Understanding Wages in Lieu of Notice: The Indian Framework

Navigating employment terminations in India requires a firm grasp of Wages in Lieu of Notice (PILON). This mechanism protects both employers and employees during separations. PILON acts as a financial cushion for employees when their employment ends without the standard notice period. It compensates for the sudden income loss and allows them time to find new work.

Imagine an employee in Delhi with over three months of service. Their contract requires a one-month notice period. If terminated immediately, the employer must pay one month’s salary as PILON. This protects the employee from financial hardship. In India, PILON (often called payment in lieu of notice) is a legal requirement. This payment is mandatory when an employer terminates an employee without the required notice, typically one month for employees with more than three months’ tenure in places like Delhi.

For example, an employee terminated without notice receives one month’s wages as PILON. This compensates them for the lost work opportunity during the notice period. Notice periods can vary by contract and industry. Some, like IT, have 60 to 90-day notices for senior roles. Learn more about Indian termination guidelines here. This framework balances employer flexibility and employee rights.

Key Aspects of PILON in India

- Legal Requirement: PILON isn’t just a nice gesture; it’s a legal obligation for employers under Indian law.

- Notice Period Variations: Standard notice periods vary depending on the employment contract, industry standards, and employee tenure. Senior IT roles, for instance, often have notice periods of 60 to 90 days.

- Contractual Agreements: While the law sets minimums, employment contracts can have specific PILON clauses, including calculations and eligibility.

- Mutually Agreed Terms: Sometimes, employers and employees can mutually agree to waive the notice period, even if shorter than legally required, with corresponding PILON. Clear communication and documentation are crucial. You might be interested in: An Overview of Employee Attrition and How to Prevent It.

Understanding PILON is essential for both employers and employees in India. It ensures legal compliance, protects employee rights, and promotes fair terminations. This knowledge helps individuals navigate job transitions smoothly and minimizes disputes.

Calculating Wages in Lieu of Notice: Beyond Basic Salary

Calculating Wages in Lieu of Notice (PILON) correctly is crucial for avoiding disputes and ensuring legal compliance. It’s more intricate than simply calculating an employee’s basic salary. This section breaks down the various components of a PILON calculation in India, highlighting how these factors can differ across roles and sectors.

Components of a PILON Calculation

A PILON calculation often involves more than just basic salary. Several other components may be included, depending on the specifics of the employment contract and the company’s internal policies. These additional components can significantly impact the final PILON amount.

- Dearness Allowance: Designed to offset the effects of inflation, this allowance is generally included in PILON calculations.

- House Rent Allowance (HRA): Like the dearness allowance, HRA is typically included when calculating the PILON amount.

- Conveyance Allowance: This allowance is usually part of the PILON if it was a regular component of the employee’s compensation.

- Leave Encashment: Accrued and unused leave is frequently converted into its monetary value and added to the PILON payment.

- Bonuses and Incentives: Whether bonuses and incentives are included in PILON depends on their vesting schedule and the terms outlined in the employment contract. Performance-based bonuses earned before the termination date are typically included.

- Gratuity: While gratuity is a separate benefit, it’s sometimes paid alongside the PILON, although calculated independently.

- Medical Insurance and Other Benefits: Depending on company policy, the continuation of medical insurance coverage or a cash equivalent for the notice period might be considered.

To better illustrate the various components involved in a PILON calculation in India, let’s look at the following table:

Components of Wages in Lieu of Notice Calculation

This table breaks down what elements are typically included or excluded when calculating wages in lieu of notice payments in India.

| Component | Typically Included | Special Considerations |

|---|---|---|

| Basic Salary | Yes | |

| Dearness Allowance | Yes | |

| House Rent Allowance (HRA) | Yes | |

| Conveyance Allowance | Yes | If regularly part of compensation |

| Leave Encashment | Yes | Based on accrued and unused leaves |

| Bonuses and Incentives | Conditional | Depends on vesting schedule and contract terms |

| Gratuity | Sometimes | Paid concurrently but calculated separately |

| Medical Insurance | Conditional | Depends on company policy |

As the table demonstrates, several factors influence the final PILON calculation. Understanding these nuances is vital for both employers and employees.

