The CHRO’s Guide to Acqui-Hiring in India

At its core, acqui-hiring is when you buy a company not for its product, its customers, or its assets, but for its people. For a Chief Human Resources Officer (CHRO), it’s a high-impact strategy to bring in a team of proven experts, jump-start innovation, and get a serious leg up in a fiercely competitive labour market.

Understanding the Acqui-Hiring Advantage

Think of it this way. Let’s say you need to assemble a world-class Formula 1 racing team from the ground up. You could spend years scouting individual drivers, mechanics, and engineers, and then cross your fingers hoping they gel as a unit. Or, you could simply acquire a smaller, existing race team that already has a winning record, its own shorthand, and works together like a well-oiled machine.

That second approach is exactly what acqui-hiring is all about. It’s not about the company’s revenue stream or its list of clients; it’s about buying the team itself. In fact, it’s common for the target company’s product to be shut down after the deal closes. The real prize is the cohesive, high-performing group of people who have already proven they can build amazing things together.

Why It’s More Than Just a Talent Grab

In today’s business world, especially within India’s booming tech scene, finding and keeping top-tier talent is a relentless battle. The traditional recruitment cycle can be painfully slow, surprisingly expensive, and full of uncertainty. An acqui-hire is a strategic shortcut, delivering a package of benefits that goes well beyond simply filling a few empty seats.

For a CHRO, this strategy hits several key pressure points:

- Speed to Market: You bring an entire team on board that can hit the ground running on a new project from day one. This can slash development timelines dramatically.

- Proven Synergy: You get a team with built-in chemistry and established ways of communicating, letting you skip the awkward and often inefficient team-forming stage.

- Specialised Skills: It’s a direct line to niche expertise—like advanced AI or data privacy engineering—that is incredibly tough to recruit for one person at a time.

- Cultural Fit: By targeting start-ups with a similar work ethic or a shared focus on innovation, you can bring in a group that already reflects the culture you’re trying to build.

An acqui-hire flips the script on valuation. Instead of looking at revenue multiples, the deal is often priced on a “per head” basis. This shows that the true value is in the human capital—the integrated, proven team you’re bringing in.

This completely changes the game compared to a standard merger or acquisition. The due diligence process spends less time on balance sheets and more on team dynamics, the quality of leadership, and how well the talent will fit into your organisation’s culture.

Acqui-Hiring vs. Traditional Recruitment at a Glance

To truly appreciate the power of this approach, it helps to see how acqui-hiring stacks up against the usual way of hiring. The goals are different, the outcomes are different, and knowing which to choose depends entirely on your strategic needs.

Here’s a quick comparison:

| Factor | Acqui-Hiring | Traditional Recruitment |

|---|---|---|

| Primary Goal | Acquire a cohesive, proven team to spearhead a strategic project or enter a new market. | Fill individual, specific job roles to support day-to-day operations. |

| Time to Productivity | Immediate. The team is already in sync and can start contributing right away. | Weeks or even months. New hires need onboarding and time to build relationships. |

| Cost Structure | High upfront cost (the acquisition price) but lower long-term recruiting and training fees. | Lower initial cost per hire, but the cumulative costs of sourcing and onboarding add up. |

| Risk Profile | The main risks are cultural integration and talent retention post-acquisition. | Risks include bad hires, slow ramp-up times, and a potential lack of team chemistry. |

Ultimately, the choice between these two methods isn’t about which one is “better,” but which one is the right tool for the job. While traditional recruitment is perfect for scaling existing teams, an acqui-hire is a bold, strategic move designed for rapid, high-impact growth.

The Strategic Case for an Acqui-Hire

Why would a company spend millions to buy another firm, only to shelve its product and keep the people? It sounds counterintuitive, but the answer is a powerful strategic calculation that puts human capital right at the heart of business growth. For a CHRO, this isn’t just another recruitment tactic; it’s a high-stakes corporate move.

At its core, acqui-hiring is a direct solution to some of the toughest, most expensive problems in business today. We’re not just talking about filling a few open roles. It’s about buying momentum, expertise, and a ready-made innovation engine. Companies pull this lever when the cost of standing still, or even just moving slowly, is far greater than the price of the acquisition.

