Payroll Deductions A CHROs Strategic Guide

When you get down to it, payroll deductions are simply the amounts taken out of an employee’s gross salary before they see their net pay. But for a Chief Human Resources Officer (CHRO), getting these deductions right is so much more than an operational task. It’s a cornerstone of financial governance, legal compliance, and employee trust, especially when you’re relying on a Recruitment Process Outsourcing (RPO) partner to manage the details.

Why Payroll Deductions Are a CHRO’s Top Priority

Think of your company’s payroll system as the very foundation of a massive building. The deductions are the critical, load-bearing pillars holding everything up. When they’re managed perfectly, no one even notices them—they just quietly support the entire structure. But a single mistake, one miscalculation or compliance slip-up, can cause catastrophic damage. We’re talking about hefty legal penalties, financial instability, and a serious crack in the foundation of employee trust.

For any CHRO, overlooking the strategic weight of payroll deductions is a massive risk. This isn’t just about arithmetic; it’s the exact point where your legal duties, company policies, and your team’s financial well-being all collide. Getting it right every single time is non-negotiable, particularly within India’s complex regulatory landscape.

The Two Pillars of Deductions

The world of payroll deductions really boils down to two main categories. Each has its own rules and strategic importance, and understanding the difference is the first step to building a bulletproof system.

- Statutory Deductions: These are the big ones—the deductions mandated by law. They are absolutely non-negotiable and include contributions to things like social security and taxes. This is the bedrock of your legal compliance.

- Voluntary Deductions: Think of these as employee-elected subtractions from their pay. They usually tie into benefits like extra health insurance, retirement savings plans, or other company programmes designed to make your employee value proposition stronger.

Juggling both requires a delicate touch. Statutory deductions demand absolute precision to sidestep legal trouble. At the same time, voluntary deductions need crystal-clear communication and flawless administration to keep your employees happy and confident in the system.

For a CHRO, this dual focus elevates payroll from a simple back-office function to a strategic one. Getting statutory deductions right shields the organisation from risk, while well-managed voluntary deductions become a powerful tool for keeping your best people engaged and on board.

Ultimately, a deep understanding of how these deductions are calculated, paid out, and reported is essential. It empowers you to effectively oversee your RPO partners, guarantee complete financial integrity, and transform a complex operational headache into a clear strategic advantage. This foundation of trust and accuracy doesn’t just support the payroll department; it props up the financial health of the entire organisation.

Mastering India’s Statutory Deductions

Navigating the web of statutory deductions in India isn’t just a payroll task; it’s a critical leadership responsibility. These aren’t optional contributions. They’re legal mandates designed to weave a social security net for employees and ensure tax compliance across the entire workforce.

For a CHRO, getting these deductions right is fundamental to risk management and operational excellence. Think of each one as a specific, non-negotiable instruction from the government. Each has a clear purpose, from funding retirement to providing medical care. Your role, often handled through an RPO partner, is to make sure every instruction is followed to the letter, protecting both your people and the organisation from legal headaches.

Let’s break down the four pillars of statutory deductions in India. Understanding the ‘why’ behind each one is just as important as knowing the calculation.

Employees’ Provident Fund (EPF): The Cornerstone of Retirement

First up is the Employees’ Provident Fund (EPF), a mandatory retirement savings scheme. Its core mission is to provide a substantial financial cushion for employees after they hang up their boots. This is all governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

It’s a joint effort. The employee contributes 12% of their basic salary plus dearness allowance, and the employer matches that contribution. The result is a powerful, compounding savings vehicle that grows over an employee’s career.

Proper management of EPF contributions directly invests in an employee’s long-term financial security. It’s a fundamental promise, and your RPO partner must ensure everyone is building this crucial nest egg as required by law.

Employees’ State Insurance (ESI): A Safety Net for Health

Next, we have Employees’ State Insurance (ESI). This is a social security scheme that provides medical and cash benefits, acting as a vital safety net for employees and their families during times of sickness, maternity, or work-related injury.

This scheme kicks in for employees earning a gross monthly salary up to ₹21,000. The employee’s contribution is a small 0.75% of their gross wages, while the employer contributes a larger share of 3.25%. This collaborative funding model ensures comprehensive healthcare access for a huge portion of the workforce.

For a CHRO, ESI compliance is a clear demonstration of the company’s commitment to employee welfare. It’s a foundational element of social responsibility that goes far beyond the payslip.

Professional Tax (PT): A State-Level Obligation

Professional Tax (PT) is a bit different. It’s a tax levied by state governments on individuals earning a professional income. The amount isn’t a percentage; it’s a fixed slab amount determined by the state and the employee’s income bracket.