Example: PILON Calculation for a Sales Manager

Let’s consider a Sales Manager in Mumbai earning a basic salary of ₹80,000 per month, with an HRA of ₹20,000 and a conveyance allowance of ₹5,000. If they have 15 days of unused leave and are entitled to a pro-rated bonus of ₹10,000 for the notice period, their PILON calculation might look like this:

(Basic + HRA + Conveyance)/30 * Notice Period (days) + Pro-rated bonus + Leave encashment

(₹80,000 + ₹20,000 + ₹5,000)/30 * 30 + ₹10,000 + (Leave encashment calculation)

This example shows that PILON calculations can become quite complex. Employers must accurately assess all applicable components to avoid underpayment and potential legal ramifications.

Handling Variable Pay and Pro-Rated Calculations

Including variable pay components, like bonuses and commissions, in PILON calculations requires careful consideration. If an employee is on a variable pay scheme, the calculation needs to account for the average variable pay earned over a specific period, such as the preceding six months or a year. Similarly, pro-rata calculations are crucial for incomplete months of service within the notice period. These calculations ensure fair and precise compensation reflecting the employee’s actual earnings.

Accurate PILON calculations protect both employers and employees. Employers avoid legal issues, and employees receive their entitled compensation. This leads to a smoother transition and maintains the employer’s positive reputation.

Industry Realities: Wages in Lieu of Notice Across Sectors

Notice periods and Wages in Lieu of Notice (PILON) practices differ significantly across Indian industries. Factors like established industry norms, company size, and the specific responsibilities of a role all contribute to these variations. These differences have a notable impact on financial planning and career transitions, especially when switching between sectors.

Sector-Specific Notice Periods and PILON Practices

- IT and Technology: This sector often has longer notice periods, sometimes between 60 to 90 days, especially for senior-level positions. This is primarily due to the need for project continuity and efficient knowledge transfer. PILON is frequently used to speed up transitions, particularly when new job opportunities arise quickly or project timelines are adjusted.

- Manufacturing and Engineering: Much like IT, these industries may also have extended notice periods to effectively manage production schedules and ensure smooth handovers of responsibilities. The use of PILON varies depending on the company and the specific nature of the role.

- Retail and Hospitality: These sectors typically have shorter notice periods, often as little as 30 days. The generally higher employee turnover in retail and hospitality often translates to a quicker transition process. PILON is less common, as shorter notice periods don’t cause as much disruption. For further insights into a related industry, take a look at the Pharmaceuticals Sectoral Report 2021.

- Finance and Banking: Due to the sensitive nature of financial data and the various regulatory requirements, notice periods in this sector can be quite extensive. The use of PILON is more strategic and often depends on the individual circumstances surrounding the termination.

To better understand the typical notice periods and PILON practices across different sectors, let’s examine the following table.

Notice Period Standards Across Indian Industries

| Industry | Typical Notice Period | PILON Frequency | Special Considerations |

|---|---|---|---|

| IT and Technology | 60-90 days | High | Project continuity, knowledge transfer |

| Manufacturing and Engineering | Extended, varies | Moderate | Production schedules, handovers |

| Retail and Hospitality | 30 days | Low | High employee turnover |

| Finance and Banking | Extended, varies | Strategic, case-by-case | Data sensitivity, regulations |

This table summarizes the general trends. Specific company policies may differ, and individual employment agreements should always be consulted for accurate information.

The use of wages in lieu of notice is common in India, especially in sectors with high employee turnover or frequent project changes. For instance, a 60- to 90-day notice period is common for senior roles in the tech industry, but PILON is often used to expedite transitions. This is especially true in regions with strict labor laws, where employers may prefer to pay wages in lieu of notice rather than deal with complex legal procedures. Industry reports indicate that PILON is more common in industries with high employee mobility, such as IT and manufacturing. Payment amounts are governed by specific rules, including at least one month’s salary for employees with more than three months of service. You can learn more about notice period rules and laws here.

