Source of Hire Mastery: Transform Your Recruitment Strategy

Making Sense of Source of Hire Without the Confusion

Many HR teams feel like they’re drowning in recruitment data, yet they can’t find any real insights. Think of the source of hire metric not as just another column in a spreadsheet, but as your recruitment compass. It’s the tool that points you directly to your most valuable talent pools.

Simply tracking where applicants come from is just the beginning. The goal is to build an intelligent recruitment strategy that can anticipate where your next top performers will emerge from. It’s about uncovering the story behind your hiring data.

The most successful talent acquisition leaders share a secret: the companies that land the best people aren’t always those with the biggest budgets. Instead, they are smarter about where they put their time and money. By analysing which channels bring in employees who perform well and stay long-term, they turn scattered data into a clear roadmap. This strategic approach then guides every decision, from buying job ads to training recruiters on the most effective sourcing methods.

From Data Points to Strategic Direction

Imagine you are planning a long road trip. You wouldn’t just start driving without a map. The source of hire is that map for your talent journey. It shows you which routes (hiring channels) are fast and direct, which are scenic but slow, and which are complete dead ends.

For example, you might notice that a large job board brings in a high volume of applications, but your employee referral programme delivers candidates who get up to speed quicker and have better retention rates. This insight is incredibly valuable. It empowers you to shift your focus and resources towards improving your referral programme, perhaps by creating better incentives or making the submission process easier for current employees.

This analytical approach becomes essential in a competitive job market. For instance, India’s employment outlook for Q2 2025 shows very strong hiring intentions, with a Net Employment Outlook of 43 percent, a figure that is much higher than the global average. In such an active environment, knowing your most reliable source of hire isn’t just helpful—it’s a key competitive advantage that ensures you attract top performers before anyone else does. Read more about India’s hiring outlook on economictimes.com.

Why Source of Hire Analytics Actually Matter to Your Bottom Line

Tracking your source of hire goes far beyond a simple reporting exercise; it’s a strategic lever that directly impacts your company’s financial performance. Many leaders get stuck on the surface-level cost-per-hire, but the true value is found much deeper. Think of it like building an investment portfolio. You wouldn’t just purchase shares because they have the lowest price. Instead, you’d analyse which stocks promise the best long-term stability and growth. Your hiring sources are investments in your talent portfolio, and they should be treated with the same strategic care.

The data you collect shows which channels deliver not just applicants, but the future leaders and high-achievers who will drive your business forward. By analysing the source of hire, you can shift from merely filling empty seats to strategically building a high-performance workforce. The average cost to bring a new employee on board is significant, with some figures hovering around $4,700 for standard roles and much more for executive positions. When you hire dozens or hundreds of people, the financial stakes become incredibly high. Relying on a poor-quality source can lead to increased turnover, costing you not only in repeated recruitment fees but also in lost productivity and diminished team morale.

Uncovering Your Golden Sourcing Channels

The real power of source of hire analytics lies in its ability to link recruitment efforts to tangible, long-term business outcomes. By tracking metrics after a hire is made, you can answer essential questions:

- Which sources deliver employees who stay longer? Employee referrals, for instance, are frequently linked to higher retention rates, which helps to reduce the expensive cycle of constant rehiring.

- Which channels produce our top performers? You might find that a niche industry forum, despite its low volume of applicants, consistently provides candidates who go on to exceed all performance expectations.

- Where do our future leaders come from? Tracing the career progression of your key talent back to their original source of hire can reveal invaluable patterns for effective succession planning.

In a competitive market, these insights are indispensable. With the hiring intent rate across India projected to reach 29 percent in 2025—a notable increase from past years—the competition for top talent is fierce. Understanding exactly which sources provide the best return on investment allows you to allocate your recruitment budget with surgical precision, giving you a distinct advantage. You can discover more about the rising hiring intent rates in India on Statista.

