Total Target Cash: Maximize Performance Pay Effectively

Understanding Total Target Cash

Navigating compensation in today’s market can be tricky. Understanding Total Target Cash (TTC) is increasingly important for organizations across India. This approach shifts traditional salary structures away from solely fixed compensation and towards more dynamic models. Forward-thinking companies are recognizing the need for this flexibility, aligning employee success with business outcomes.

Why Total Target Cash Matters

Total Target Cash represents the total cash compensation an employee can receive upon achieving 100% of their performance goals. This typically includes base salary and short-term incentives like bonuses and commissions. TTC offers a clear view of potential earnings, promoting transparency and encouraging goal-oriented performance. This is especially important in India’s competitive job market, where attracting and retaining top talent is crucial.

While specific data on Total Target Cash within India isn’t readily accessible, the core principles apply. Total Target Cash is fundamentally part of a broader compensation strategy encompassing both fixed and variable components. Like many regions, Indian companies often structure compensation to incentivize meeting performance targets, such as sales quotas. This aligns with global compensation trends. Learn more about Total Target Cash and compensation strategies here.

Real-World Applications of Total Target Cash

From startups to established corporations, Total Target Cash is used across diverse Indian sectors. This approach allows tailoring compensation to specific roles and industries. For example, a sales representative might have a higher portion of their TTC tied to commissions, while a software engineer might have a larger base salary with bonuses linked to project milestones.

The Benefits of TTC for Organizations

- Improved Talent Acquisition: TTC helps attract top talent with competitive compensation.

- Increased Employee Retention: Clear earning potential and performance-based rewards can boost employee satisfaction and loyalty.

- Enhanced Performance: Linking compensation to business goals drives individual and team performance.

- Greater Transparency: TTC creates a transparent compensation structure, building trust between employers and employees.

Understanding Total Target Cash is essential in India’s dynamic business environment. By adopting this approach, organizations can build a more engaged, motivated, and high-performing workforce. This sets the stage for creating an effective TTC structure, a topic we’ll explore further in the next section.

Building Your Total Target Cash Structure That Works

A well-structured Total Target Cash (TTC) program is essential for a successful compensation strategy. It’s all about finding the sweet spot between financial security and performance incentives. This requires careful consideration of the different parts of a TTC package and how they work together to motivate employees.

Designing Effective Compensation Packages

Industry leaders often focus on a balanced approach. They want their compensation packages to be both competitive and sustainable. They achieve this by understanding their employees’ needs and the demands of their industry. This involves knowing the right mix of fixed components (base salary) and variable components (incentives and bonuses) for different roles and seniority levels.

For example, entry-level employees might appreciate a higher base salary for stability. But for senior roles, especially in sales or business development, a larger variable component tied to performance can be more motivating. This could include quarterly or annual bonuses, commissions, or profit-sharing.

A successful TTC structure also includes clear performance metrics. These metrics should be transparent, measurable, and aligned with business goals. This transparency builds trust and motivates employees.

