Salary Adjustment Mastery: Your Complete Strategy Guide

Understanding Salary Adjustment In Today’s Workplace

Let’s talk salary adjustments. Think of it less like corporate jargon and more like tending a garden. You need to water and fertilize (adjust salaries) to help your plants (employees) thrive. It’s about more than just raises; it’s about creating a compensation system that keeps your best people around while staying financially responsible.

This means talking to CHROs who’ve been there and done that, from startup growth spurts to corporate restructuring. These conversations reveal how smart organizations use salary adjustments strategically. For instance, sometimes when you give a raise can be more important than how much. Successful companies know this and communicate adjustments carefully to avoid internal friction.

This understanding is what separates adjustment programs that inspire teams from those that cause resentment. We’ll also look at real-world examples where well-meaning adjustments went wrong, offering valuable lessons. Analyzing these situations prevents repeating past mistakes, saving your organization time and money.

Salary Adjustments in India: A Look at the Numbers

To get a clearer picture of salary adjustments, let’s consider the Indian market. As of 2025, the average annual salary in India is about 358,000 INR (roughly 4,186 USD). This highlights the differences in pay across sectors and regions within India. Salary adjustments need to consider these baseline numbers to be competitive and fair. Want to learn more? Check out average salary trends in India: Discover more insights.

Connecting Salary Adjustments to Company Culture

Effective salary adjustments also need to fit with your overall company culture and employee recognition programs. You might find this interesting: Best Companies to Work For. This link between how you pay people and your company culture creates a positive work environment. It also shows employees how much you value them. By seeing salary adjustments as a key part of the employee experience, companies can build a more engaged and motivated team, leading to better results for everyone. Understanding these details helps CHROs make smart choices that benefit both employees and the organization.

