Ad-Hoc Payment: Guide for Indian HR Teams

Think of your company’s payroll as a finely tuned machine, running like clockwork every month to deliver regular salaries. But what happens when you need to make a payment that doesn’t fit this neat, predictable schedule? That’s where ad-hoc payments come in.

An ad-hoc payment is simply a one-time, unscheduled payment made to an employee that falls outside their regular, recurring salary. It’s the financial equivalent of a spontaneous gesture—a special, one-off transaction for a specific reason.

What Is Ad-Hoc Payment in an HR Context?

While your standard payroll is all about consistency, an ad-hoc payment system is built for flexibility. It’s the tool that allows your organisation to react swiftly to unique situations, whether it’s rewarding outstanding work or helping an employee with an unforeseen expense.

These aren’t just administrative odd jobs; in the Indian business landscape, ad-hoc payments are a vital part of modern HR strategy. They provide a direct, immediate, and tangible way to acknowledge and motivate your people when it matters most.

How Ad-Hoc Payments Differ from Regular Salary

It’s easy to get these mixed up, but the distinction is crucial. The real difference between an ad-hoc payment and a regular salary component comes down to two things: frequency and purpose.

For example, a House Rent Allowance (HRA) is a fixed, recurring part of an employee’s monthly salary structure. An ad-hoc payment, on the other hand, is a one-off, triggered by a specific event.

Here are a few classic examples of ad-hoc payments:

- Spot Bonuses: Awarded on the spot for incredible work on a tough project.

- Relocation Allowances: To help a new hire cover the costs of moving to a new city for the job.

- Employee Referral Bonuses: A thank you for bringing great talent into the company.

- Severance Pay: As part of an employee’s final settlement package.

To make this distinction crystal clear, let’s break it down in a table.

Ad-Hoc Payments vs Regular Salary: A Quick Comparison

This table highlights the fundamental differences between ad-hoc payments and standard, recurring salary components in an Indian payroll context.

| Attribute | Ad-Hoc Payment | Regular Salary |

|---|---|---|

| Frequency | One-time, irregular, and unscheduled. | Recurring, predictable (e.g., monthly). |

| Purpose | Tied to a specific, non-routine event (e.g., bonus, reimbursement). | Covers the basic compensation for the job role. |

| Predictability | Unpredictable; happens ‘as needed’. | Fixed and scheduled in advance. |

| Examples | Spot bonus, referral award, relocation expenses, severance. | Basic pay, HRA, dearness allowance, special allowance. |

| Payroll Cycle | Processed ‘off-cycle’ or alongside regular pay, but itemised separately. | Core part of the standard, scheduled payroll run. |

As you can see, keeping these two types of payments separate is essential for both clarity and compliance.

This clear separation is becoming easier to manage, thanks to India’s booming digital payment infrastructure. The prepaid card and digital wallet market is projected to grow at an incredible annual rate of 30.3%, hitting an estimated USD 81.65 billion by 2025. This explosion in digital convenience is exactly what’s needed to make ad-hoc transactions smooth and effective. You can learn more about the rapid expansion of India’s prepaid and digital wallet market.

By separating these special payments from the regular payroll run, HR teams can ensure accurate tax calculations, maintain clear financial records, and provide employees with a transparent understanding of their total compensation.

Ultimately, this careful distinction prevents one-off payments from mistakenly inflating an employee’s regular monthly income, which could cause a domino effect of confusion and compliance headaches. Managing them well is a cornerstone of any responsive and fair compensation strategy.

Key Use Cases for Ad-Hoc Payments

Knowing what an ad-hoc payment is is one thing, but seeing it in action is where you really grasp its power. These aren’t just entries in a payroll ledger; they’re smart, flexible tools that Indian businesses rely on to solve immediate problems, inspire their people, and ultimately, drive better performance. Think of them as the practical link between your HR strategy and real, tangible action.

From snagging the best talent in a tight market to rewarding a job well done, the ways you can use them are incredibly varied and have a real impact. Let’s walk through some of the most common scenarios.

Incentivising Performance and Recognising Excellence

Imagine your tech team pulls a couple of all-nighters to get a critical product update out the door. They hit a make-or-break deadline and save a major client account. A simple “thank you” is nice, but a spot bonus landing in their bank account a few days later speaks volumes. It’s an immediate, concrete way to show you value that kind of dedication.

Performance incentives are another classic example. This might be a bonus for a salesperson who smashes their quarterly target or a special award for an employee who comes up with a brilliant new process that saves the company money.