Unlike EPF or ESI, PT regulations vary from one state to another, which adds a layer of complexity. This is where an expert RPO partner becomes invaluable for navigating these regional nuances accurately. It’s essential for ensuring your company stays compliant across all its operational locations in India. You can explore how data-driven RPO services can help manage these complexities in our guide on high-impact hiring driven by data.

Tax Deducted at Source (TDS): The Engine of Tax Collection

Finally, there’s Tax Deducted at Source (TDS), the primary mechanism the government uses to collect income tax directly from an employee’s salary. As the employer, you are responsible for deducting this tax and remitting it to the government on the employee’s behalf.

The TDS amount is calculated based on the employee’s annual income, the applicable tax slab, and any declared investments or expenses that qualify for tax breaks. Indian Income Tax law offers various deductions to encourage savings. For instance, Section 80C allows a deduction of up to ₹1.5 lakh for investments in things like EPF and life insurance.

Getting TDS calculations right is arguably one of the most complex parts of payroll. Any errors can lead to significant penalties for the company and frustrating tax notices for your employees, making expert oversight an absolute must.

Breakdown of Key Statutory Deductions in India

To bring it all together, here is a quick summary of these essential payroll deductions. This table offers a clear snapshot of each component, its purpose, and the contribution structure.

| Deduction Type | Governing Act | Purpose | Employee Contribution | Employer Contribution |

| EPF | EPF & MP Act, 1952 | Retirement Savings | 12% of Basic + DA | 12% of Basic + DA |

| ESI | ESI Act, 1948 | Medical & Social Security | 0.75% of Gross Wages | 3.25% of Gross Wages |

| PT | State Professional Tax Acts | State Revenue | Varies by State (Slab-based) | N/A |

| TDS | Income Tax Act, 1961 | Income Tax Collection | Varies by Income Slab | N/A |

Understanding the mechanics and legal framework behind these deductions is non-negotiable for maintaining a compliant and responsible payroll operation in India.

Leveraging Voluntary Deductions for Employee Engagement

While statutory deductions are a matter of legal obligation, think of voluntary deductions as a strategic opportunity. These aren’t just administrative burdens; they are the building blocks of a far stronger employee value proposition.

By offering a thoughtful suite of voluntary programmes, you can directly contribute to your workforce’s financial wellness, satisfaction, and long-term loyalty. It’s a powerful move.

Think of these deductions as personalised pathways to financial security. When an employee chooses to contribute to a pension scheme or opts for better health coverage, they’re taking an active role in their own future.

Facilitating this seamlessly shows a genuine commitment to their well-being that goes far beyond the monthly payslip. This is exactly where an expert RPO partner can turn a complex administrative task into a meaningful employee benefit.

Building Trust Through Financial Wellness

The whole idea is to empower your employees with choices that truly matter. Offering popular options like contributions to the National Pension Scheme (NPS) or supplemental health insurance shows you’re invested in their life outside of work.

These programmes build a deep sense of trust and security. People feel looked after.

A proficient RPO partner is crucial here. They manage the tricky administration behind these personalised choices, making sure every contribution is accurate and every selection is perfectly reflected on their payslip. This precision is vital; errors in voluntary deductions can quickly undo all the trust you’re trying to build.

Voluntary deductions are a tangible expression of a company’s culture. They signal that leadership sees employees not just as workers, but as individuals with unique financial goals and family needs.

Key Voluntary Deduction Programmes in India

A well-rounded benefits package includes several key voluntary deduction options that cater to the diverse needs of your employees. Each one tackles a different aspect of financial health and long-term planning.

- National Pension Scheme (NPS): This government-backed retirement savings plan offers another way for employees to build a pension pot, complementing the mandatory EPF.

- Supplemental Health Insurance: Offering top-up health plans or specialised coverage lets employees protect their families against unexpected medical costs, going beyond basic ESI or standard group policies.

- Flexible Benefit Plans (FBP): These plans give employees the freedom to structure a part of their salary to pay for various expenses, like telephone bills or food coupons, in a tax-efficient manner.

Effective administration of these programmes is a core skill of any strong RPO partner. Their expertise ensures that the complex rules for each option are followed, allowing your employees to maximise their benefits without any compliance headaches.

For example, the government has encouraged retirement savings by increasing the deduction allowed on an employer’s NPS contribution from 10% to 14%. Similarly, for the financial year 2024-25, the standard deduction from salary income was increased to ₹75,000 from the previous ₹50,000, which directly lowers taxable income for employees. You can find more detail on these adjustments to income tax deductions on economictimes.com.

