Semi Monthly Pay Guide: Smart Decisions for Indian Employers

Understanding Semi-Monthly Pay in India’s Evolving Workplace

In the landscape of Indian compensation structures, the semi-monthly pay schedule is a term that often requires some clarification. While the conventional monthly salary is still the most common approach, this alternative method is gaining traction across different industries. A semi-monthly pay system means employees receive their salary twice a month on specific, fixed dates—typically the 15th and the last day of the month. This results in a predictable pattern of 24 pay periods each year.

This payment structure is more than just a different way to divide a salary; it fundamentally changes the cash flow experience for employees. Its main advantage is its ability to lessen the financial strain many people feel between monthly paycheques. For example, getting a part of their salary mid-month can make it much easier to manage regular expenses like utility bills, rent, or EMIs, which often have different due dates.

The Mechanics and Psychological Impact

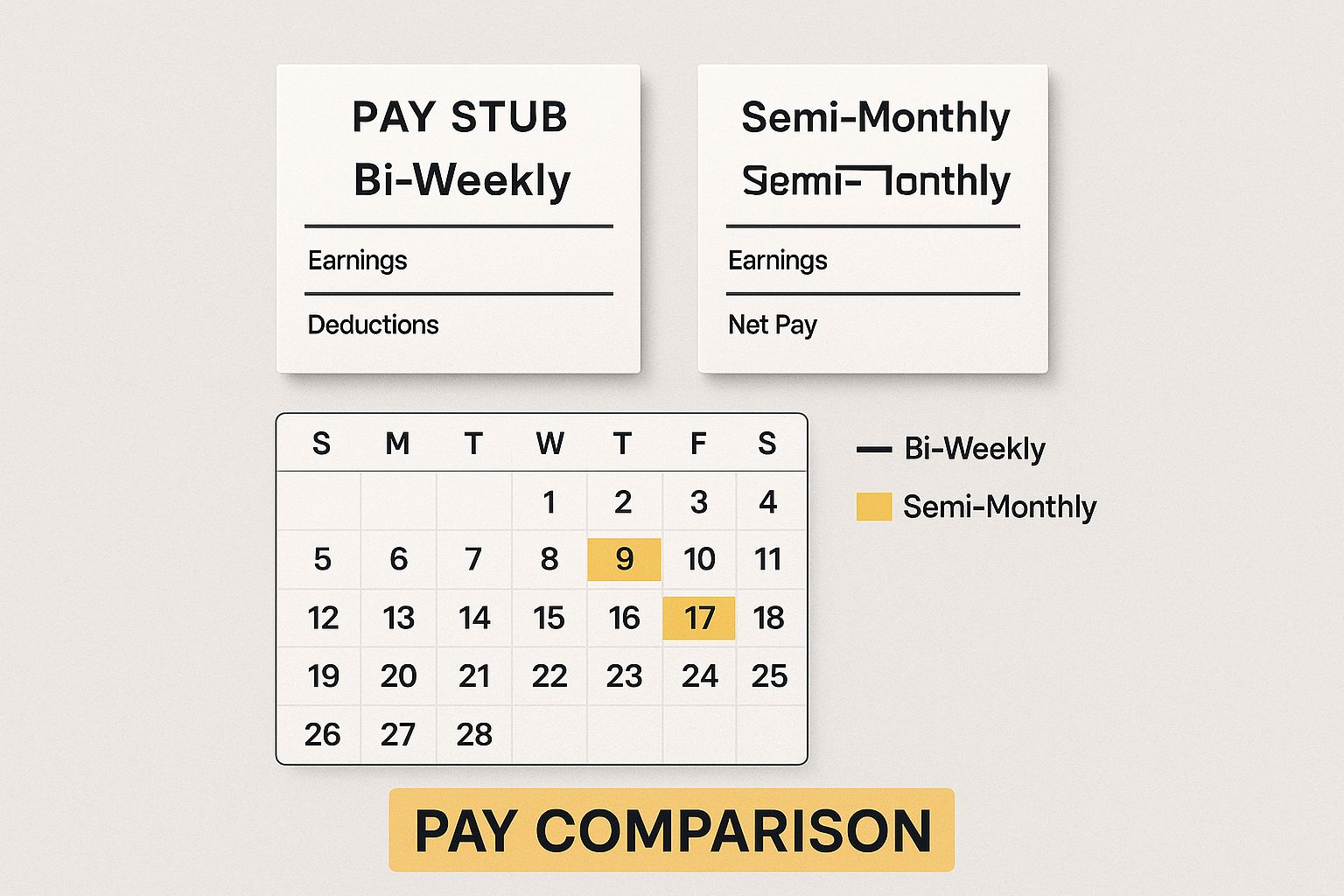

The core mechanism of semi-monthly pay is simple: the total monthly salary is split into two equal, consistent payments. This consistency is a key feature that sets it apart from other frequent payment models, such as bi-weekly pay, where payday dates can change and the number of paydays per month might vary. The predictability of getting a fixed amount on the same two dates every month can encourage better financial discipline and planning.