The Five Forces That Drive Smart Salary Adjustments

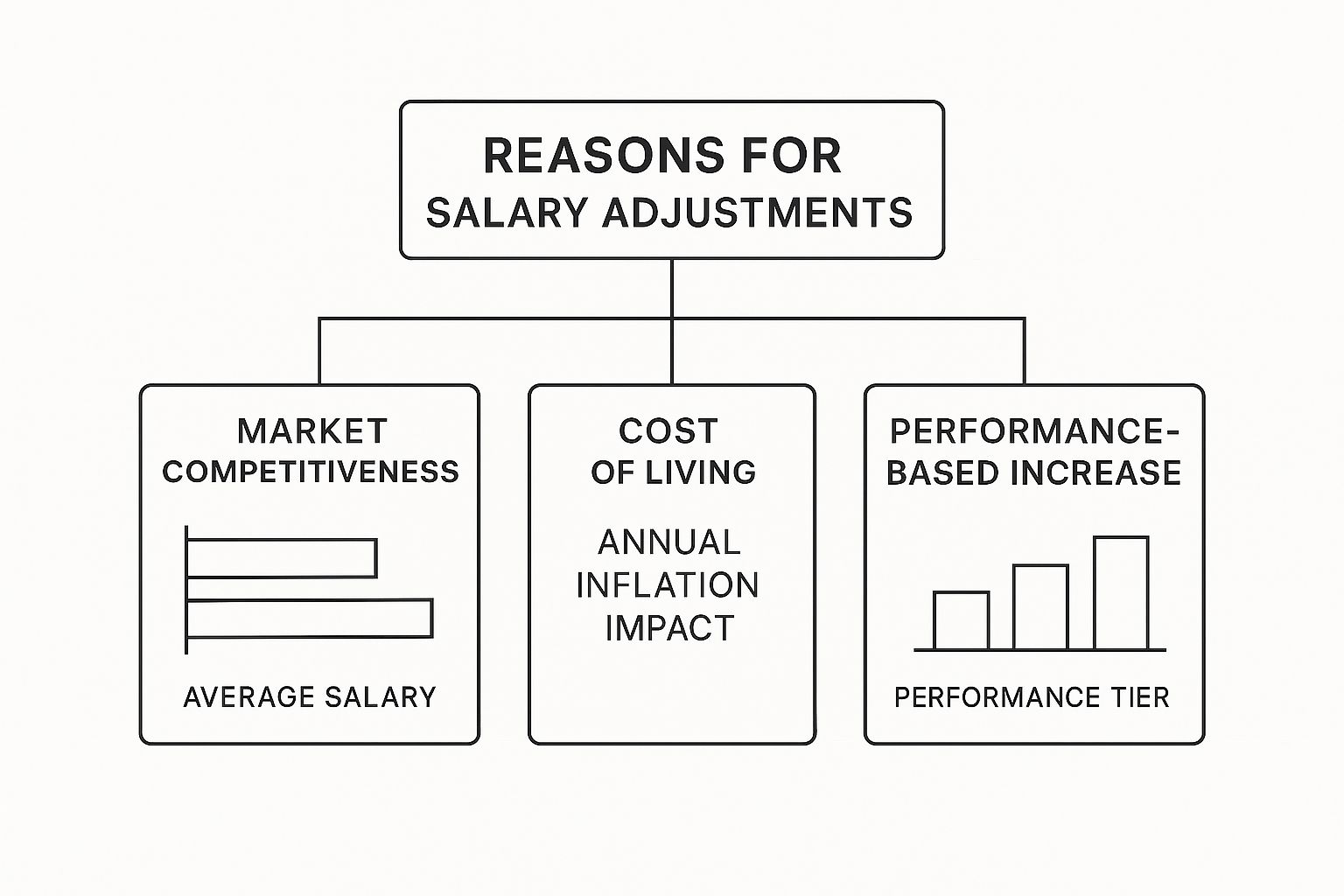

The infographic above gives us a visual snapshot of why salary adjustments are necessary. It boils down to three core areas: keeping up with the market, accounting for the cost of living, and recognizing strong performance. These factors don’t exist in isolation; they’re interwoven and shape your overall compensation approach. For CHROs, grasping this interplay is key to navigating the often-complex world of salary adjustments.

Think of it like sailing a ship. You wouldn’t set out without considering currents, wind, and tides. Just like those forces impact a ship’s course, five key drivers affect salary decisions: market shifts, inflation, performance recognition, retention, and organizational change. Let’s explore each one.

Riding the Waves of Market Shifts

Market shifts can quickly make your compensation packages less competitive. Imagine a sudden surge in demand for software developers. If your salaries stay put while others offer more, you risk losing your best people. If the average market rate for a data scientist suddenly increases by 15%, your current data scientists might start looking elsewhere. It’s a simple supply and demand equation.

Keeping Pace with Inflation

Inflation quietly chips away at the value of a paycheck. What employees could buy last year might cost more this year. This can lead to financial strain and discontent, especially for lower-paid employees. Salary adjustments help maintain purchasing power and ensure fair compensation. This is especially important in dynamic economies like India. Recent projections show a consistent trend of salary hikes between 9% and 10% across various sectors from 2022 to 2025. This reflects a balance between economic progress and cost management. Want to dive deeper? Read the full research.

Recognizing and Rewarding Performance

Not all salary adjustments are reactive. Recognizing and rewarding top performers is a proactive strategy. Giving high-achievers a raise boosts morale, encourages them to keep excelling, and sets a positive precedent. It fosters a meritocratic culture and motivates the entire team.

The Retention Factor

Sometimes, salary adjustments are necessary to retain key employees. If competitors are trying to poach your talent, a raise can be a strong incentive for them to stay. It’s often more economical to adjust salaries than to go through the process of recruiting and training replacements. Losing institutional knowledge and disrupting team dynamics can be significantly more expensive in the long run.

Navigating Organizational Change

Finally, changes within your organization, like restructuring, mergers, or acquisitions, often require salary adjustments. New roles, responsibilities, and reporting structures might necessitate a compensation review to maintain internal equity. These transitions can also provide opportunities to optimize your compensation structure and align it with the organization’s evolving needs. Ignoring these factors can lead to discontent, lower productivity, and even legal issues.