Think about a company trying to build a new AI division. Doing it the old way—hiring one by one—could take years of painstaking recruitment. Even then, there’s no guarantee the new hires will gel into a cohesive, effective team. An acqui-hire presents a compelling shortcut, letting the company instantly bring on board a team that has already proven it can work together and deliver.

Accelerating Innovation and Market Entry

One of the strongest arguments for an acqui-hire is pure, unadulterated speed. In today’s fast-paced industries, being first to market can be the difference between success and failure. Traditional hiring is slow; it can take months to land a single senior expert. An acqui-hire compresses that timeline from years into a single deal.

This rapid injection of talent is absolutely vital when:

- Entering New Markets: Acquiring a local team gives you an instant foothold, complete with established expertise and networks.

- Launching New Products: Instead of building a product team from scratch, you get one that’s already been through the early development trenches together.

- Pivoting Strategy: When a company needs to make a sharp turn, an acqui-hire delivers the specific skills needed to execute the new vision immediately.

The real return on investment (ROI) in an acqui-hiring isn’t about comparing salaries. It’s measured in the value of slashed product development cycles, the revenue from beating competitors to market, and the massive advantage of having a world-class team from day one.

This need for strategic speed is a huge driver in India, where the battle for specialised tech talent is fierce. In fact, a recent study found that over 80% of acqui-hiring deals in the country are driven by the need to get teams with critical skills and the right cultural DNA. The most in-demand skills? Java development, data engineering, and analytics—all reflecting an urgent need for ready-made technical units.

De-Risking Talent Acquisition

Every single hire comes with a degree of risk. Will they fit the culture? Can they collaborate with the existing team? Do their skills really apply to your company’s unique problems? An acqui-hire smooths out many of these uncertainties by bringing in a known quantity. You aren’t just hiring individuals; you’re buying their proven synergy, their shared language, and their collective problem-solving muscle.

This is a huge plus for large organisations and Global Capability Centres (GCCs), which can sometimes struggle with agility. Acquiring a small, nimble startup team can inject a much-needed dose of entrepreneurial energy straight into the corporate bloodstream. For a closer look at this dynamic, you can learn more about how GCCs in India can attract and hire the best talent.

Ultimately, the strategic case for an acqui-hiring is clear. It’s a bold move to buy time, secure proven talent, and grab an immediate competitive edge. By reframing the ROI to include speed, synergy, and reduced risk, CHROs can make a powerful case for it as a critical investment in the company’s future.

Executing a Successful Acqui-Hire Deal

Turning an acqui-hiring opportunity into a genuine strategic win takes a structured, people-first approach. Unlike traditional M&A where financial assets and intellectual property take centre stage, here the focus is squarely on the talent. A single misstep can mean losing the very people the deal was designed to secure.

Think of it like transplanting a high-performance engine from a nimble sports car into a larger, more powerful vehicle. You can’t just drop it in. The process demands precision, care, and a deep understanding of both systems to ensure the engine not only fits but thrives in its new home.