This approach has a direct effect on employee spending habits and overall financial wellness. A shorter interval between payments can decrease the need to rely on credit or short-term loans to handle mid-month expenses, which is a frequent issue for many in the workforce. By aligning income more closely with spending cycles, it helps establish a more stable financial foundation for employees.

The following screenshot shows the basic elements managed within a standard payroll system, which would be set up to process these fixed payment dates.

The image illustrates the various inputs and outputs of payroll, from wage calculations to deductions, all of which need to be processed twice under a semi-monthly model. To put this into perspective with numbers, consider that in 2025, the average salary in India is about ₹32,000 per month. With a semi-monthly pay arrangement, this would be divided into two reliable payments of approximately ₹16,000 each pay period, assisting employees in better managing their finances. You can explore more about Indian salary trends to understand these figures better. This structured payment can make a significant difference in how employees view and manage their income throughout the month.

Semi Monthly vs Monthly Pay: Real-World Impact Analysis

Choosing between a semi-monthly and a monthly pay schedule goes beyond simple definitions; it has tangible financial and operational results for both employers and employees. A monthly schedule simplifies payroll processing to just 12 cycles per year, which can seem more efficient at first glance. However, a semi-monthly pay system, with its 24 annual paydays, often aligns better with the cash flow realities of the Indian workforce, which can improve morale and financial wellness. The core decision for employers is balancing administrative ease against the financial well-being of their staff.

Financial and Administrative Considerations

From an administrative viewpoint, monthly payroll is less demanding. It involves fewer processing runs, fewer bank transfers, and more direct calculations for monthly deductions like Provident Fund (PF) and taxes. On the other hand, a semi-monthly schedule effectively doubles the number of payroll cycles. This demands a reliable payroll system that can manage these frequent, consistent payments without errors. While this might add to the administrative workload, the predictability of semi-monthly pay—always on set dates like the 15th and the end of the month—makes it easier to manage than a bi-weekly schedule’s shifting pay dates.

For employees, the difference centres on personal budgeting. A single monthly salary requires diligent financial planning to cover expenses throughout the month, which can be a significant challenge when bills are due at different times. Semi-monthly payments provide a mid-month financial infusion, potentially reducing the need for credit and alleviating financial stress. This regular flow of funds helps employees manage their expenses more effectively without the long wait for a single payday. This consistency also ensures paycheque amounts are stable, unlike bi-weekly schedules where pay can vary.

To better understand how these payment schedules affect both parties, the table below breaks down the key differences.

Semi Monthly vs Monthly Pay Comparison

Detailed comparison of payment frequency impacts on employees and employers

| Aspect | Semi Monthly Pay | Monthly Pay | Impact Analysis |

|---|---|---|---|

| Payment Frequency | 24 payments per year (twice a month) | 12 payments per year (once a month) | Semi-monthly offers more frequent access to earned wages, which can be crucial for employees managing regular expenses. Monthly pay requires more stringent budgeting from employees. |

| Administrative Effort | Higher due to more frequent processing cycles. Requires a robust payroll system. | Lower due to fewer processing cycles. Simpler for manual or less advanced payroll systems. | Employers must weigh the cost of more frequent payroll runs against the potential benefits for employee satisfaction and retention. |

| Employee Budgeting | Easier for employees to manage cash flow and align pay with mid-month expenses. | Can be challenging for employees, potentially leading to financial stress or reliance on credit towards the end of the month. | The semi-monthly model provides a more consistent financial rhythm, directly impacting employee financial wellness. |

| Paycheque Consistency | Pay amounts are consistent and predictable for salaried employees. | Pay amount is consistent for salaried employees. | Both schedules offer predictability for salaried staff, but the frequency of semi-monthly payments makes managing day-to-day finances smoother. |

| Best Suited For | Organisations focused on employee financial wellness; competitive industries aiming to attract talent. | Large organisations with standardised processes; companies prioritising administrative simplicity. | The choice often reflects a company’s culture and priorities—whether operational efficiency or employee-centric benefits take precedence. |

The table highlights that while monthly pay offers administrative simplicity, the semi-monthly schedule is often more aligned with the financial needs of employees, creating a more stable and less stressful environment.