Ultimately, a strong voluntary deductions programme can be a huge differentiator in a competitive talent market. By offering benefits that support financial wellness, you create a compelling reason for the best talent to join—and stay—with your organisation. Check out our guide on how GICs in India can attract and hire the best talent to learn more about this connection.

The Mechanics of Accurate Deduction Processing

Knowing the high-level concepts is one thing, but overseeing the actual mechanics of deduction processing is where a CHRO’s strategic input really counts. It’s about understanding the operational journey of an employee’s salary, from the gross figure on paper to the final net pay that hits their bank account.

Think of it like a finely tuned assembly line. Every single step must happen in a precise order, with absolute accuracy. One small mistake can throw the whole system out of whack, leading to incorrect payslips, compliance headaches, and a serious blow to employee morale.

It all starts with one foundational number: the gross salary. This is the total compensation—basic salary, dearness allowance, house rent allowance, and everything else—before a single rupee is taken out. From this starting point, the careful process of subtractions begins, dictated by both legal mandates and an employee’s personal choices.

The Critical Sequence of Payroll Deductions

The order in which you apply deductions isn’t random; it’s a critical factor that directly impacts both the final net pay and the tax calculations. Broadly speaking, the process is split into two distinct phases: pre-tax and post-tax deductions.

- Pre-Tax Deductions: These are amounts subtracted from the gross salary before any income tax is calculated. Consider these the legally prioritised contributions. In India, the most significant one is the employee’s contribution to the Employees’ Provident Fund (EPF). By taking this amount out first, you lower the employee’s taxable income, which naturally leads to a smaller tax bill.

- Post-Tax Deductions: These are amounts taken out after income tax has already been calculated and deducted. This bucket includes more voluntary deductions like loan repayments, contributions to certain schemes that don’t offer tax benefits, or other personal financial arrangements the company helps facilitate.

Getting this sequence right is non-negotiable. If you were to apply a post-tax deduction before tax, you’d be artificially lowering an employee’s taxable income, landing the company in hot water for a serious compliance violation.

A CHRO doesn’t need to be the one doing the maths, but they must ensure their RPO partner has ironclad, tech-driven processes that enforce this correct sequence every single time. This is a fundamental control point for safeguarding the integrity of your entire payroll function.

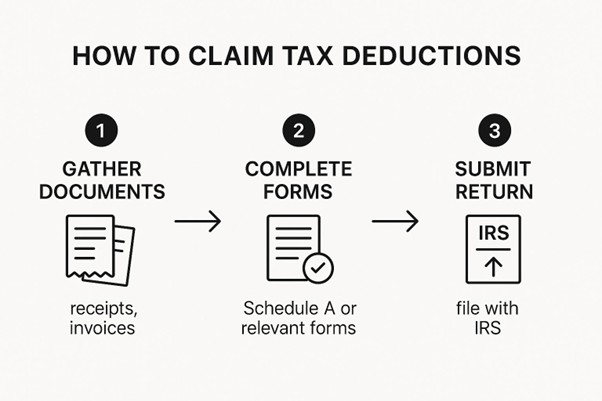

The following infographic gives a clear picture of the steps involved for an employee claiming tax deductions—a crucial part of the whole payroll puzzle.

This visual guide breaks down an employee’s responsibilities into three clear stages, from gathering documents to filing their return, highlighting just how important organised record-keeping really is.

A Real-World Scenario Unpacked

Let’s walk through a simplified example to see how this sequence plays out in the real world.

Imagine an employee, Priya, who has a monthly gross salary of ₹1,00,000. Her payroll process would look something like this:

- Step 1: Calculate Pre-Tax Deductions: First, her mandatory EPF contribution is deducted. Let’s say this is 12% of her basic salary, which comes out to ₹6,000.

- Step 2: Determine Taxable Income: Her taxable income for the month is now ₹94,000 (₹1,00,000 – ₹6,000).

- Step 3: Calculate TDS: Tax Deducted at Source (TDS) is now calculated on this new figure of ₹94,000, based on her specific tax slab. Let’s assume her TDS is ₹10,000.

- Step 4: Apply Post-Tax Deductions: Priya has a voluntary deduction for a festival loan repayment of ₹5,000 per month. This amount is subtracted after the tax has been calculated.

- Step 5: Arrive at Net Pay: Her final take-home pay is calculated as: ₹94,000 – ₹10,000 (TDS) – ₹5,000 (Loan) = ₹79,000.

This step-by-step flow really shows why technology and RPO expertise are so essential. A modern payroll platform automates this entire sequence, making sure every calculation is both compliant and spot-on.

