Say on Pay in India: The CHRO’s Complete Strategic Guide

Understanding Say on Pay: The New Rules of Executive Accountability

This image, a snapshot of Wikipedia’s “Say on Pay” page, highlights its growing global presence. It reflects a shift towards increased transparency and accountability in how executives are compensated. Say on Pay is moving from a niche topic to a core demonstration of a company’s commitment to shareholder value.

Think of it like this: Say on Pay gives shareholders a voice in executive compensation decisions. It transforms what used to be a closed-door discussion into a more open process. It’s more than just checking a compliance box; it’s about building a healthy relationship between a company and its owners.

This shift fundamentally changes executive compensation. It encourages a move from fixed salaries towards performance-based incentives, linking executive pay directly to company success and aligning the interests of management and shareholders.

The Evolving Role of the CHRO

The CHRO’s role is also significantly impacted. They become crucial in shaping the conversation around executive compensation, communicating effectively with both the board and shareholders. They’re responsible for designing compensation packages that not only attract and retain top talent but also withstand shareholder scrutiny. For more insights on attracting top talent, check out this article: How to Hire Top Talent & Accelerate Recruitment in 2023.

A Proactive Approach to Corporate Governance

Say on Pay also fosters a more proactive approach to corporate governance. Companies need to anticipate and address shareholder concerns, leading to more robust governance and a focus on long-term value. When the US implemented mandatory Say on Pay votes in 2011, shareholder engagement skyrocketed. In the first year alone, 37 companies in the Russell 3000 index failed to secure majority shareholder support. Discover more insights about Say on Pay.

Beyond Compensation: A Broader Impact

The influence of Say on Pay extends beyond just compensation. It affects board dynamics, CEO succession planning, and overall shareholder engagement. Companies embracing Say on Pay often see improvements in transparency, accountability, and strategic thinking. This builds trust with investors and strengthens the company’s market reputation. For a related perspective, see: COVID-19 Impact: Companies Looking To Raise Variable Pay Component.

This new focus on accountability helps build stronger, more resilient organizations prepared for today’s complex business environment. It paves the way for a future where executive compensation isn’t just about rewarding individuals but about creating long-term value for all stakeholders.

Say on Pay in India: Where We Are and Where We’re Headed

India’s journey with Say on Pay is a carefully crafted evolution, a different path compared to the rapid mandates we’ve seen in other parts of the world. Instead of a sudden shift, India is thoughtfully navigating this complex area through evolving SEBI guidelines and progressively developing governance frameworks. This measured approach allows Indian companies to adapt strategically.

This screenshot shows the SEBI website, the regulatory body shaping India’s evolving corporate governance landscape, including aspects of Say on Pay. SEBI’s involvement highlights the increasing emphasis on corporate governance and transparency within India.

The Voluntary Embrace of Shareholder Engagement

What’s interesting is that many forward-thinking Indian companies are already proactively integrating Say on Pay mechanisms, even before strict regulations are in place. This shows a growing understanding of the advantages of engaging with shareholders and a proactive approach to corporate governance. This voluntary adoption speaks volumes about the changing relationship between companies and their investors.

Institutional Investors as Catalysts for Change

A major force behind this change is the increasing influence of institutional investors. These investors are becoming more vocal about the need for executive accountability and are actively advocating for greater transparency in how compensation is determined. Their influence is reshaping how companies think about executive pay.

The Rising Importance of ESG Considerations

Adding another dimension to the conversation, ESG (Environmental, Social, and Governance) factors are playing a bigger role in compensation decisions. Investors are increasingly examining executive pay through an ESG lens, requiring that compensation align with sustainability goals and social responsibility. This adds a new layer of complexity to Say on Pay discussions. For instance, companies are exploring ways to connect executive compensation to ESG performance metrics.