These kinds of recognition-based payments send a powerful signal across the entire organisation: go the extra mile, and it will be noticed, appreciated, and rewarded quickly. It’s how you build a culture of excellence.

Attracting and Securing Top Talent

In India’s competitive hiring landscape, you have to be fast and flexible to win. An ad-hoc payment can often be the very thing that tips the scales in your favour. For instance, offering an attractive signing bonus can be the final nudge a top-tier candidate needs to choose your offer over a competitor’s. It’s a clear, one-time signal that you’re serious about getting them on your team.

This is particularly true in specialised sectors like Global In-house Centres (GICs). For a closer look at this, our guide on how GICs in India can attract and hire the best talent has some great insights.

Relocation allowances are another perfect use case. When you find the ideal candidate but they live in a different city, an ad-hoc payment to help with moving costs removes a huge headache and makes their decision to join you that much easier.

Supporting Employees and Managing Transitions

Ad-hoc payments are also essential for supporting your team through life’s various events, both planned and unexpected. If an employee has to dash off for an unplanned client meeting, you can quickly push through an ad-hoc payment for their travel and hotel. This saves them from having to cover significant costs out of their own pocket, which is always a welcome relief.

At the other end of the employee journey, severance packages are a critical type of ad-hoc payment. When someone leaves the company, their final settlement isn’t just their last salary. It often includes other one-off amounts like payment for unused leave or a specific severance payout. Handling this as a separate, one-time payment ensures everything is accurate, compliant, and handled with care during a sensitive process.

The Real-World Payoff: Why a Smooth Ad-Hoc System Matters

Handling an ad-hoc payment isn’t just about moving money from one account to another; it’s a strategic move that can have a massive impact on your business. When you swap out clunky, manual processes for a well-oiled system, the benefits ripple out far beyond your finance team. Suddenly, these one-off payments stop being administrative headaches and become powerful tools for creating a better, more responsive workplace.

The first thing you’ll notice is a genuine lift in employee morale and engagement. Think about it: when someone gets a spot bonus or a quick expense reimbursement without any drama, they feel seen and respected. That speed tells them their hard work is valued and that the company is nimble enough to acknowledge it right away.

A slow, mistake-ridden payment process sends the complete opposite message—that recognising good work is a low priority. A fast, clean system, on the other hand, makes every single ad-hoc payment a positive experience, strengthening the bond between your people and the company.

In today’s cut-throat talent market, that kind of efficiency can be your secret weapon.

Gaining an Edge in the War for Talent

When you’re trying to hire the best people, speed and decisiveness are non-negotiable. Having a streamlined ad-hoc payment system gives you a real, practical advantage. The ability to push through a signing bonus or a relocation allowance without delay can be the very thing that convinces a top-tier candidate to accept your offer over another.

This isn’t just a nice-to-have; it’s about meeting modern expectations. As digital transactions become second nature, people expect the same speed from their employer. In fact, India’s retail digital payments space—which includes these kinds of spontaneous transfers—is projected to double, hitting an incredible USD 7 trillion by 2030. Keeping pace isn’t optional anymore. You can read more about the growth of India’s retail digital payments and see just how big this shift is.

Building an Employer Brand People Talk About

Your reputation as an employer is built on thousands of small moments. How you handle something as basic as paying your people speaks volumes about your company’s character. A business known for being efficient and transparent naturally develops a powerful employer brand.

Here’s how it helps build your reputation:

- A Stronger Reputation: Word travels fast. When people know you reward contributions quickly and fairly, your company becomes a much more desirable place to work.

- Deeper Trust: A reliable payment system is a trust-builder. Your employees feel secure, confident that they’ll be paid correctly and on time.

- A Magnet for Talent: A great employer brand doesn’t just attract new talent; it helps you keep the amazing people you already have. People want to build a career with an organisation that clearly values them.

At the end of the day, putting resources into a solid ad-hoc payment system is a direct investment in your people and your company’s long-term success.

Navigating Indian Compliance and Taxation

When it comes to ad-hoc payments, getting the money to your employee quickly is only half the battle. For any HR leader in India, the real tightrope walk is compliance. One small misstep with tax or statutory deductions can snowball into hefty penalties, nightmarish audits, and, worst of all, unhappy employees. Frankly, this is where a solid grasp of the rules isn’t just helpful—it’s non-negotiable.

The main challenge? Not all ad-hoc payments are created equal in the eyes of Indian law. A spot bonus for stellar performance is treated very differently from a reimbursement for a business trip. Getting this distinction right is the secret to staying compliant and avoiding those costly, time-consuming mistakes.