For a CHRO, the key is to keep an eye on the control points. This means making sure data inputs are accurate, the system’s logic for the deduction sequence is flawless, and a final verification or audit process is in place. These checks and balances are what guarantee your payroll function remains accurate, compliant, and a source of trust for every single employee.

Getting the Most Out of Your RPO Partnership for Deductions Management

Bringing a Recruitment Process Outsourcing (RPO) provider on board to manage your payroll is a massive strategic move. But here’s the thing: you can’t just hand over the keys and walk away. To really nail this, you need to build a true partnership that’s laser-focused on the complex world of deductions.

Think of your RPO partner less like a vendor and more like an extension of your own finance and HR teams. This relationship needs a solid foundation, built from the ground up with clear expectations, diligent oversight, and a shared vision of success. The goal isn’t just to get payroll done—it’s to turn a routine cost centre into a smooth, efficient machine that delivers valuable business intelligence.

As a CHRO, this means you need to be hands-on from day one, setting the rules of engagement. By establishing clear benchmarks and keeping the lines of communication wide open, you ensure your partner operates with the precision and accountability your organisation needs.

Establishing Airtight Service Level Agreements

The absolute cornerstone of any successful RPO relationship is a rock-solid Service Level Agreement (SLA). This isn’t just a contract; it’s your operational playbook. It needs to define every single detail of how payroll deductions will be handled.

Your SLA has to be incredibly specific. Ambiguity is the enemy here—it leads to mistakes and finger-pointing down the line. You need to clearly map out all roles, responsibilities, and performance metrics for the entire deduction management process.

Here are the non-negotiables for your SLA:

- Accuracy Rates: Set a clear target, like 99.9% accuracy, and define the penalties for missing that mark.

- Turnaround Times: Specify hard deadlines for everything—processing payroll runs, remitting statutory payments, and even answering employee questions.

- Compliance Responsibility: Make it crystal clear that the RPO is responsible for staying on top of every change in Indian tax and labour laws that affect deductions.

- Reporting Cadence: Don’t just ask for reports; mandate specific ones. This could be anything from monthly remittance challans to comprehensive quarterly compliance summaries.

Implementing Rigorous Oversight and Audits

Trust is good, but verification is better. Setting up a regular schedule for audits and data validation isn’t optional; it’s essential for keeping control of your payroll function. This proactive approach helps you spot potential fires before they turn into expensive, full-blown compliance disasters.

Schedule periodic audits—maybe quarterly or semi-annually—to dive into a sample of payslips, statutory payment records, and deduction calculations. To keep things impartial, have these conducted by your internal team or bring in a third-party expert. It’s also vital to have strict data validation protocols to make sure the information flowing from your HR systems to the RPO is perfect from the start.

An effective partnership thrives on transparency. Regular audits are not a sign of mistrust; they are a hallmark of a mature, well-governed process that protects both your organisation and your RPO partner from unforeseen risks.

Creating transparent communication channels is just as critical. You need a clear escalation path for handling employee queries about their deductions. When someone has a question about their payslip, they deserve a fast, accurate answer. A streamlined process, managed jointly with your RPO, builds employee confidence and takes a huge administrative weight off your HR team’s shoulders. To get a better sense of how these integrated services come together, you can learn more about the benefits of Recruitment Process Outsourcing.

By actively managing your RPO partnership with clear SLAs, consistent audits, and open communication, you can rest assured that your deductions are being handled with the highest level of accuracy and compliance. This strategic oversight transforms a complex operational task into a reliable and insightful part of your overall HR strategy.

Avoiding Common and Costly Deduction Pitfalls

Let’s be blunt: managing payroll deductions is a high-stakes game. Tiny oversights can quickly snowball into serious financial and legal headaches. Think of it as walking through a minefield—one wrong step could mean penalties, tax notices, and a damaged company reputation. As a CHRO, spotting these risks before they become problems isn’t just good practice; it’s essential.

The most common mistakes often boil down to simple human error or system glitches. Getting Tax Deducted at Source (TDS) calculations wrong is a classic example and a surefire way to get unwanted attention from the tax authorities. In the same vein, delaying statutory payments for EPF or ESI can attract hefty penalties that pile up fast, turning a small administrative slip into a major financial drain.

Proactive Strategies to Mitigate Risk

To keep your organisation safe, you need to shift from firefighting to fire prevention. By anticipating the common issues, you and your RPO partner can build a fortress of safeguards that ensures your payroll operation is both seamless and bulletproof.

