Your Guide to Supplemental Pay in India

So, what exactly is supplemental pay? Think of it as any payment an employee receives that falls outside their regular, predictable salary. This covers everything from performance bonuses and commissions to overtime pay. It’s the extra fuel in the tank that boosts total earnings beyond the base amount.

Getting to Grips with Supplemental Pay

Let’s use an analogy. An employee’s standard salary is like the steady, reliable engine of a car—it gets them from A to B consistently, week in and week out.

Supplemental pay, on the other hand, is the turbocharger. It kicks in to provide an extra burst of power and performance when specific conditions are met, whether that’s smashing sales targets or putting in extra hours on a critical project.

This additional compensation isn’t a fixed part of an employee’s base wage. Instead, it’s variable and usually tied to specific achievements, extra effort, or even the company’s overall success. For employers, knowing how to structure these payments is a strategic advantage. For employees, understanding how this income works is vital for financial planning, especially since it’s often taxed differently and can significantly change their take-home pay.

Regular Wages vs. Supplemental Pay at a Glance

To draw a clearer line between the two, it’s helpful to see them side-by-side. This quick comparison breaks down the key differences between a standard salary and the various forms of extra compensation.

| Attribute | Regular Wages | Supplemental Pay |

|---|---|---|

| Frequency | Fixed and predictable (e.g., monthly) | Variable and often irregular |

| Basis | Based on a set salary or hourly rate | Based on performance, extra hours, or profit |

| Purpose | To compensate for standard job duties | To reward, incentivise, or compensate for extra work |

| Examples | Monthly salary, bi-weekly paycheque | Annual bonus, sales commission, overtime pay |

As the table shows, the core difference is simple: regular wages are for the job you do every day, while supplemental pay is for going above and beyond that baseline.

Why This Is a Big Deal in the Indian Context

The conversation around supplemental pay is particularly relevant in India, where compensation structures can be quite complex. While research indicates that daily wages nearly doubled between 1993 and 2012, it also points to significant and persistent wage inequality. This suggests that the rewards from extra compensation might not be reaching everyone across the workforce equally.