To understand the impact of these drivers, let’s look at the following table:

Salary Adjustment Drivers and Their Impact Factors

A comprehensive comparison of the five key drivers, their typical adjustment percentages, and implementation timelines

| Driver Type | Typical Adjustment Range | Implementation Timeline | Primary Impact Area |

|---|---|---|---|

| Market Shifts | 5% – 15% (or more in high-demand fields) | Ongoing / As Needed | Competitiveness, Attracting Talent |

| Inflation | 2% – 5% (aligned with inflation rates) | Annual / Bi-Annual | Cost of Living, Purchasing Power |

| Performance Recognition | 3% – 10% (based on performance ratings) | Annual / Performance Review Cycle | Employee Motivation, Meritocracy |

| Retention | Varies (often significant to match competitor offers) | As Needed / Case-by-Case | Employee Retention, Reducing Turnover |

| Organizational Change | Varies widely (depends on the nature of the change) | During/After Restructuring, Merger, etc. | Internal Equity, Role Alignment |

This table illustrates how different drivers influence salary adjustments, from the minor tweaks needed to offset inflation to the more substantial changes during market shifts or organizational restructuring. Understanding these dynamics empowers CHROs to make informed decisions that support both their employees and the organization’s goals.

Cracking The Code On Salary Adjustment Calculations

So, we’ve talked about why salary adjustments matter. Now, let’s get into the nitty-gritty of how they actually work. Forget about those blanket percentage increases – they can cause more headaches than they solve. Savvy CHROs use more focused methods that keep employees happy and the budget balanced.

Market Benchmarking: Staying Competitive

Think of market benchmarking like shopping for groceries. You compare prices at different stores before buying, right? It’s the same with salaries. You need to know what other companies are paying for similar roles in your area to stay competitive and attract top talent. It’s not about blindly matching the average, though. It’s about understanding the salary range and figuring out where your company fits in.

Performance-Based Adjustments: Rewarding Excellence

Performance-based adjustments link salary increases directly to how well someone performs. Think of a sports team: star players often earn bigger salaries because of their impact on the game. This approach can really motivate employees, but it’s important to recognize solid performers too, so everyone feels valued.

Conducting Meaningful Salary Surveys: Getting the Right Data

To get a real picture of the market, you need solid data, and that means conducting salary surveys. Forget generic industry averages; you need specifics. A good survey dives deep into compensation for similar roles in your region, considering factors like experience, skills, and location. This gives you a solid foundation for making smart salary decisions.

Building Adjustment Matrices: Ensuring Internal Equity

Salary adjustment matrices help keep things fair within your own company. They take into account things like job complexity, location, and experience. For example, a senior software engineer in Bangalore likely earns a different salary than a junior engineer in Hyderabad, even if the overall market rate for software engineers is similar. The matrix helps maintain consistency and fairness across the board. You might find this interesting: Check out our guide on creative compensation strategies.

Personalized Adjustment Formulas: Transparency and Fairness

Openness is key. Personalized adjustment formulas let employees see exactly how their salary adjustments are calculated. A clear formula might combine market data, performance reviews, and internal equity factors. For instance: Base Salary Adjustment = (Market Adjustment Percentage + Performance Rating Percentage) * Current Salary. This builds trust and helps everyone understand the process.

Handling the Edge Cases: Flexibility and Judgment

Let’s be real, not everything fits neatly into a formula. There will always be unique situations that need a personal touch. Maybe someone took on extra responsibilities, or a critical role is tough to fill. In these cases, you need flexibility, balancing company guidelines with the specific circumstances.

To help visualize the different calculation methods, let’s look at a comparison table:

Salary Adjustment Calculation Methods and Applications

Detailed breakdown of different calculation approaches with their pros, cons, and best use cases

| Calculation Method | Best Used For | Complexity Level | Accuracy Rating | Resource Requirements |

|---|---|---|---|---|

| Market Benchmarking | Maintaining competitiveness, attracting new talent | Moderate | High | Market data subscriptions, salary surveys |

| Performance-Based Adjustments | Rewarding top performers, driving motivation | Moderate | Moderate | Performance management system, clear evaluation criteria |

| Cost-of-Living Adjustments | Protecting employee purchasing power | Low | Moderate | Inflation data, consistent application |

| Combination Approach (Market + Performance) | Balancing external competitiveness with internal equity | High | High | Requires both market data and robust performance management |

| Personalized Formulas | Transparency, individualized adjustments | Moderate to High | Moderate to High | Requires clear communication and potentially complex calculations |

This table highlights how each method has its own strengths and best-use cases. A combined approach often provides the most balanced and accurate adjustments.