Navigating India’s Unique Corporate Governance Landscape

India’s corporate governance environment has its own distinct characteristics. It’s a complex mix of regulations, cultural nuances, and evolving best practices. This context influences how Say on Pay is put into practice and how companies approach shareholder engagement. Grasping these nuances is crucial for successful Say on Pay implementation in India. The expanding role of proxy advisory firms adds yet another element to this changing landscape. They advise shareholders on how to vote on Say on Pay proposals, further influencing corporate actions. As India’s approach continues to develop, it has the potential to become a global example of balanced and effective Say on Pay frameworks.

How Say on Pay Transforms Executive Compensation Design

Think of executive compensation like a recipe. The old way was simple: base salary plus a bonus, with a few perks thrown in. Predictable, sure, but not always something shareholders enjoyed. Say on Pay has changed that recipe. It’s added new, performance-based ingredients that shareholders can understand and get behind.

This shift represents a real change, moving from guaranteed pay to compensation based on incentives. It ties executive rewards to the interests of shareholders, who want to see a clear connection between pay and how well the company does. This isn’t just a passing trend; it’s a fundamental shift in how companies create and reward value.

From Fixed to Flexible: The Evolution of Compensation

Executive compensation used to rely heavily on fixed amounts. Salaries and bonuses were often set in advance, no matter how the company performed. Say on Pay has challenged this, encouraging companies to use more variable pay structures. This means a significant chunk of executive pay is now “at risk,” depending on whether specific performance goals are met.

For example, instead of a guaranteed bonus, executives might receive performance-linked incentives tied to things like revenue growth, market share, or return on equity. This motivates executives to focus on what directly benefits shareholders. Long-term incentives like stock options and performance shares also strengthen this link by connecting executive wealth to shareholder value. In 2023, CEOs of the world’s largest companies saw an average of 85% of their total pay come from incentives, about 8 percentage points higher than in past years. Discover more insights on CEO compensation trends. This shift reflects a basic change in how we measure and reward executive contributions.

To illustrate this shift, let’s look at a comparison:

Let’s take a closer look at how this shift plays out in practice. The table below compares traditional and performance-linked compensation structures.

| Component | Traditional Approach | Performance-Linked Approach | Shareholder Impact |

|---|---|---|---|

| Base Salary | High, fixed amount | Lower, fixed amount | Less sensitive to company performance |

| Annual Bonus | Often predetermined | Tied to specific, measurable performance goals | Encourages short-term performance improvements |

| Long-Term Incentives | Stock options, restricted stock | Performance shares, long-term performance-based awards | Aligns executive and shareholder interests for long-term value creation |

| Benefits & Perks | Extensive, often unrelated to performance | More streamlined, potentially tied to performance outcomes | Increased scrutiny and potential for shareholder disapproval if perceived as excessive |

This table highlights how the focus has shifted from guaranteed rewards to performance-driven incentives, aligning executive interests more closely with shareholder value creation.

The Impact on Talent Acquisition and Retention

This new performance-driven model also affects how companies attract and keep top talent. Competitive base salaries are still important, but the emphasis on variable pay lets companies offer significant upside to high-performing executives. This makes the job more appealing to those confident in their ability to deliver results. However, it also means CHROs must be more strategic when creating compensation packages, balancing the need to attract talent with the need to meet shareholder expectations.

This change in compensation design isn’t just about following the rules; it’s about building a sustainable model that works for both the company and its shareholders. It’s about creating a system where executive rewards are directly linked to building long-term value.

Your Say on Pay Implementation Roadmap: From Planning to Success

Imagine building a bridge between your boardroom and your shareholders. That’s essentially what implementing Say on Pay is all about. It requires careful planning, solid foundations, and crystal-clear communication. This roadmap will guide you through every step, from those initial boardroom discussions to a successful launch.

Phase 1: Laying the Foundation

First things first: talk to your board. Explain the advantages of Say on Pay, and address any reservations they might have. Getting them on board early is essential. Then, assemble your A-team – a dedicated group to manage the implementation. Ideally led by the CHRO, this team should include members from legal, finance, and investor relations.

- Establish Clear Objectives: Don’t just aim for compliance. What else do you want to achieve? Perhaps better shareholder engagement or improved corporate governance?

- Conduct Internal Audits: Take a close look at your current compensation practices. Are there any areas that might raise eyebrows among shareholders? Addressing these proactively can save you headaches down the road.