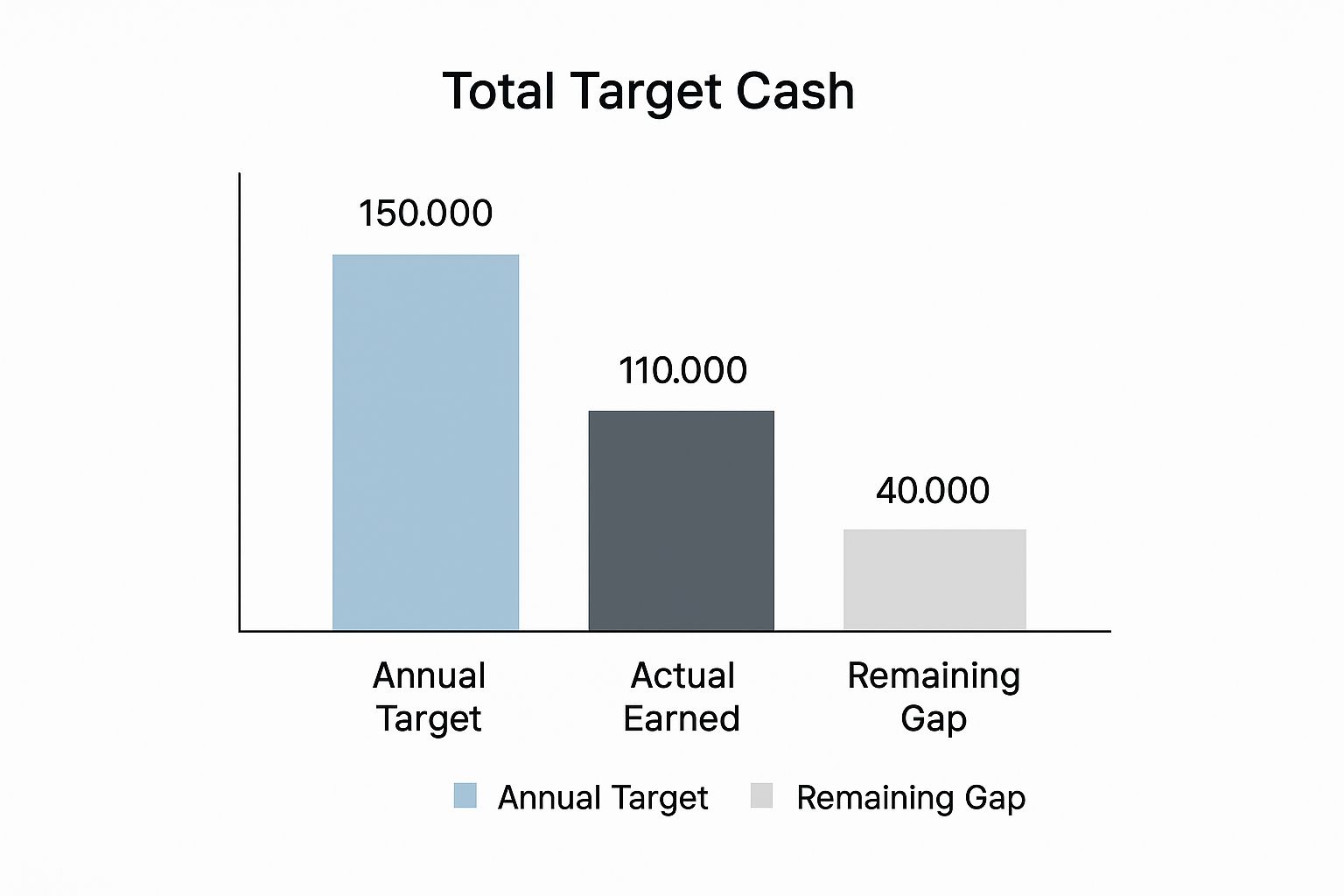

To illustrate this, the infographic below shows a typical Total Target Cash compensation plan. It visually represents the relationship between the annual target, the actual amount earned, and any remaining gap.

As the infographic shows, understanding the parts of TTC is key. Meeting the target TTC demonstrates strong performance aligned with company objectives. A gap highlights areas for improvement. This visual emphasizes the importance of setting realistic yet challenging targets.

In India, understanding the components of Total Target Cash is crucial. It usually includes base salary and short-term incentives like commissions and bonuses. For instance, sales roles often have a base salary plus a target variable compensation component. This lets employees earn more by meeting or exceeding their targets. You can explore this further in this Mercer report.

To provide a more detailed understanding of how Total Target Cash packages are structured in India, let’s examine a typical breakdown:

Total Target Cash Components Breakdown

Comprehensive breakdown of fixed and variable components that make up Total Target Cash packages in India.

| Component | Percentage of Total | Payment Frequency | Performance Criteria |

|---|---|---|---|

| Base Salary | 70% – 80% | Monthly | N/A |

| Annual Bonus | 10% – 15% | Annually | Company Performance & Individual Goals |

| Sales Commission (for Sales Roles) | 10% – 15% | Quarterly/Annually | Sales Targets & Revenue Generation |

This table provides a general overview, and the specific percentages can vary based on the industry, company, and individual role. Understanding this breakdown allows companies to create competitive compensation plans that attract and retain top talent.

Structuring Incentives for Optimal Impact

Understanding these components is crucial for effectively implementing quarterly bonuses, annual incentives, and commission models. Designing a TTC structure is about more than just percentages; it’s about understanding how different incentives influence behavior.

For example, a tiered commission structure can motivate healthy competition and reward exceeding targets. Profit-sharing programs can create a sense of ownership and encourage teamwork. But poorly designed incentives can lead to unwanted outcomes, like excessive risk-taking or focusing on individual gain over team success. Careful planning and execution are essential for developing TTC programs that benefit both the employee and the organization.