This infographic helps visualise the timing differences and structure between payment schedules. The visual contrast shows how semi-monthly paydays are fixed within each calendar month, establishing a predictable financial cadence for employees.

The visual contrast shows how semi-monthly paydays are fixed within each calendar month, establishing a predictable financial cadence for employees.

Strategic Impact on Workforce Management

The choice of pay schedule also has strategic implications. In a competitive job market, offering an employee-friendly pay cycle can be a significant advantage. Companies that place a high value on employee wellness may find that the positive effects of reduced financial strain and higher morale justify the additional administrative tasks. For instance, a technology startup looking to hire top engineers might feature semi-monthly pay in its benefits package to stand out. In contrast, a large manufacturing firm with thousands of workers and a highly structured system may find the switch too complex, opting for the administrative convenience of a monthly schedule.

Ultimately, the right choice depends on balancing the company’s operational capacity with the financial well-being of its workforce.

Salary Impact Across India’s Income Spectrum

The decision to adopt a semi-monthly pay schedule has vastly different implications across India’s diverse economic landscape. What might be a minor convenience for one employee could be a crucial support system for another. Recognising this variation is fundamental to creating a payroll strategy that truly serves the entire workforce. For employees at the lower end of the income scale, receiving a salary twice a month can be a significant financial stabiliser.

Financial Stability for Lower-Income Earners

For workers in entry-level or lower-wage positions, the gap between monthly paydays can create considerable financial strain. A semi-monthly payment schedule provides a more manageable cash flow, helping to cover essential expenses like rent, utilities, and daily needs without a long wait. This more frequent access to earned wages can reduce the need to rely on high-interest credit or informal loans to manage mid-month financial gaps, promoting better financial health and lowering stress.

When an employee’s budget is tight, splitting their income into two predictable payments offers both a practical and psychological benefit for managing day-to-day costs. This is a vital consideration for companies evaluating their compensation approach, a subject we explore further in our detailed industry report.

Convenience for High-Income Professionals

In contrast, high-income professionals are less likely to feel the direct financial necessity of semi-monthly pay. Their larger salaries typically provide a sufficient financial cushion to manage expenses throughout the month without encountering cash flow problems. For this demographic, the advantage is more about personal preference and administrative ease rather than financial survival. A more frequent payment schedule might align better with personal investment cycles or simply feel more in line with modern practices.

Recent data shows that India’s payroll structures are evolving to reflect this varied workforce. With an average base pay of around ₹9.45 lakh annually in 2024, the salary spectrum is wide, with monthly incomes ranging from ₹8,000 to ₹1,43,000. On a semi-monthly basis, this translates to payments as low as ₹4,000 or as high as ₹71,500. You can find more details about these Indian salary figures on Playroll.com. This data underscores why a uniform approach to payment frequency is becoming less effective.

Navigating Legal Compliance and Wage Regulations

Bringing a semi-monthly pay schedule into your organisation in India means paying close attention to the country’s detailed regulatory framework. Employers have a duty to make sure their payment frequency is in line with both central and state-specific labour laws. Failing to do so can lead to serious legal and financial consequences. The main piece of legislation here, the Code on Wages, 2019, sets out the rules for when wages must be paid, but applying these to a semi-monthly system requires careful planning.

The main difficulty comes from calculating and submitting statutory deductions twice a month. This covers key contributions like the Provident Fund (PF), Employee State Insurance (ESI), and Tax Deducted at Source (TDS). These are usually figured out on a monthly basis. A semi-monthly payroll, however, needs a system that can accurately divide these deductions or handle them correctly in each pay cycle without mistakes. Any errors can result in non-compliance, which not only brings penalties but also erodes employee trust.

Minimum Wage and Overtime Complexities

Keeping up with minimum wage laws is a major compliance point. India’s minimum wage structure has a direct effect on semi-monthly payments, particularly in states with a higher cost of living. The Minimum Wages Act of 1948, which is now part of the Code on Wages Act 2019, establishes daily wage rates that must be applied correctly. For example, if a state’s minimum wage is ₹400 per day and an employee works 26 days, their monthly wage is ₹10,400. A semi-monthly system has to ensure each of the two payments is at least ₹5,200, covering the work done in that specific period. You can find more details on how these salary structures are calculated on ClearTax.in.