- Benchmark Against Peers: Look at how similar companies in your industry, especially those in your region, have handled Say on Pay. Learn from their wins and avoid their missteps.

Phase 2: Building the Framework

With the groundwork laid, it’s time to design the nuts and bolts of your Say on Pay process. How often will shareholders vote? What will the proposal look like? How will you communicate with them? Getting input from key shareholders during this phase is a smart move – it ensures your approach aligns with their expectations.

- Develop a Clear Voting Policy: Outline the entire voting process, including who’s eligible and how they can cast their votes. Make it transparent and easy for everyone to understand.

- Craft a Compelling Narrative: Explain your philosophy on executive compensation. How does it tie into company performance and long-term value? This narrative is your key to winning shareholder support.

- Prepare for Different Scenarios: Develop a plan for handling both positive and negative voting outcomes. How will you respond to shareholder feedback and adjust your compensation practices accordingly?

Phase 3: Crossing the Bridge: Implementation and Communication

Now comes the crucial part: implementation. Transparency is key here. Explain the Say on Pay process clearly to everyone involved, using language that’s easy to grasp, even for those outside of HR. Shareholders need to understand not just what you’re doing but why.

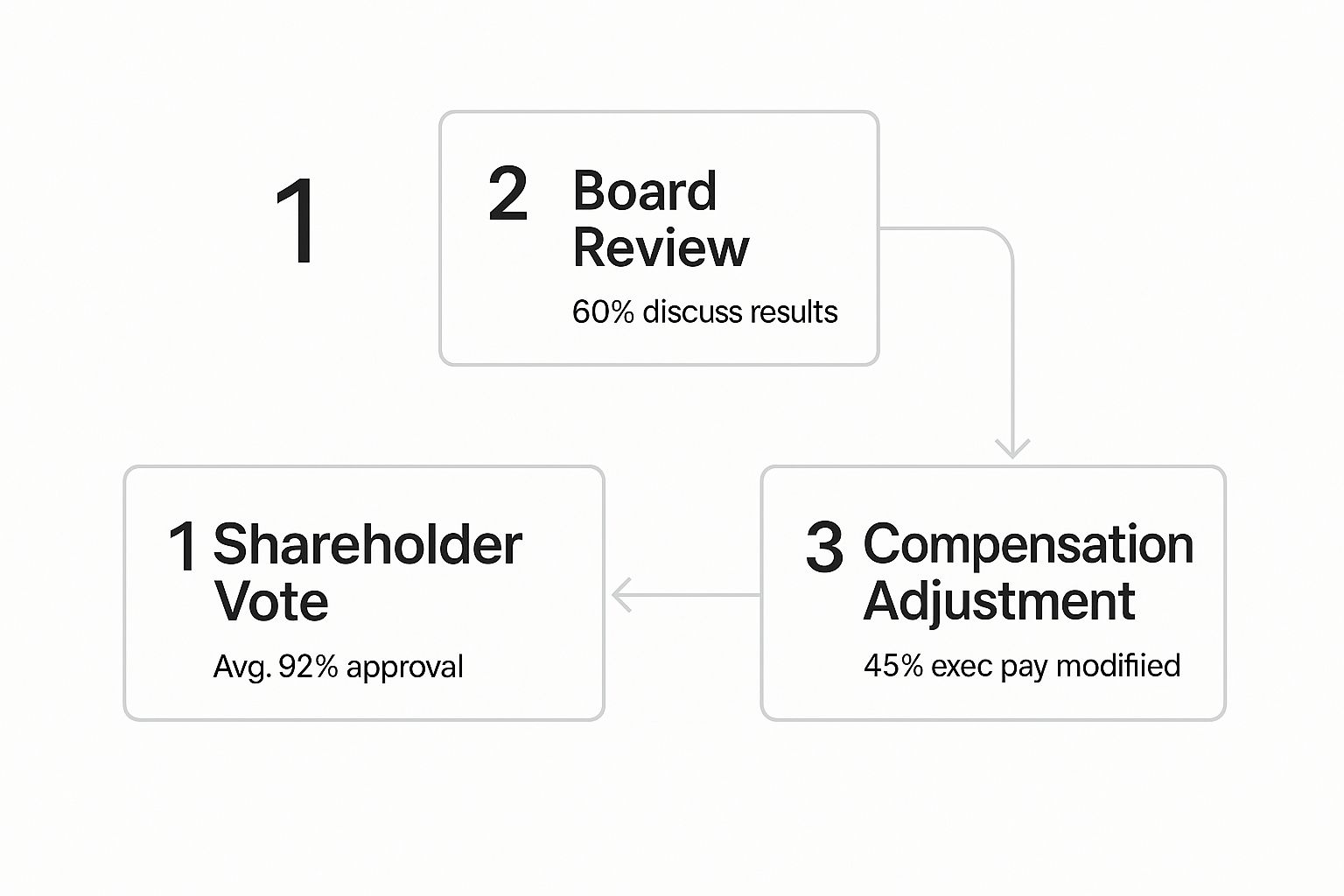

The following infographic shows the Say on Pay process, from the shareholder vote to the board review and any potential compensation adjustments:

This data shows that while shareholder approval is generally high (around 92% on average), a significant number of boards (60%) actively discuss the results. And 45% of companies actually modify executive pay based on shareholder feedback, highlighting the real impact of Say on Pay.

To help you stay organized during this phase, here’s a sample implementation timeline:

To help you stay organized throughout the Say on Pay implementation process, here’s a sample timeline you can adapt to your specific needs:

Say on Pay Implementation Timeline and Key Milestones

| Phase | Timeline | Key Activities | Stakeholders | Success Metrics |

|---|---|---|---|---|

| Planning & Preparation | Months 1-3 | Board education and buy-in, internal audit of compensation practices, peer benchmarking, establish objectives, form implementation team | Board of Directors, CHRO, Legal, Finance, Investor Relations | Board approval of Say on Pay implementation plan, documented objectives and success metrics |