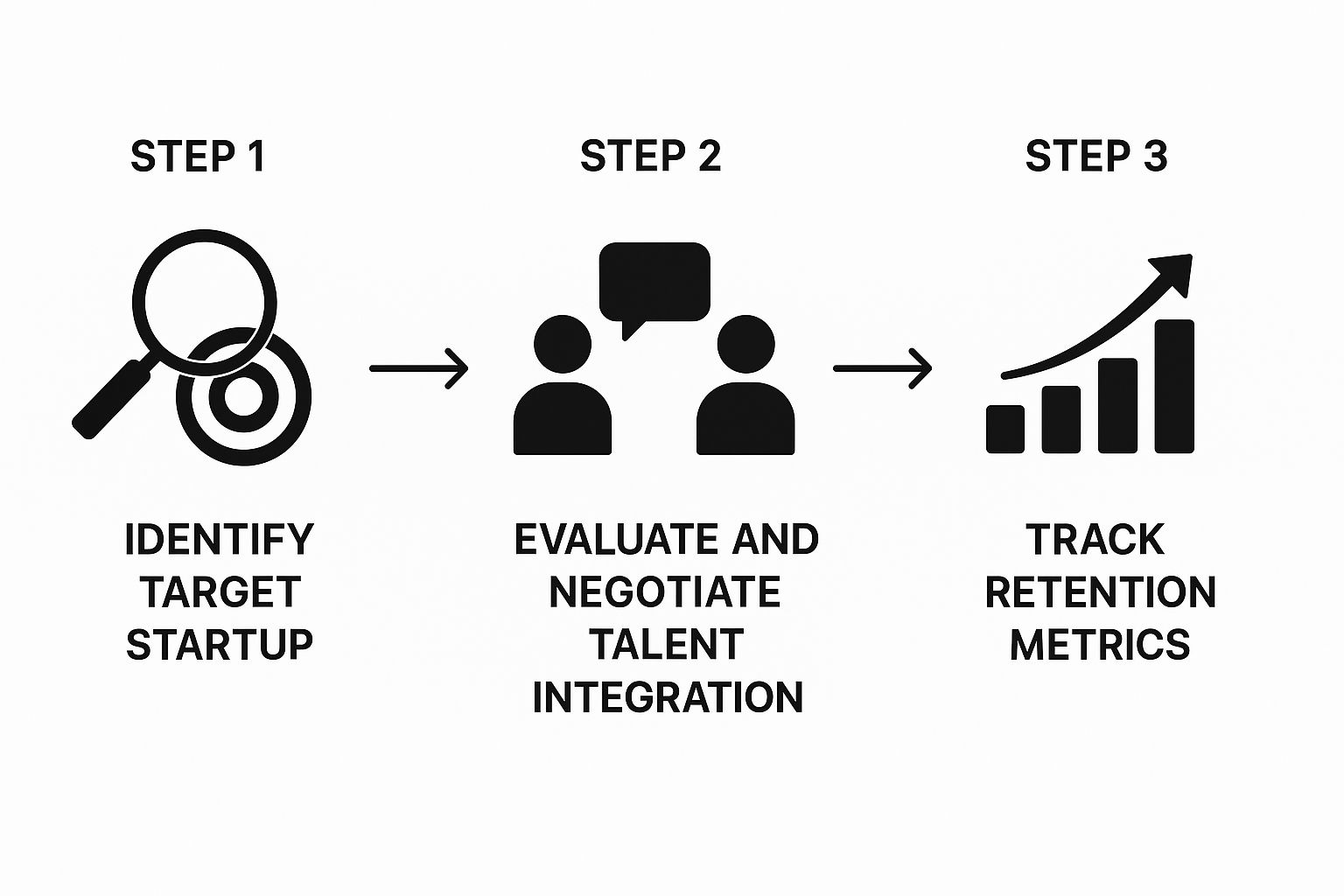

This infographic outlines the core flow of a talent-centric acqui-hiring process.

As the visual shows, success isn’t just about closing the deal. It’s about a clear progression from identifying the right team to ensuring they stay and deliver value long after the papers are signed. Success is measured by people, not just financials.

Stage 1: Identifying and Vetting Targets

The whole process kicks off with a clear internal need. Are you trying to launch a new mobile application? Build out a data science division? Maybe break into a new geographical market? Your strategic goal dictates the exact kind of team you should be looking for.

Once that goal is defined, the search goes way beyond LinkedIn profiles and job boards. It’s about looking at:

- Startups with Strong Engineering Cultures: Find companies known for their technical excellence, even if their product hasn’t quite hit commercial success.

- Teams with Proven Cohesion: Look for groups that have worked together on complex projects for a good amount of time. That pre-existing synergy is a massive asset.

- Founder Leadership Quality: You need to assess the founders not just as engineers or product leads, but as potential leaders within your own organisation. Their ability to guide their team through a major transition is absolutely vital.

This initial scouting is less about spreadsheets and more about human dynamics. You’re looking for a cohesive unit, not just a collection of skilled individuals.

Stage 2: Conducting Talent-Centric Due Diligence

In a normal acquisition, due diligence is all about financial statements, IP ownership, and legal liabilities. For an acqui-hire, you flip that script. The top priority becomes assessing the talent.

The most critical question during due diligence is not “What has this team built?” but rather, “What can this team build for us?” This changes the entire discovery process, prioritising skill assessments, cultural alignment, and future potential over past performance.

Key activities during this phase include:

- Technical Interviews and Code Reviews: Have your senior engineers engage directly with the target team. This is about validating their technical chops and problem-solving approaches in a real-world context.

