valuable insights for your own implementation.

For example, one company saw a 15% decrease in turnover after implementing a clear salary midpoint system. Another found it much easier to attract talent once their midpoints aligned with market data. These examples show the real benefits a well-executed salary midpoint strategy can bring.

Ready to improve your recruitment process and build a winning talent strategy? Explore Taggd, your partner in Recruitment Process Outsourcing. Visit us at https://taggd.in to learn more.