| Framework Development | Months 4-6 | Design voting policy, develop communication plan, draft shareholder proposal, engage with key shareholders | Implementation team, Legal, Communications, Investor Relations, Key Shareholders | Finalized voting policy and shareholder proposal, positive feedback from key shareholders |

| Implementation & Communication | Months 7-9 | Launch communication campaign, conduct shareholder vote, analyze results, board review and potential compensation adjustments | All shareholders, Board of Directors, Executive team, Communications | High shareholder participation rate, clear communication of results, board engagement with feedback |

| Monitoring & Evaluation | Ongoing | Track voting results and shareholder feedback, identify areas for improvement, refine Say on Pay process | Implementation team, Board of Directors, Investor Relations | Continuous improvement of Say on Pay process based on data and feedback |

This table provides a month-by-month overview of the key activities, stakeholders, and success metrics for each phase of your Say on Pay implementation journey. Remember, this is a sample timeline – you may need to adjust it based on your company’s specific circumstances and shareholder expectations.

Key takeaways from the timeline include the importance of early planning and preparation, active stakeholder engagement, and continuous monitoring and evaluation.

- Engage with Key Shareholders: Talk to institutional investors and other important shareholders. Discuss your Say on Pay proposal and answer any questions they might have. This helps build relationships and encourages informed voting.

- Time Your Vote Strategically: Think about when shareholder engagement is likely to be highest. The annual general meeting is often a good choice.

- Monitor and Evaluate: Keep track of the voting results and analyze shareholder feedback. This will help you assess how effective your Say on Pay process is and identify areas for improvement.

By following this roadmap, you can turn Say on Pay from a compliance exercise into a strategic advantage. It can boost your company’s reputation and strengthen your relationships with investors and stakeholders.

The Ripple Effects: How Say on Pay Elevates Corporate Governance

Imagine dropping a stone into a still pond. The initial splash is just the beginning. Ripples spread outward, impacting the entire surface. Say on Pay is much the same. It’s not just about shareholders voting on executive compensation; it creates a ripple effect that touches all aspects of corporate governance. Companies embracing Say on Pay often discover benefits far beyond compensation decisions, improving everything from board dynamics to long-term strategy.