Understanding PILON Variations

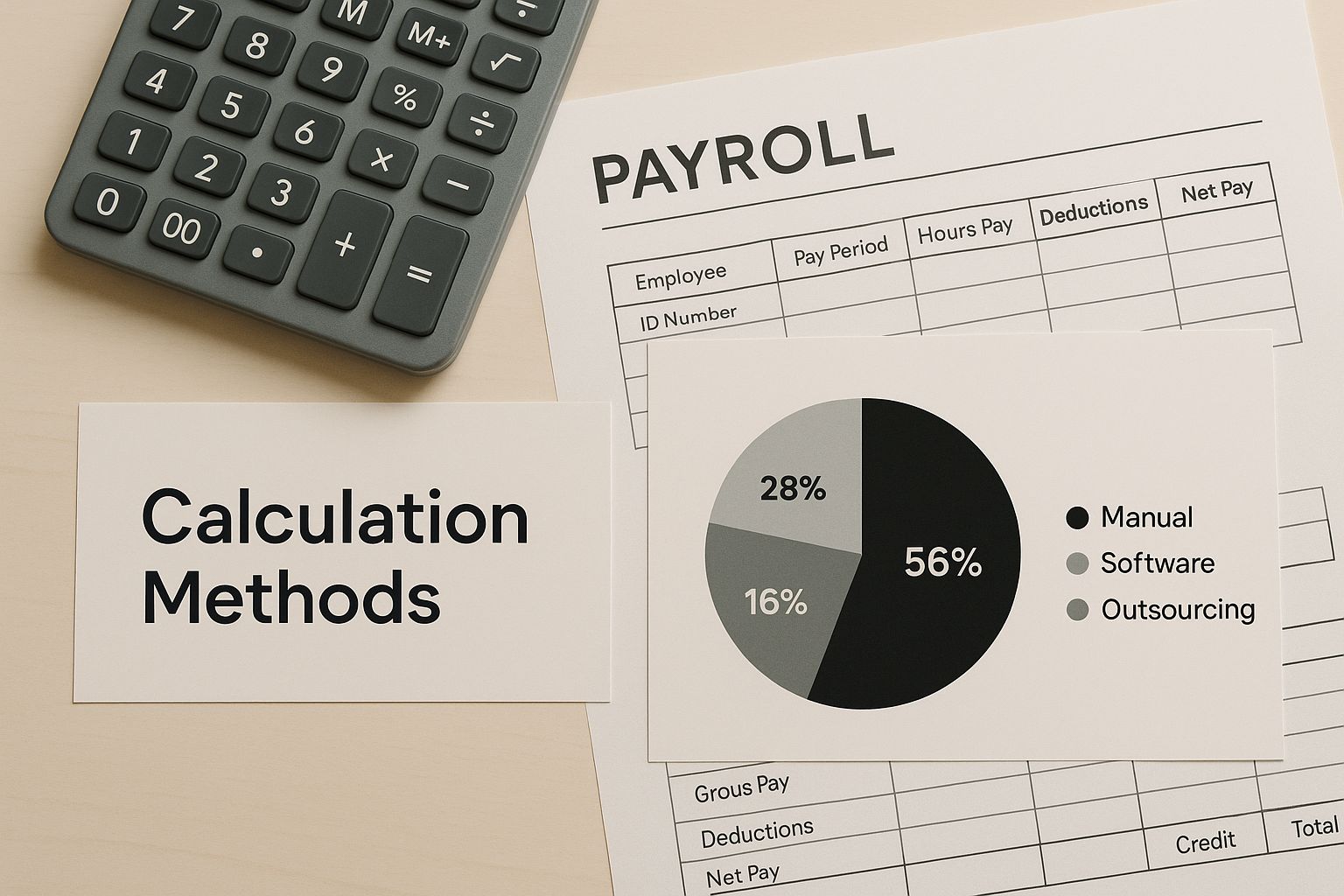

The image below visualizes different ways Wages in Lieu of Notice are calculated.

Calculating PILON can be complex and involves factors beyond base salary, such as allowances, unused leave, and potential bonuses. Understanding these components is important for both employers and employees.

Impact on Career Transitions

These sector-specific variations significantly affect career changes. Moving from a sector with a long notice period to one with a shorter one may require careful negotiation. Conversely, transitioning to a role in a sector with a longer notice period might delay your start date unless PILON is an option.