- Cultural Compatibility Checks: Arrange informal meetings between your leaders and the startup’s team. The aim is to gauge personality fit, communication styles, and whether their agile, fast-paced culture can realistically co-exist with your own corporate structure.

- Mapping Roles and Responsibilities: Get specific. Clearly define where each member of the acquired team will fit into your organisation. Ambiguity is the enemy of retention; everyone needs to see a clear and exciting future for themselves post-acquisition.

Stage 3: Structuring a Compelling Deal

A successful acqui-hire deal is built around one thing: retention. The purchase price is often worked out on a per-employee basis, with a huge chunk of the compensation tied to keeping that team intact for a set period.

A typical deal structure includes:

- Upfront Cash Payments: A portion of the deal is paid out to founders and investors when the deal closes.

- Equity in the Acquiring Company: This is crucial. It gives the new team a real stake in the larger company’s success and aligns their long-term interests with yours.

- Retention Bonuses: These are substantial, often performance-based bonuses paid out over 2-4 years. This is your primary tool for preventing a talent drain after the ink is dry.

The goal is to put an offer on the table that’s so compelling that the entire team sees it as a better outcome than going it alone or looking for individual jobs elsewhere. It’s not just about the money, either. Clear communication about career paths, project ownership, and the mission they’ll be working on is just as important. Failing to provide this clarity is a common pitfall that can sink the entire deal before it even gets off the ground.

Lessons From Real Acqui-Hires In India

Theory is great, but the real lessons in acqui-hiring come from seeing how it plays out in the trenches. The Indian tech ecosystem, with its fierce competition for niche talent, is the perfect place to watch this strategy unfold. By looking at actual deals, we can get beyond the buzzwords and pull out some concrete, actionable insights.

These aren’t just dry transactions; they are stories of strategic vision. They show companies making bold moves to lock in a competitive edge. More importantly, they reveal how a sharp acqui-hire can solve major business headaches, whether it’s plugging a specialised skill gap or fast-tracking product development in hot areas like AI and data privacy.

Digging into these case studies helps us understand the ‘why’ behind each deal, offering a masterclass for any CHRO thinking about this path. Let’s break down a couple of high-profile examples to see the mechanics and results of real-world acqui-hiring in India.

CleverTap and rehook.ai: A Play for AI-Powered Retention

CleverTap, a big name in customer engagement, knew it needed to seriously upgrade its AI game. The objective was clear: give clients smarter, automated tools to build out promotions and loyalty schemes. Trying to build this kind of tech from the ground up would have been a long, expensive gamble with no promise of a payoff.

So, instead of taking the slow road, CleverTap made a classic strategic move. In India, acqui-hiring is becoming the go-to tactic for snapping up specialised teams, and its purchase of rehook.ai is a textbook case. This Y Combinator-backed startup already had a sharp team laser-focused on this exact problem, making them the perfect catalyst for CleverTap’s product roadmap. This deal is a great reflection of the wider trend of strategic acqui-hiring for AI talent, as detailed on moneycontrol.com.

This acquisition gives us a few key takeaways:

- Targeted Skill Acquisition: CleverTap didn’t just hire a few AI engineers. It brought on board an entire, cohesive team with proven success in a very specific AI application.

- Speed to Market: The move allowed them to roll out advanced features far more quickly than if they had tried to develop them in-house.

- Strategic Alignment: The startup’s mission was a perfect match for CleverTap’s product goals, which made integrating both the tech and the vision much smoother.

Persistent Systems and Arrka: Fortifying Data Privacy Capabilities

In today’s world, data privacy isn’t just a nice-to-have; it’s a non-negotiable. Companies are scrambling to build out strong security and compliance programmes. Persistent Systems, a global digital engineering firm, saw that deep expertise in data privacy was becoming a massive competitive advantage for its clients.

To answer this demand, Persistent Systems executed an acqui-hire of Arrka, a firm specialising in data privacy and security. This wasn’t about buying software. It was about absorbing Arrka’s team of seasoned privacy pros into the Persistent family. The move instantly gave Persistent deeper consulting muscle and more credibility in a very tricky field.

By acquiring Arrka, Persistent Systems didn’t just add to its headcount. It integrated a team with deep, domain-specific knowledge that could immediately start advising clients on global privacy laws and building sophisticated data protection solutions.