Here are a few key pitfalls and how to sidestep them:

- Pitfall 1: Inaccurate TDS Calculations. This usually happens when an employee’s investment declarations aren’t processed right, or when tax law changes aren’t rolled out immediately.

- Solution: Put a dual-verification process in place for all payroll inputs. Insist that your RPO partner conducts regular training sessions to stay on top of the latest tax updates.

- Pitfall 2: Delayed Statutory Remittances. Missing the deadlines for depositing EPF, ESI, or TDS is a costly mistake. It also sends a clear signal of poor governance.

- Solution: Set up iron-clad Service Level Agreements (SLAs) with your RPO partner. These should include serious penalties for late payments and a requirement to see proof of remittance (challans) within a fixed window each month.

The real goal here is to move away from a reactive, problem-fixing mode and into a proactive, risk-avoidance culture. That takes crystal-clear communication, well-defined responsibilities, and an absolute commitment to compliance from both your team and your RPO partner.

Staying Ahead of Legislative Changes

Regulatory updates are a constant in India’s financial world, and falling behind is not an option. For instance, the government often tweaks TDS thresholds to balance tax collection with taxpayer relief. In the Union Budget 2025-26, the TDS threshold on rental income was bumped up from ₹2.4 lakh to ₹6 lakh annually. This change, along with better deduction limits for senior citizens, is part of a bigger picture to streamline tax deductions and ease the compliance load.

You can find more details about these tax provision updates from the Press Information Bureau. A top-tier RPO partner will be all over these changes, tracking them obsessively to keep you compliant and out of trouble.

Frequently Asked Questions About Payroll Deductions

When you start digging into payroll deductions, especially with an RPO partner in the mix, a lot of questions pop up. It’s natural. For any CHRO, getting clear on who’s responsible for what—liability, compliance, reporting—isn’t just a “nice-to-have.” It’s absolutely critical for managing risk and governing your partnership effectively.

Let’s tackle some of the most common questions head-on. Getting these answers straight ensures everyone is on the same page and builds a partnership you can actually count on.

Who Is Liable for Deduction Errors?

This is usually the first question on everyone’s mind: who carries the can if a deduction error is made? Does the buck stop with your company or the RPO provider?

Here’s the hard truth: while your RPO partner handles the day-to-day payroll tasks, the ultimate legal liability for statutory compliance rests with your company. You are the employer of record. It’s a vital distinction and highlights why your partnership agreement needs to be rock-solid.

To keep your organisation protected, there are a few non-negotiables for your contract: clear indemnity clauses, specific SLAs for accuracy and timeliness, and a fixed schedule for regular audits. A real partnership is built on shared responsibility, with transparent systems designed to catch mistakes before they ever happen.

Your RPO executes the tasks, but your organisation owns the legal risk. Therefore, robust oversight isn’t just good practice; it’s a fundamental fiduciary duty to safeguard the company from potential penalties and legal challenges related to payroll deductions.

How to Ensure RPO Partners Stay Current?

Tax and labour laws in India are anything but static. They’re constantly shifting. So, how can you be sure your RPO partner is keeping up with all the changes that impact payroll deductions?

A top-tier RPO provider’s entire value proposition is built on their expertise and their proactive stance on legislative updates. When you’re vetting potential partners—and during every performance review—you need to see proof of their compliance management framework.

Look for these tell-tale signs of a system that works:

– Dedicated Compliance Teams: Specialists whose only job is to track regulatory changes.

– Legal Update Subscriptions: Evidence they invest in real-time legal and tax news services.

– Industry Body Memberships: Active involvement in professional organisations that share crucial compliance updates.

A key performance indicator is their ability to tell you about upcoming changes before they happen and show you a clear plan for how they’ll implement them.

What Reporting to Demand from Your RPO?

Finally, what reports should you be demanding? To have real oversight, you need more than just a data dump at the end of the month.

You should expect a mix of standard operational reports and high-level strategic summaries. Think of it in two layers:

– Standard Reports: This includes the basics, like monthly statutory payment challans (for EPF, ESI, TDS) and detailed payroll registers that break down the calculations for every single employee.

– Strategic Reports: This is where you get true oversight. Insist on consolidated reports that show total deduction liabilities, cost-to-company variance analysis, and a high-level compliance dashboard that gives you a quick, clear picture of where things stand.

These reports aren’t just for ticking boxes. They’re essential for sharp financial planning, making audits a breeze, and empowering you to make informed strategic decisions.

At Taggd, we transform complex payroll challenges into streamlined, compliant solutions. Discover how our expert RPO services can bring clarity and confidence to your deductions management by visiting us at https://taggd.in.