By concentrating on channels that yield quality and longevity, you’re not just managing expenses—you are actively constructing a more stable, productive, and successful organisation. This is why forward-thinking CHROs are deeply focused on this metric, recognising it as a cornerstone of a modern talent strategy. To learn more, check out our insights on the top hiring trends to reinvent your recruiting strategy.

Building a Tracking System That Actually Works

To make sound hiring decisions, you need data you can trust. But here’s the good news: building an effective system to track your source of hire doesn’t require a massive budget or complicated software integrations. The most successful HR teams rely on practical, straightforward measurement methods that deliver reliable information without burying their teams in busywork. The secret lies in consistency and simplicity, making it easy for everyone in the hiring process to accurately log where candidates come from.

This can get tricky when candidates interact with your company at several different points. For instance, a candidate might first hear about an opening from a friend, later see a post about it on LinkedIn, and finally submit their application through a job board. So, which one counts as the true source of hire? This is where having clear, simple rules becomes essential for maintaining clean data.

Practical Solutions for Messy Realities

The recruitment journey is rarely a straight line. To keep your data accurate, you need practical fixes for these common, real-world situations:

- Multi-channel Applications: When a candidate applies through more than one channel, it’s best to standardise a “last-touch” attribution model. This means you record the final platform they used to submit their application as the primary source. This method is simple to track and keeps your data consistent across the board.

- Referrals via Social Media: If an employee shares a job and their friend applies through a professional network like LinkedIn, it should still be classified as a referral. The platform is just the vehicle; the personal connection is the real source. You should create a simple way for employees to log these informal referrals so they get the credit they deserve.

- Ensuring Team Adoption: Your tracking system is only as effective as the data put into it. It’s crucial to train your recruitment team on why accurate tracking matters and make it a standard part of the hiring workflow. Simplicity is your greatest advantage here—avoid overly complex dropdown menus with dozens of options in your Applicant Tracking System (ATS).