Strengthening Board Composition and Effectiveness

One of the most significant ripples is the impact on board composition and effectiveness. When shareholder votes on executive pay are in play, boards become acutely aware of the need to justify their decisions. This heightened scrutiny leads to more robust discussions about executive performance, emphasizing linking pay to tangible results. It can also encourage boards to diversify their expertise, bringing in members deeply familiar with compensation best practices and shareholder expectations.

Enhancing CEO Succession Planning

Say on Pay also influences how companies plan for CEO succession. By focusing on performance-based compensation, it encourages boards to develop clear criteria for evaluating potential successors. This emphasis on measurable results creates a more objective framework for selecting future leaders and fosters a culture of accountability at the top. It also allows for more transparent conversations with shareholders about leadership transitions and compensation packages offered to new CEOs.

Transforming Shareholder Engagement

Say on Pay also reshapes shareholder engagement. Instead of a once-a-year interaction at the annual general meeting, it promotes a continuous dialogue. Companies with robust Say on Pay processes often proactively engage with shareholders, seeking feedback on compensation practices and explaining the rationale behind their decisions. This ongoing engagement builds trust and strengthens the company-shareholder relationship. Academic research suggests that Say on Pay can lead to better alignment between pay and performance, even curbing excessive pay growth, especially in companies with weaker governance. For a deeper dive into this topic, check out this research: Discover more insights about Say on Pay and corporate governance.

Fostering Transparency and Accountability

Even when Say on Pay votes are advisory, they encourage greater transparency and accountability. Knowing their compensation decisions are subject to shareholder scrutiny motivates leadership teams to make justifiable choices and explain them clearly. This increased transparency can also extend to other areas of corporate governance, leading to more open communication about company strategy, performance, and risk management.

Driving Long-Term Strategic Thinking

Finally, Say on Pay fosters a culture of long-term strategic thinking. By linking executive compensation to long-term performance goals, it encourages leadership to focus on sustainable value creation, not just short-term gains. This benefits not only shareholders but also employees, customers, and other stakeholders invested in the company’s continued success. This long-term perspective aligns the interests of all stakeholders, creating a more stable and resilient organization. The impact of Say on Pay extends beyond a simple vote. It drives meaningful change within organizations, fostering stronger governance, better leadership, and more sustainable practices.

CHRO Mastery: Winning Strategies for Say on Pay Success

Imagine a CHRO in today’s business world. It’s a bit like being a skilled translator, bridging the communication gap between the board, shareholders, regulators, and employees. Each group has its own perspective on executive compensation. This section explores practical, proven strategies from CHROs who have successfully navigated the complexities of Say on Pay, turning it from a compliance exercise into a valuable tool for strengthening corporate governance.

Crafting a Compelling Compensation Narrative

Think of your executive compensation plan as a story. A good story needs a clear and engaging narrative. Shareholders, in particular, want to understand the why behind executive pay. They’re not just interested in the numbers; they want to see the connection between compensation and company performance.

Explain this connection in plain language, avoiding technical jargon. For example, instead of just stating the bonus amount, explain how it’s tied to specific, measurable achievements like reaching a revenue target or increasing market share. Make the story relatable and easy to understand for those outside of HR.

Building Bridges with Institutional Investors

Don’t wait until voting season to start talking to institutional investors. These investors often hold a substantial portion of company shares, and their votes carry significant weight. Regular communication is key.

By engaging in proactive dialogue, you can understand their concerns, address any misconceptions about your compensation practices, and build trust. This ongoing relationship-building can significantly impact voting outcomes and demonstrate your commitment to transparency.

Transparency Without Compromising Competitiveness

Openness is important in the Say on Pay process, but it’s also crucial to protect your company’s competitive edge. You don’t need to reveal every detail of your compensation strategy. How to Hire Top Talent & Accelerate Recruitment in 2023 offers valuable insights.