To better understand how state-level minimum wages affect semi-monthly payroll, the table below shows calculations for a few sample states.

State-wise Minimum Wage Impact on Semi Monthly Pay

Breakdown of how different state minimum wages translate to semi monthly payment calculations

| State | Daily Minimum Wage (INR) | Monthly Total (INR) | Semi Monthly Amount (INR) |

|---|---|---|---|

| Delhi | ₹757 | ₹19,682 | ₹9,841 |

| Maharashtra | ₹474 | ₹12,324 | ₹6,162 |

| Karnataka | ₹463 | ₹12,038 | ₹6,019 |

| Uttar Pradesh | ₹458 | ₹11,908 | ₹5,954 |

| West Bengal | ₹373 | ₹9,698 | ₹4,849 |

Note: Figures are for unskilled workers and based on a 26-day working month. Rates are indicative and subject to change.

The data highlights that the semi-monthly payment amount varies significantly based on state regulations. Employers must ensure each pay cheque meets or exceeds the pro-rated minimum wage for the pay period.

Overtime pay also adds another layer of complexity. If overtime is figured out weekly or daily, it needs to be tracked precisely and paid in the correct pay period. A semi-monthly schedule can make this more challenging than a weekly or bi-weekly one because a workweek might fall across two different pay periods. To handle this, businesses need solid time and attendance systems that integrate smoothly with their payroll software.

Ensuring Fair and Transparent Practices

Beyond meeting legal requirements, being transparent with employees is essential for a smooth transition. Communicating clearly about how deductions are calculated and when they are submitted helps build trust in the new pay system. This also supports a culture of fairness, which is a key part of positive employee relations. For more tips on creating a transparent workplace, you can read our advice on setting up a whistle-blower policy.

Ultimately, a successful move to semi-monthly pay depends on a solid grasp of wage laws and a commitment to accurate, open payroll processing.

Implementation Strategies for Different Business Models

Adopting a semi-monthly pay schedule isn’t a simple switch; its success depends entirely on a business’s operational flow and workforce makeup. A strategy that is effective for a technology firm might not work in a manufacturing environment. Therefore, a sector-specific approach is crucial for a smooth and effective implementation.

Assessing Organisational Readiness

Before committing to a change, an organisation must perform an honest evaluation of its readiness. This means looking closely at three main areas: administrative capacity, employee demographics, and operational tempo.

- Administrative Capacity: Can your current payroll system manage 24 pay cycles a year without issues? Processing payroll more often increases the administrative work. A solid, automated system is essential to handle this without adding significant costs or risking mistakes in deductions and compliance.

- Employee Demographics: Think about the financial literacy and income levels of your workforce. Semi-monthly pay often provides more stability for lower-income employees by improving their cash flow. On the other hand, higher-salaried staff may not view it as a major advantage, making the administrative shift less impactful.

- Operational Rhythm: How does your business run? A company with many hourly workers or frequent overtime must consider how a semi-monthly schedule complicates wage calculations, especially when workweeks cross over pay periods.

Sector-Specific Implementation Scenarios

The suitability of semi-monthly pay changes a lot across different industries. The key is to match the payment frequency with the business model and what employees need.

Sector Suitability Analysis for Semi-Monthly Pay

| Industry | Implementation Feasibility | Key Considerations & Recommendations |

|---|---|---|

| IT Services & Consulting | High | This sector is mostly made up of salaried professionals who can adapt easily. The predictable nature of 24 paydays a year fits well with project-based work and can be a competitive perk for attracting talent. Recommendation: Market it as a modern, employee-focused benefit. |

| Manufacturing | Moderate | The main difficulty is managing payroll for a large, often hourly, workforce. Overtime calculations can become very complex. Recommendation: Invest in a reliable time and attendance system that integrates smoothly with payroll software before making the change. A phased rollout, starting with salaried employees, could be an effective approach. |

| Retail & Hospitality | High | With high staff turnover and many employees on lower wages, semi-monthly pay can be a great benefit, helping with retention and financial stability. The predictable schedule helps staff manage their personal budgets more effectively. Recommendation: Clearly communicate the cash-flow advantages to staff to maximise the positive effect on morale. |

| Government & Public Sector | Low to Moderate | These organisations often have rigid, long-established monthly payroll systems. The bureaucratic obstacles and costs involved in changing set processes can be considerable. Recommendation: A transition is only practical with strong leadership support and a clear directive for modernisation, supported by a detailed cost-benefit analysis. |

Ultimately, a successful transition relies on a deep understanding of your organisation’s unique situation. By carefully evaluating administrative readiness and tailoring the approach to your sector, you can avoid common problems and set up a pay schedule that truly benefits both the business and its employees.