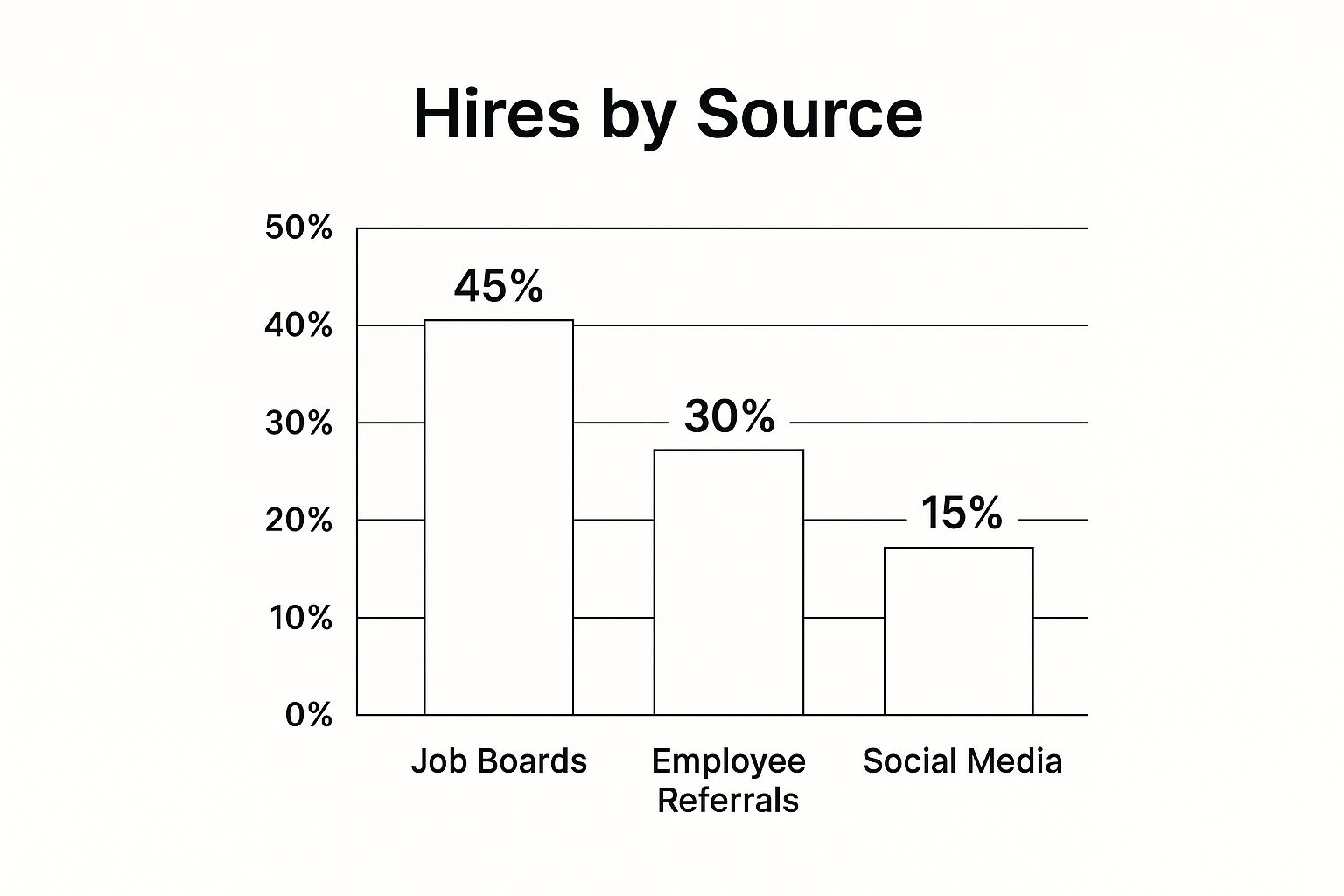

The chart below illustrates a typical breakdown of hires by source, showing where many organisations find their top talent.

As this visual makes clear, a large percentage of hires often originates from just a few key channels, with job boards and employee referrals leading the pack. By focusing your tracking efforts on these high-impact sources first, you can gain the most valuable insights right away.

Navigating the New Landscape of Digital Talent Sources

The ways we find top candidates have changed completely, and so have the best places to look. For today’s CHROs, the task isn’t just about finding new hiring channels but carefully assessing them without getting swayed by the latest fads. Imagine a seasoned chef discovering new ingredients. They don’t just throw every new spice into a signature dish; they test each one to see how it truly adds to the flavour. In the same way, you must thoughtfully experiment with new digital sources to see if they genuinely improve your recruitment results.

From AI-driven sourcing platforms to niche professional groups, it’s vital to separate the sources that deliver real value from those that are just costly distractions. The most effective leaders use a structured method to test and measure new channels without disrupting what’s already working. This involves running small-scale pilot programmes for new sources, defining clear success metrics, and comparing the outcomes against your established, proven channels.

Identifying High-Potential Digital Channels

The key is to direct your energy where top talent now spends their time. A complete source of hire strategy should involve a frank evaluation of these modern channels:

- Social Media Recruiting: This goes beyond simply posting job openings. It involves actively connecting with potential candidates on platforms like LinkedIn. It’s about building a community and presenting your employer brand to attract passive talent—professionals who aren’t actively searching for a job but might be open to the right opportunity.

- Professional Networking Platforms: These are more than digital resumes. They are active hubs for industry-specific discussions and knowledge exchange, providing a direct connection to highly skilled professionals.

- Niche Communities: Never underestimate the influence of specialised forums and online groups. These platforms often bring together passionate experts in a specific field, creating a rich source for finding candidates with very particular skill sets.

This digital evolution is reshaping how industries hire. The substantial effect of technology on recruitment in India is evident, with projections for 2025 indicating that sectors like IT, BFSI, and Retail expect a combined hiring growth of around 9 percent. This growth is largely fuelled by these new tech-enabled recruitment methods. You can discover more insights about India’s hiring trends on indiaemployerforum.org. By systematically exploring and adopting these digital avenues, you can ensure your source of hire strategy stays effective and ready for the future.