Managing Multi-Industry Workforces

For companies operating across multiple sectors, understanding these nuances is crucial for managing terminations effectively. A standardized PILON policy may not be suitable. A more flexible approach might be necessary to accommodate the specific needs of each sector and ensure fair treatment of all employees.

Employer Responsibilities When Paying Wages in Lieu of Notice

Choosing to pay Wages in Lieu of Notice (PILON) instead of requiring an employee to work through their notice period offers employers flexibility. However, it also comes with specific responsibilities. Properly handling PILON ensures legal compliance and minimizes potential disputes. This section outlines the essential steps employers in India must take when opting for PILON.

Documentation and Communication

Clear documentation is essential when implementing PILON. This includes a formal termination letter that clearly states the reason for termination, the PILON amount, and the date of the final payment. The letter should also acknowledge that the employee has received all outstanding dues, including salary, allowances, and leave encashment.

Open communication with the departing employee is key. Explain the reason for offering PILON and make sure they understand how it was calculated. For example, if an employee’s contract requires a 30-day notice period but the company chooses immediate termination, the PILON letter must specify the 30 days’ worth of wages being paid.

Accurate and Timely Payment

PILON payments must be accurate and on time. Employers should use the correct calculation method, including all components of the employee’s compensation as defined in their employment contract. This includes basic salary, dearness allowance, House Rent Allowance (HRA), and other applicable benefits.

The timing of the payment is equally critical. Ensure the PILON is paid on or before the employee’s last working day, along with any other outstanding dues. Payment delays can lead to legal problems and harm the company’s reputation. For example, an employer must include unused earned leave when calculating the final PILON amount.

Handling Company Assets and Access

When an employee leaves immediately due to PILON, promptly retrieving company assets is crucial. This includes items like laptops, mobile phones, and access cards. Clearly communicate the return process and ensure proper documentation is completed.

Simultaneously, revoke the employee’s access to company systems and data to protect sensitive information. This often involves deactivating login credentials and restricting physical access. This quick action helps reduce security risks and prevents potential data misuse. Check out our guide on How Can Recruitment Process Outsourcing Help In High-Impact Hiring Driven By Data?.

Knowledge Transfer and Transition

Even with an immediate departure due to PILON, facilitating a smooth knowledge transfer is essential. Identify important information or projects handled by the departing employee. Ensure this knowledge is documented or shared with a colleague. This might involve a brief handover, even if the employee isn’t actively working.

This proactive approach minimizes disruption to projects and maintains business continuity. Designating a point of contact for the departing employee can also be helpful for addressing urgent questions during the transition.

Legal Compliance and Best Practices

Following all applicable labor laws and regulations is paramount when implementing PILON. This includes compliance with notice period requirements as specified in the Industrial Disputes Act and other relevant legislation. Seek legal advice if needed to ensure correct procedures.

Consider best practices like offering outplacement services or career counseling. This supports the departing employee’s job search and creates a more positive experience, even during termination. These measures can contribute to a smoother transition for everyone involved and enhance the organization’s employer brand.

Protecting Your Rights: Employees and Wages in Lieu of Notice

Termination can be a stressful experience, especially when it comes to your final pay. Understanding your rights regarding Wages in Lieu of Notice (PILON) in India is crucial for protecting your finances during this time. This section will help you navigate PILON effectively.

Verifying Payment Accuracy

Your PILON payment should accurately reflect your total compensation. This includes your base salary plus allowances such as Dearness Allowance, House Rent Allowance (HRA), and Conveyance Allowance. Accrued and unused leave should also be included.

For example, if your contract includes HRA and you are entitled to 30 days of PILON, the HRA for those 30 days should be part of your PILON payment. Carefully review your final settlement statement to ensure all components are included and correctly calculated. If your monthly salary is ₹50,000 and you’re due a month’s notice, your PILON should be ₹50,000, plus any relevant allowances and leave encashment.

Identifying Unfair Employer Tactics

Some employers may try to reduce PILON payments. This could involve misclassifying earnings, excluding certain allowances, or disputing your accrued leave. For instance, they might attempt to exclude bonuses or incentives, arguing they are not part of your regular pay.

Be aware of these tactics and consult your employment contract and company policies. Also, be cautious about signing release documents before thoroughly reviewing your payment. Doing so might prevent you from claiming what you’re owed later.