Instead, focus on explaining the core principles and framework behind your compensation decisions. Highlight the performance-driven elements that tie executive pay to company success. For example, you can disclose the performance metrics used for incentive plans without disclosing specific target amounts, protecting sensitive competitive information.

Practical Tools for CHROs

Several tools can help CHROs effectively manage the Say on Pay process:

- Compensation Benchmarking Frameworks: These provide market data to ensure your executive pay is competitive and justifiable to shareholders, offering insights into industry best practices.

- Peer Group Analysis Methodologies: By examining the compensation practices of similar companies, you can demonstrate that your approach is aligned with market standards and justify any differences based on your company’s unique situation.

- Stakeholder Communication Templates: Using pre-designed templates can streamline your communication, ensuring consistent messaging across all stakeholder groups.

Elevating HR Strategy Through Say on Pay

Smart CHROs are using Say on Pay to drive positive changes within their HR departments. The process of explaining and justifying executive compensation decisions can lead to improvements in performance evaluations, clearer goal setting, and a stronger connection between individual contributions and company success.

One study showed that companies with Say on Pay saw a 6.6% decrease in CEO pay, suggesting a shift towards more performance-based compensation. This focus on performance ultimately benefits the entire organization.

By embracing these strategies, CHROs can turn Say on Pay from a potential challenge into a strategic opportunity, building trust with investors and stakeholders, and strengthening corporate governance.

Future-Proofing Your Say on Pay Strategy: Trends and Opportunities

The future of Say on Pay in India is still developing. Imagine it like a sapling just planted – its growth depends on careful nurturing and attention. CHROs are the gardeners here, tending to its development and responding to the ever-shifting regulatory landscape. As shareholder activism grows more sophisticated, successful CHROs anticipate and prepare for the road ahead.

Emerging Trends in Say on Pay

Several key trends are shaping the future of Say on Pay, influencing how companies design and implement their strategies:

- ESG-Linked Compensation: Linking executive pay to Environmental, Social, and Governance (ESG) metrics is gaining traction. This means tying executive rewards to achieving sustainability goals, promoting ethical behavior, and fostering diversity and inclusion. This connection with broader societal values strengthens a company’s reputation and attracts investors who prioritize responsible business practices.

- Growing Influence of Proxy Advisory Firms: Proxy advisory firms like Institutional Shareholder Services (ISS) and Glass Lewis guide institutional investors on how to vote on Say on Pay proposals. Their recommendations carry significant weight, making it crucial for companies to understand their evaluation criteria and engage with them proactively.

- Technological Advancements: Technology is reshaping shareholder voting. Online platforms and mobile apps are streamlining the voting process, boosting shareholder participation, and enabling real-time feedback. These developments require companies to adapt their communication and embrace digital tools for more effective engagement.

Navigating the Evolving Landscape

As global governance standards become more aligned, Indian companies need to stay informed about international best practices and adjust their Say on Pay strategies accordingly. This includes staying current with evolving regulations and understanding how institutional investors influence compensation practices across different sectors. For insights on attracting top talent in India, check out this article: How GICs in India Can Attract and Hire the Best Talent.

Building Sustainable Competitive Advantages

Forward-thinking companies understand that Say on Pay is not just a box to check for compliance – it’s a chance to build lasting competitive advantages. By adopting transparent and performance-based compensation practices, they can:

- Attract and Retain Top Talent: A strong Say on Pay framework demonstrates good corporate governance, attracting executives who value accountability and openness.

- Enhance Investor Confidence: Showing a commitment to shareholder interests through Say on Pay builds trust and strengthens the company’s reputation among investors.

- Drive Long-Term Value Creation: By aligning executive compensation with long-term strategic objectives, companies encourage sustainable growth and value creation for everyone involved.

Staying ahead of regulatory changes and proactively adapting to these evolving trends positions companies for success in the dynamic world of executive compensation. By using Say on Pay as a strategic lever, CHROs can build a sustainable and competitive compensation framework that benefits both the company and its shareholders.

Ready to improve your recruitment process and build a winning talent acquisition strategy? Visit Taggd to explore our Recruitment Process Outsourcing services.