Creating Your Perfect Source Mix Strategy

Think of a smart investor. They don’t put all their money into a single stock, do they? They diversify their portfolio to handle market swings and get the best returns. A forward-thinking CHRO should approach hiring the same way, by building a resilient sourcing strategy that works well in any market condition. This involves creating a deliberate source mix—a balanced blend of different hiring channels designed to attract a broad spectrum of talent.

Putting all your energy into one channel, like a single popular job board, is risky. It’s the recruitment equivalent of betting your entire investment on one company. It might pay off for a short time, but if that channel’s performance drops, you could be left scrambling to fill crucial roles. The most successful talent teams know they can’t put all their recruitment eggs in one basket.

Leading companies regularly review their source mix to identify any risky over-reliance on a single channel and to find new, untapped opportunities. By building this kind of flexibility into your strategy, you ensure that a single point of failure—like a platform changing its algorithm or raising its prices—won’t derail your entire hiring function.

Balancing Cost, Quality, and Volume

Crafting the ideal source mix is a careful balancing act. Your strategy needs to blend affordable sources with more premium channels, all without compromising on the quality of candidates. For instance, employee referral programmes are often very cost-effective and bring in candidates who tend to get up to speed faster and stay with the company longer. Think of these as your “blue-chip stocks”—they are reliable and consistently perform well.

On the other hand, engaging executive search firms is a premium investment. You save this for high-stakes leadership roles where the high cost is justified by the immense strategic value of the hire.

To manage this mix effectively, you need a clear picture of how each source of hire performs against key recruitment metrics. This analysis must go beyond just the cost-per-hire. It should also include how long it takes to fill a role, the quality of the hire once they are on board, and their long-term retention rates.

To help visualise this, here is a dashboard that outlines key performance indicators for evaluating different hiring sources.

| Hiring Source | Cost per Hire | Average Time to Fill | Quality Score (1-10) | 12-Month Retention Rate | Volume Capacity |

|---|---|---|---|---|---|

| Employee Referrals | Low | Fast | 9 | 85% | Medium |

| Corporate Career Site | Very Low | Varies | 7 | 70% | High |

| LinkedIn Sourcing | Medium | Medium | 8 | 75% | High |

| Niche Job Boards | Medium | Fast | 8 | 65% | Low |

| Executive Search | Very High | Slow | 10 | 95% | Very Low |

By regularly reviewing data like this, you can make smarter, data-backed decisions about where to allocate your recruitment budget. You might see the high quality and retention from referrals and decide to increase your referral bonus to drive more volume. Or, you might experiment with a new niche job board to find candidates for those hard-to-fill technical roles. This kind of active, strategic management is vital, especially for specialised business units. For those interested in a deeper dive, our guide on how GICs in India can attract and hire the best talent explores tailored sourcing strategies in greater detail.

Turning Data Into Recruitment Predictions That Work

Moving beyond simply reporting what happened last quarter is where the real value of source of hire data lies. The best talent acquisition teams don’t just look at their data; they use it as a crystal ball to forecast hiring trends and make proactive adjustments. Think of it like a seasoned meteorologist who uses historical weather data not just to report yesterday’s temperature, but to predict next week’s storm, giving everyone time to prepare. This is the heart of predictive recruiting.

By analysing your historical source of hire data, you can uncover patterns that are invisible on the surface. For instance, you might find that your top engineering talent consistently comes from a specific university’s career fair held every March. Or perhaps applications for sales roles spike right after your annual industry conference in October. These insights allow you to fine-tune your recruitment calendar and budget with incredible precision, putting resources where they will have the most impact, right before you need them.