By understanding these different methods and creating a flexible system, CHROs can effectively manage salary adjustments, ensuring fairness, transparency, and alignment with company goals.

Building Salary Adjustment Policies That Actually Work

Let’s face it, many salary adjustment policies feel like they were designed with lawyers in mind, not the people they actually affect. Truly effective policies act as helpful guides, not rigid, frustrating rules. This section explores building policies that offer clear direction while remaining adaptable to real-world situations.

Balancing Consistency and Adaptability

The sweet spot lies in balancing consistency with adaptability. Think of it like building a house: a strong foundation (consistent guidelines) is essential, but you also need flexibility to customize the rooms (adapt to unique situations). We’ll look at organizations that have successfully struck this balance, examining how they handle challenges like rewarding high performers while managing budget limitations.

Essential Components of a Strong Policy

Successful salary adjustment policies share a few key ingredients. Eligibility criteria should be crystal clear. For instance, is everyone eligible, or only those who’ve been with the company for a specific time? The approval process needs to be efficient and transparent. Who gives the final okay? How long does it typically take? Finally, clear communication protocols are essential for building trust. How and when will employees learn about adjustments? These elements create a sense of fairness and manage expectations effectively.

Protecting Against Bias and Legal Issues

Safeguards against bias and legal issues are paramount. Policies should explicitly outline how adjustments are calculated, reducing subjectivity. Documented procedures for review and approval create an audit trail, protecting both the company and its employees. This transparency minimizes the risk of discrimination claims and promotes fairness.

Building Trust Through Appeals

No system is foolproof. A solid appeal mechanism lets employees challenge decisions they perceive as unfair. This process should be accessible, easy to understand, and handled impartially. A well-designed appeals process builds employee trust and demonstrates the organization’s commitment to fairness.

Practical Examples and Case Studies

Imagine a company that showers top performers with substantial raises but overlooks consistent, reliable employees. This breeds resentment and demotivates the majority. On the flip side, a company focused solely on cost-of-living adjustments might struggle to attract and retain top talent in a competitive market.

Consider a fast-growing startup versus a large, established corporation. The startup might need a more flexible policy to attract and retain talent in a dynamic environment, perhaps making larger, more frequent adjustments. The established company, however, might prioritize consistency and predictability.

Key Takeaways for CHROs in India

For CHROs in India, understanding local regulations and market dynamics is critical. India’s diverse workforce and varied compensation practices require careful thought. Regional cost of living differences and industry-specific salary benchmarks are key factors. A successful salary adjustment policy in India needs to be tailored to the specific context of the Indian workplace while respecting local laws. A clear, effective policy not only ensures fair compensation but also strengthens employee trust and boosts organizational performance.

Implementation Strategies That Drive Real Results

Rolling out salary adjustments can feel like navigating a minefield. One wrong step, and you’re dealing with more than just numbers; you’re dealing with people’s livelihoods and perceptions of fairness. This section dives into the nitty-gritty of implementation, sharing insights from HR leaders who’ve successfully managed adjustments of all scales. We’ll explore the entire journey, from securing stakeholder buy-in to managing budget constraints and communicating transparently with your team.

Building Stakeholder Buy-In: Getting Everyone on Board

Think of it like renovating a house. You wouldn’t start tearing down walls without the architect and contractor on board, right? Salary adjustments are similar. You need the support of key stakeholders like senior management, finance, and department heads. Clearly articulate the “why” behind the adjustments. Focus on the benefits, such as better employee retention and a boost in motivation. Back up your reasoning with solid data. A strong business case demonstrating the return on investment is essential.

Managing Budget Realities: Making the Numbers Work

Let’s be realistic, salary adjustments impact your bottom line. This means careful planning and smart resource allocation are non-negotiable. Partner closely with your finance team to ensure the adjustments are financially sound. Explore various scenarios and consider phasing in adjustments over time if needed. Open communication with finance is key. This collaborative approach ensures your salary adjustment strategy aligns with the organization’s overall financial health. Interestingly, salary adjustments in India have a unique history. The early 2010s saw substantial increases, often reaching double digits. In 2011, they peaked at 12.6 percent, fueled by economic growth and high demand for skilled professionals. Explore the data to learn more about these historical trends.