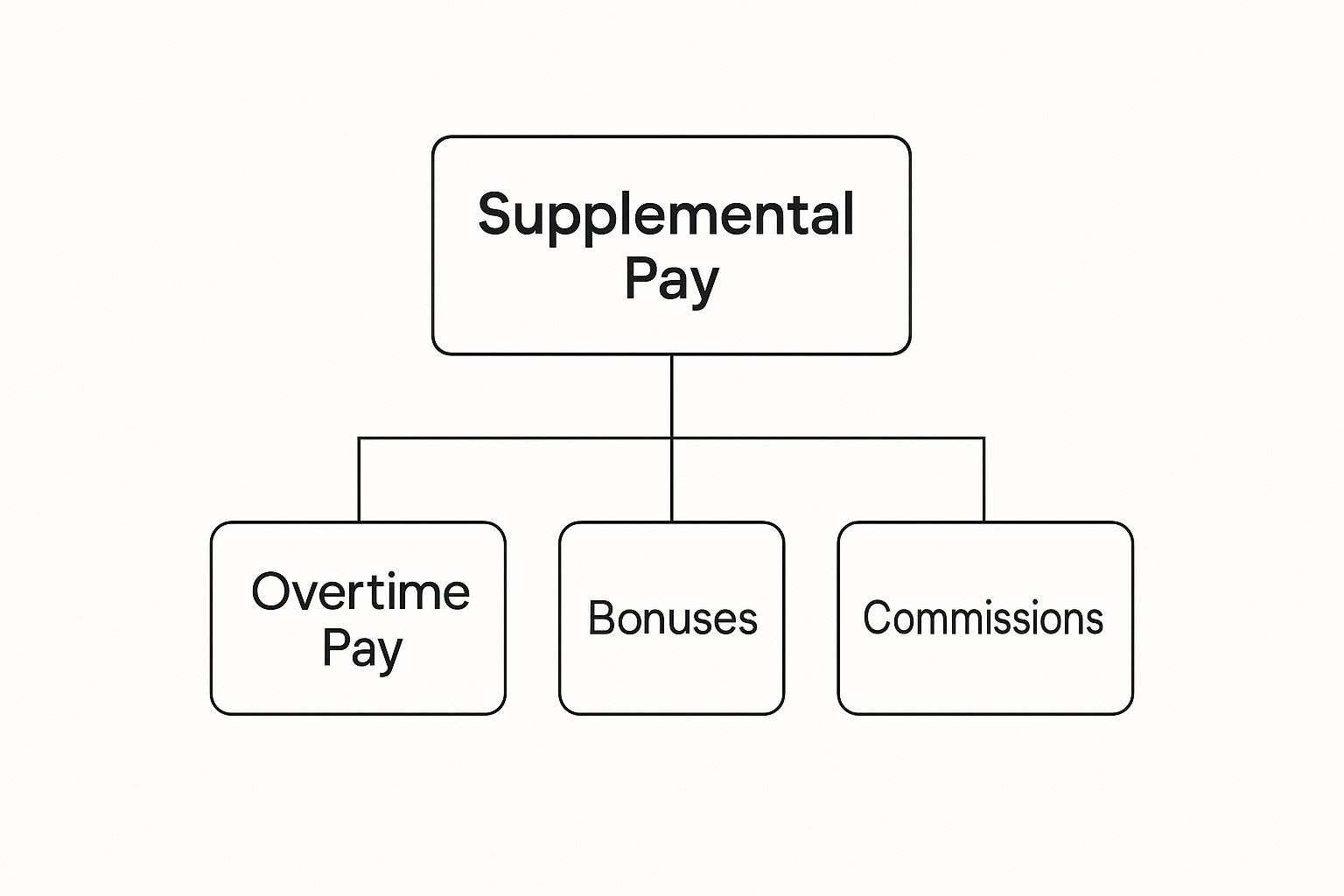

The infographic below highlights the most common forms supplemental pay can take.

As you can see, these payments branch out into distinct categories like overtime, bonuses, and commissions, each with its own purpose. When designed thoughtfully, these aren’t just extra cash payouts; they become powerful tools in a dynamic compensation strategy. To dive deeper, check out our guide on how to use creative compensation to boost your recruiting.

Decoding Common Types of Supplemental Pay

While the idea of getting paid extra is simple enough, the ways it happens can be surprisingly diverse. Each type of supplemental pay is a different tool in a company’s compensation toolkit, designed for a specific purpose. Understanding these variations helps companies create effective incentive programmes and gives employees a clearer picture of their total earning potential.

Let’s break down the most common categories you’ll see in the Indian workplace. Each one is built to reward different kinds of contributions, from outstanding performance to putting in extra hours.

Performance Bonuses: The Ultimate Motivator

Performance bonuses are probably the most famous type of supplemental pay. They’re usually one-off payments given to individuals or teams for hitting specific, pre-agreed goals. Think of it as a reward for crossing a major finish line that pushes the company’s success forward.

These bonuses are powerful because they draw a straight line between an employee’s effort and a real financial reward. For instance, a software development team might get a bonus for launching a new product ahead of schedule. An HR professional could also earn one for successfully hitting a target to reduce employee turnover.

A well-structured bonus isn’t just a payment; it’s a message from the company that says, “We saw your outstanding work, and we value it.” This recognition can be a significant driver of morale and future performance.

Overtime Pay and Sales Commissions

Overtime and commissions are two other crucial kinds of supplemental pay, but they’re tied to very different aspects of an employee’s work.

- Overtime Pay: This is money paid for hours worked beyond the standard workweek, as defined by Indian labour laws. It’s not really a reward for amazing performance, but a legally required payment for extra time on the clock. A factory worker staying late to finish a big order, for example, is entitled to overtime for those extra hours.

- Sales Commissions: This type of pay is a direct incentive for anyone in a role that generates revenue. It’s calculated as a percentage of the sales an individual makes. A real estate agent who earns a cut of a property’s sale price is a classic example of commission-based pay.

Exploring Other Forms of Supplemental Earnings

Beyond the big three—bonuses, overtime, and commissions—companies can get quite creative. These other forms of supplemental pay show a real commitment to an employee’s overall well-being and professional growth, helping to build loyalty.