Decoding Tax and Statutory Deductions

The very first thing you need to do is classify the payment. Is it a reward for great work? A simple reimbursement? Or perhaps part of a final settlement? The answer to this question dictates how it’s taxed and whether you need to worry about contributions like Provident Fund (PF) and Employee State Insurance (ESI).

Let’s break down the key components you need to watch out for:

- Tax Deducted at Source (TDS): Most one-off payments that aren’t reimbursements—think bonuses, incentives, or festival allowances—are treated as part of an employee’s income. That means you have a legal obligation to calculate and deduct TDS before the money ever hits their bank account, just like you do with their regular monthly salary.

- Provident Fund (PF): Generally, any payment that falls under the definition of ‘wages’ will attract PF contributions. While expense reimbursements are safely outside this net, things like bonuses can be a grey area. It often depends on your company’s compensation structure and the specific wording in your employment contracts.

- Employee State Insurance (ESI): ESI kicks in for employees who earn below a specific salary threshold. Be careful here, as a one-time ad-hoc payment can sometimes push an employee’s earnings for that month over the limit, affecting their ESI eligibility for that period.

- Professional Tax: This is a state-level tax levied on earned income. Any ad-hoc payment that inflates an employee’s gross income for the month will almost certainly be subject to professional tax.

The rule of thumb is quite simple: if the payment is an extra earning for the employee, it’s almost certainly taxable. If you’re just paying them back for a business expense they covered out of pocket, it’s usually not. The key is to have crystal-clear documentation to back up that distinction.