Industry-Specific Total Target Cash Applications

A Total Target Cash (TTC) structure isn’t universal. What works well for one industry might not be suitable for another. Therefore, customizing your TTC approach for each sector in India is vital for success. Let’s explore how different industries are adapting TTC structures for maximum impact.

Technology Companies: Equity’s Role in TTC

Technology companies in India often integrate equity components, such as stock options or grants, into their TTC offerings. This is particularly attractive to employees in the dynamic tech industry.

For instance, a startup might offer a lower base salary complemented by significant equity. This allows employees to participate in the company’s potential growth. This strategy not only attracts top talent but also cultivates a sense of ownership and long-term commitment.

Pharmaceutical Firms: Territory-Focused Incentives

In the pharmaceutical industry, territory-based metrics are frequently key in determining TTC payouts. Sales representatives, for example, often have targets linked to specific regions.

This encourages them to develop in-depth market expertise and strong relationships with healthcare providers in their assigned territories. This targeted approach allows for better performance tracking and compensation adjustments based on regional market conditions. You might be interested in: Pharmaceuticals Sectoral Report 2022.

Financial Services: Balancing Act in TTC

Financial services organizations need to balance individual performance with team collaboration. TTC structures in this sector often blend individual and team-based incentives.

This approach encourages employees to excel individually while contributing to the overall success of their team or department. For example, a wealth manager’s TTC package could combine individual sales targets with a bonus tied to the branch’s performance.

Manufacturing Companies: TTC on the Production Line

Implementing TTC programs on the factory floor requires a distinct strategy. Manufacturing companies often link incentives to production output, quality control, or safety metrics.

This motivates factory workers to maintain high standards and contribute to overall production efficiency. This might involve bonuses for surpassing production goals, meeting quality benchmarks, or upholding a safe work environment. However, defining these metrics requires careful planning to ensure fairness and prevent unintended consequences.

By understanding the specific requirements and obstacles of each sector, organizations can create TTC programs that deliver substantial results and promote a culture of performance and engagement. This focused approach to compensation is critical for attracting, retaining, and motivating top talent in India’s diverse industries.

Setting Performance Targets That Actually Motivate

Setting the right performance targets is crucial for the success of any Total Target Cash (TTC) program. It’s a balancing act: targets should be challenging yet attainable. This section explores how leading organizations in India create these effective performance benchmarks.

Establishing a Baseline for Expectations

The first step is establishing a realistic baseline. This should reflect current market conditions and individual employee capabilities. For example, a sales target for a new employee in a competitive market will differ from the target for a seasoned employee in a growing market. These initial targets become the foundation for future growth and performance evaluation.

Furthermore, the baseline should consider business cycles. During economic downturns, overly ambitious targets can be counterproductive. Conversely, periods of growth may warrant more aggressive targets. This adaptability ensures the TTC program remains relevant and motivating, regardless of market fluctuations.

Creating Stretch Goals That Inspire

Beyond the baseline, stretch goals encourage employees to exceed expectations. These goals are ambitious yet achievable, prompting employees to develop new skills and innovative approaches. For instance, a stretch goal might involve not only achieving a sales target but also acquiring a certain number of new clients. This promotes both individual and business growth.

However, stretch goals shouldn’t feel impossible. Unrealistic targets can lead to frustration. Instead, stretch goals should inspire excellence, fostering a sense of accomplishment. You might be interested in: How to Use Creative Compensation to Boost Your Recruiting.

Measuring Performance Across Different Roles

Different roles require different performance metrics. A sales representative’s performance is often measured by revenue, while a customer service representative’s performance might be assessed based on customer satisfaction. A balanced scorecard approach can effectively capture multiple dimensions of success, providing a holistic view of an employee’s contributions.

The following table illustrates how different roles might use different metrics and target-setting methods:

To understand how various roles are evaluated within a TTC program, let’s look at some common performance indicators and target-setting approaches.