Some popular examples include:

- Profit-Sharing Plans: These programmes share a slice of the company’s profits among its employees. This gives everyone a direct stake in the organisation’s financial success, encouraging a team effort to boost efficiency and profitability.

- Stipends and Allowances: Companies often provide stipends for specific needs, like professional development, wellness activities, or setting up a home office. For example, giving an annual ₹25,000 stipend for courses and certifications helps employees sharpen their skills, which is a win-win for them and the company.

- Signing Bonuses: This is a one-time payment offered to a new hire as an extra nudge to join the company. It’s a common tactic used in competitive fields to attract top talent.

By getting to grips with this diverse menu of supplemental pay options, organisations can build a flexible and compelling compensation strategy that truly supports their business goals and connects with their people.

Navigating Taxes on Supplemental Pay in India

While offering various forms of supplemental pay is a fantastic way to motivate and reward your team, it adds a crucial layer of complexity to payroll: taxation. The main thing to remember is simple: in India, any extra income is just treated as part of an employee’s total earnings.

There isn’t a special, flat tax rate for bonuses or commissions. Instead, these amounts are simply added to the employee’s gross salary for that pay period. This new, larger total is then taxed according to their personal income tax slab.

This means a one-time bonus can temporarily bump an employee into a higher tax bracket for that month’s salary calculation, which definitely impacts their take-home pay. It’s something both employers and employees need to anticipate to avoid any nasty surprises come payday.

The Role of Tax Deducted at Source (TDS)

For employers, the biggest responsibility here is to correctly calculate and send off the Tax Deducted at Source (TDS) on these extra payments. Just like you deduct TDS from a regular monthly salary, you have to do the same for any supplemental earnings.

The TDS amount is figured out by estimating the employee’s total annual income (including the bonus) and then calculating their tax liability based on the tax regime they’ve chosen (Old or New). This makes sure tax is paid on every part of their income as they earn it, keeping you fully compliant with income tax rules.

Under Section 192 of the Income Tax Act, employers are legally required to deduct tax from any income paid under the head ‘Salaries’. This covers all forms of supplemental pay—from performance bonuses to overtime—making accurate TDS calculation a non-negotiable part of payroll.

How a Bonus Impacts Take-Home Pay

Let’s walk through a quick example to see how this plays out. Imagine an employee has a fixed monthly salary and gets a one-time performance bonus.

- Calculate Total Income: First, the employer adds the bonus to the regular monthly salary. So, if the salary is ₹80,000 and they get a ₹50,000 bonus, the gross income for that month shoots up to ₹1,30,000.

- Estimate Annual Tax: The payroll system then re-estimates the employee’s total annual income with this bonus included. This new figure is used to find the right tax slab and the total tax owed for the year.

- Deduct Monthly TDS: Finally, the system deducts a proportionate slice of that annual tax from the month’s bigger paycheque. Because the income is higher for that month, the TDS deduction will be significantly higher than usual.

This process ensures you stay on the right side of the law, but it’s vital to communicate it clearly. Employees need to understand why their take-home pay from a bonus might be less than they first expected. With the growing trend of variable pay in compensation packages, mastering these tax calculations is more critical than ever. In fact, we’ve seen how the COVID-19 impact led companies to raise the variable pay component in their salary structures.

Getting a handle on these tax rules allows your business to manage supplemental pay smoothly, staying compliant while ensuring your reward programmes are transparent and appealing to your workforce.

Staying Compliant with Indian Labour Laws

When you’re running a business in India, managing supplemental pay isn’t just a matter of crunching numbers in payroll. It’s a journey into the world of legal compliance, and it’s one you need to navigate carefully. Getting Indian labour laws right isn’t just good practice—it’s essential for operating fairly and keeping your organisation out of serious legal trouble.

These regulations are there for a reason: to protect employees and make sure any extra compensation is handed out in a fair and transparent way. Slip up, and you could be facing hefty penalties, drawn-out legal fights, and a real dent in your company’s reputation. A solid grasp of the legal side of things is non-negotiable.

Key Legislation You Must Know

Several major laws shape how supplemental pay works in India. The big one you absolutely have to know is The Payment of Bonus Act, 1965. This law makes paying an annual bonus mandatory for employees in specific types of establishments.