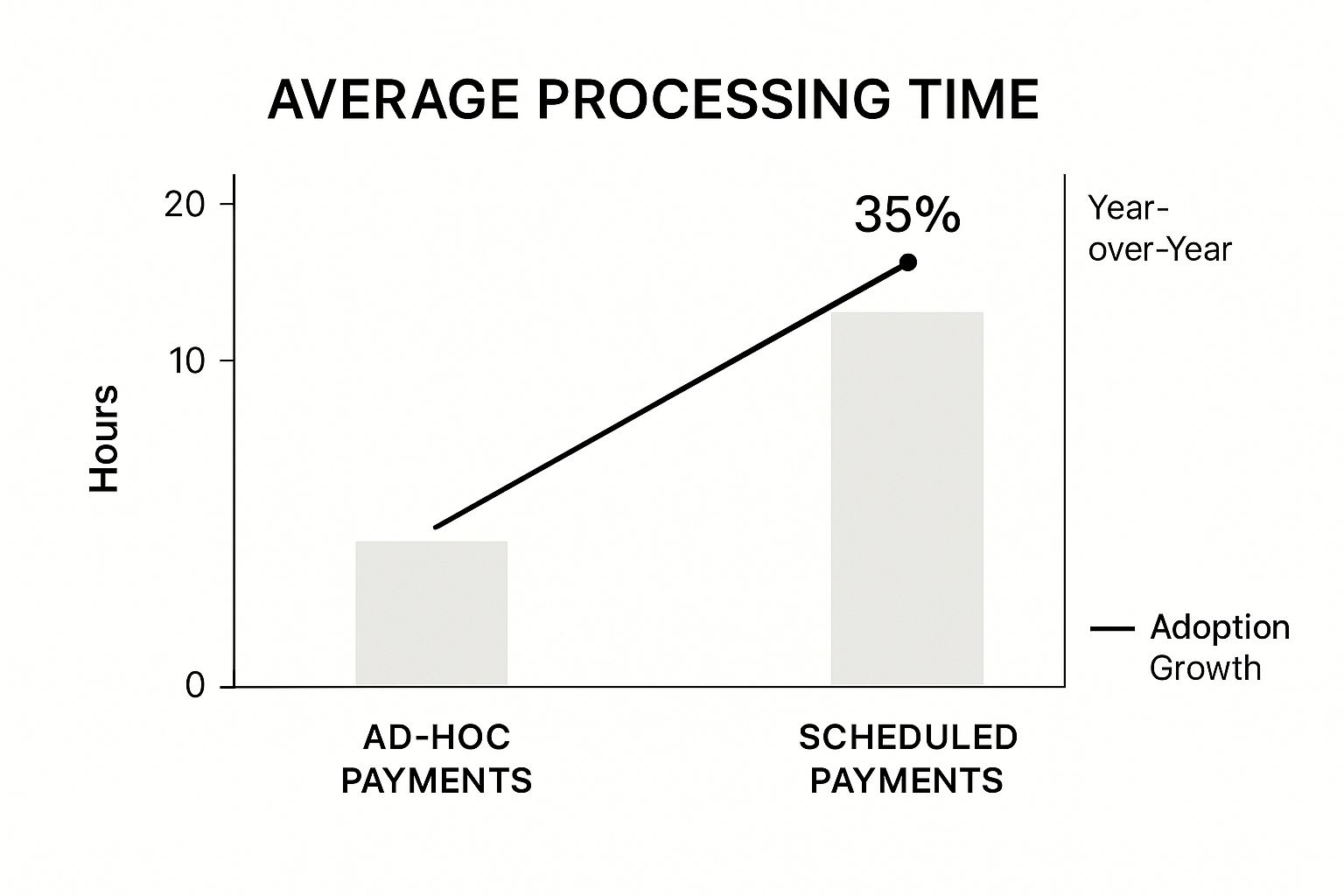

This infographic highlights the sheer speed of ad-hoc payments compared to scheduled payroll and their growing popularity.

As the data shows, the ability to process these payments in just a few hours is a major reason why so many forward-thinking businesses are embracing them.

Tax and Compliance Checklist for Common Ad-Hoc Payments

Navigating the tax implications for every type of payment can feel overwhelming. To help, here’s a high-level overview of how common ad-hoc payments are typically treated under Indian tax and compliance laws. Remember, specific company policies and individual circumstances can create exceptions, so this should be used as a general guide.

| Payment Type | TDS Applicability | PF Contribution | ESI Applicability |

|---|---|---|---|

| Performance Bonus | Yes, part of salary | Often, depends on policy | Yes, if within wage limit |

| Referral Bonus | Yes, part of salary | Often, depends on policy | Yes, if within wage limit |

| Expense Reimbursement | No, not income | No | No |

| Relocation Allowance | Varies; some components may be exempt | Generally No | Generally No |

| Joining Bonus | Yes, part of salary | Often, depends on policy | Yes, if within wage limit |

| Severance Pay | Yes, with exemptions | No | No |

This table serves as a quick reference, but it’s always best to consult with a tax advisor or your payroll team to confirm the treatment for any significant or unusual payments. A little due diligence upfront can save a world of trouble later on.

Best Practices for Your Ad-Hoc Payment Process

A great ad-hoc payment system doesn’t just fall into place. It’s the result of smart planning, clear rules, and the right technology. Without a solid framework, what’s meant to be a flexible tool can easily turn into a mess of confusion, delays, and perceptions of unfairness. Your goal should be to build a process that is both fast and fair, so every one-off payment is handled consistently and accurately.

Think of it like setting up guardrails on a high-speed lane of your payroll highway. Those guardrails let you move quickly, but they also keep everything safe, orderly, and on track. It all starts with a crystal-clear policy that everyone in the organisation can follow.

Establish a Clear and Fair Policy

Your very first move should be to create a formal policy document. This document becomes the single source of truth for your organisation when it comes to any one-time payments. It needs to be straightforward, easy to find, and leave absolutely no room for interpretation.

A robust policy should clearly spell out:

- What qualifies: Be specific about the types of payments that are covered. Is it for spot bonuses, employee referral awards, or relocation allowances? List them out.

- Who can approve: Define the chain of command for authorising these payments to prevent delays and bottlenecks.

- What the limits are: Set clear monetary caps for different payment types and the managers authorised to approve them.

- Required documentation: Detail exactly what paperwork or justification is needed to support each payment request.

Having this policy in place ensures decisions are grounded in objective criteria, not personal whim. This is fundamental to promoting fairness across every team and department.

By standardising the rules, you eliminate ambiguity. A manager in sales and a manager in engineering will know the exact same process applies when they want to award a spot bonus, ensuring consistency and equity.

Define Simple and Efficient Workflows

With a solid policy in hand, your next job is to design an approval workflow that’s built for speed, not bureaucracy. A convoluted, multi-stage approval process is the biggest enemy of an agile ad-hoc system. The secret is to keep it as lean as possible without sacrificing essential oversight.

This is where standardised digital forms can be a real game-changer. These forms make sure all the critical information—employee details, payment amount, the reason for the payment, and necessary tax info—is captured correctly right from the start. That one simple change can dramatically cut down on the frustrating email chains and corrections that grind things to a halt.

The push for this kind of efficiency is reflected in the broader Indian economy. The card payment market recently grew at a compound annual growth rate (CAGR) of 19.5%, hitting INR 27.5 trillion (roughly $328.9 billion). This signals a massive shift towards expecting quick, digital financial transactions, an expectation that employees now bring to the workplace.