Performance Metrics by Role Type

Common performance indicators and target-setting approaches for different job functions in Total Target Cash programs

| Role Category | Primary Metrics | Target Setting Method | Review Frequency |

|---|---|---|---|

| Sales | Revenue, New Clients | Historical Data, Market Analysis | Quarterly |

| Customer Service | Customer Satisfaction, Resolution Time | Industry Benchmarks, Internal Surveys | Monthly |

| Marketing | Lead Generation, Brand Awareness | Campaign Performance, Market Share | Quarterly |

| Engineering | Project Completion, Code Quality | Project Scope, Team Velocity | Bi-Annually |

As shown in the table, sales roles often focus on revenue and new client acquisition, while customer service emphasizes customer satisfaction and resolution times. Marketing targets are typically centered on lead generation and brand awareness, whereas engineering roles prioritize project completion and code quality. The review frequency also varies depending on the role, ranging from monthly to bi-annually.

Maintaining Fairness and Motivation Through Reviews

Regular reviews and adjustments are vital for a fair and motivating TTC program. These reviews provide opportunities to discuss performance, provide feedback, and adjust targets based on evolving circumstances. For example, if market conditions shift significantly, targets might need revision.

This flexibility builds trust and ensures the program remains aligned with individual and organizational goals. Ultimately, effective TTC target setting creates a system that drives results while fostering continuous improvement and motivation.

Implementation That Gets Results, Not Resistance

The success of a Total Target Cash (TTC) program depends heavily on its implementation. A poorly planned rollout can create confusion and skepticism, even leading to resistance. This section provides a practical roadmap for smoothly and effectively introducing performance-based compensation.

Conducting Thorough Market Research

Before launching any TTC program, understanding the existing compensation landscape in India is essential. Market research helps determine competitive salary ranges and incentive structures for various roles. This ensures your TTC program attracts and retains top talent.

Understanding current trends also informs program design and helps avoid potential issues. For example, research might reveal certain incentives are more effective within your specific industry.

Developing Effective Internal Policies

The foundation of a successful TTC program lies in clear, well-defined policies. These policies should cover every aspect of the program. This includes everything from performance metrics and target setting to payout schedules and how to handle disputes.

A strong policy should detail exactly how performance is measured, how targets are adjusted, and the process if targets are not met. This transparency builds trust with employees.

Overcoming Implementation Obstacles

Introducing a new compensation model often presents challenges. Employee skepticism is common. Addressing these concerns openly and honestly is crucial.

Clearly communicate the benefits of TTC and how it connects individual success with company performance. Offering training and support helps employees adapt to the new system. For further insights into compensation trends, review this helpful guide: COVID-19’s Impact on Companies and Variable Pay.

Communicating Effectively and Building Buy-In

Effective communication is essential for a smooth transition to a TTC model. Explain the reasoning behind the program, its advantages, and how it works in practice.

Regular communication and feedback mechanisms address employee concerns and build buy-in. Town hall meetings, Q&A sessions, and online forums can create an open dialogue and promote understanding.

Training Managers to Lead Under the New System

Managers are vital to the success of a TTC program. They need training on setting effective performance targets, providing constructive feedback, and managing employee performance under the new compensation model.

This training should emphasize coaching skills, performance management techniques, and aligning individual goals with overall business objectives.

Streamlining Administration with Technology

Administering a TTC program can be complex. Technology solutions can streamline the process, reducing the burden on HR teams and improving transparency.

Software platforms like SAP SuccessFactors can automate tasks like performance tracking, bonus calculations, and reporting. This allows HR professionals to focus on strategic initiatives. Employee self-service portals provide easy access to performance data and compensation information, which further promotes transparency and engagement.

By proactively addressing potential obstacles and focusing on open communication, organizations in India can successfully implement Total Target Cash programs that drive performance and cultivate a motivated workforce. This creates a strong foundation for long-term success and a positive organizational culture.

Navigating Legal Requirements and Compliance

Getting Total Target Cash (TTC) right in India requires careful attention to legal compliance. This means understanding and adhering to Indian labor laws, protecting both your organization and your employees. This section helps you navigate these often complex regulations.

Essential Documentation and Agreements

Solid documentation is the foundation of any successful TTC program. This starts with comprehensive employment agreements. These agreements should clearly outline the terms of the TTC structure, detailing how fixed and variable components are calculated. Transparency here builds trust and avoids potential misunderstandings down the line.

Employee offer letters must clearly state the Total Target Cash amount, breaking it down into base salary and incentives. For example, an offer letter might state: “Your Total Target Cash is ₹12,00,000 per annum, comprising a base salary of ₹9,00,000 and a target variable pay of ₹3,00,000.” This clarity from the start ensures everyone is on the same page.