Navigating Dispute Resolution

If you believe your PILON payment is incorrect, document your concerns and communicate them to your employer in writing. Always keep copies of all communication.

If your employer doesn’t address the issue, explore dispute resolution options. Depending on your situation and the amount in question, this could include filing a complaint with the appropriate labor authorities or getting legal advice. A legal professional specializing in employment law can offer guidance specific to your case.

When PILON Isn’t Permitted

Sometimes, employers cannot legally substitute notice with payment. This can happen if your employment contract has specific clauses preventing it or if there are pending disciplinary actions against you. Familiarize yourself with the terms of your contract and relevant labor laws. If an employer insists on PILON despite these restrictions, seek legal counsel to safeguard your rights.

Coordinating PILON with Other Benefits

PILON often coincides with other termination benefits, such as gratuity and leave encashment. Make sure you understand how these are calculated and how they interact with your PILON to ensure you receive everything you are due. For example, if you’re eligible for both gratuity and PILON, confirm these amounts are calculated and paid separately according to regulations.

Coordinating these benefits ensures you receive all entitled compensation during your transition. Understanding your PILON rights in India empowers you to advocate for yourself during termination. By verifying payment accuracy, recognizing potential employer tactics, and knowing your dispute resolution options, you can protect your financial well-being and move smoothly into your next opportunity.

Navigating the Tax Implications of Wages in Lieu of Notice

Understanding the tax implications of Wages in Lieu of Notice (PILON) is crucial for both employers and employees in India. This guide clarifies how these payments are taxed and how to ensure compliance. Properly handling PILON taxation can optimize after-tax benefits and prevent future issues.

How PILON Payments Are Taxed

Wages in lieu of notice are treated as salary income for tax purposes. This means they are subject to Income Tax, just like your regular salary. The amount is added to your annual income and taxed according to the applicable tax slab.

This categorization ensures consistent treatment, simplifying payroll processing and tax reporting for employers while also ensuring the government receives the correct tax revenue.

TDS on PILON Payments

Tax Deducted at Source (TDS) applies to PILON payments. Employers are required to deduct TDS before disbursing the payment to the employee. The TDS rate is determined by the employee’s estimated total income for the financial year, including the PILON amount.

This TDS deduction is a crucial compliance aspect. Failure to deduct and remit TDS can result in penalties for the employer.

GST Considerations

Goods and Services Tax (GST) does not apply to PILON payments. Since these payments are considered salary income, they fall outside the scope of GST.

This distinction is important for accurate tax calculations and reporting, simplifying the process for both employers and employees.

Potential Exemptions and Deductions

While PILON is generally taxable income, certain situations might offer partial exemptions or deductions. Consulting with a tax advisor can help determine eligibility for such benefits.

Additionally, certain allowances within the PILON, such as HRA (House Rent Allowance), may offer tax benefits depending on individual circumstances and supporting documentation.

Documentation and Reporting

Maintaining proper documentation is essential. Employers should provide a detailed breakdown of the PILON calculation in the termination letter, including the gross amount, TDS deducted, and net payable amount. Employees should retain this documentation for income tax filing.

Accurate reporting on income tax returns is crucial. Employers must report PILON payments as part of the employee’s salary, and employees must include this amount in their annual income declaration. This thorough record-keeping helps avoid issues during tax assessments.

Recent Tax Rulings and Updates

Tax laws are subject to change. Staying informed about the latest rulings and amendments related to PILON taxation is vital for continued compliance.

Subscribing to tax updates from reputable sources or consulting with a tax professional can help navigate these changes and avoid potential problems.

Maximizing After-Tax Benefits

Proper planning can optimize tax outcomes related to PILON payments. Strategically timing the payment or exploring potential exemptions can maximize after-tax benefits for both employers and employees.

Consulting a tax advisor can help identify specific tax-saving opportunities based on individual circumstances.

Are you looking to streamline your recruitment process and ensure compliance with all relevant regulations, including proper PILON calculations and tax management? Talent Hired – The Job Store Private Limited offers comprehensive Recruitment Process Outsourcing (RPO) solutions. Visit taggd.in to learn more.