Crafting Effective Employee Communications: Transparency and Clarity

How you communicate salary adjustments matters just as much as the adjustments themselves. Clarity, conciseness, and transparency are your guiding principles. Explain the logic behind the adjustments, how they were calculated, and their effective date. Utilize multiple communication channels like email, your company intranet, and town hall meetings to ensure everyone receives the news. Address any employee questions or concerns promptly and honestly.

Sequencing Adjustments for Maximum Impact: Strategic Rollout

Timing is crucial. Consider the bigger picture when deciding when to implement salary adjustments. Aligning them with performance reviews or annual cycles can reinforce a merit-based system. However, if market forces demand action, a quicker response may be necessary.

Handling Pushback: Addressing Concerns and Resistance

Some pushback is inevitable. Not everyone will be thrilled with their adjustment. Prepare for these conversations by having data and clear explanations at the ready. Listen empathetically to employee concerns and address them fairly. While it’s impossible to please everyone, showing fairness and transparency can significantly reduce negative reactions.

Measuring Success: Beyond the Basics

Evaluating the success of your salary adjustment program goes beyond ticking boxes. Track important metrics such as employee turnover, engagement scores, and internal promotions. These provide a more comprehensive view of the actual impact. Collect feedback from employees and managers to pinpoint areas for improvement in future adjustment cycles. This continuous feedback loop keeps your strategy effective and aligned with your organizational goals.

Troubleshooting Common Challenges: Proactive Solutions

Anticipate potential roadblocks. Budget overruns can strain resources, while unexpected employee reactions can affect morale. Develop contingency plans to address these issues proactively. For example, establish clear escalation procedures for handling disagreements regarding adjustments. This preparation helps maintain stability and minimizes disruptions.

By following these strategies, you can turn salary adjustments from a potential headache into a valuable tool for attracting, retaining, and motivating your workforce. Remember, successful implementation requires careful planning, clear communication, and continuous evaluation.

Surviving Common Salary Adjustment Disasters

Every seasoned HR pro has a story or two (or ten!) about salary adjustments gone wrong. Instead of sweeping these potential pitfalls under the rug, let’s tackle them head-on with practical, real-world solutions. We’ll explore common issues that can derail even the best-laid plans: budget overruns, negative employee reactions, managerial pushback, and unfortunate timing conflicts.

Budget Overruns: Keeping Finance Happy

Picture this: you’ve spent weeks crafting the perfect salary adjustment plan, only to have finance slam the brakes due to budget constraints. It happens more often than you’d think. The key is to loop in finance early. Work with them to develop a realistic budget that aligns with the company’s overall financial goals. Maybe phase in adjustments over time or explore alternative compensation strategies, like better benefits or bonuses. This collaborative approach prevents nasty surprises and builds trust between HR and finance.

Employee Reactions: Managing Expectations

Salary adjustments can be an emotional rollercoaster for employees. Some will be thrilled, others disappointed. Transparency is your best friend here. Clearly explain the reasoning behind the adjustments, highlighting the factors considered, like market data and performance reviews. Provide individual explanations to address specific employee concerns and make sure everyone feels heard. For more on managing expectations and preventing people from heading for the door, check out this article: Learn more in our article about employee attrition.

Manager Resistance: Fostering Buy-In

Managers are often the ones explaining and implementing salary adjustments on the ground. Getting them on board is crucial. Give them the information and training they need to answer employee questions confidently. Involve them early in the process to get their input and address any concerns they might have. This turns managers into champions of the program, not roadblocks.

Timing Conflicts: Choosing the Right Moment

Announcing raises right after layoffs or during a financial downturn? Talk about bad timing. Poorly timed adjustments can completely undermine their impact. Think about the bigger picture when scheduling adjustments. Aligning them with performance reviews or annual cycles often makes sense, but be flexible and adjust your timeline if needed.