Meticulous record-keeping is also essential. Maintain detailed records of performance evaluations and payout calculations. This documentation is vital for demonstrating legal compliance and can be invaluable in case of disputes.

Compliance With Indian Labor Laws

Indian labor laws have specific provisions regarding wages and compensation. Minimum wage compliance is paramount. The fixed component of the TTC must meet legal minimums, regardless of whether an employee achieves their performance targets.

Calculating overtime with variable pay structures can be tricky. Your TTC program must clearly define how overtime is calculated when incentives are earned beyond the base salary. This requires careful consideration of various legal scenarios.

Termination can also present complications regarding outstanding incentive payments. Clear policies within your TTC program should address these situations, protecting both the employee’s right to earned compensation and the company’s interests.

Dispute Resolution Mechanisms

A well-defined dispute resolution process is crucial for handling disagreements about TTC payouts. This could involve an internal review process or using an external mediator. A structured process offers a fair and efficient method for managing conflicts.

Adapting to Regulatory Changes

India’s regulatory environment is dynamic. Building adaptability into your TTC program is essential. This could involve annual policy reviews and updates, or consulting with legal experts to stay informed about changes in regulations.

By implementing these strategies, organizations can develop TTC programs that are not only motivating and effective, but also legally compliant. This protects your company and fosters a positive work environment for everyone.

Measuring Success and Continuous Improvement

A Total Target Cash (TTC) program’s true value lies in the tangible results it delivers. Measuring these results requires a more nuanced approach than simply tracking the payouts. This section focuses on building effective evaluation frameworks that reveal a program’s true effectiveness.

Key Performance Indicators Beyond Participation

While participation rate offers a basic snapshot of employee engagement, a comprehensive understanding of a TTC program’s impact requires looking beyond this single metric. Key Performance Indicators (KPIs) such as employee satisfaction trends, retention improvements, productivity gains, and measurable business impact paint a much richer picture of program effectiveness. For example, an upward trend in employee satisfaction scores after implementing a TTC program can suggest a positive correlation.

Similarly, improved employee retention rates may indicate that the program is helping attract and retain valuable talent. These KPIs offer data-driven insights into how TTC programs influence employee behavior and, ultimately, organizational performance.

By consistently monitoring these metrics, businesses gain invaluable feedback regarding a program’s strengths and areas for improvement. This data-driven approach allows for continuous refinement and optimization of the TTC program.

Conducting Meaningful Program Audits

Regular audits are crucial for ensuring the long-term health and effectiveness of a TTC program. These audits should extend beyond basic financial reviews and delve into gathering qualitative feedback from participants. Surveys and focus groups, for example, can offer valuable insights into employee perceptions of the program.

This feedback helps identify what aspects of the program resonate with employees and where adjustments are necessary. This might involve revisiting the performance metrics used or recalibrating target goals to maintain motivation and relevance. Additionally, periodic benchmarking against industry standards is essential.

By understanding how your TTC program compares to those offered by competitors, you can identify areas of excellence and areas needing improvement. This practice helps your program remain competitive and attract top talent.

Advanced Analytics for Understanding Program Performance

Advanced analytics can provide a deeper understanding of your TTC program’s performance. Leveraging analytics tools like Tableau can reveal trends and patterns in program data. For instance, you might discover that certain roles or departments respond more favorably to specific incentive structures.

This information allows for fine-tuning the program to maximize its impact across different segments of your workforce. This data-driven approach ensures your TTC program adapts to the evolving needs of your organization and its employees.

It also facilitates anticipating future trends in compensation and benefits, enabling proactive adjustments to stay ahead of the curve. This proactive approach helps maintain the program’s effectiveness and attractiveness in the long run.

Practical Approaches for Evolution and Adaptation

Just like the marketplace, a successful TTC program is dynamic. As your organization grows and evolves, so too should your compensation strategies. This includes regularly reviewing and updating your TTC program. Changing market conditions, for example, may necessitate adjusting target goals.

Alternatively, as your company expands into new areas, different performance metrics might become more relevant. By embracing continuous evolution and adaptation, you ensure your TTC program remains competitive, relevant, and effective in attracting, retaining, and motivating your most valuable employees. This ongoing refinement is key to maximizing the return on investment in your TTC program.

Ready to transform your talent acquisition strategy and build a high-performing workforce? Explore Talent Hired’s recruitment process outsourcing solutions and take your organization to the next level. Visit Taggd today.