The Act is crystal clear on who is eligible, the minimum and maximum bonus percentages you can pay, and the deadline for getting it done. This isn’t a “nice-to-have” — if the law applies to your organisation, you are legally bound to pay this bonus. It’s a critical piece of your annual compensation puzzle.

Then there’s the matter of overtime. The Factories Act, 1948, along with various state-level Shops and Establishments Acts, lays down the law for overtime work.

These acts are very specific. They state that any employee working beyond the standard daily or weekly hours must be paid at a higher rate—usually double their normal wages. Diligently tracking hours and calculating this pay correctly isn’t just a task; it’s a core compliance duty.

Maintaining Fairness and Transparency

Beyond these specific acts, the principles of fairness and non-discrimination are threaded throughout India’s labour laws. When you’re putting together performance-based supplemental pay schemes, you have to ensure they’re applied consistently and without any bias.

This means the goalposts for earning a bonus or commission must be clear, objective, and communicated to every eligible employee. Your best friend here is a well-documented compensation policy. Think of it as your rulebook.

This document should transparently outline:

- How different types of supplemental pay are calculated.

- Who is eligible for each type of incentive.

- The specific performance metrics or goals needed to earn them.

Putting this in writing eliminates confusion for your team and gives your company a clear, defensible standard to stand by. It helps turn compensation from a potential source of conflict into a process everyone understands and trusts.

A detailed checklist can be a lifesaver, ensuring you’ve ticked all the right boxes before rolling out any plan.

Key Compliance Checklist for Supplemental Pay

To help you stay on the right side of the law, here’s a quick summary of the essential checks every employer should perform when dealing with supplemental compensation.

| Compliance Area | Key Consideration | Relevant Act (if applicable) |

|---|---|---|

| Annual Bonus | Is the bonus paid within 8 months of the financial year-end? | The Payment of Bonus Act, 1965 |

| Overtime Pay | Are extra hours compensated at double the regular rate? | The Factories Act, 1948 |

| Policy Documentation | Is your compensation policy clear, written, and accessible to all employees? | General Contract Law |

| Non-Discrimination | Are incentive criteria objective and applied fairly across the board? | The Equal Remuneration Act, 1976 |

Following this checklist is a great starting point. It helps ensure that your approach to supplemental pay is not only strategic but also fundamentally sound from a legal perspective, protecting both your employees and your business.

Using Supplemental Pay as a Strategic Growth Tool

It’s easy to look at supplemental pay as just another expense on the balance sheet, but that’s a massive missed opportunity. When you handle it with a bit of strategy, it stops being a cost and starts becoming a powerful investment vehicle, one that can steer your company towards its biggest, most ambitious goals. We’re talking about more than just handing out extra cash; it’s about making that cash work for you.

A well-designed compensation plan uses different kinds of supplemental pay to build a direct bridge between what your employees do every day and your core business objectives. It creates a simple but powerful “if-then” scenario for your team: if you help us hit this key target, then you will get a piece of the reward. That direct link is what builds a culture of ownership and high performance.

Aligning Performance with Company Objectives

The most direct way to get strategic with supplemental pay is by tying it directly to specific company milestones. Performance bonuses are the perfect tool for this job. Instead of vague, generic annual bonuses, think about creating incentives linked to measurable outcomes that actually move the needle.

For instance, you could tie a bonus to:

- Achieving a 15% reduction in customer churn.

- Successfully launching a new product line by the end of Q3.

- Boosting operational efficiency by a specific, agreed-upon percentage.

This method ensures your team’s energy is always channelled towards the targets that create real business growth. It shifts the entire conversation from simply rewarding “hard work” to rewarding the right work.

When your performance incentives are transparent and tied to clear goals, you effectively turn your compensation strategy into a roadmap for success. Everyone knows exactly what they need to do to win, and the business reaps the rewards of that laser-focused effort.

Attracting and Keeping Top Talent

In a tight job market, a standard salary package just doesn’t cut it anymore if you want to attract the best of the best. This is where a strategic use of supplemental pay can give you a serious competitive edge. Offering perks like signing bonuses, profit-sharing plans, or stock options can be a total game-changer. These aren’t just financial add-ons; they’re signals to potential hires that you are genuinely invested in their long-term success with the company.