Navigating Difficult Conversations: Addressing Concerns

Let’s be honest, some employees will feel shortchanged no matter what. Prepare for these conversations. Understand the reasoning behind each adjustment inside and out. Be ready to present the data and explain the decision-making process clearly. You can’t always make everyone happy, but demonstrating fairness and providing a clear explanation can help maintain trust.

Handling Internal Equity Challenges: Maintaining Fairness

Sometimes, market data and internal equity clash. Offering a new hire a higher salary than a current employee in a similar role can breed resentment. Be prepared to explain how market forces impact compensation decisions while reinforcing your commitment to internal fairness. Consider targeted adjustments for existing employees to maintain balance and prevent internal disparities.

Addressing the Domino Effect: Preventing New Disparities

Salary adjustments for one team can trigger a chain reaction. Raising salaries in one department might create pressure to do the same in others. Think ahead and develop strategies to handle these potential ripple effects. A phased approach or clear communication about criteria for future adjustments can help. By anticipating and addressing these challenges proactively, you can turn potential salary adjustment disasters into opportunities to build stronger relationships and increase trust within your organization.

Measuring Success and Optimizing Your Approach

How do you know if your salary adjustments are hitting the mark? Sure, retention and employee satisfaction are important, but truly successful HR leaders dig deeper. Think of it like a doctor checking your vital signs – they don’t just ask how you feel, they measure your pulse and blood pressure. We’ll explore those vital signs for your compensation strategy, both the hard numbers like cost-per-adjustment, time-to-fill, and productivity metrics, and the softer signals like employee engagement and how well managers are handling the process.

Establishing Baselines and Setting Realistic Targets

Imagine you’re baking a cake. You wouldn’t just throw ingredients together and hope for the best, would you? You’d follow a recipe. Setting baselines is like having your recipe for compensation success. Before you change anything, understand your starting point. Track things like current salaries, turnover rates, and how long it takes to fill open positions. Then, set achievable goals. Don’t expect to become a Michelin-star baker overnight! Small improvements add up over time.

Building a Reporting System that Provides Actionable Insights

Data without context is like a pile of puzzle pieces – interesting, but ultimately useless. You need a reporting system that assembles those pieces into a clear picture. If your cost-per-adjustment is suddenly through the roof, it’s a signal to check your calculations. If you’re still struggling to fill key roles even after increasing salaries, maybe the problem isn’t pay, but your recruitment process. Your reporting system should help you spot these red flags and know where to focus your efforts.

Leveraging Advanced Analytics: Predicting Future Needs

Leading companies don’t just react to market changes, they anticipate them. Think of it like a farmer using weather forecasts to plan their crops. Advanced analytics can be your compensation weather forecast. By analyzing historical data, market trends, and what’s happening within your company, you can prepare for future salary pressures. This proactive approach helps you manage your budget more effectively and avoid making hasty, last-minute adjustments.

Demonstrating ROI: Showing the Value to Senior Leadership

Salary adjustments aren’t just an expense, they’re an investment. And like any investment, you need to show a return. Connect your salary program to tangible business outcomes. Did higher salaries result in a productivity boost? Did better retention rates save money on recruitment? Quantifying the impact of your program proves its value to senior leaders and makes it easier to get buy-in for future initiatives.

Building Feedback Loops: Continuous Improvement

Even the best recipes can be improved. The same goes for salary adjustment programs. Get regular feedback from both employees and managers. What’s working well? Where can things be better? This constant feedback loop helps you catch small problems before they snowball. Maybe your communication around adjustments was unclear, or your performance metrics don’t align with employee goals. These insights help you fine-tune your approach and achieve better results.

Real-World Examples: Putting it All Together

Imagine a company implements a performance-based adjustment system and sees productivity go up. They can connect the dots and demonstrate a clear link between the two. Or a company that shortens its hiring time for competitive roles after adjusting salaries has concrete proof that their strategy is working. By focusing on both the “what” (the numbers) and the “why” (the impact), you can truly measure the effectiveness of your salary adjustment program and create lasting value for your organization.

Ready to step up your recruitment game? Visit Taggd and discover how Recruitment Process Outsourcing can transform your talent acquisition.