This case demonstrates how acqui-hiring can be used to bring in not just technical skills, but also vital consulting and advisory talent. The Arrka team carried a depth of experience that would have been incredibly hard to piece together through individual hires. By studying these and other examples, organisations can learn from the successes of others. You can explore a variety of in-depth business growth stories in our case studies to see how different strategies deliver powerful results.

Navigating Legal and Cultural Integration Hurdles

An acqui-hire is far more than a financial transaction. It’s really a delicate merger of people, their ways of working, and often, two profoundly different company cultures. Honestly, closing the deal is the easy part.

The real challenge—and where most acqui-hires either triumph or fail—is in the integration that comes after. CHROs have to be on the front foot, expertly managing both the legal knots and the human dynamics to make sure the value of their new team isn’t lost in translation.

Successfully merging a nimble startup into a larger corporate machine is a bit like helping a speedboat crew learn to operate an aircraft carrier. The speedboat team is used to making quick turns, talking directly to the person in charge, and having everyone jump in to solve a problem. The aircraft carrier, on the other hand, has established protocols, clear hierarchies, and very specialised roles. Without a solid plan, that speedboat crew will feel lost, stifled, and probably start looking for the nearest exit.

This transition needs a deft touch, focusing as much on emotional and cultural alignment as it does on legal paperwork.

Tackling the Legal Framework First

Before you can even think about culture, you need to build a rock-solid legal and financial foundation for the incoming team. Any ambiguity in contracts or compensation is the fastest way to break trust before it’s even been built. The legal side of an acqui-hiring deal has several key pieces that need careful handling right from the start.

Three areas demand your immediate focus:

- New Employment Agreements: These team members aren’t just being transferred; they are becoming brand new employees of your company. Their contracts must clearly spell out their new roles, who they report to, their salaries, and the benefits package. This is the first and most critical step in giving them a sense of stability and clarity.

- Equity and Vesting Schedules: The startup’s stock options are now essentially worthless. A crucial part of the deal is converting that old equity into new stock or options in your company. The vesting schedule for this new equity is a powerful retention tool, often tied to a 2-4 year commitment. This ensures your key new talent stays invested in the long-term vision.

- Intellectual Property (IP) Nuances: While talent is the main prize, the deal will almost certainly involve the target company’s IP. You have to decide what to do with their existing product or code. Will it be integrated into your own products, repurposed for something new, or shut down entirely? Handling these assets with clear legal language prevents future disputes and ensures a clean transfer.

The most successful acqui-hires treat the legal process not as a box-ticking exercise, but as the first act of building trust with the new team. Transparency around contracts, equity, and future roles shows a genuine commitment to their success within your organisation.

Mastering the Art of Cultural Integration

With the legal structure in place, the much harder work of cultural integration begins. This is where so many large companies stumble, accidentally crushing the very spirit of innovation they paid a premium to acquire. The goal isn’t to force the startup team to conform, but to create a protected space where their agile culture can thrive and even influence your own.

Preventing an ‘us vs. them’ mentality is absolutely critical. The new team shouldn’t feel like a foreign object that’s been awkwardly attached to the main company. They need to feel welcomed, valued for their unique perspective, and given a clear, compelling mission. This is less about HR policies and more about proactive, human-centric leadership.

For instance, assigning a dedicated ‘integration buddy’ from your existing team can help new members get a feel for the unwritten rules and build social connections. Celebrating early wins achieved by the combined team also does wonders to reinforce a sense of shared purpose. Sometimes, the complexities of bringing new teams into an established system can be managed better with outside expertise. For a deeper dive, you might want to learn how recruitment process outsourcing can help in high-impact hiring driven by data to see how similar talent acquisition challenges can be streamlined.

Best Practices for Retaining Your New Talent

At the end of the day, the success of an acqui-hiring is measured by one simple metric: talent retention. If the core team walks out the door within the first year, the deal has failed.

Here are a few actionable steps to keep your newly acquired talent engaged and productive:

- Communicate a Clear Vision: Don’t leave them in the dark, wondering what their purpose is. Right away, you need to articulate the exciting new projects they’ll be leading and how their work fits into the company’s bigger picture.

- Give Them Autonomy: Resist the corporate urge to micromanage. This team was acquired for its ability to innovate independently. Give them the resources they need, but also the freedom to solve problems in their own way.