Employee Financial Wellness and Behavioural Impact

The frequency of salary payments does more than just affect an employee’s ability to manage bills; it shapes their financial behaviour and overall sense of security. A semi-monthly pay schedule, by providing income twice a month, can directly address the psychological stress that comes with waiting for a single monthly paycheque. This structured, predictable cash flow is often instrumental in fostering better financial habits, such as consistent saving and more deliberate spending.

When employees have a shorter gap between paydays, their reliance on credit or high-interest loans for mid-month expenses often decreases. This shift is not just practical; it is behavioural. The consistency of receiving pay on fixed dates, like the 15th and the end of the month, builds a rhythm that encourages better budgeting. For many, this leads to a greater sense of control over their finances, reducing the financial anxiety that can negatively affect workplace focus and productivity.

The Link to Job Satisfaction and Retention

Improved financial wellness often translates directly into higher job satisfaction and better employee retention. When an organisation implements a pay schedule that eases financial pressures, it sends a clear message that it values its employees’ well-being. This can be a powerful, though subtle, factor in retaining talent, especially in competitive industries. An employee who feels financially stable is more likely to be engaged, motivated, and loyal to their employer.

Analysis of spending patterns shows that more frequent pay cycles can lead to better emergency preparedness. Instead of a single large sum that can be quickly depleted, smaller, more regular payments encourage employees to allocate funds more thoughtfully. This improved financial management capability is a significant contributor to overall life satisfaction, which in turn boosts morale and performance at work. For those interested in exploring further strategies to enhance employee engagement, you can discover more on our blog.

Ultimately, the choice of a pay schedule like semi-monthly pay has a clear effect on workforce stability. By reducing financial stress, employers can cultivate a more focused, productive, and satisfied team. The practical benefits of improved cash flow are amplified by the psychological advantage of financial predictability, making it a strategic tool for fostering a positive work environment.

Making the Strategic Choice: Your Decision Framework

Deciding to implement a semi-monthly pay schedule isn’t just an administrative tweak; it’s a strategic move. This decision requires looking beyond a simple pros and cons list to a more structured evaluation of your organisation’s unique situation. The choice weighs potential employee benefits against operational complexity. A well-thought-out framework can clarify whether this pay structure will improve your operations or create unnecessary friction. The fundamental question is: does your organisation’s profile match the demands and benefits of a semi-monthly system?

Key Organisational Indicators

The first step is a practical check of your company’s readiness. Certain signs strongly suggest success with semi-monthly pay, while others indicate that sticking with a monthly system might be wiser.

- Workforce Composition: Companies with a high percentage of salaried, office-based professionals often have a smoother transition. Their consistent hours make payroll calculations simpler. In contrast, businesses with a large, fluctuating hourly workforce may face big challenges in accurately calculating overtime and wages for 24 pay cycles a year.

- Payroll Technology: Your current payroll software is a critical piece of the puzzle. A modern, automated system can manage the higher frequency of a semi-monthly schedule with little extra effort. However, if your payroll process is heavily manual or uses outdated software, the administrative load of running payroll twice a month could lead to errors, delays, and higher costs.

- Employee Financial Needs: Think about the financial reality of your employees. For a large part of your workforce in lower to middle-income brackets, the better cash flow from semi-monthly pay can be a significant advantage, boosting morale and easing financial stress. For a workforce of mainly high earners, this benefit may be less important.

Creating Your Decision Matrix

To make a well-rounded choice, a decision matrix can help. This tool lets you weigh key factors based on their importance to your organisation, making the decision process more objective.

| Decision Factor | Low Importance (1) | Medium Importance (3) | High Importance (5) |

|---|---|---|---|

| Employee Financial Wellness | – | – | ✔️ |

| Administrative Simplicity | – | ✔️ | – |

| Talent Attraction & Retention | – | ✔️ | – |

| Payroll System Capability | – | – | ✔️ |

| Compliance Complexity | – | – | ✔️ |

By scoring these factors, you can get a clearer picture of whether the strategic benefits, like improved employee satisfaction and retention, are worth the operational costs and complexities. A company that prioritises employee wellness and has a capable payroll system is a strong candidate for semi-monthly pay.

Ready to attract and retain top talent with a modern, employee-centric approach? Discover how Talent Hired’s recruitment process outsourcing can help you build a workforce that drives success. Visit Taggd to learn more.