This is especially true when you’re hunting for that top-tier talent everyone wants. Learning about unique recruitment strategies to hire talent effortlessly can highlight just how much a creative compensation package can make your company stand out from competitors who are only offering a flat salary.

Fostering Long-Term Engagement and Growth

Finally, supplemental pay can be a brilliant way to invest directly in your people. When you offer stipends for things like education, professional certifications, or even wellness programmes, you’re sending a clear message: we are committed to your development and well-being.

Think about it. When an employee uses a stipend to learn a new skill, they instantly become more valuable to your organisation. When they use a wellness allowance, they’re more likely to be engaged, healthy, and productive. This kind of supplemental pay offers an incredible return, helping you build a more skilled, motivated, and loyal workforce that’s ready to push the company forward. It transforms your compensation plan from a simple line item into a true strategic asset.

Your Top Questions About Supplemental Pay, Answered

Let’s be honest, the world of supplemental pay can feel like a maze of “what-if” scenarios. It’s easy for both employers and employees to have lingering doubts. To help clear the air, we’ve put together some of the most common questions we hear about how these extra payments work in India. Think of this as your straightforward guide to handling these situations with confidence.

We’re going to tackle the frequent points of confusion, from how gifts are treated to the legal side of a declared bonus. Our aim is to give you practical clarity so that everyone involved is on the same page.

Is a Gift Voucher From My Employer Taxed Like a Bonus?

This is a classic question, and the answer isn’t a simple yes or no. Under Indian tax law, gift vouchers from your employer are usually seen as a ‘perquisite’—a benefit that isn’t straight cash. The good news is, there’s a specific exemption for them.

If the total value of all the gifts or vouchers you get in a financial year is less than ₹5,000, you don’t have to pay tax on it. But here’s the catch: if the total value tips over that ₹5,000 threshold, the entire amount becomes fully taxable as part of your salary. So, if you get a ₹6,000 gift voucher, you aren’t just taxed on the extra ₹1,000; the whole ₹6,000 gets added to your taxable income.

How Is Overtime Calculated For Salaried Employees?

For salaried employees who fall under specific labour laws, like The Factories Act, 1948, the rule is pretty clear. If you work more than the standard weekly limit (which is usually 48 hours over six days), you’re entitled to overtime pay.

Calculating this type of supplemental pay is quite direct:

– Rate: Overtime has to be paid at double the ordinary rate of your wages.

– Calculation: To figure this out, your monthly salary (including any relevant allowances) is broken down into an hourly figure. That figure is then doubled to get your overtime rate for each extra hour you put in.

It’s absolutely vital for employers to keep a close and accurate track of these hours to stay on the right side of the law.

Can a Company Legally Decide Not to Pay a Declared Bonus?

This is where things can get serious. Once a bonus has been officially declared and communicated to employees, it generally becomes a legally binding promise. Think of a declared bonus as becoming part of your employment contract for that period, which gives you an enforceable right to it.

If an employer has formally announced a bonus—whether it’s through a company-wide email, an official notice, or individual letters—trying to back out of that promise can easily lead to legal trouble. An employee could file a claim for unpaid wages, because the bonus is no longer just a discretionary gift but an earned part of their compensation.

There is one exception, however. If the bonus was explicitly linked to hitting certain company-wide targets that weren’t met, the company might have a case for not paying it out—but only if this condition was made crystal clear from the very beginning.

Are Stipends and Allowances Treated the Same for Tax?

No, and this is an important distinction to understand. A stipend is usually a fixed amount paid to help cover expenses during an internship or training, and it’s almost always fully taxable. An allowance, on the other hand, like a House Rent Allowance (HRA) or Leave Travel Allowance (LTA), is given for a specific purpose.

The real difference comes down to tax exemptions. Many allowances come with specific exemptions under the Income Tax Act, provided you show proof that you spent the money as intended. For instance, you can claim a part of your HRA as exempt from tax if you live in a rented house. Stipends rarely have these kinds of tax benefits and are typically taxed just like regular income.

At Taggd, we understand that building a fair and strategic compensation plan is key to attracting top-tier leaders. Our expertise in Recruitment Process Outsourcing helps you secure the talent that will drive your business forward. Learn more about how we can help at https://taggd.in.