- Protect Their Identity: Let the team hold on to some of its own rituals, tools, and meeting styles. This helps them retain a sense of who they are and eases the transition into the wider corporate culture.

By thoughtfully addressing both the legal nuts and bolts and the delicate human elements, a CHRO can turn a simple talent acquisition into a powerful, long-term strategic asset.

Answering Your Key Acqui-Hiring Questions

Even with a crystal-clear strategy, the on-the-ground realities of an acqui-hire can throw up some tricky questions. Let’s be honest: this is a complex move. It’s a delicate blend of M&A, high-stakes recruitment, and organisational design. For the CHROs and business leaders steering the ship, getting straight answers to common concerns is crucial for keeping everyone confident and aligned.

This final section cuts through the noise and tackles the most frequent and critical questions that pop up during acqui-hiring talks. Think of it as your practical FAQ, here to clear up uncertainties on everything from deal structure to what this all means for the people at the very heart of the deal. Nailing these details is what separates a strategically brilliant move from a costly mistake.

How Is an Acqui-Hire Different From a Regular Acquisition?

The biggest difference comes down to one simple word: intent. In a typical acquisition, the buyer is after the target company’s assets. This could be their product, customer list, intellectual property, or a solid stream of recurring revenue. The team is often an afterthought, and in many cases, redundancies are almost expected.

An acqui-hire flips this script completely. Here, the team is the main asset, the crown jewel of the deal. The target’s product might be interesting, but it often gets shut down after the papers are signed. The real prize is the cohesive, high-performing group of people and their proven ability to build great things together.

What Happens to the Founders of an Acqui-Hired Startup?

In an acqui-hire, founders aren’t just another employee; they are the strategic centrepiece. These are the leaders who cultivated the team’s unique culture and had the vision that made them so attractive in the first place. Because of this, their role in the new organisation is a make-or-break part of the deal’s success. Usually, founders are offered key leadership positions within the acquiring company. They might step into a role like Director of Engineering, Head of Product for a new initiative, or a lead architect. Their new mission is to steer their team through the integration and keep the innovation engine running, but now with the resources and scale of a much larger organisation behind them. This structure gives founders a significant financial win and a clear, impactful path forward. It makes the acqui-hire an incredibly attractive option compared to the high-risk, high-stress world of chasing more venture funding.

Is Acqui-Hiring a Success or a Failure for a Startup?

From the outside, seeing a startup’s product get shelved can easily look like a failure. But inside the industry, an acqui-hire is widely seen as a successful talent exit. It is a respectable and often financially rewarding outcome for a company that built an amazing team but could not quite nail product-market fit or land that next crucial funding round.

It is a soft landing that creates a win-win-win situation.

The team: Employees get to stick together, skip the stress of a job hunt, and join a stable company with fresh, interesting problems to solve.

The founders: They get a significant financial return and a prestigious leadership role, which validates their ability to build a world-class team.

The investors: They often get their initial investment back, and sometimes even a modest profit, which is far better than the alternative of shutting down and returning nothing.

At its core, an acqui-hire is a celebration of human capital. It is an acknowledgement that the most valuable thing the startup created was not a product, it was its people.

What Are the Biggest Risks for the Acquiring Company?

While the upside is significant, an acqui-hire is far from risk free. The two biggest threats that can derail the investment are cultural clashes and a talent exodus.

– Cultural clash: A small, nimble startup team used to flat structures and rapid decisions can feel stifled by corporate bureaucracy, frequent meetings, and a slower pace. If their innovative spirit is crushed, their value disappears.

– Talent drain: The other major risk is that the very people you acquired decide to leave. This happens when the integration is clumsy, when they are not given a clear and motivating mission, or when promises made during negotiations are not honoured. A vague role or a feeling of drift is the fastest way to lose the talent you paid a premium for.

Avoiding these pitfalls calls for a proactive and empathetic integration plan. You need to protect the new team’s culture while helping them learn to navigate the larger organisation. Success is not sealed when the deal closes, it is earned in the months and years that follow.

Executing a complex talent strategy like an acqui-hire demands precision and expertise. At Taggd, we specialise in helping organisations navigate high-stakes recruitment and talent integration challenges. Discover how our Recruitment Process Outsourcing solutions can support your most ambitious growth goals. Learn more at https://taggd.in.