Finally, integrating this process directly into your primary payroll software is non-negotiable. This link automates the final payment, gets rid of manual data entry errors, and guarantees every ad-hoc payment is perfectly recorded for a clean audit trail. This kind of smart system design is also a key ingredient in a modern compensation strategy. For more on this, check out our guide on how to use creative compensation to boost your recruiting.

The Future of Ad-Hoc Payments in HR Tech

The world of compensation is no longer chained to the predictable monthly payroll cycle. When we look at the future of ad-hoc payments, we’re not just talking about getting better at managing exceptions. We’re talking about embedding immediate, data-rich payments directly into the very flow of work. Technology is the engine behind this shift, turning what was once a clunky, reactive admin task into a sharp, strategic tool.

Modern Human Capital Management (HCM) platforms are at the forefront of this evolution. By integrating seamlessly with fintech solutions, they make off-cycle payments instant and frictionless. Gone are the days of waiting for the next payroll run to process a spot bonus. Today’s systems can get it done in minutes. This isn’t just a nice-to-have; it’s essential for meeting the expectations of a workforce that gets on-demand everything in the rest of their lives.

From Ad-Hoc to On-Demand

This fusion of HR tech and fintech is sparking some powerful new trends that are a natural evolution of the traditional ad-hoc model. We’re seeing a significant move toward giving employees far greater financial flexibility, which we know has a direct and positive impact on retention and satisfaction.

Two key trends are really taking centre stage:

- Earned Wage Access (EWA): This is a game-changer. It allows employees to access a portion of their earned salary before the official payday, providing a crucial financial cushion when life throws them a curveball.

- On-Demand Pay: Working on a similar principle to EWA, this model hands employees the reins, letting them decide when they receive their earned wages. It completely reframes the relationship between work performed and reward received.

These models are effectively blurring the lines between scheduled and unscheduled payments, making the entire compensation experience feel more fluid and, most importantly, more human.

The core idea is simple yet incredibly powerful: by connecting real-time recognition platforms with payment systems, a manager’s “great job” can be followed by an immediate financial reward. This turns a delayed payroll item into an instant motivational tool, reinforcing positive behaviours the moment they happen.

This evolution is fundamentally changing how we, as HR leaders, approach talent strategy. By analysing the data from these instant payments, you can unlock a goldmine of insights into performance, team dynamics, and what truly drives engagement. The future of jobs will be shaped by this ability to offer more flexible and responsive compensation. For a deeper dive into this topic, you can explore our article on what you need to know about the future of jobs.

Ultimately, it’s a move away from simply processing payments to strategically deploying capital to motivate and hold onto your best people.

Got Questions About Ad-Hoc Payments? We’ve Got Answers

Even with the best-laid plans, one-off payments can throw up some tricky questions. Let’s tackle a few of the common queries that HR leaders in India often find themselves asking.

Can We Pay an Ad-Hoc Bonus in Cash?

Technically, you can, but it’s not a path I’d recommend. Paying bonuses in cash creates a compliance headache. Digital payments through banking channels are your best friend here. They leave a clear, auditable trail that’s invaluable for TDS calculations and proving everything is above board during financial audits. Stick to digital—it’s just safer and cleaner for everyone involved.

How Does a Joining Bonus Affect an Employee’s Taxable Income?

Think of a joining bonus as part of an employee’s salary for the year—because that’s exactly how the tax authorities see it. It’s 100% taxable. This bonus gets added to the employee’s gross income for that financial year, and you must deduct the applicable TDS in the same month you pay it out. A quick word of advice: Be upfront about this with your new hire. A simple conversation explaining that the amount hitting their bank account is post-tax can prevent a lot of confusion and potential disappointment down the line.

Are Reimbursements for Business Expenses Considered Ad-Hoc Payments?

Yes, they definitely fall under the ad-hoc umbrella since they are unscheduled, one-time payments. However, they play by a different set of tax rules. Here’s the key difference: as long as an employee provides valid proof of the expense—we’re talking actual bills and receipts—the reimbursement isn’t treated as income. This means no TDS is due. Proper documentation is everything; it’s what separates a non-taxable reimbursement from a taxable payment in the eyes of the law.

Getting your ad-hoc payment system right is more than just an administrative task; it’s a vital part of a modern talent strategy. At Taggd, we specialise in building the kind of robust HR frameworks that help you attract, keep, and reward the people who drive your business forward.

See how our Recruitment Process Outsourcing services can help you build a more flexible and compliant HR function.