From Reactive to Proactive Recruiting

Mastering predictive recruiting means you can spot early warning signs before they become full-blown crises. Let’s say your data shows that a key job board’s performance in delivering quality candidates has dipped by 15% over the last two months. Instead of waiting until you have an urgent, unfilled role, you can immediately investigate. Is the platform’s audience changing? Is your job description no longer effective? Answering these questions early allows you to pivot your strategy, perhaps by shifting budget to another, better-performing channel.

This predictive power is also vital for building a strong business case for recruitment investments. When you can show leadership that a £10,000 investment in your employee referral programme last year generated new hires with an 85% one-year retention rate, your request for an increased budget becomes a data-backed strategic proposal, not just another expense.

Here are a few practical techniques to get started with predictive analysis:

- Seasonal Trend Analysis: Map out your hiring volume and source performance month-by-month to identify predictable peaks and troughs for different roles.

- Role-Based Source Optimisation: Analyse which sources consistently deliver the best candidates for specific departments or seniority levels (e.g., junior vs. senior roles).

- Performance Forecasting: Use a simple trendline in a spreadsheet to project a source’s future performance based on the last six to twelve months of data.

This strategic approach transforms the talent acquisition function from a cost centre into a predictive engine for business growth. For organisations looking to scale this capability, exploring options like data-driven RPO can be a powerful next step. You can learn more about this by reading our guide on how recruitment process outsourcing can drive high-impact hiring.

Your Step-by-Step Implementation Roadmap

Turning your source of hire tracking from a simple spreadsheet into a strategic advantage needs a clear, actionable plan. Think of this process as a journey, not a sprint. This roadmap breaks down the transformation into manageable phases, helping you guide the change smoothly and lock in long-term success.

Phase 1: Foundation and Stakeholder Buy-In (Weeks 1-4)

The very first step is to build a solid foundation. Before you introduce any new process, you must get your key leaders on board. This is more than just getting permission; it’s about turning them into advocates for the change.

- Build the Business Case: Use the data you currently have, no matter how basic, to show potential cost savings and improvements in hire quality. Connect the initiative to the company’s bottom line. For instance, explain how focusing on sources that bring in employees with higher retention rates can cut down on bad hire costs, which can be as high as 15%-21% of an employee’s salary.

- Identify Key Stakeholders: This group includes your CFO, department heads, and recruitment team leaders. Present a clear vision of how better source of hire analytics will help them hit their own departmental targets, like filling critical roles faster or boosting overall team performance.

- Define Success Metrics: Decide together what success will look like. Is it a 10% drop in cost-per-hire? Or perhaps an improvement in 90-day retention figures? Having clear metrics from the start will be essential for proving the return on investment later on.

Phase 2: System Setup and Team Training (Weeks 5-8)

Once you have leadership’s support, it’s time to build the operational framework. The main goal here is to make accurate tracking as simple as possible for your team.

- Establish a Governance Framework: Create a straightforward document that clearly defines each source of hire category. For example, you should specify that an application from a link shared by an employee on social media is counted as a “Referral,” not “Social Media.” Consistency is the key to reliable data.

- Train the Recruitment Team: Run hands-on training sessions. Don’t just show your team how to track sources in your Applicant Tracking System (ATS); explain why it’s so important. Link their daily tasks back to the bigger strategic goals you outlined in Phase 1. Your goal is to turn them into data champions.

The image below gives a broad overview of Human Resource Management, showing how recruitment fits into a larger strategic picture.

This visual is a great reminder that tracking recruitment sources is a vital activity that directly influences wider talent management and organisational design strategies.

Phase 3: Launch, Monitor, and Refine (Weeks 9+)

Now, it’s time to go live. The first few weeks are all about monitoring how well the new process is being adopted and gathering feedback. Schedule regular catch-ups with the recruitment team to sort out any issues. Use the data you begin collecting to build your first source performance dashboard and be sure to share early wins with stakeholders to keep the momentum going.

Ready to build a world-class recruitment function powered by data? Taggd offers expert Recruitment Process Outsourcing to help you implement and manage a winning source of hire strategy. Discover how we can help you achieve your hiring goals.